The punditry’s all of a piece That growth in the future will cease But ‘flation still reigns And Jay’s been at pains To force prices, soon, to decrease

There is a website, Seeking Alpha, that publishes a great deal of macroeconomic and market commentary on a daily basis. Yesterday morning’s top headlines under the Economy section included the following list.

- Is Recent GDP Data Overestimating U.S. Growth?

- U.S. Stagflation Risks Rise as Service Sector Falters Alongside Manufacturing Downturn

- Global PMI Shows Recovery Fading Further in August as Developed World Output Falls

- The Unemployment Rate Just Signaled that a Recession May Occur Within the Next 6 Months

- German Industrial Production Goes from Bad to Worse

- The Economy is Not ‘Running Hot’

- U.S Labor Market Activity: Slowing, Not Weakening

The authors ranged from Investment firms like Neuberger Berman and ING to individuals with decent reputations and large numbers of followers (for whatever that is worth.) My point is there is a lot of negativity in the analyst community regarding the near-term future of economic activity. My question is, are people really concerned about the growth trajectory? Or are they just trying to make the case that the Fed will consider cutting interest rates sooner rather than later in an effort to support the equity market?

While I understand the negativity based on anecdotal evidence, the headline data continues to print at better than expected levels. For instance, yesterday’s Initial and Continuing Claims data both fell sharply during the most recent week, indicating that the labor market remains quite robust. It remains very difficult for me to see a case for the Fed to even consider cutting anytime soon. Rather, the case for another rate hike seems to be growing, and if next week’s CPI print is at all hot, look for that to be the market discussion going forward.

Of course, my opinions don’t sway markets. The important voices are those of the Fed members themselves and yesterday, we heard from several of them that a pause is in the offing. Based on the comments from John Williams (voter), Lorrie Logan (voter), Raphael Bostic (non-voter) and Austan Goolsbee (voter), it seems that the market pricing of < 7% probability of a hike on September 20th is appropriate. However, the views of Fed actions in the ensuing meetings are beginning to diverge. There are those (Logan, Bowman and Waller) who have been clear that further rate hikes past September may still be appropriate depending on the totality of the data. Meanwhile, there are others who are quite ready to call the top and one (Harker) who is already calling for cuts in 2024. In the end, though, Chairman Powell’s views remain the most important and the last we heard from him was that higher for longer remains the story and more hikes are possible.

The pressure’s been simply too great For Xi’s central bank to dictate The yuan shouldn’t sink Which led them to blink And now further weakness is fate

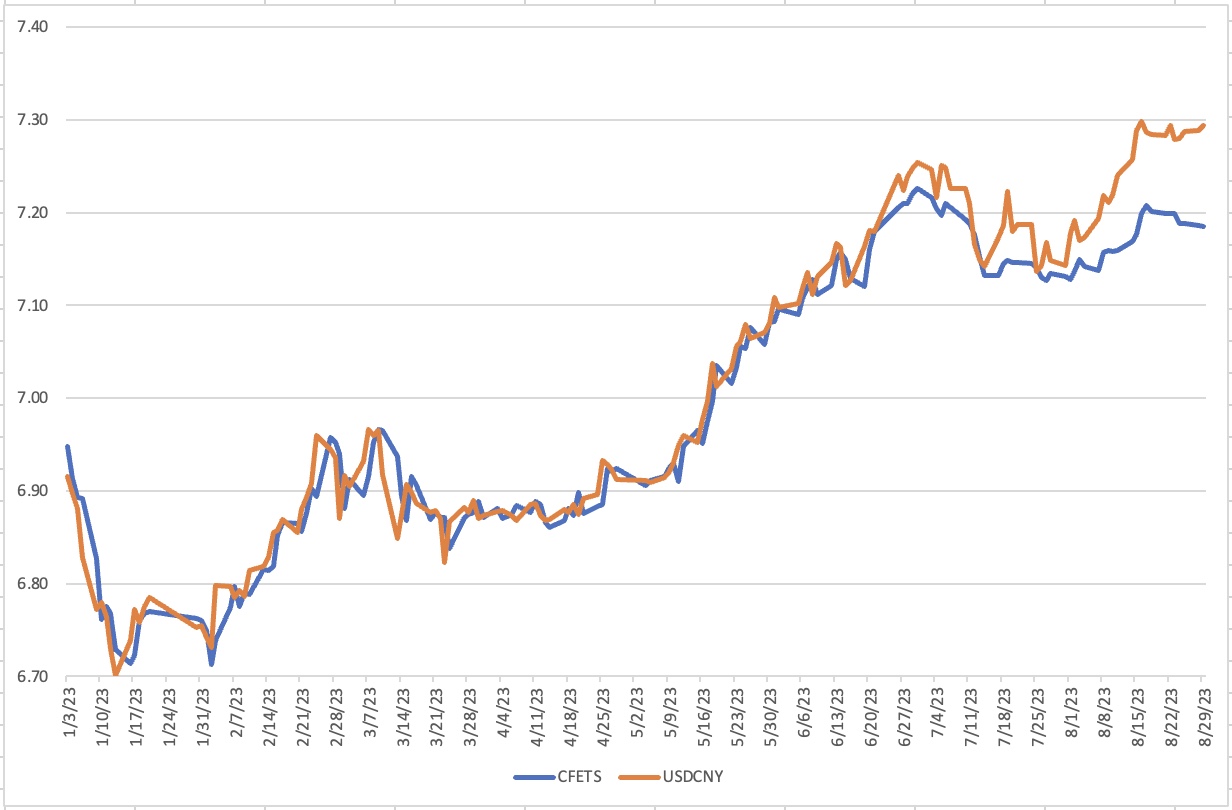

The PBOC cried uncle last night when they fixed the renminbi at its weakest level since early July as the pressures had simply grown too great to withstand. The onshore yuan fell further and the spread between the fix and the spot rate there remains just below 2%. The offshore market shows an even weaker CNY and looks like it will soon be trading more than 2% weaker. As well, the CNY lows (dollar highs) seen in October 2022 are in jeopardy of being breeched quite soon. Clearly, there is a steady flow of capital out of China at the current time and given the lackluster economic performance there along with the structural problems in the property market, it is hard to make a case that China is a good spot for investment right now. And just think, this is all happening while the market belief is the Fed is finished raising rates. What happens if we do see hotter inflation data and the Fed decides another hike is appropriate? As I have maintained for quite a while, I expect the renminbi to continue to slide and a move to 7.50 or beyond to occur over the rest of 2023. In fact, today I saw the first analyst say 8.00 is in the cards before this move is over. Hedgers beware.

So, what comes next? Well, on a day with no noteworthy economic data and no Fed speakers scheduled, with the FOMC set to enter their quiet period, market participants will be forced to look elsewhere for catalysts. My take on the current zeitgeist is that the negativity seen in those headlines listed above is seeping into risk attitudes overall. Not only that, but that there is nothing in the near-term that will serve to change that viewpoint. We will need to see a very cool CPI print next Wednesday to get people excited and given the combination of base effects and oil’s recent price trajectory, that seems unlikely. Anyway, let’s look at the overnight sessions results.

Equities continue to perform poorly overall as yesterday’s broad weakness in the US was followed by weakness in Asia across the board while European bourses are also all in the red. In fairness, the European session, while uniform in direction, has not seen significant declines. Rather, markets are down by -0.25% or so on average. Alas, US futures are still under pressure at this hour (7:30), but here, too, the losses are modest so far.

Bond markets are not doing very much this morning as yields in the US and Europe are within 1 basis point of yesterday’s closing levels. Yesterday we did see 10yr Treasury yields slide 4bps, but we remain at 4.25%, a level that is not indicative of expectations of rapidly declining inflation. The odd thing about this is that if you look at inflation expectation metrics, they almost all are looking at inflation heading back to the 2% level within a year or two. Something seems amiss here although exactly what is not clear.

Oil prices are rebounding this morning as the recent uptrend resumes. If we continue to see better than expected US data and the soft landing or no landing thesis remains in play, it is hard to accept the idea that oil demand will decline very much. Add to that the very clear efforts by OPEC+ to push prices higher and it seems there is further room to rise here. But once again, the rest of the commodity space is telling a different story with base metals softer along with agricultural prices in general. That is much more of a recession story than a growth one. This is just another of the many conundra in markets these days.

Lastly, the dollar is softer this morning overall, although not dramatically so, at least not against its major counterparts. The biggest gainer today is MXN (+0.7%) which is benefitting from one thing, the highest real yields available for investment at 5.5%, while overcoming another, comments from the opposition presidential candidate, Xochitl Galvez, that the peso is too strong and is hurting exports. (There is a presidential election next year in Mexico and AMLO is prohibited from running as they have a one-term limit in place there.) Regarding the peso, unless Banxico starts to cut rates aggressively, of which there is no sign, I expect it will continue to perform well. As to the rest of the EMG bloc, there are more gainers than losers, but the movements have not been substantial. In the G10, it is no surprise that NOK (+0.4%) is higher on the back of the rise in oil prices, and we have also seen NZD (+0.5%) rally, although that looks more like a trading rebound than a fundamental move. Given the dollar’s relative strength over the past several sessions, it is no surprise to see it drift back at the end of the week.

There is no data of consequence on the docket and no Fed speakers. This implies that the FX market will be looking for its catalysts elsewhere and that usually means the stock market. If we continue to see weakness in equities, I suspect the dollar will regain a little ground, but in truth, ahead of next week’s key CPI data, I don’t anticipate very much activity at all today.

Good luck and good weekend

Adf