If anyone thought Jay was thinking

‘Bout raising rates while growth was sinking

The chairman was clear

That long past next year

Their balance sheet will not be shrinking

The money quote: “We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates,” said Mr. Powell. And this pretty much sums up the Fed stance for the time being. While there are those who are disappointed that the Fed did not add to any programs or announce something like YCC or, perhaps, more targeted forward guidance, arguably the above quote is even more powerful than one of those choices. Frequently it is the uncertainty over a policy’s duration that is useful, not the policy itself. Uncertainty prevents investors from anticipating a change and moving markets contrary to policymakers’ goals. So, for now, there is no realistic way to anticipate the timing of the next rate hike. Perhaps the proper question is as follows: is timing the next hike impossible because of the lack of clear targets? Or is it impossible because there will never be another rate hike?

What the Fed did tell us (via the dot plot) is that only two of the seventeen FOMC members believe interest rates will be above 0.0% in 2022 (my money is on Esther and Mester, the two most hawkish members), but mercifully, not a single dot in the dot plot was in negative territory. They also expressed a pretty dour view of the economy as follows:

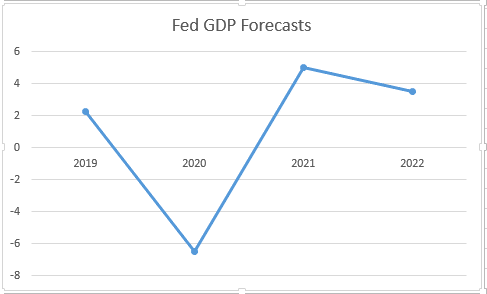

| 2020 | 2021 | 2022 | |

| Real GDP | -6.5% | 5.0% | 3.5% |

| Core PCE | 1.0% | 1.5% | 1.7% |

| Unemployment | 9.3% | 6.5% | 5.5% |

Source: Bloomberg

It is, of course, the 11.5% gain from 2020 to 2021 that encourages the concept of the V-shaped recovery as evidenced by simply plotting the numbers (including 2019’s 2.3% to start).

So, perhaps the bulls are correct, perhaps the stock market is a screaming buy as growth will soon return and interest rates will remain zero for as far as the eye can see. There is, however, a caveat to this view, the fact that the Fed is notoriously bad at forecasting GDP growth over time. In fact, they are amongst the worst when compared with Wall Street in general. But hey, at least we understand the thesis.

Another interesting outcome of the meeting was the tone of the press conference, where Chairman Jay sounded anything but ebullient over the current economic situation, especially the employment situation. And it is this takeaway that had the biggest market impact. After the press conference, equity markets in the US sold off from earlier highs (the NASDAQ set another all-time high intraday) and Treasuries rallied with yields falling again. In other words, despite the prospect of Forever ZIRP (FZ), equity investors seemed to lose a bit of their bullishness. This price action has been in place ever since with Asian equity markets all falling (Nikkei -2.8%, Hang Seng -2.3%, Shanghai – 0.8%) and Europe definitely under pressure (DAX -2.1%, CAC -2.2%, FTSE 100 -2.0%). US futures are also lower with the Dow (-1.9%) currently the laggard, but even NASDAQ futures are lower by 1.1% at this hour.

It should be no surprise that bond markets around the world are rallying in sync with these equity declines as the combination of risk-off and the prospect for FZ lead to the inevitable conclusion that lower long term rates are in our future. This also highlights the fact that the Fed’s concern over the second part of its mandate, stable prices, has essentially been set aside for another era. The belief that inflation will remain extremely low forever is clearly a part of the current mindset. Yesterday’s CPI (0.1%, 1.2% core) was simply further evidence that the Fed will ignore prices going forward. So, 10-year Treasury yields are back to 0.7% this morning, 20 basis points below last Friday’s closing levels. In other words, the impact of last Friday’s NFP number has been erased in four sessions. But we are seeing investors rotate from stocks to bonds around the world, perhaps getting a bit nervous about the frothiness of the recent rallies. (Even Hertz, the darling of the Robinhooders, is looking like Icarus.)

With risk clearly being jettisoned around the world, it should be no surprise that the dollar has stopped falling, and in fact is beginning to rally against almost all its counterparts. While haven assets like CHF (+0.2%) and JPY (+0.1%) are modestly higher, NOK (-0.9%) and AUD (-0.85%) are leading the bulk of the G10 lower. Norway is suffering on, not only broad dollar strength, but oil’s weakness this morning, with WTI -3.1% on the session. As to Aussie, the combination of weaker commodity prices, the strong dollar, and market technicals as it once again failed to hold the 0.70 level, have led to today’s decline.

Emerging market activity is also what you would expect in a risk-off session, with MXN (-1.6%), ZAR (-1.1%) and RUB (-0.7%) leading the way lower. Obviously, oil is driving both MXN and RUB, while ZAR is suffering from the weakness in the rest of the commodity complex. I think the reason that the peso has fallen so much further than the ruble is that MXN has seen remarkable gains over the past month, more than 13% at its peak, and so seems overdue for a correction. One notable exception to this price action today is THB, which is higher by 0.65% on a combination of reports of a fourth stimulus package and a breach of the 200-day moving average which got technicians excited.

This morning’s data brings the latest Initial Claims data (exp 1.55M), as well as Continuing Claims (20.0M) and PPI (-1.2%, 0.4% core). While nobody will care about the latter, there will be ongoing intense scrutiny on the former as Chairman Jay made it abundantly clear that employment is the only thing the Fed is focused on for now. With the FOMC meeting behind us, we can expect to start to hear from its members again, but on the schedule, nothing happens until next week.

It is not hard to make the case that both the euro and pound have been a bit toppish at recent levels, and with risk decidedly off today, further declines there seem quite viable.

Good luck and stay safe

Adf