Takaichi-san

Her pronouns so very clear

Brings the winds of change

Japan has a new Prime Minister, Sanae Takaichi, the first woman to hold the position. She was deemed by most of the press as the most right-wing of the candidates, which fits with a growing worldwide narrative regarding nationalism, antagonism toward immigration and concerns over China and its plans in the region. However, in the waning days of the campaign, she moderated a number of her stances as she does not have a majority in either house of the Diet, and will need to persuade other, less rigid members to vote with her in order to pass legislation.

However, the initial market response has been remarkable. The Nikkei opened in Tokyo +5.5% and held most of those gains, closing higher by 4.75%. USDJPY gapped 1.3% on the Tokyo opening and is currently higher by 2.0% and back above 150. Perhaps the most interesting thing is that despite dollar strength, the precious metals have roared higher with both gold and silver gaining 1.4% as gold touches yet another new all-time high and silver pushes ever closer to $50/oz. Meanwhile, JGB yields are little changed as I imagine it will take a few days, at least, for investors to get a better sense of just how effective she will be at governing in a minority role.

Below is the chart for USDJPY, demonstrating just how big the gap was. This appears to be another chink in the ‘end of the dollar’s dominance’ armor. Just sayin’!

Source: tradingeconomics.com

In Europe, the powers that be

Have found citizens disagree

With most of their actions

Thus, building up factions

That want nothing but to be free

The most recent story is France

Where Macron’s PM blew his chance

He’s now stepped aside

But Macron’s denied

He’ll willingly exit the dance

However, the dollar’s gains today are not merely against the yen, but also, we have seen the euro (-0.7%) slide sharply with the proximate cause here being the sudden resignation of French PM LeCornu. And the reason it seems like it was only yesterday that France got a new PM after a no-confidence vote in September, is because it basically was only yesterday. PM LeCornu lasted just one month in the role as President Macron didn’t want to change the cabinet there, thus making LeCornu’s job impossible. While the next presidential election is not scheduled until April 2027, and Macron is grasping to his role as tightly as possible, it appears, at least from the cheap seats over here in the US, that the vote will happen far sooner than that. He appears to have lost whatever credibility he had when first elected, and France has now had 4 PM’s in the past twelve months, hardly the sign of a stable and successful presidency.

Like the bulk of the current European leadership, Macron has decided that nearly half the country should not have their voices heard by banning Madame LePen’s RN from government. And while President Biden was never successful imprisoning President Trump, in France, they managed to convict LePen on some charge and ban her from running. But that has not dissuaded her followers one iota. We see the same behavior in Germany with AfD, and the Merz government’s attempts to ban them as a party, and similar behavior throughout Europe as the unelected Brussels contingent in the European Commission struggles to do all they can to retain power.

In fact, if you look at the most recent polls I can find for France, from Politico, you can see that RN, LePen’s party, is leading the polls while ENS, Macron’s centrist party has just 15% support. The far left NFP is in second place and the center-right LRLC is at 12%. It is difficult for me to believe that Macron can hold on until 2027, at least 18 months away, and if he does, what type of damage will he do to France?

The point of the story is that whatever you may think of Donald Trump, he has the reins of government and is doing the things he promised on the border and immigration, reducing government and reducing regulations. In Europe, the entrenched bureaucracy is fighting tooth and nail to prevent that from happening with the result that economic activity is suffering and prospects for future growth are stunted. And all that was before the US change in trade policy. With that in mind, absent a massive Fed turnaround to dovishness, which doesn’t seem likely in the near term, the euro has more minuses than pluses I think and should struggle going forward.

Ok, two political stories are the driver today, and neither one has to do with Trump! Meanwhile, let’s look at how everything else has behaved overnight. Friday saw a mixed session in the US, and all I read and heard over the weekend was that the denouement was coming, perhaps sooner than we think. The recurring analogy is Hemingway’s description of going into bankruptcy, gradually, then suddenly, and the punditry is trying to make the case that the ‘suddenly’ part is upon us. I’m not convinced, and would argue that, at least in the US, things can go on longer than they should. This is not to say the US doesn’t have serious fiscal issues, just that we have better tools to address them than anyone else.

Elsewhere in Asia, China is still on holiday while HK (-0.7%) could find no joy in the Japanese election. But Korea (+2.7%), India (+0.7%) and Taiwan (+1.5%) all rallied nicely with only the Philippines (-1.8%) showing contrary price action as investors grew increasingly concerned over a growing corruption scandal with the government there and infrastructure embezzlment allegations. I didn’t mention above but the rationale behind the Japanese jump is that Takaichi-san is expected to push for significant fiscal expansion on an unfunded basis, great for stocks, not as much for bonds.

In Europe, though, you won’t be surprised that France (-1.6%) is leading the charge lower, although in fairness, the rest of the continent is doing very little with the other major exchanges +/- 0.1% basically. As to US futures, at this hour (7:15), they are all pointing higher by 0.5% or so.

In the bond market, Treasury yields have moved higher by 4bps this morning, adding to a similar gain on Friday as it appears there are lingering concerns over what happens with the government shutdown. (Think about it, that issue hasn’t even been a topic of discussion yet this morning!). But remember, the government shutdown does not impact the payment of coupons on Treasury debt, so the issues are very different than the debt ceiling. As to European sovereigns, not surprisingly, French OATs are the wors performers, with yields jumping 8bps (they have real fiscal problems) but the rest of the continent has tracked Treasury yields and are higher by 3bps to 4bps as well.

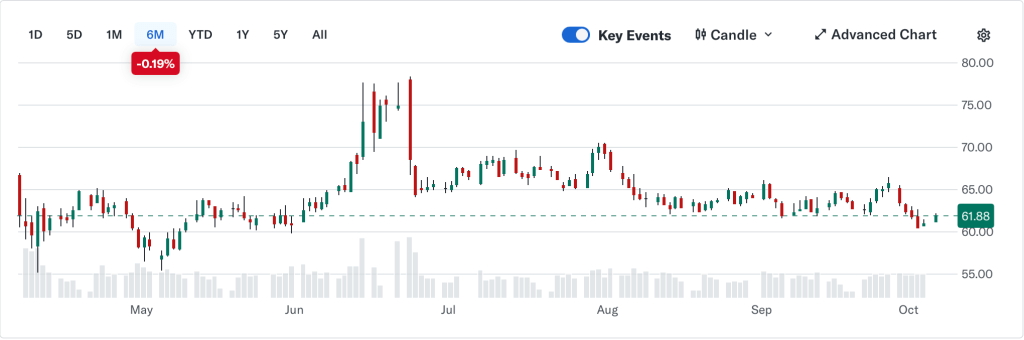

I’ve already highlighted precious metals, although copper (-0.7%) is bucking the trend, albeit after having risen more than 10% in the past month. Oil (+1.4%) is also continuing to bounce off the bottom of the range trade and remains firmly ensconced in the $61.50 to $65.50 range as it has been for the past six months. In fact, looking at the chart below from Yahoo finance, you can see that except for the twelve-day war between Israel and Iran, nothing has gone on here. The net price change in the past six months has been just -0.19% as you can see in the upper left corner. While this will not go on forever, I have no idea what will break this range trade.

Finally, the dollar is stronger across the board with the pound (-0.4%) and SEK (-0.5%) the next worst performers in the G10 while CAD and NOK are both unchanged on the day, reflecting the benefits of stronger oil and commodity prices. In the EMG bloc, the CE4 are all softer by between -0.6% and -0.9%, tracking the euro, and we have seen APAC currencies slip as well (KRW -0.5%, CNY -0.15%). MXN (-0.2%) and ZAR (-0.3%) seem to be holding in better than others given their commodity linkages.

And that’s all we have today. With the shutdown ongoing, there are no government statistics coming but we will hear from 8 different Fed speakers, including Chairman Powell on Thursday morning, over a total of 15 different venues this week. Again, there is a wide dispersion of views currently on the FOMC, so unless we start to see some coalescing, which given the lack of data seems unlikely in the near term, I don’t think we will learn very much new. As far as the shutdown is concerned, the next vote is scheduled for today, but thus far, it doesn’t seem the Democratic leadership is willing to change their views. Funnily, I don’t think the markets really care.

Overall, I see more reasons to like the dollar than not these days, and it will take a major Fed dovish turn to change that view.

Good luck

Adf