There once was a group of old men

Who spoke via paper and pen

Last week, this odd choir

With hair all on fire

Explained that the world would soon end

I wonder if this week we’ll learn

This group now has nought left to burn

If so, we may find

That all of mankind

Could yet weather any downturn

I have no idea how this is going to play out and truthfully neither does anybody else. While I am happy to admit that fact, my sense is others will not be so forthcoming. President Trump made clear that he wanted to change the way things are done. He was explicit in his efforts to rearrange the global trading system, and by extension the global economy, so that it was less punitive to American businesses. At least in his mind.

I think the other thing to remember is he was elected by Main Street, not Wall Street. The MAGA movement was originally composed of small-town folks who had not benefitted from the financialization of the economy that really accelerated with the GFC. And most of these folks don’t look at the stock market every day, nor the bond market nor the value of the dollar in the FX market. They do see the price of gasoline at the pump, and the price of groceries in the store, but otherwise, market activity is not a primary focus.

I mention this because I think it is critical to remember Trump’s primary audience if we are to understand why he is doing what he is doing. Bill Ackman screaming on X is not the president’s concern. Redeveloping the US manufacturing base is his goal.

Now, will his actions lead to that outcome? There are many naysayers and most of them write for major news outlets or are politically motivated (isn’t that the same thing?). But remember, Trump doesn’t have to run for office again. I suspect the fact that the Senate passed their version of the “big, beautiful bill” for taxes and the budget last week was of far more interest to the President than the fact that Senator Chuck Schumer is calling his actions reckless.

My point here is to highlight that all those who believe that President Trump will succumb and change his stance because equity prices have fallen are still not listening to the man.

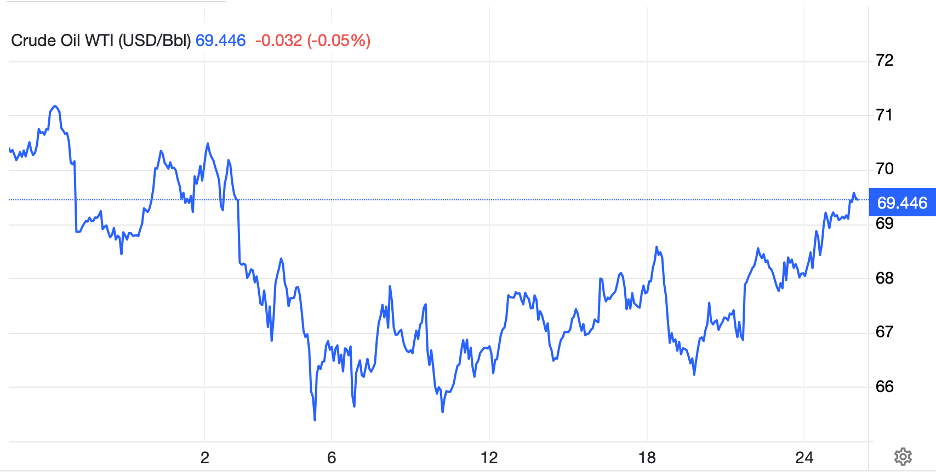

Speaking of prices at the pump, there was news last week that was missed by many, if not most, people, and that is likely to have a significant impact on oil prices. It turns out, that in the wake of the tariff announcements, OPEC explained they would be increasing production by 411K bbl/day beginning in May with potentially larger increases going forward. It appears that the loss of market share is becoming untenable in their eyes, and so they are on their way to regaining that, even if prices are to decline further.

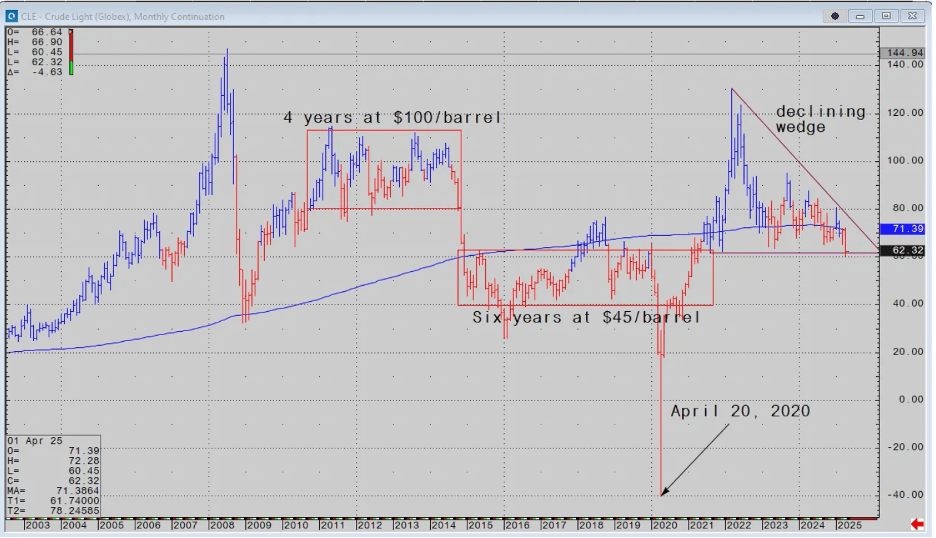

There are some who speak of a deal with President Trump, who you may recall has been seeking to lower oil prices, and I suppose that is quite possible. But, regardless of the driving force behind the action, as my friend Alyosha on Substack explains eloquently, it is quite possible that we are entering a new regime in oil prices. This chart from his most recent Substack posting is instructive.

In essence, his theory, which this chart describes, is we may well be heading into a new long-term range of oil prices that is far below what we have been used to, especially since the Russian invasion of Ukraine. Remember, if energy prices decline, that reduces cost pressures for the entire economy. And here we are this morning with oil (-4.0%) breaking below $60/bbl and down -10% in the past month. Despite all the headlines that tariffs are going to raise prices, this is something that will clearly offset any general rise in price pressures.

But markets are still digesting the tariff news and are not happy about it. Apparently, several nations have reached out to the president to discuss what can be done to address this change in tariff behavior, including the UK, Japan and Taiwan. As a negotiating tactic, it strikes me that Trump will not want to waver if he is to achieve better trade deals for the US. And while he may be subject to the slings and arrows of a negative press in the US, there is nobody on the planet who is more capable of absorbing those and continuing on his merry way.

Ok, let’s see the damage wrought in the overnight markets, where adjustments are still being made. Before we start, though, remember, US share prices were at extremely high valuations prior to all this with just seven companies representing nearly one-third of the value of the S&P 500. The common refrain was that these conditions could not be maintained forever. That refrain was correct, but the speed of the adjustment has clearly been more rapid than many had hoped expected. The below reading of the Fear and Greed Index speaks for itself. But remember, this is seen as a contra-indicator, where extreme fear is seen as a buying opportunity.

Source: cnn.com

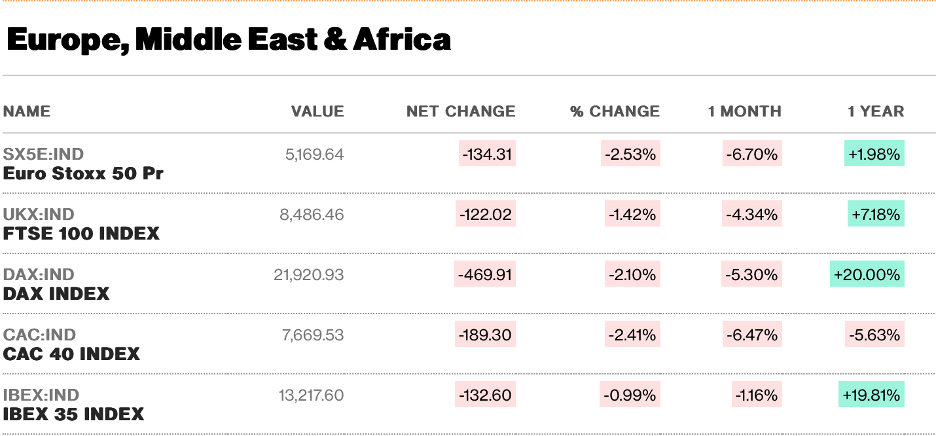

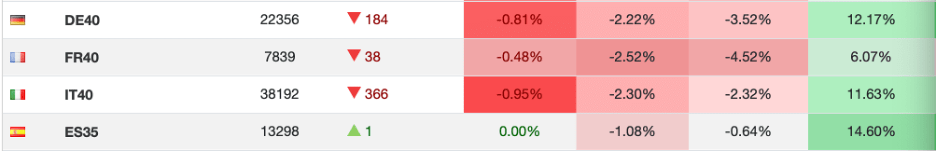

Ok, now to markets. The nearly -6% declines across the board in the US on Friday have been followed by even large declines in Asia, with the Nikkei (-7.8%), Hang Seng (-13.2%) and CSI 300 (-7.1%) all suffering greatly. Taiwan (-9.7%) and Singapore (-7.6%) were the other largest movers with the rest of the region declining on the order of -4.0% give or take a bit. In Europe, the losses are not quite as severe, with declines on the continent averaging -6.2% or so and UK shares slipping “just” -4.8%. interestingly, US futures, which had been down as much as a further -6.0% in the early part of the overnight session, have rebounded slightly and now (5:40) sit lower by around -3.4% or so. It appears we are seeing the first nibbles of value buyers.

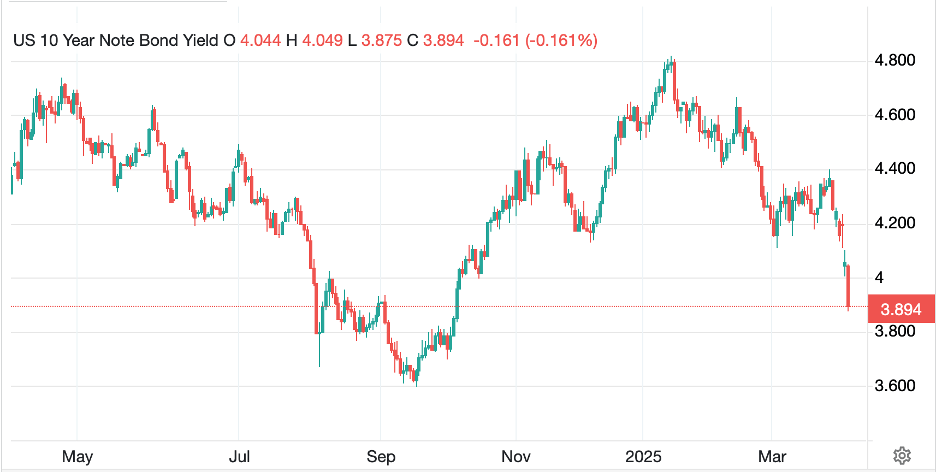

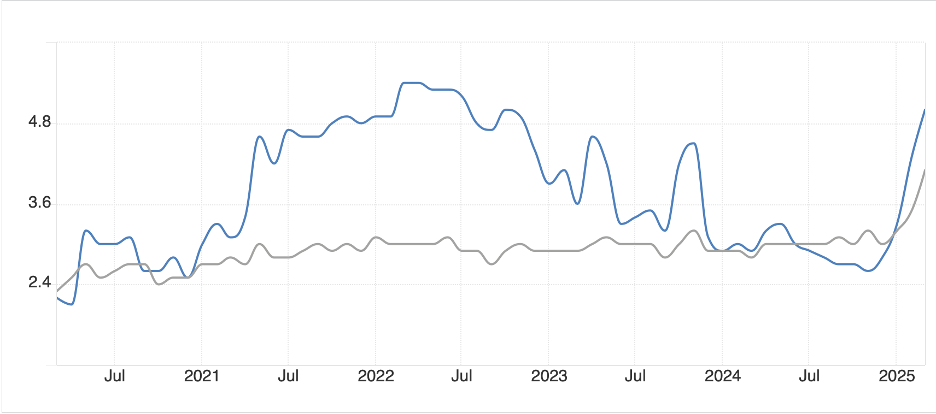

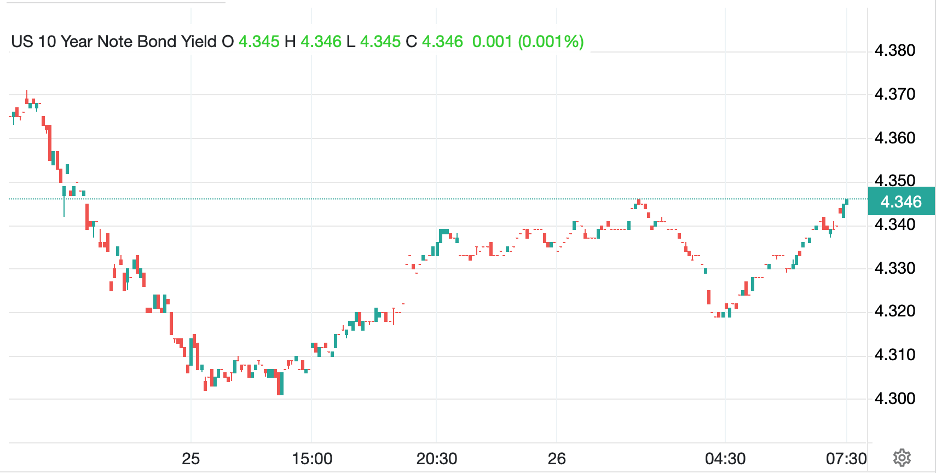

Bond yields continue to decline as the flight to the relative safety of government debt is rampant. While Treasury yields (-4bps) are only a bit lower, in Europe, German bunds (-12bps) and French OATs (-8bps) are leading the way. Recession concerns have risen everywhere, with the punditry now highly convinced a recession is a given and the only question is whether or not this will turn into a depression. That feels premature to me, but I’m just a poet. As to JGB yields, they, too, have tumbled further as funds flow back to Japan, and are down a further -8bps this morning, now yielding just 1.09%, a far cry from the 1.60% level just two weeks ago.

I’ve already discussed oil so a look at metals shows gold (-0.3%) consolidating last week’s declines and still above $3000/oz. My take is gold’s decline was a result of equity losses and margin calls being covered by gold positions. I do not believe the barbarous relic has seen its highs. As to the other metals, silver (+2.3%) is bouncing this morning, although it did fall more than 10% in the past week, and copper (-1.4%) is under increasing pressure on the weakening economic growth story.

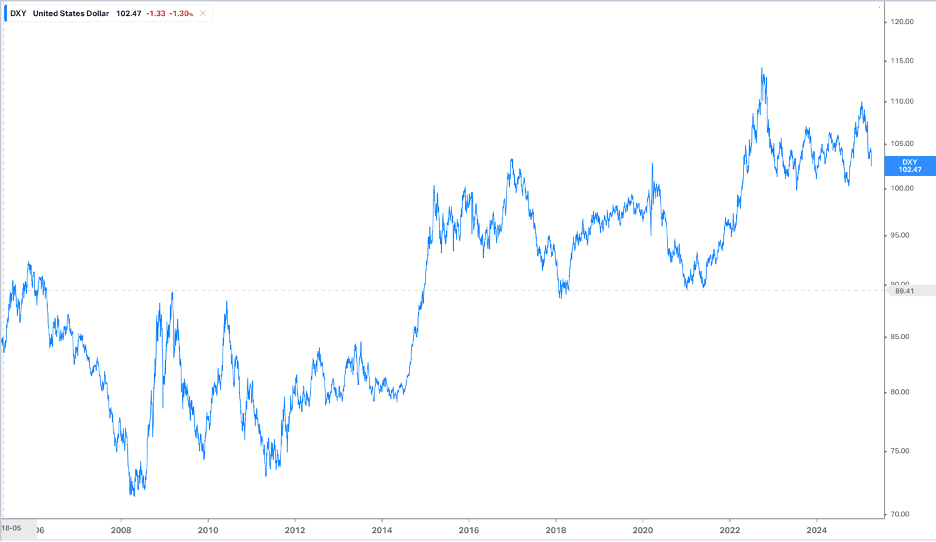

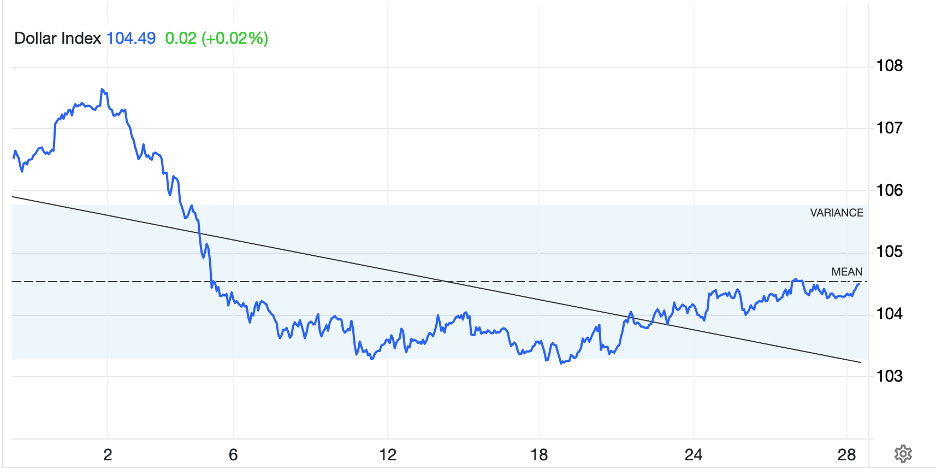

Finally, the dollar is all over the map, showing net strength this morning, but weaker vs. the two main havens, JPY (+0.55%) and CHF (+0.9%). Interestingly, the euro is unchanged on the day as it appears traders cannot decide who will be more greatly impacted, the US or Europe. But otherwise, the dollar is generally firmer with NOK (-1.75%) suffering alongside oil, MXN (-1.5%), ZAR (-1.3%) and CLP (-1.7%) all feeling the pressure from the tariffs. Other G10 currencies are softer, but not as dramatically, with AUD and NZDZ (both -0.5%) and CAD (-0.3%) moving more in line with a normal session. While we have gotten used to the idea that the dollar rallies on a risk-off thesis, given the nature of this particular version of risk-off, I have a feeling the dollar’s gains may be capped. However, my previous thesis on the declining dollar is much harder to discern given the changing nature of economic outcomes.

As an aside, the Fed funds futures market is now pricing a 50% probability of a Fed cut in May and a total of 113bps of cuts by the end of 2026. However, this will all depend on the evolution of things going forward, and, similar to the fear and greed index above, may represent an extreme view right now.

On the data front, Friday’s better than expected NFP data was lost in the shuffle. The front of this week doesn’t have much although we do get CPI on Thursday.

| Today | Consumer Credit | $15.2B |

| Tuesday | NFIB Small Biz Optimism | 101.3 |

| Wednesday | FOMC Minutes | |

| Thursday | Initial Claims | 224K |

| Continuing Claims | 1915K | |

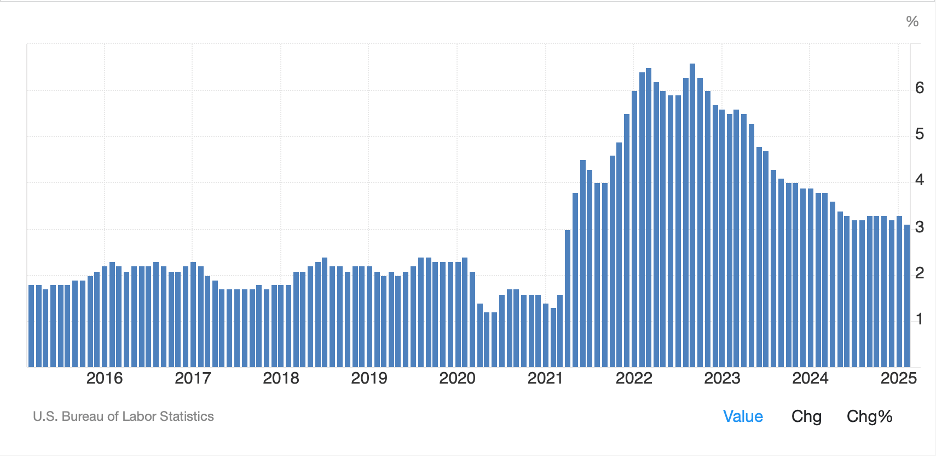

| CPI | 0.2% (2.6% Y/Y) | |

| Ex food & energy | 0.3% (3.0% Y/Y) | |

| Friday | PPI | 0.1% (3.3% Y/Y) |

| Ex food & energy | 0.3% (3.6% Y/Y) | |

| Michigan Confidence | 54.7 |

Source: tradingeconomics.com

It’s hard for me to believe the FOMC Minutes will matter much given all that has transpired since then. We do hear from seven more Fed speakers this week, but their comments have been swallowed by the ether as none of them, Chairman Powell included, has any inside track as to how things will evolve going forward.

My experience is that markets have a great deal of difficulty remaining in max fear mode for very long as it is simply too tiring for market participants. I don’t ever recall seeing the fear and greed index at 4, even during Covid (it is only about 12 years old), but my take is we are likely to see at least a respite here, before any significant further declines in risk assets. As to the dollar, if that is the case, I expect it will cede some of its recent gains, at least vs. the EMG bloc.

Good luck (we all need it!)

Adf