For those of the dovish persuasion

Last Friday was quite the occasion

At zero percent

Those doves are now bent

On writing a new Fed equation

If PCE really is nil

It’s likely that Chair Powell will

Be forced to cut rates

And shut down debates

Inflation is bothersome still

Meanwhile, out of France its reported

Macron’s government’s been aborted

Will Madame Le Pen

Now lead all Frenchmen

Or will her success soon be thwarted?

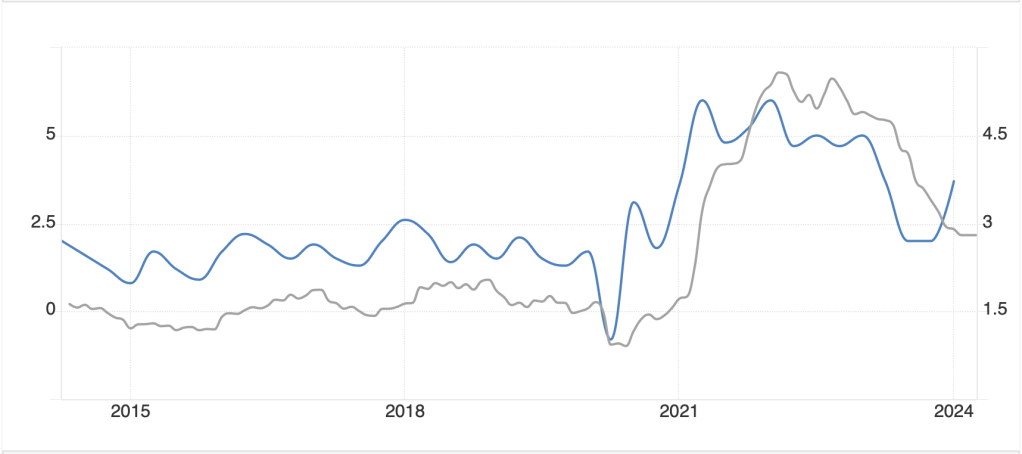

A funny thing happened on the way to lower interest rates on Friday; the long end of the curve, from 10-year to 30-year Treasury yields, exploded higher by 15bps from their post PCE nadir. While the initial reaction to the PCE data, which, by the way, was exactly in line with forecasts, was to see a modest decline in yields as all those pushing for Fed rate cuts were out in force making their case again, by the end of the day, the damage was done with yields 10bps higher despite the data.

Now, part of that move might be blamed on the fact that Chicago PMI printed at a much better than expected 47.4, indicating that last month’s horrendous figure of 35.4 was the true aberration. And part might be blamed on the Michigan Consumer sentiment, having barely fallen, to 68.2, rather than the expected 3+ point fall the analysts had forecast. Of course, there were those who raised the question of the outcome of the US elections in November after Thursday night’s debate and the disastrous Biden performance seemed to open the door for a Trump victory. For some reason, bond investors seem to think that Trumpian spending is worse than Bidenomics spending although both are likely to be far too much overall.

Or perhaps, this is the first step toward a growing concern that the trajectory of US government spending is becoming problematic writ large. After all, there is no indication that whoever is the next president is going to rein in spending and run an austerity budget. While they may spend on different things, it will still require the Treasury to borrow trillions more dollars. Perhaps the biggest buyers of Treasury debt, be they foreign governments, hedge funds or individual investors do not believe that the Fed is going to do, as Mario Draghi once promised, “whatever it takes” to achieve their 2.0% inflation target. If this is the case, then beware as yields will be able to rise much further. I’m not saying this is what is happening, just that it is one possible explanation.

While there is much yet to discern in the US, we must, at this stage, turn to France, where the first round of President Macron’s snap election was held yesterday and the results were largely as expected, although Marine Le Pen’s RN party did not quite achieve quite the heights that some had feared forecasted. However, she did win more than one-third of the vote relegating Macron to just over 20% and the awkward coalition of the Left, the so-called New Popular Front, to 29% or so. (Maybe they aren’t as popular as they thought!)

The upshot is that there are now all types of maneuvering between the New Popular Front and Macron to figure out a way to prevent Le Pen’s RN from winning an outright majority of 289 seats. That vote comes this Sunday so we will have to wait and see what happens, but between now and then, there is an enormous amount of new information due to arrive including the results of the UK elections on July 4th and then the US employment report on July 5th. This week has the opportunity to be quite volatile given the news forthcoming and the fact that in the US, there will be many trading desks that are lightly staffed due to the holiday.

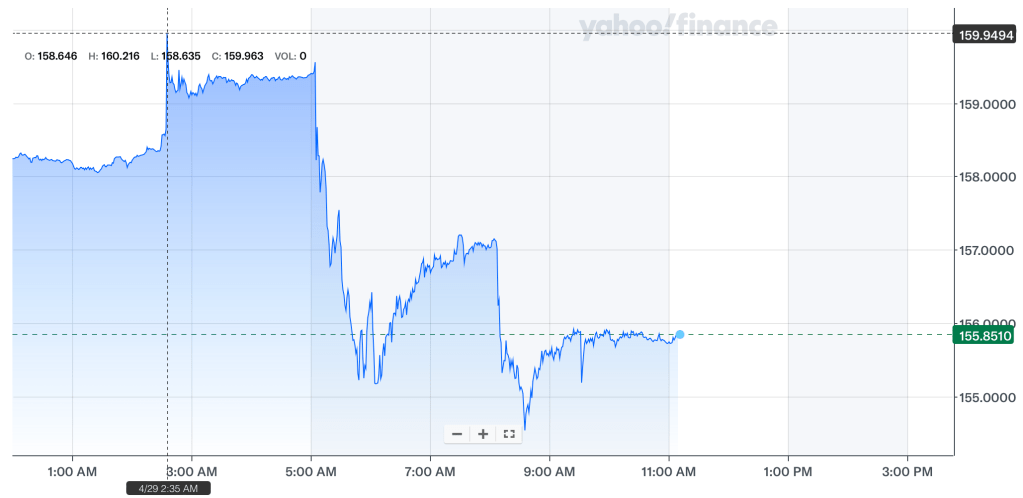

So, let’s take a look at how markets are behaving given all the new information. The first thing to note is that despite a strong start in US equity markets Friday, all three major indices closed in the red, not dramatically so, but certainly a concerning reversal of fortune. This, of course, coincided with the melt down in Treasury prices. However, in Asia, there is far more green than red on the screen led by China (+0.5%) and India (+0.5%) with most other markets showing less enthusiasm and Australia following the US markets as the only nation with equity declines. Japanese Tankan data was largely in line with expectations with one outlier, the Non-Manufacturing Outlook was much weaker than expected. Chinese Manufacturing PMI data was unchanged at 49.5, still hovering below the growth/slowdown line while the Non-Manufacturing Index fell to 50.5, down 0.6 and indicative of the fact that economic growth in China is slowing more quickly than expected. It appears that market participants are now looking for more stimulus from the government, hence the support in the equity markets.

In Europe, markets are powering ahead this morning led by the CAC (+1.25%) in Paris as the new story is there is hope that Le Pen’s RN party will not win an outright majority of Parliament and therefore be unable to implement their policies. It is not clear why a caretaker government, which would be the result in that case, is seen as so positive, although arguably, this is simply a modest retracement of the CAC’s 8% decline over the past six weeks as fears over a Le Pen victory rose. However, the rest of the continent is also moving higher this morning despite (because of?) PMI data showing that the continent remains in the economic doldrums. I guess the view is ongoing weakness will reduce inflationary pressures and thus allow the ECB to cut rates more aggressively. Finally, US futures at this hour (6:00) have edged higher by 0.1% or so.

The bond market, though, is where there has been far more activity as following Friday’s massive sell-off in the US, we are seeing European yields climb, although there are idiosyncratic stories here as well. For instance, German Bunds have seen yields jump 8bps, while French OATs are only higher by 2bps and Italian BTPs are unchanged. It appears that bond investors have taken equal solace in the fact that the RN party may not win an outright majority on Sunday coming, and so are modestly less worried about more pressure in the Eurozone. However, it cannot be overlooked that yields are generally higher this morning across the board than they were las Monday, and the market appears far more concerned over the future.

In the commodity markets, oil (+0.55%) is modestly higher this morning as are the metals markets with both precious and base metals all in the green. While oil has had a life of its own lately, responding to idiosyncratic features of the market, the metals have lately been closely linked to the dollar, rallying when the dollar is under pressure and vice versa. Today is a perfect example of that movement with the dollar largely weaker across the board.

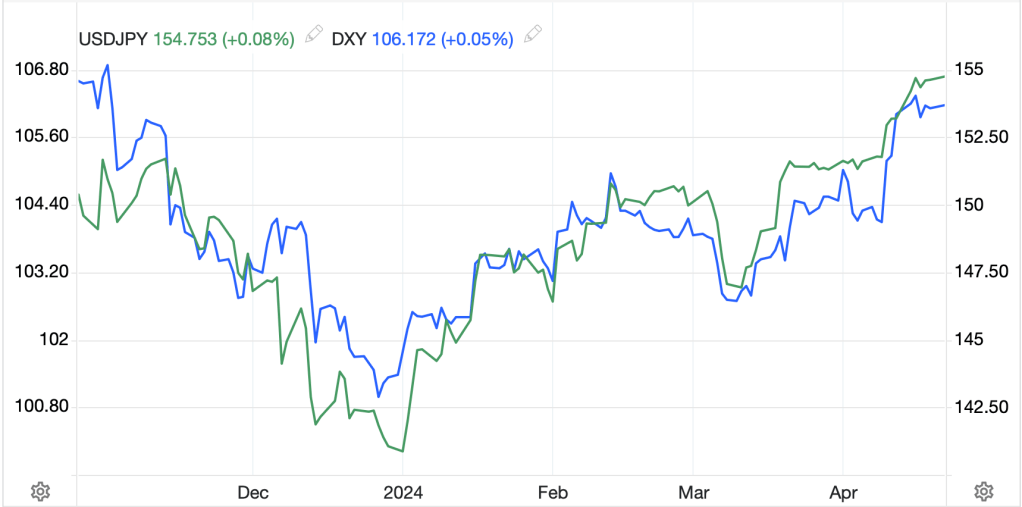

The biggest mover in the dollar, at least vs. the G10 currencies, is the euro (+0.35%) as traders and investors follow French stocks and have shown some relief in the fact that an RN victory may not be forthcoming. (Just be prepared for a major reversal if RN does win an outright majority.). This has helped virtually all the other G10 currencies except the yen (-0.15%) and CHF (-0.3%), both of whom have lost some of that haven status this morning. In the EMG bloc, things are largely as you would expect with the CE4 all gaining and ZAR (+0.8%) gaining slightly more with the help of metals markets. As to APAC currencies, they are essentially sitting out the French elections and are little changed across the board this morning.

On the data front, as it is the first week of the month, there is much to await.

| Today | ISM Manufacturing | 49.1 |

| ISM Prices Paid | 55.9 | |

| Tuesday | JOLTS Job Openings | 7.85M |

| Wednesday | ADP Employment | 170K |

| Initial Claims | 235K | |

| Continuing Claims | 1841K | |

| Trade Balance | -$76.0B | |

| ISM Services | 52.5 | |

| Factory Orders | 0.3% | |

| -ex Transport | 0.3% | |

| FOMC Minutes | ||

| Friday | Nonfarm Payrolls | 195K |

| Private Payrolls | 169K | |

| Manufacturing Payrolls | 5K | |

| Unemployment Rate | 4.0% | |

| Average Hourly Earnings | 0.3% (3.9% Y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.7% |

In addition to all this, we hear from Chairman Powell tomorrow morning and NY Fed president Williams on Wednesday and Friday. Given Friday’s PCE data moved closer to their target, there are many looking for a clear signal that rate cuts are coming soon. The Fed funds futures market has not really changed its pricing with a bit more than a 10% probability of a July cut and a roughly two-thirds probability for September. And remember, virtually every Fed speaker in the past two weeks has looked through the data and indicated they need to see more of it moving in their direction to consider it to be time to ease policy. I suspect that Friday’s NFP and Unemployment Rate are going to be critical at this juncture although certainly Chairman Powell can change the tone of the narrative all by himself.

One last thing, Thursday, the UK will hold an election with the Labour Party is so far ahead in the polls, it appears a foregone conclusion that they will win, ousting the Tories after 14 years in power. As such, the market has already made their peace with that. In the end, the hopes and prayers of many are that inflation is truly ebbing and that the Fed will be able to take their foot off the brakes. Certainly, if the NFP is weak, we need to look for them to hit the gas and rate cuts will be back in play for this month. In that case, look for the dollar to tumble and stocks to rock. But if NFP and Unemployment remain solid, there is little cause for the Fed to change the current higher for longer.

Good luck

Adf