The talking points have been disbursed

With narrative writers well-versed

The dollar is falling

‘Cause Trump is now calling

For Powell to leave, “He’s the worst!”

The idea is Trump will soon name

The next Fed Chair, turning Jay lame

This shadow Fed Chair

Will have to beware

Since he’ll, for bad outcomes, get blame

The dollar is weaker this morning and if we use the Dollar Index as a proxy, it has fallen to its lowest level since February 2022.

Source: tradingeconomics.com

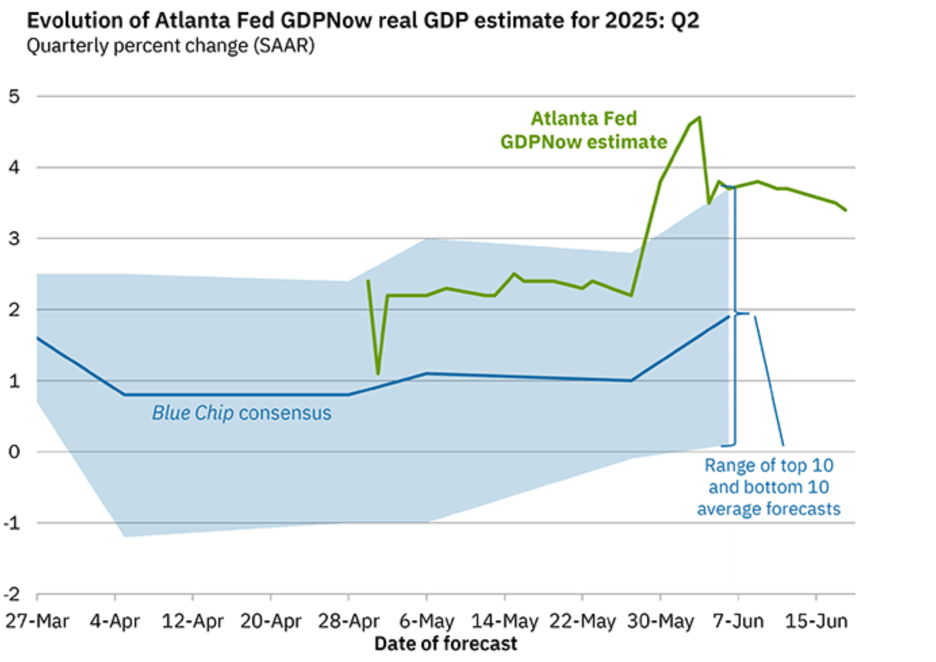

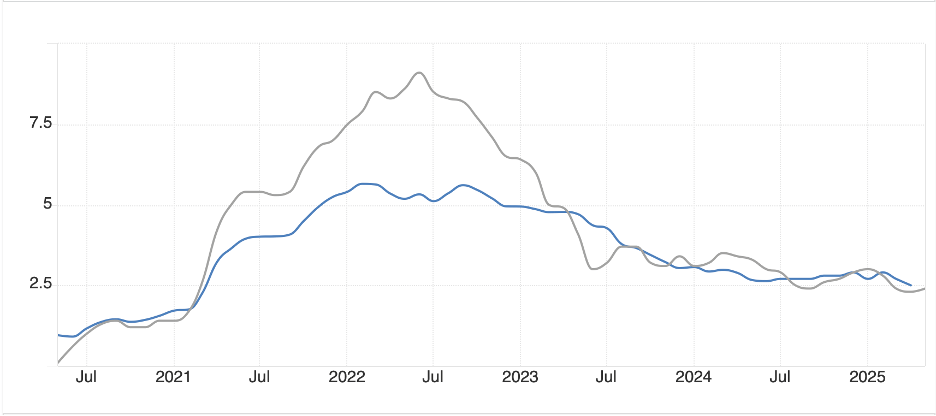

While certainly a part of this movement has been the fact that US yields continue to slide lately, it also seems there is a new narrative that has been distributed to journalists, the dollar is falling because President Trump is considering naming a new Fed Chair much earlier than usual in an effort to undermine Chairman Powell. We have all heard about the rants the President has had regarding Powell’s unwillingness to cut rates even though inflation readings have been declining for the past two months, and are, on a Y/Y basis back to their lowest level since March 2021 whether measured as CPI (grey line) or Core PCE (blue line).

Source: tradingeconomics.com

But in an exclusive (!) article in the WSJ, which was repeated in Bloomberg, that is the story du jour. While Bloomberg’s take cannot be a surprise given Mayor Mike’s intense hatred of Trump (after all Trump is the NY billionaire that became president, not Bloomberg), and editorial direction clearly comes from the top, it is more interesting that the Journal is pushing this theme. Of course, given the Fed whisperer is the article’s writer, it is more than possible that he is simply airing Powell’s views and trying to explain how any move like this would result in chaos, so it’s not Powell’s fault if things go pear-shaped.

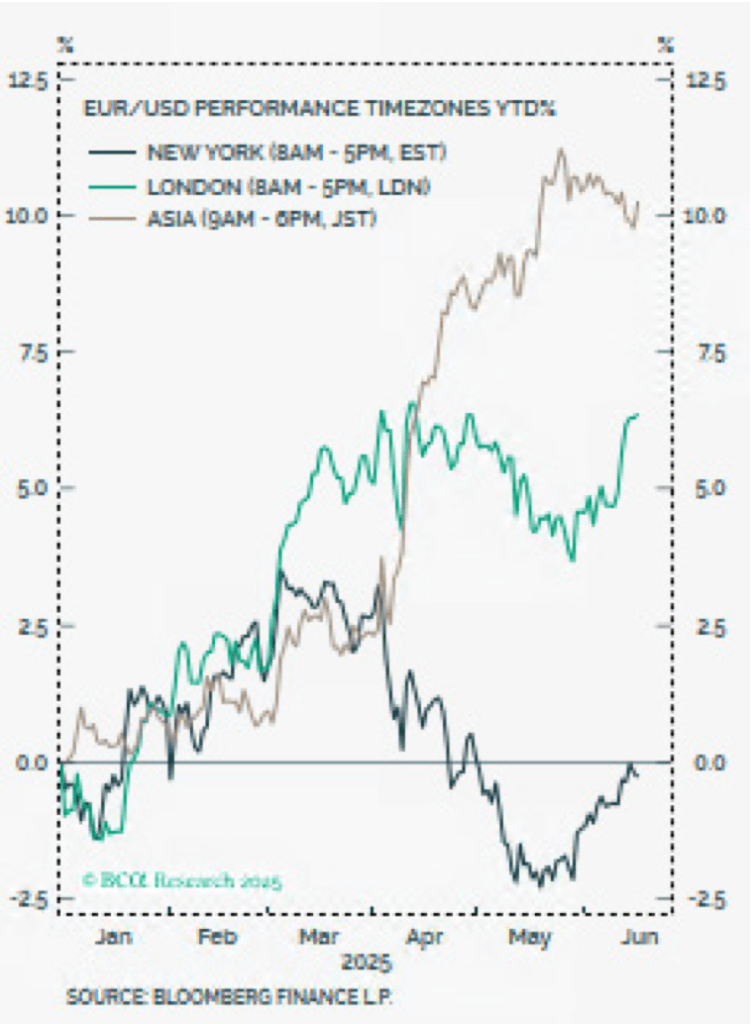

Nonetheless, that is today’s story. In concert with this story, though is another, somewhat more interesting feature, where a really smart analyst, Marko Papic, has broken down the dollar’s movements across different time zones during 2025. The chart below shows that the dollar selling has been emanating from Asia mostly with Europe having a lesser impact and no substantive change in the NY session. The implication is that Asian holders of dollars, which tend to be sovereigns rather than other users like investors or corporates, are the ones bailing out.

This activity first became noticeable in early April, right around “Liberation Day” and does fit with the idea that higher US tariffs will result in a smaller US trade deficit. But as I consider that concept, it strikes me that a smaller US trade deficit will result in fewer dollars around the rest of the world, a reduction in supply, and that would arguably increase the dollar’s value ceteris paribus. Perhaps this reflects investors selling US assets and converting them to Europe, which has been another theme this year as European companies are set to benefit from a major increase in defense spending by NATO. However, that doesn’t really sync with the fact that US equities continue to trade near all-time highs. At this point, I think this is an interesting observation, but am not sure of its meaning. I’m open to suggestions.

Ok, while that is the narrative this morning, let’s look at how markets are behaving. Yesterday’s lackluster activity in the US, with the S&P 500 almost exactly unchanged and the other two main indices +/- 0.3% was followed by a burst higher in Tokyo (Nikkei +1.6%) but lagging activity in HK (-0.6%) and China (-0.4%). The rest of the region couldn’t decide on much with a couple of solid performances (India, Indonesia) and one laggard of note (South Korea). In Europe, Germany (+0.6%) is leading the way higher across the board, as NATO countries have promised to spend upward of 5% of GDP on total defense (including nonlethal investments), with as much as possible going to European based companies. That is a lot of money, well over $1.5 trillion. Meanwhile, US futures are all higher at this hour (7:15), up by about 0.4% or so.

In the bond market, Treasury yields (-2bps) continue to slip and are now back to their lowest level since early May. Perhaps more interestingly, European sovereign yields are sliding today as well, led by Italian BTPs (-4bps) but lower across the board. This is interesting given the promises of more borrowing based on the NATO announcement. But net, bond yields have not really done very much lately at all.

In the commodity markets, oil (+0.5%) is continuing to slowly bounce from the initial lows in the wake of the Iran/Israel ceasefire. This market still feels quite heavy to me and absent a major change on the ground in the Middle East, if war were to resume and oil facilities be attacked, I still think lower is the way. In the metals markets, gold (+0.25%) which tried to sell off yesterday continues to find bids below the market, likely central bank support. But silver (+0.9%) and copper (+2.3% and above $5.00/lb) are looking good although nowhere near as impressive as platinum (+3.4%) which has now risen above $!400/oz and is going parabolic here. There is much talk here about a supply shortage (it is used for catalytic converters) and significant Chinese demand.

Source: tradingeconomics.com

Finally, the dollar, as mentioned, is under pressure across the board, although the magnitude of this morning’s movement has not been that large. The largest movement has been in Asia with IDR (+0.6%), JPY (+0.4%) and KRW (+0.35%) while European and LATAM movements have been generally 0.2% or less. So, the direction is clear, but it has not been impressive.

On the data front, there is plenty today starting with the weekly Initial (exp 245K) and Continuing (1950K) Claims, the Chicago Fed National Activity Index (-0.1), the last look at Q1 GDP (-0.2%), and Durable Goods (8.5%, 0.0% ex-Transports). We also hear from four more Fed speakers, but Powell just repeated yesterday that they are happy where they are and unlikely to move soon unless something really changes rapidly. However, despite Powell’s claims of nothing to come, the Fed funds futures market is pricing a 25% probability of a cut at the July 30 meeting. There is a lot of time between now and then for that to change.

I keep trying to figure out what actually matters to markets anymore as responses to different potential catalysts seem confused. People do seem to be coalescing around the dollar is falling theme, something I have believed for a while, and if the Fed does lean to a cut next month, I do believe there is further for it to fall. One thing to remember, though, is with Mr Trump as president, things are still a tweet away from a dramatic change. If I were in charge of hedging risk, I would adhere to guidelines closely. There is too great an opportunity for a sudden major reversal in the current environment.

Good luck

Adf