Six central bank meetings this week

Will give us a new inside peak

At their dedication

To wipe out inflation

And just how much havoc they’ll wreak

Investors have made all their bets

And so far, today, risk assets

Show green on the screen

Ere any convene

Methinks, though, there’ll be some regrets

It is central bank week as we hear from more than half of the G10 between tomorrow and Thursday. The BOJ kicks things off followed by the RBA, FOMC, Norgesbank, the SNB and finally the BOE. A great deal of stock has been put into these meetings by both traders and investors as everyone is seeking clues for the future. Alas, looking for central banks, whose crystal balls are cloudier than most, to give solid clues is probably not the best idea. But let’s take a quick look at each meeting and expectations:

BOJ – next to the Fed, this is the meeting that has gotten the most press both because Japan is the largest of the other economies, but also because there is much talk that they are going to raise their base rate for the first time in 17 years! At this point, despite the most recent dovish comments from Ueda-san two weeks’ ago, the best indicator seems to be Nikkei News, which has had several articles (courtesy of Weston Nakamura’s Across the Spread substack) declaring that rate hike is coming. Apparently, they have a perfect record in these forecasts, so it looks a done deal.

Arguably, the question is will they do anything else beyond moving from NIRP to ZIRP? There are several analysts who believe they will adjust YCC as well, either eliminating it completely, or changing the terms to buy a fixed amount each period rather than responding to market conditions. As well, they continue to buy equity ETFs and REITs so it is quite possible they end those programs.

The funny thing is so many believed that when the BOJ finally started their tightening cycle that would be the signal for selling JGBs and buying yen. Well, if that has been your strategy going into the meeting, it has not worked out that well. JGB yields (-3bps) have been consolidating around the 0.75% level virtually all year while the yen, which did have a little pop higher at the beginning of the month, is now back close to 150 again. Regarding the yen, the driver in the currency continues to be US interest rates and the incremental adjustment by the BOJ is just not enough to move the needle absent a firm commitment by Ueda-san to hike regularly going forward. And there is no evidence of that. As to JGB yields, a slow grind higher seems possible, but a run up above 1.0% seems highly unlikely, especially given the economic cycle has just turned down with two consecutive quarters of negative real GDP activity.

RBA – there is no policy movement anticipated here for this meeting as both growth and inflation remain above targets but have not been relatively stable. In fact, there is a minority looking for a cut, but that seems unlikely right now simply based on the inflation data. Generically, I find it extremely difficult to believe that any central bank will be able to cut their rates with inflation running well above the target and, in most places, looking like it has found a bottom. I realize there is a significant desire to cut rates by virtually all central bankers, but given the current economic situation, if they want to salvage whatever credibility they may have left, it is a hard case to make to cut right now.

One other thing to remember is that Australia is more dependent on China than any other G10 nation and China last night published better than expected economic data with IP jumping to 7.0%, far better than expected and its fastest pace in two years. If China is starting to pick up again, that will be a net benefit for Australia and put upward pressure on commodity prices and prices in general Down Under. I think they remain on hold for a while yet.

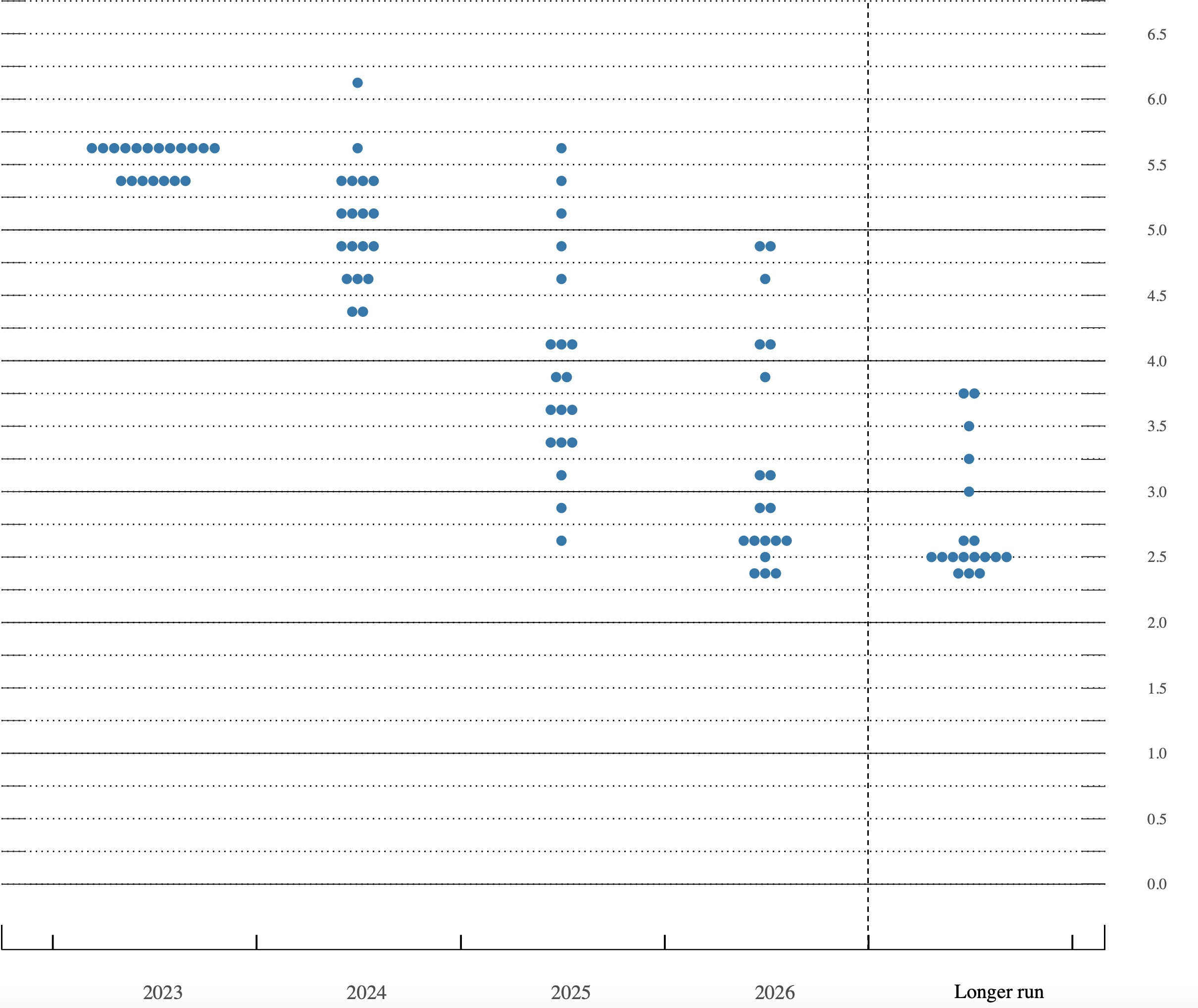

FOMC – suffice to say no change in rate policy but we will discuss the other features tomorrow regarding the dot plot and potential guidance.

SNB – The Swiss may be the other central bank to move this time as inflation there has fallen to 1.2%, well below the ceiling of their 0% – 2% target range. While the market consensus remains no change and the franc has softened nearly 4% vs. the euro so far this year, we cannot forget that it remains far stronger than its historic levels and the opportunity to weaken the currency a bit to help its export industries while inflation remains quiescent is something that may appeal to SNB President Jordan. Keep an eye out here.

Norgesbank – No change here as inflation remains far too firm, ~5%, while oil’s recent rebound has helped the currency rebound. I don’t think there is anything to be learned from this outcome.

BOE – Here, too, no change is expected and there is no press conference. As such, the most interesting question will be the vote split. Last time, the split was 1-6-2 for a cut, hold and hike respectively. (Talk about not seeing things the same way! How is it possible that two committee members can look at the same data and believe opposite conclusions? Seems there is some ideology in play there.). At any rate, a change in the vote count will be a signal. Recent data has shown that wages are still hot, but slowing down, while inflation is similarly hot but slowing. The latest CPI data will be released on Wednesday so the BOE will have that to account for as well as everything else. At this point, I’m in the no move camp with the same split of votes the outcome.

With that recap, let’s look at the overnight session briefly. As mentioned above, equities are green everywhere with the Nikkei (+2.7%) leading the way around the world and pushing back close to the key 40K level. But there was strength in every market in Asia. Europe, too, is all green, albeit less impressively, with gains on the order of 0.25% while US futures are looking good at this hour (7:45) with the NASDAQ leading the way, up 1.0%. (Here, many are counting on more amazing news from Nvidia as they have a weeklong conference starting today.)

After last week’s rush higher in yields on the strength of the hotter inflation prints from the US, this morning is seeing very little movement overall ahead of the central bank meetings this week. Basically, every market is within 1bp of Friday’s closing levels, with a few higher and others lower. One other thing I failed to mention was the PBOC will be revealing their 5-year Loan Prime Rate on Tuesday night, and while no change is forecast, it was last month when they cut this to help the property market that kicked off the idea more stimulus was coming.

Oil prices continue to perform well on the back of several different factors. First, we have seen inventory draws much greater than expected in the US. At the same time, Ukraine has damaged several Russian refineries thus reducing the supply of products and we still have OPEC+ maintaining their production restrictions. Add to this China’s apparent rebounding growth supporting demand and that is a recipe for higher prices. As to the metals markets, despite the dollar’s recent rebound, gold continues to hold its own and copper is still rising consistently. In fact, the red metal is higher by 5% in the past week, a potential harbinger of better global growth.

Finally, the dollar is a touch softer this morning, but only a touch. The biggest mover is ZAR (-0.6%) which is opposite the broader trend of very slight dollar weakness. While South African equities have been drifting lower of late, today’s move feels more like an order in the market than a fundamental change. Away from that, though, no currency of note has moved more than 0.2% on the day as traders await the onslaught of central bank news.

Speaking of news, we have other things beyond the central banks as follows:

| Tuesday | Housing Starts | 1.43M |

| Building Permits | 1.50M | |

| Thursday | Initial Claims | 216K |

| Continuing Claims | 1815K | |

| Philly Fed | -2.5 | |

| Current Account | -$209.5B | |

| Existing Home Sales | 3.95M | |

| Flash PMI Manufacturing | 51.7 | |

| Flash PMI Services | 52.0 |

In addition, starting Thursday, the first Fed speakers will be back on the tape to reinforce whatever message Chair Powell articulates on Wednesday.

From my vantage point, it appears that the BOJ’s rate hike has been accepted and priced in already, while the biggest surprise could be Switzerland. However, the fate of the dollar lies in the hands of Powell, and that is an open question we will discuss tomorrow. For today, don’t look for too much of anything in any market.

Good luck

Adf