The only discussion today

Is how badly tariffs will weigh

On stocks and on growth

As certainly both

Will feel some more stress and dismay

But hopefully, once they’re in force

It will change the pundits’ discourse

‘Cause I’m sick and tired

That it’s now required

We all, tariffs, hate or endorse

A funny thing happened on the way to the market collapsing yesterday, especially given the early morning portents, and that is the market didn’t collapse at all. Equities opened lower and rallied all day with the Dow even having a quite respectable 1% gain when all was said and done. I think the lesson that needs to be taken from this is markets have a tendency to get ahead of the news and reversals are pretty frequent. In fact, this is a perfect example of ordinary market behavior, a sharp move in one direction is suddenly reversed for no obvious reason. Certainly, there was nothing said or done yesterday that seemed a specific catalyst for a short-term rebound. That, my friends, is simply how markets work.

However, for now, with tomorrow being President Trump’s “liberation day” when tariffs will be announced, they remain the major story across both financial markets and political narratives. As I sit here in the cheap seats, observing the back and forth, what has become abundantly clear is that the politicization of economic actions is the true reality. Yesterday I highlighted the difference between Democrat and Republican views on future inflation. Reading through the commentary on X, as well as stories in Bloomberg and the WSJ, I think this is the same situation, with Democrats certain tariffs will be the downfall of the economy and lead to rampant inflation, while Republicans believe they will help the nation recapture lost manufacturing capacity. Personally, I’m just looking forward to moving on to a different story as we have been discussing tariffs for more than two months straight and it is tiresome.

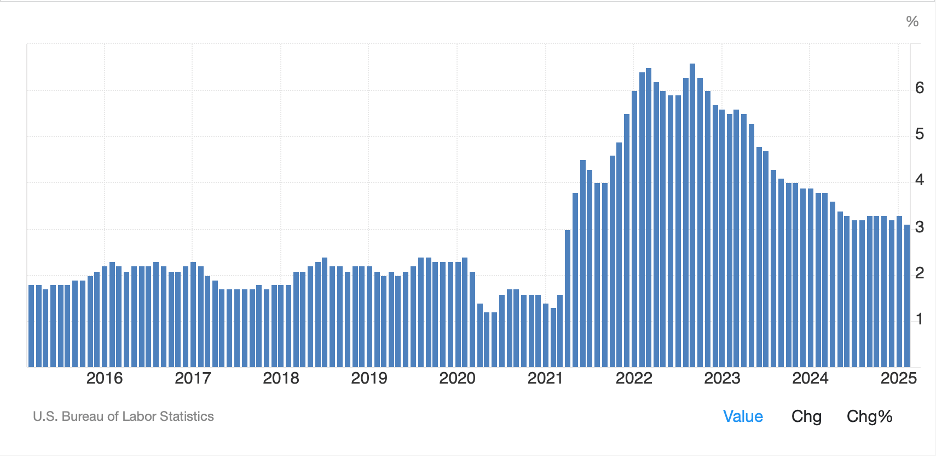

Here’s the one thing of which I am confident, however, and that is nobody has any idea what the impacts will ultimately be on either markets or the economy. I maintain that pretty much every model that has been in use for the past two decades, all of which were developed based on data during a period of low inflation and declining interest rates as well as significant increases in central bank provided liquidity, no longer work. After all, those underlying conditions no longer exist. Inflation remains much higher than during the pre-pandemic decades;

Source: tradingeconomics.com

Interest rates are much higher;

Source: fred.stlouisfed.org

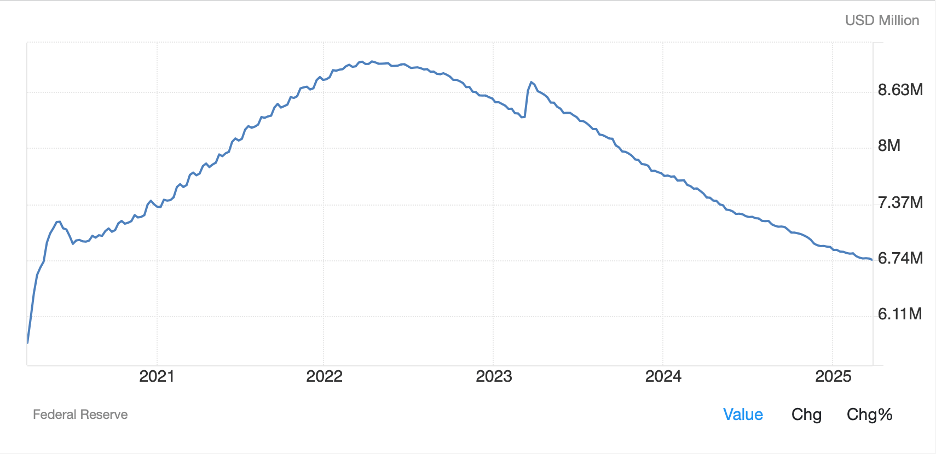

And central banks have been reducing net liquidity for some time now (think QT).

Source: tradingeconomics.com

So, if all the underlying conditions have changed, it seems unlikely that the models based on those conditions will add much value. After all, nobody really knows how elastic prices are for any given goods directly, nor how willing companies will be to sacrifice margin to maintain sales. As such, forecasting short-term movements is a mugs’ game here. In fact, yesterday’s price action is a perfect example of how things are not necessarily how they appear.

With that in mind, let’s see how yesterday’s risk reversal in US equity markets fed into the rest of the world. Asian equities saw a wide range of price action overnight. While Japan, Hong Kong and China were all tantamount to unchanged, Korea (+1.6%) and Taiwan (+2.8%) saw significant bounces while India (-1.8%) fell after concerns that President Trump’s mooted additional sanctions on any nation that buys Russian oil hit home as India buys, I read, 44% of their oil from Russia. Meanwhile, in Europe, screens are green this morning with gains across the board of between 0.7% and 1.0%. This is despite weaker PMI data, with every nation in Europe reporting a sub 50 manufacturing number. However, inflation fell a tick more than expected with Core falling to 2.4% and headline down to 2.2% and this has encouraged traders to believe that the ECB will be cutting again later this month despite some commentary to the contrary from several ECB members. As to US futures, at this hour (7:15) they are pointing lower by about -0.4% across the board.

In the bond market, 10-year yields continue to slide around the world with Treasuries (-5bps) falling back to their lowest level in a month and prior to that since early December. Too, European sovereigns are seeing yields fall sharply, with declines of between -6bps and -10bps as the combination of slowing inflation and weak PMI data has overwhelmed the previous concerns about German defense spending. In fact, that is a story we have not heard in a while, eh? Last week, that was the end of European bond markets, today it is ancient history!

Turning to commodities, oil (+0.1%) is consolidating after a sharp $2/bbl rise yesterday that was fomented by Trump’s threats to both Russia and Iran (he threatened to bomb them if they didn’t renounce their nuclear ambitions). The thing about oil’s price action is since late 2022, it has remained in a trading range of $65/$80 more or less, so despite the large move yesterday, I would argue no new ground has been covered. Certainly Trump’s efforts to open up more area for drilling is likely to weigh on prices over time, but over what timeframe remains to be seen. As it is a day ending in “y”, gold is higher again, this morning by 0.3%, but there is no indication this trend is running out of steam. The remarkable thing is the steadiness of the move. However, the other two major metals, silver (-0.35%) and copper (-0.3%) have slipped a bit this morning.

Finally, the dollar remains confused. Versus the euro (-0.25%) it is stronger, but versus the CHF (+0.25%) and JPY (+0.5%) it is weaker. Now, you might say that is a sign of a risk-off trade, but equity markets are rallying in Europe along with bonds. So, is this a move to havens or risk? The biggest mover this morning is CLP (-0.9%) but it has been one of the biggest gainers YTD, so with copper soft, this looks a lot like some profit taking. Otherwise, movements of +/- 0.2% are the order of the day.

Here’s a crazy theory, perhaps President Trump is seeking to drive the economy weaker in order to force the Fed to cut rates. After all, that appears to be the Fed’s bias, but recent inflation data has made them uncomfortable to do so. If Trump can drive up Unemployment, maybe it does the trick!

Ok, let’s see the data the rest of the week as yesterday’s Chicago PMI (47.6) while modestly better than expected really didn’t seem to matter that much.

| Today | ISM Manufacturing | 49.5 |

| ISM Prices Paid | 65.0 | |

| JOLTS Job Openings | 7.63M | |

| Wednesday | ADP Employment | 105K |

| Factory Orders | 0.5% | |

| -ex Transport | 0.7% | |

| Thursday | Initial Claims | 225K |

| Continuing Claims | 1860K | |

| Trade Balance | -$123.0B | |

| ISM Services | 53.0 | |

| Friday | Nonfarm Payrolls | 128K |

| Private Payrolls | 110K | |

| Manufacturing Payrolls | 1K | |

| Unemployment Rate | 4.2% | |

| Average Hourly Earnings | 0.3% (3.9% Y/Y) | |

| Average Weekly Hours | 34.2 | |

| Participation Rate | 62.4% |

Source: tradingeconomics.com

In addition to all this, we hear from six Fed speakers including Chairman Powell Friday morning at 11:30am. For today and tomorrow, tariffs will be the primary story, although it is not clear it is the primary driver. However, once they are announced, I expect we will move onto the next big thing, although I have no idea what that will be. But the one thing on which we can count regarding President Trump is there will be another big thing. Stay hedged is all the advice I can give because uncertainty is extremely high.

Good luck

Adf