Before yesterday traders whined

‘Bout how much that vol had declined

But President Trump

Caused copper to dump

And still, Chairman Powell, maligned

So, chaos is now the new theme

Though most hope it’s just a bad dream

And ere the week ends

Based on recent trends

We could see, results, more extreme

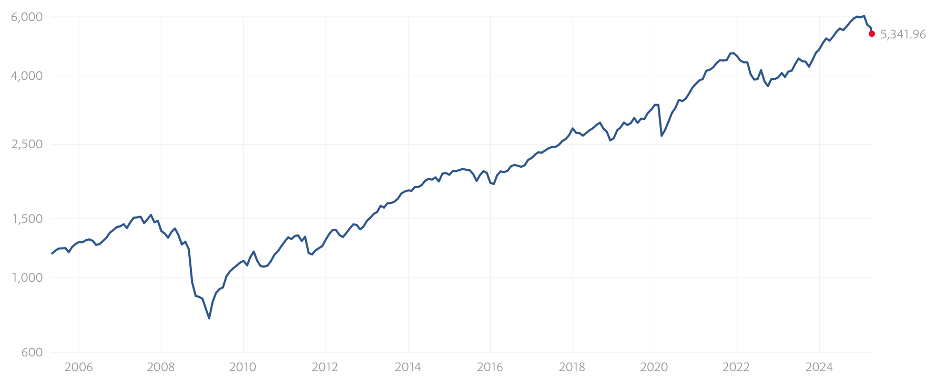

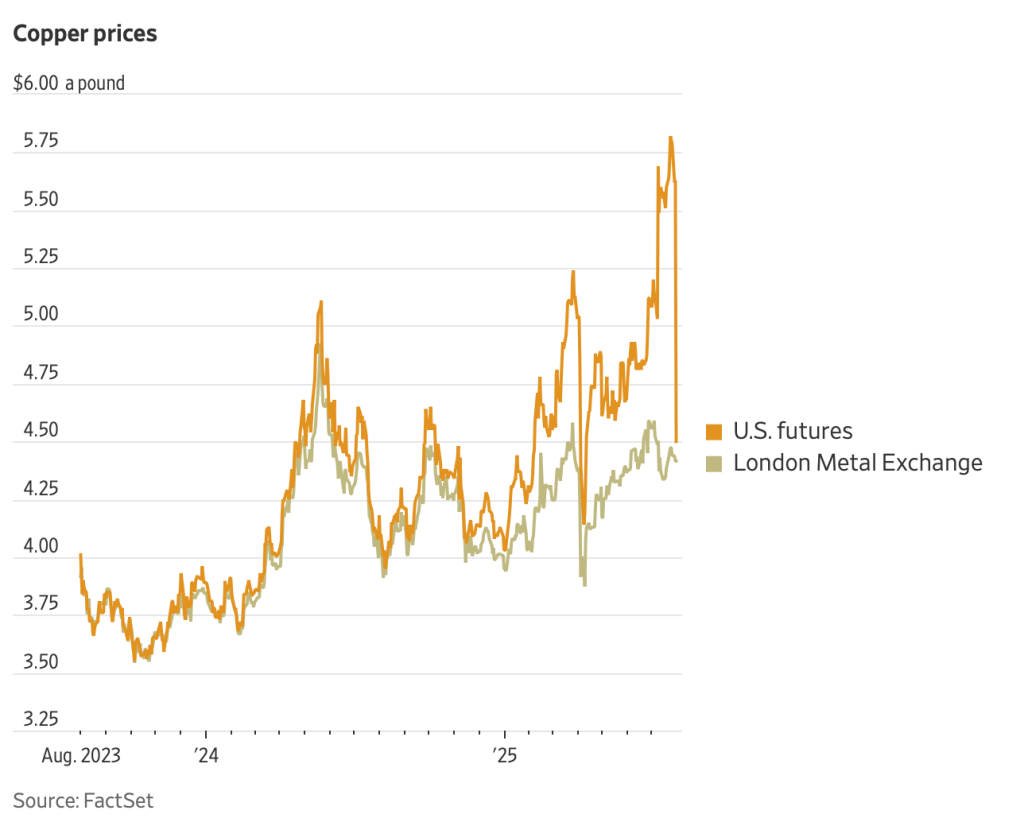

It isn’t often that copper is the talk of the town, but this is a new world in which we live, and as I’ve repeatedly explained, all that we think we knew about the way things work, or have worked in the past, is generically wrong. It is with this in mind that I lead with a chart of the copper price, which after having rallied dramatically back in April, after Liberation Day, and again in July, both times on the back of tariff announcements, collapsed yesterday when President Trump altered the conversation by explaining that tariffs on copper would not be on the raw metal itself, but rather on refined products instead. As you can see from the chart, this resulted in a massive decline, nearly 23% in the past twenty-four hours.

Source: WSJ.com

Essentially, the US price, as traded on the COMEX, returned to be in line with the ROW price, as traded on the LME. That doesn’t make the move any less dramatic, but the question of how long those price differentials could be maintained was always an open one. At any rate, that was the biggest mover of the day yesterday and naturally, it had knock-on effects elsewhere with the entire metals complex falling sharply (Au -1.85%, Ag -3.0%, Pt -9.7%) as well as some currencies that are linked to those metals like CLP (-1.5%) and ZAR (-1.4%). Remember how much complaining there was because market activity had slowed so much? I bet most folks are looking wistfully at that pace this morning!

Turning to the other key focus of yesterday, the FOMC meeting, the FOMC statement was exactly as expected, with continued focus on “solid” labor market conditions and moderate economic activity acting as the rationale to leave rates on hold. As widely expected, both Governors Bowman and Waller dissented, each calling for a 25 basis point cut. The two schools of thought continue to be 1) headline data releases have been masking underlying economic weakness (declining home sales, declining air travel and restaurant activity); and 2) while those issues may be real at the margin, the fact that financial markets continue to rise, with significant speculative activity in things like meme coins and cryptocurrency in general, as well as Private Credit, indicate there is ample liquidity in the market and no reason to adjust policy.

This poet, while not a PhD economist (thankfully!), comes down on the side of number 2 above. There has been talk by numerous, quite smart analysts, about the underlying weakness in the economy and how the data would be demonstrating it very soon. Whether it is the makeup of the employment situation, the housing market showing a huge imbalance of homes for sale vs. buyers (at least at current prices) or the added uncertainty of tariffs and how they will impact the economy, this story has been ongoing for more than three years without any proof. In fact, yesterday’s GDP reading for Q2 was a much higher than expected 3.0%, once again undermining the thesis that the economy is already in a recession. If so, it is the fastest economic growth ever seen in a recession.

In fact, I do not understand the rationale for so many that a rate cut is necessary. I realize the market continues to price a 60% probability of a cut in September and about 35bps of cuts by year end, but it makes no sense to me. In fact, the market is pricing for 110 basis points of cuts through 2026. Now, either market participants are anticipating a significant slowdown in inflation, which given all the tariff talk seems unlikely, or they see that recession on the horizon. At this point, I have come to believe it is nothing more than wishful thinking because there is such a strong belief that Fed funds rate cuts lead to higher equity prices, and after all, isn’t that the goal?

Chairman Powell, despite all the pressure he receives from the White House, has not budged. In this instance, I believe he is correct. After all, if the data suddenly implodes, the Fed can cut far more substantially and do so on an intermeeting basis if necessary. Remember, ahead of the election, he cut rates 50bps for no discernible reason based on the data. Unemployment had risen from 3.9% to 4.2% over the prior three months and that was enough to scare him (although there was clearly a political motive as well). If the Unemployment Rate rises to 4.5% on September 5th, they could cut that day if they thought things were really unraveling. If the Fed is truly data dependent, then the data does not yet point to a major economic problem. And the one thing we know about the Trump administration’s policies is they are going to try to run the economy as hot as possible. That does not speak to lower interest rates.

Ok, let’s look at how markets around the world absorbed these changes, and how they are preparing for today’s PCE and tomorrow’s NFP data. Despite all the noise, the DJIA was the worst performer yesterday, sliding just -0.4%, while the NASDAQ actually rallied at the margin, +0.15%. And this morning, futures are pointing much higher (NASDAQ +1.4%, SPU +1.1%) as both Meta and Microsoft beat estimates handily.

Overnight, while Japanese shares (+1.0%) rallied nicely, China (-1.8%) and Hong Kong (-1.6%) significantly underperformed as weaker than expected PMI data put a damper on the idea that stimulus was going to solve Chinese problems. A greater surprise is that Korea (-0.3%) didn’t perform better given the announcement that they had agreed a trade deal with the US with 15% baseline tariffs, although that may have been announced after the markets there closed. But the rest of Asia had a rough session with most key regional exchanges (Singapore, Philippines, Indonesia, Malaysia) all declining about -1.0% with only Taiwan (+0.35%) on the other side of the ledger. However, if we continue to see strength in the US tech sector, and trade deals keep getting inked, I suspect these markets will be able to rebound.

In Europe, the picture is also mixed, with the CAC and DAX essentially unchanged after in-line inflation readings, while Spain’s IBEX (+0.5%) reacted positively to Current Account data while the FTSE 100 (+0.5%) rallied on strong earnings data from Rolls Royce and Shell Oil.

Perhaps the most interesting aspect of yesterday was how the bond market sat out the chaos. Treasury yields edged higher by 2bps yesterday and this morning they have fallen back by -1bp. European sovereign yields this morning are essentially unchanged, although a few nations have seen yields slip -1bp. In many ways, I feel that this is confirmation that despite a lot of noise, not much has really changed.

Oil (-0.5%), is giving back some of yesterday’s $2.00/bbl surge which was based on more sanctions talk from President Trump on Russia and reviving the discussion on 100% secondary sanctions on nations that import oil from Russia. While EIA data showed a major inventory build, the talk was more than enough to spook traders.

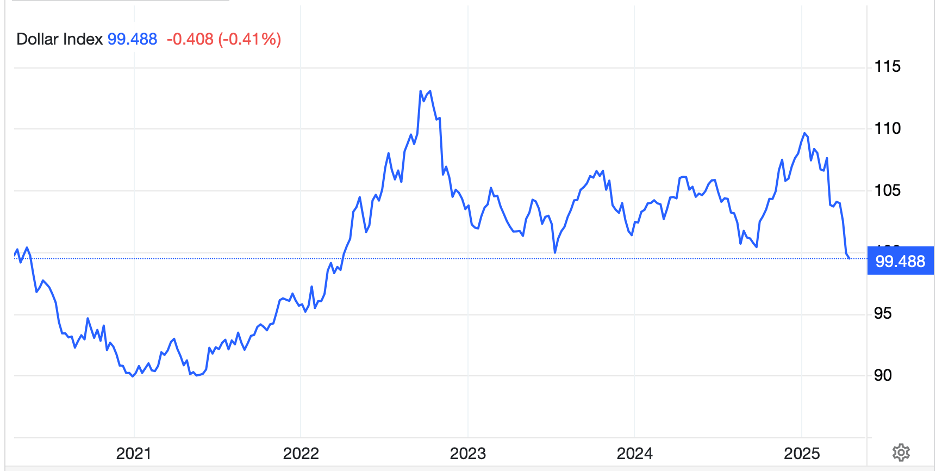

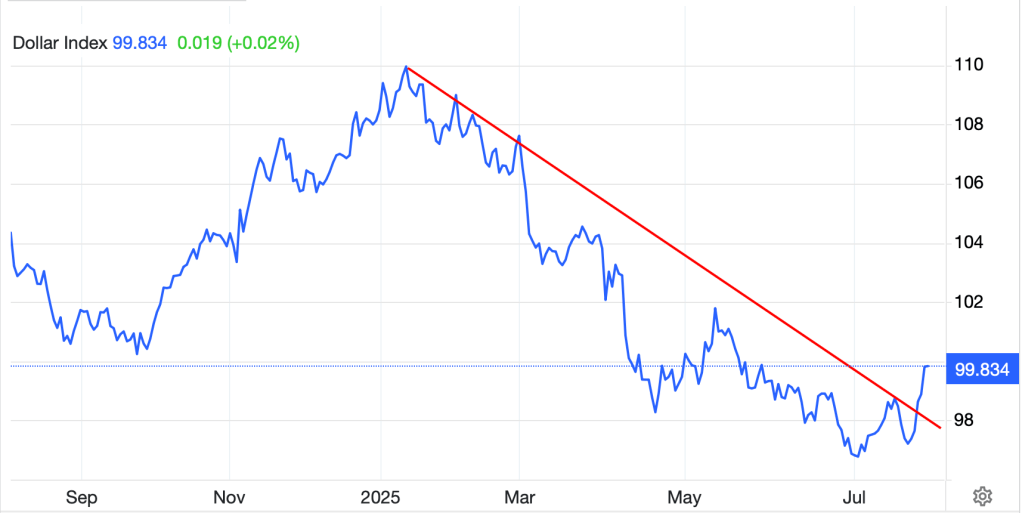

Finally, currency markets, which have seen dollar strength for the past several sessions, are relatively calm this morning, at least in the G10, where the DXY is unchanged, although at its highest level since just before Memorial Day. In that bloc, JPY (-0.5%) is the laggard after the BOJ left policy on hold, as expected, and while the yen has not been the market’s focus lately, it is back to 150.00 this morning for the first time since March.

Source: tradingeconomics.com

Remember all the talk about the end of the carry trade and how the yen was going to explode higher? Me neither! As to the EMG bloc, other than the aforementioned metals focused currencies, there has not been much movement in this space either. However, overall, while the longer-term trend has clearly been lower, this bounce looks more and more like it is gaining strength. The DXY is a solid 2% through the trendline and a move to 102 seems well within reason in the near term.

Source: tradingeconomics.com

On the data front, this morning brings Initial (exp 224K) and Continuing (1960K) Claims, Personal Income (0.2%) and Spending (0.4%) and PCE (0.3%, 2.5% Y/Y headline, 0.3%, 2.7% Y/Y Core) all at 8:30. Then at 9:45 we see Chicago PMI (42.0). There are no Fed speakers and assuming today’s data is in line, I expect that all eyes will turn to earnings from Apple and Amazon after the close and then NFP tomorrow. So, despite yesterday’s volatility, I see a respite for the day.

Good luck

Adf