All week we had heard many clues

That fifty is what Jay would choose

And that’s what he cut

With only one but

From Bowman, who shuns interviews

The key is now recalibration

In order to tackle inflation

Without driving higher

The joblessness spire

So, trust us, it’s all celebration

“Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.” [emphasis added]

Reading the opening paragraph of the FOMC Statement, it might be confusing as to why they needed to cut rates 50bps. After all, the economy is expanding at a solid pace (In fact, after the Retail Sales data on Tuesday, the Atlanta Fed’s GDPNow reading for Q3 is up to 3.0%!) unemployment remains low and inflation is still somewhat elevated. I know I am a simple poet, but the plain meaning of those words just doesn’t lead my thinking to, damn, we better cut 50 to get started. But I guess that is just another reason I am not a member of the FOMC.

Perhaps the more interesting thing was the Summary of Economic Projections and the dot plot which showed that while expectations were for rates to fall far more dramatically than in June, the longer run expectations continue to rise. In fact, Chairman Powell specifically addressed the SEP in the press conference, “If you look at the SEP you’ll see that it’s a process of recalibrating our policy stance away from where we had it a year ago when inflation was high and unemployment low to a place that’s more appropriate, given where we are now and where we expect to be, and that process will take place over time.” [emphasis added] In fact, there was a lot of recalibrating going on as that appears to be the Chairman’s new favorite word, using it 8 times in the press conference.

Source: federalreserve.cgov

Notice that their current forecasts are for GDP to slow to 2.0% with Unemployment edging only slightly higher while PCE inflation magically returns to their 2.0% target. And take a look at the last two lines, with the Fed funds rate projections falling substantially for the next three years, far more quickly than their previous views, although they think the long-run level will be higher.

I wonder about that last issue. Historically, the thought was that the long run Fed funds rate would be inflation (2.0%) + real interest rate (0.5%) and they pegged it at 2.5% for years. Now that they see it at 2.9%, is that because they think inflation is going to be higher (not according to their projections) which means that for some reason they think real interest rates are going to be higher. However, when asked, Chairman Powell and every member of the board has been unable to explain this change.

But what really matters is how have markets responded to this earth-shattering news? The initial movement was as expected, with stocks rallying sharply (see chart below) and yields sliding along with the dollar while commodities rallied.

Source: Bloomberg.com

But a funny thing happened on the way to the close, as can be seen in the chart. Stocks gave back all their gains and then some, with all three major indices lower on the session while 10yr Treasury yields backed up 7bps and the dollar rebounded. Arguably, this was a sell the news response, but we need to be careful. Remember, there are many analysts who believe the economy is in deep trouble already and by starting off with a big cut, those with paranoia may be wondering what the Fed knows that the data, at least the headline data, is not really showing.

So much for yesterday, now let’s look at markets this morning beyond the initial knee-jerk responses. Absent any other major news or data (Norgesbank leaving rates on hold doesn’t count as major), markets have played out far more along the lines of what would have been expected in the wake of a 50bp cut. In other words, the dollar has fallen sharply against almost all its counterparts, equity markets have rallied around the world, commodity prices have rallied sharply, and bond yields are…unchanged?

Which brings us to the question that has yet to be answered. Which market is right, stocks or bonds? They appear to be telling us different stories with stocks pushing to new highs amid rising multiples and rising profit growth expectations while bonds are pricing in another 200bps of rate cuts by the end of 2025, an outcome that would only seem to make sense in the event the economy fell into a recession. But if we are in a recession, corporate earnings seem highly unlikely to rise as much as currently forecast and typically, P/E multiples contract. Meanwhile, if the economy is humming along such that current equity pricing is warranted, what will be the driver for the Fed to cut rates as that will almost certainly reignite inflation.

History has shown that the bond market tends to get these big questions right when they are pointing in different directions, but that doesn’t mean that risk assets will stop rallying right away. In fact, this will likely take quite a while to play out.

Ok, so let’s put a little more detail on the market activity overnight. Tokyo rocked (+2.0%) as did Hong Kong (+2.0%), Taiwan (+1.7%), Singapore (+1.1%) and even mainland China (+0.8%) managed to rally some. It appears that investors around the world believe the Fed has opened the floodgates for a much lower interest rate environment everywhere. European bourses, too, are sharply higher led by the CAC (+2.1%) but with strength across the board (DAX +1.5%, FTSE 100 +1.3%). And US futures have shaken off the late selloff yesterday and are firmly higher this morning led by the NASDAQ (+2.2%).

Bond yields, though, are largely unchanged on the day, with yesterday’s backup in Treasury yields maintained and European sovereigns all within 1bp of yesterday’s close. It appears that bond investors are less confident in a soft landing than equity investors. Interestingly, JGB yields rose 2bps last night as Japanese markets prepare for the BOJ meeting tonight.

In the commodity markets, oil (0.75%) is continuing its recent rebound after another massive inventory draw was revealed by the EIA yesterday prior to the Fed meeting. There is a growing concern that inventories in Cushing, Oklahoma are falling to a point where products like gasoline and diesel will not be able to be produced. As an example, gasoline futures have risen far more than crude futures this week on that fear. As to the metals markets, gold briefly touched $2600/oz yesterday immediately in the wake of the FOMC but sold off hard afterwards. This morning, however, it is back pushing up to that level again and the entire metals complex is rising nicely.

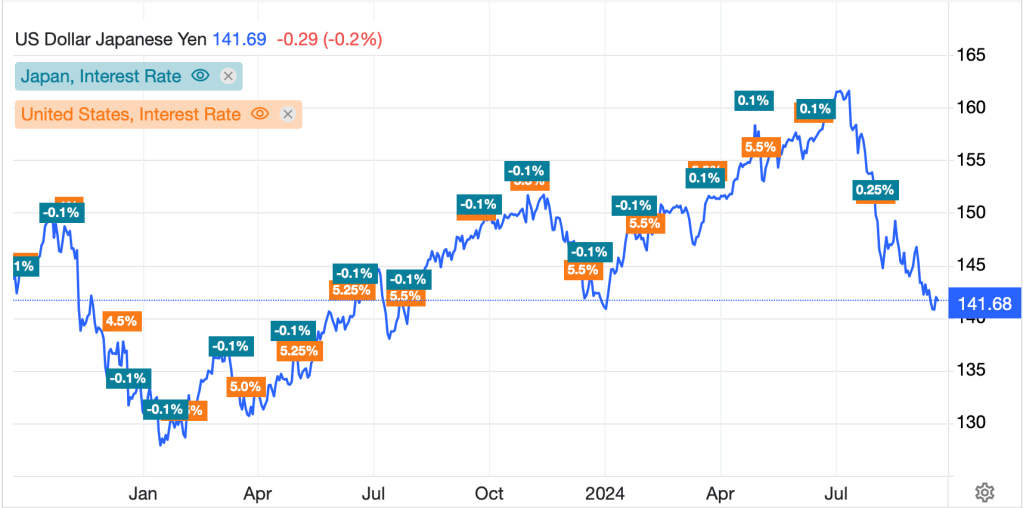

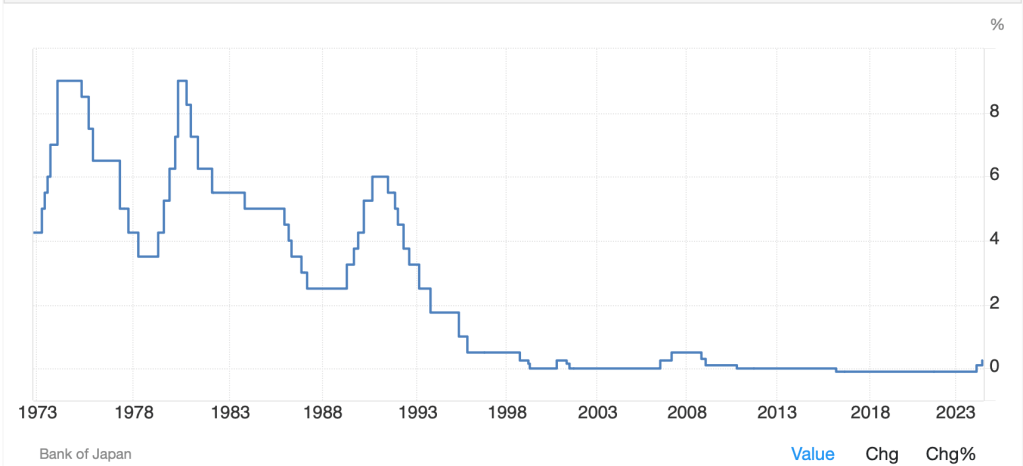

Finally, the dollar, has been a whipsaw of late. Post the FOMC, it fell sharply across the board, and then into yesterday’s close it rebounded to close higher on the day. However, this morning it has given back all those late gains and then some, and is now sitting at its lowest level, at least per the DXY, since April 2022. This morning, in the G10, we are seeing many currencies rally between 0.5% (EUR) and 1.3% (NOK) vs the dollar and everywhere in between. The one exception to that is the yen (-0.2%) which is biding its time ahead of the BOJ meeting. The working assumption is that the BOJ will do nothing tonight, but now that the Fed has cut 50bps, and given Ueda-san’s history of actively trying to surprise markets to achieve outcomes he wants, we cannot rule out another rate hike in Japan. Monday morning, USDJPY fell below 140 for the first time in 18 months. My take is Ueda-san is quite comfortable with it heading back to the 130 level, if not the 120 level. If he were to surprise markets and raise the base rate by even 10bps tonight, I think we would see a sea change in sentiment and a much lower dollar. And given inflation in Japan seems to have stalled at 2.8%, well above their 2.0% target, he has a built-in excuse.

Too, watch the CNY (+0.45%) as it is now trading at its highest level (weakest dollar) in more than a year, and is approaching the big, round number of 7.00. the linkage between JPY and CNY is tight as they constantly compete in markets, especially now in autos and electronics. If the Fed is really going to cut as much as markets are pricing, both these currencies should strengthen much further.

It is almost anticlimactic to discuss the data today but here goes. First, the BOE left rates on hold, as expected and the market impact was limited. Expectations are they will cut next in November. As to data, we see Initial (exp 230K) and Continuing (1850K) Claims, Philly Fed (-1.0) and Existing Home Sales (3.90M). None of that is likely to change any views. Prior to the BOJ meeting, at 7:30 this evening we see Japanese CPI, which may change views there.

For now, the dollar is very likely to remain on its back foot as enthusiasm builds for multiple rate cuts by the Fed going forward. However, if the data continues to impress like it has lately, that enthusiasm will need to be tempered.

Good luck

Adf