The Beige Book reported inflation

Was modest across the whole nation

And growth and employment

Found little enjoyment

While JOLTs data showed retardation

The upshot is traders were caught

Offsides, which is why bonds were bought

But so too was gold

And as things unfold

Be nimble or you’ll be distraught

Bonds rallied on both soft data, Factory Orders falling and JOLTs Job openings declining as well as a Beige Book that described modest economic activity across the nation. Some cherry-picked quotes are as follows:

- Most of the twelve Federal Reserve Districts reported little or no change in economic activity since the prior Beige Book period.

- Eleven Districts described little or no net change in overall employment levels, while one District described a modest decline.

- Ten Districts characterized price growth as moderate or modest. The other two Districts described strong input price growth that outpaced moderate or modest selling price growth.

Actually, these were the first lines from each of the key segments, Overall Economic Activity, Labor Markets and Prices. But if you read them, it is hard to get excited about either growth or inflation as both seem pretty lackluster. This is at odds with the Q2 GDP results as well as the early Q3 estimates from the Atlanta Fed’s GDPNow forecast as per the below showing 3.0% growth.

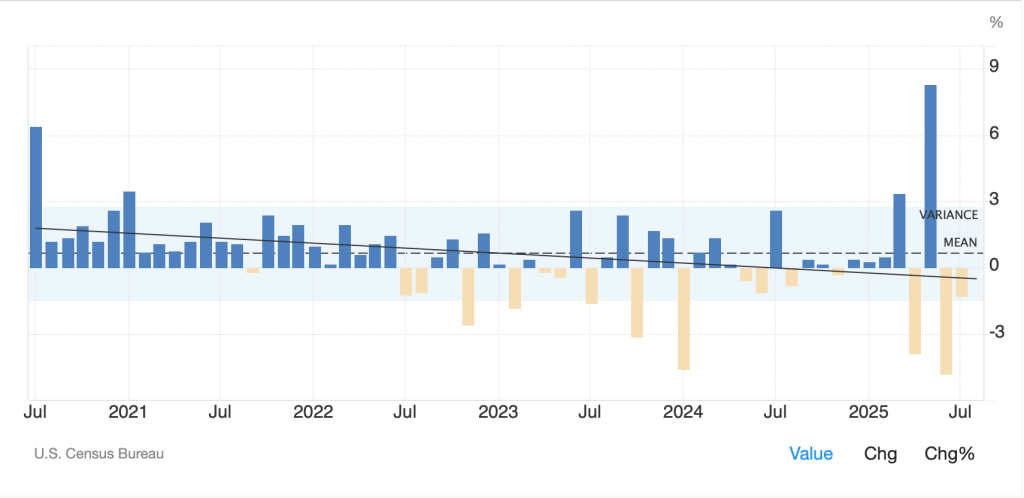

While the JOLTS data has always been confusing, and I think is even less reliable these days given the number of phantom job openings (just ask anybody looking for a job using LinkedIn), the Factory Orders data seems to have lost some of its information content given current tariff policies, and their substantive changes on short notice, have upset a lot of apple carts. I had the system draw a trend line in the below data because it was difficult for me to eyeball it, but FWIW this does not seem a positive result. Arguably, this is exactly why President Trump is seeking to bring manufacturing back to the US.

Source: tradingeconomics.com

Meanwhile, with ADP jobs this morning (exp 65K) and NFP tomorrow (exp 75K), it is difficult to get too excited about the JOLTS data. One interesting thing about this data is how it is undermining the higher bond yield narrative that has been rampant (I wrote about it on Tuesday) with yields around the world slipping yesterday in the US and then everywhere else overnight. For instance, 10-year Treasury yields are lower by -9bps since yesterday morning with virtually all European sovereign yields having fallen about -5bps over the same period. This is true even in France which auctioned €11 billions of 10yr through 30yr debt this morning. Compared to their last auction, yields are 30bps to 40bps higher, a strong indication that investors are concerned over the French fiscal situation.

Of course, these two narratives can be simultaneously correct with timing the key difference. While the short-term view is weaker economic activity will dampen demand and reduce yields, the long-term trajectory of government spending and debt issuance almost ensures that yields will go higher. Corroborating the long-term story is gold (-0.6% this morning, +3.6% this week) as though some profit taking is evident right now, the barbarous relic has managed to trade to new all-time highs yet again. That is not a sign of confidence in government finances.

And truthfully, that last sentence continues to be the overriding issue to my mind. No matter what we hear from any government (perhaps Switzerland should be excluded here), spending is on a sharp upward trajectory, and no government wants to slow it down. What they want to do is sound like they are doing things to slow it down, but politicians see too much personal benefit from increased government spending to ever stop. And so, this will continue until such time as it no longer can. Yesterday I mentioned YCC and I remain convinced that is coming to every major economy over time. But different nations will respond on different timelines and that is what will drive FX rates given they are the ultimate relative relationship asset class. I wish I could paint a cheerier picture, but I just don’t see it at this point.

So, let’s see how other markets behaved overnight. Yesterday’s US equity rally (mostly anyway) seemed entirely on the back of Google’s legal victory allowing it to keep Chrome, where spinning it off was one of the proposed penalties in the anti-trust case, and which saw the share price rally more than 9% in the session. That move helped Japan (+1.5%) and Australia (+1.0%) but China (-2.1%) and Hong Kong (-1.1%) both suffered on rumors that the government was growing concerned with excess speculation and would soon be implementing rules to prevent further inflating the stock market. These two markets have had a very nice run since April, rising on the order of 25% each as per the below.

Source: tradingeconomics.com

As to the rest of the region, Korea (+0.5%) was the next best performer with lots of nothing elsewhere, +/-0.3% or so. In Europe, the DAX (+0.7%) and IBEX (+0.6%) are having solid sessions although the CAC (-0.2%) seems to be feeling pressure from the bond auctions and concerns over the future government situation. European data was largely in line with expectations and secondary in nature at best. Meanwhile, at this hour (7:20) US futures are little changed to slightly higher.

We’ve already discussed bonds, but I should mention that even JGB yields slid -4bps overnight as the status of the Ishiba government remains unclear as well.

In the commodity space, oil (-1.3%) continues to chop around in its recent trading range as yesterday’s concerns over OPEC increasing production seem to be giving way to today’s story about weaker demand and growing inventories available in the US. It’s tough to keep up without a scorecard, that’s for sure. It should not be surprising that the other metals (Ag -0.75%, Cu -1.2%) are also slipping this morning after they also rallied sharply along with gold yesterday. In fact, as is often the case, silver’s recent moves have been much more aggressive than gold’s, although in the same direction.

Finally, the dollar is a bit firmer this morning after a modest decline yesterday. If we use the DXY as our proxy, while there is no doubt the dollar fell sharply during the first half of the year, arguably, since just past Liberation Day in early April, it has gone nowhere.

Source: tradingeconomics.com

The short-term story for the dollar revolves around the Fed and its behavior. After yesterday’s data, Fed funds futures increased the probability of a cut on the 17th to 97.6% with a one-third probability of a total of 75bps by year end. If the Fed were to become more aggressive, perhaps after a much weaker than expected NFP number on Friday, then the dollar would have room to fall. But you cannot show me the combined fiscal and economic situations elsewhere in the world and explain those are better places to hold assets at this time.

As to today’s movements, the laggards are ZAR (-0.9%) following the precious metals complex lower, and NOK (-0.6%) suffering on the back of oil’s decline. Otherwise, there is a lot of -0.2% across the board with no terribly interesting stories.

This morning’s data brings Initial (exp 230K) and Continuing (1960K) Claims along with ADP as well as the Trade Balance (-$75.7B), Nonfarm Productivity (2.7%), Unit Labor Costs (1.2%) and finally ISM Services (51.0). Two more Fed speakers are on the docket, Williams and Goolsbee, but the Fed story is much more about President Trump’s ability to fire Governor Cook than about the nuances these speakers are trying to get across.

Weak data should reflect as a weaker dollar in the near term, and the opposite is true as well. My sense is a very weak number on Friday will result in the market starting to ramp up the odds of a 50bp cut later this month and that will undermine the buck. But if that number is solid, I need another reason to sell dollars and I just don’t have it yet.

Good luck

Adf