In Germany, data’s still weak

For Europe, that doesn’t, well, speak

So, riddle me this

Are traders remiss

For claiming that euros are chic?

It’s true interest rates matter most

And Powell said Fed funds are toast

But can M. Lagarde

Just simply discard

The Germans, though they’re comatose?

There is a growing opinion that the dollar is going to decline sharply as the Fed begins to cut rates. Numerous analysts believe that the market is underpricing how many Fed fund cuts are coming as they are all-in on the US recession story. After Friday’s Jackson Hole speech, it certainly appears that we will get at least one cut come September, but stranger things have happened. And obviously, given Powell’s pivot from inflation to unemployment as job #1, the NFP report a week from Friday is going to be crucial.

But we must never forget that the FX market is a relative concept. It is not simply that one country’s economy is doing well or poorly, nor that their interest rates are high or low, or perhaps moving up or down, it is how those data points compare to other countries that determines the movement in the FX markets, at least the fundamentals, but also frequently the capital flows. It is with this in mind that on a quiet day we have time to dissect the story in Germany for a bit. Early this morning, Germany’s Federal Statistical Office released two data points, the GfK Consumer Confidence reading, which fell sharply to a below consensus reading of -22.0 and the Final GDP Growth numbers for Q2, which printed at -0.1% Q/Q and 0.0% Y/Y. Now, this is not a single quarter feature in Germany as is illustrated in the below chart.

Source: tradingeconomics.com

In fact, GDP growth in Germany has averaged just 0.3% annually over the past 5 years, a pretty anemic level, and one that bodes ill for Europe as a whole. Recall, Germany’s economy is the largest in Europe (and 3rdlargest in the world) and represents about 28.6% of the Eurozone’s total economy. If the largest economy in a group of nations is stagnating, it is very difficult for the group’s overall growth rate to expand. Compare that to the fact that the data to date in the US indicate that growth remains fairly solid (GDP +2.8% in Q2), and then ask yourself, where are the opportunities for activity more prevalent, Europe or the US? Again, the macro picture seems to point to the US as a continued preferred destination for capital.

And yet, the euro is pushing back to its highest level since a brief spike in July 2023, and otherwise, early 2022 prior to that. So, does it really make sense for the euro to continue to rally from here? Literally, the only argument in its favor is that the Fed has now committed to begin easing policy and the market is pricing in about 200bps of rate cuts through the end of 2025. Meanwhile, although the ECB has implemented their first rate cut, and seem set to execute their second next month, the market is only pricing in 125bps of cuts by December 2025, and just 50bps total for 2024, compared to 100bps for the Fed.

As such, here is the explanation for the euro’s recent solid performance. But I believe the question to ask is, can this last? If Germany’s economy is going to continue to bounce along at essentially zero growth, and there is nothing indicating a rebound is coming soon, it seems more likely to me that the rest of Europe follows it lower, rather than ignores Germany and powers ahead. It’s not that individual small nations in the Eurozone won’t grow more quickly, but Germany’s position in the Eurozone, notably as a trade partner, implies that things are more likely to sag than soar.

Yes, the euro has rebounded lately, but that has been in response to the interest rate pricing described above. I think it is a fair bet that Madame Lagarde, when faced with a Eurozone that is growing more slowly than desired, is likely to accelerate interest rate cuts there. And when that happens, the euro’s recent rise will very likely retrace. I am not saying that the dollar is going to climb against everything, just that the euro’s strength feels suspect. One poet’s view.

I’m sorry for the focus on Germany, but some days, there is very little macro news of note, and this seemed the most important, especially given that the idea of a much weaker dollar going forward is gaining traction.

Ok, with that in mind, let’s look at the overnight activity, which was not all that substantial. After yesterday’s split between tech shares (NASDAQ -0.85%) and industrials (DJIA +0.16% and a new ATH), Asian shares were mixed as well. The Nikkei (+0.5%) had a solid session as did the Hang Seng (+0.4%) although mainland Chinese shares (-0.6%) continue to suffer, last night due to a much weaker than forecast earnings result from the parent company of Temu. Of more concern than the result was the commentary by their CEO that prospects for consumption were dimming. In Europe, there are some very modest gains, with the DAX (+0.2%) surprisingly holding up well, although the move is obviously quite minimal. I cannot look at the Eurozone economy and expect anything other than more aggressive rate cuts from the ECB going forward. As to US futures, at this hour (7:30), they are essentially flat.

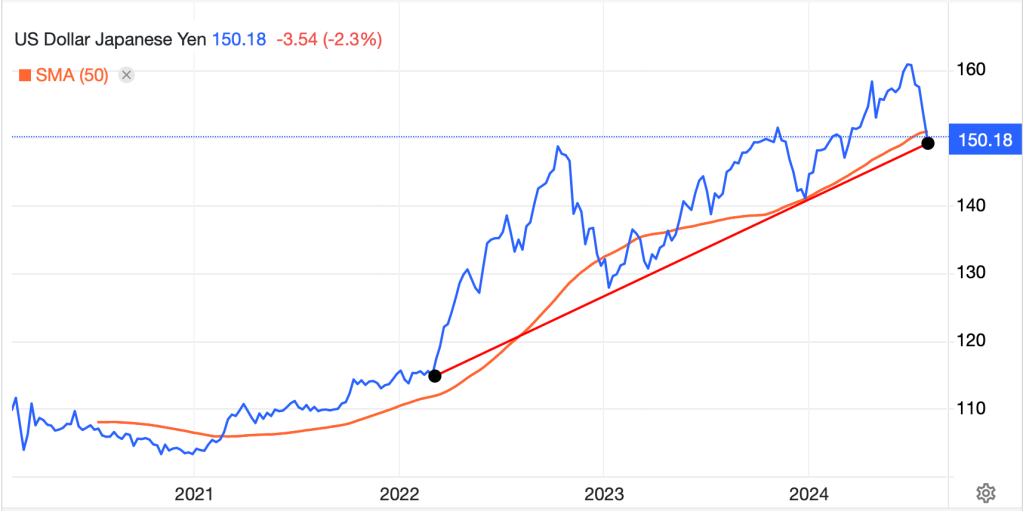

In the bond market, yields are backing up from their recent lows with Treasuries higher by 3bps and European sovereigns by between 5bps and 7bps. In fact, the real outlier is the UK gilt market where 10yr yields are higher by 9bps as there is an increasing concern that the Starmer government is going to blow up the budget there as the PM tries to implement his new policies. You may remember what happened when Liz Truss was PM and proposed a high spending, high deficit budget and caused all kinds of havoc in the gilt market back in October 2022. I would not rule out another situation like that quite frankly. Finally, JGB yields edged lower by 1bp last night, continuing to prove that normal monetary policy in Japan remains a distant prospect.

In the commodity markets, oil (-0.4%) which is higher by > 5% in the past week, has stopped climbing for now. Perhaps the fact that there have been no new military incursions in the Middle East has been sufficient to get the algos to start selling again on the poor demand story. Gold (-0.2%) is also biding its time, as are the other metals, although all are retaining the bulk of their recent gains. Generically, my dollar view is that it will weaken vs. stuff like commodities, not necessarily vs. other currencies. Of course, this implies a rebound in inflation, something which I continue to see going forward.

Lastly, the dollar is little changed this morning, with most G10 and EMG currencies +/-0.2% or less compared to yesterday’s closing levels. The biggest mover today is NZD (+0.4%), although I am hard-pressed to see any fundamental reason as there was neither data nor central bank commentary. Arguably, this is the result of some position changes rather than a fundamental move. And after that, nothing has moved much at all.

Yesterday’s Durable Goods print of +9.9% was astonishingly high, although the ex-transport reading of -0.2% was a tick lower than forecast. I guess Boeing sold more planes than anticipated. As to this morning, we see Case-Shiller Home Prices (exp 6.0%) and Consumer Confidence (100.7), neither of which seems likely to have a major impact. SF Fed president Daly reiterated the Powell idea that the time has come to cut rates, and I expect every Fed speaker going forward up to the quiet period to say the same. I guess the real problem will be if the NFP report is hot. Right now, the early forecasts are for 100K NFP and the Unemployment Rate to remain unchanged at 4.3%. But what if it prints at 200K and Unemployment slips back a tick? Will they still be anxious to cut? I’m not forecasting that, simply reminding us all that assumptions need to be tempered.

As it is the last week of August with holidays rife around the Street, I suspect it will be very quiet overall. At this point, we need more data to make decisions, so look for limited activity in the FX markets, although I guess the world is really waiting for Nvidia’s earnings tomorrow more than anything else.

Good luck

adf