Up north is a nation quite vast

Whose money, of late’s been, out, cast

But word that Trudeau

Is soon set to go

Has seen Loonies quickly amassed

One of the biggest stories over the weekend has been the sudden upsurge in articles and discussion regarding the remaining tenure for Canadian PM Justin Trudeau. For the past several weeks, since his FinMin Krystia Freeland resigned and published a scathing resignation letter, pressure on Trudeau has increased dramatically. It appears that it is coming to a head with articles from both Canadian and international sources indicating he may step down as soon as this week. As well, his main political rival, conservative party leader Pierre Poilievre, is touted, according to the betting websites, as an 89% probability to be the next PM.

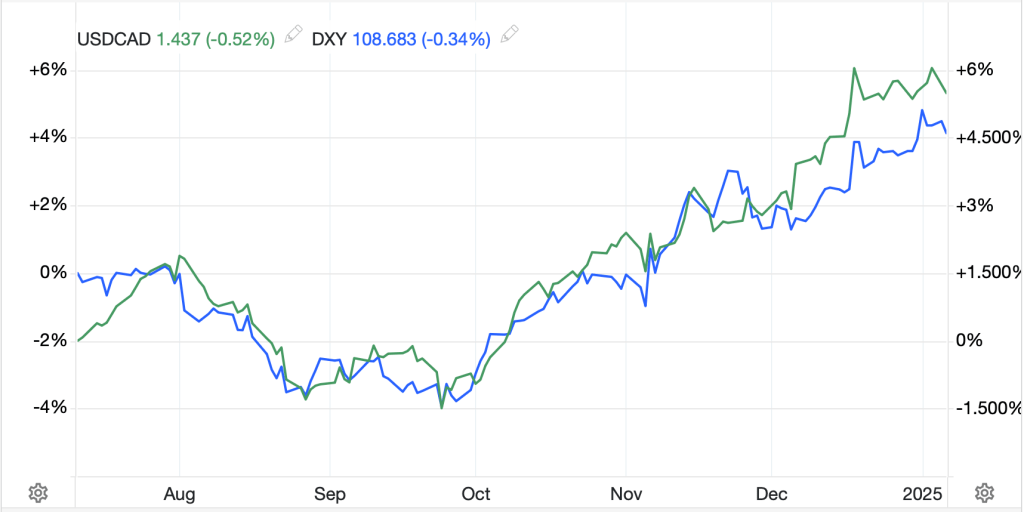

Now, we all know the dollar has been strong in its own right lately, and I suspect that while there will be bumps along the road, it will get stronger still over the year absent some major Fed rate cutting. As such, USDCAD is higher along with everything else. However, you can see in the chart below (the green line rising faster than the blue line since December) that it has been an underperformer for the past month, since that Freeland resignation, as investors have been shying away from Canada, given the combination of concerns over the incoming Trump administration imposing tariffs and no political leadership to address these issues.

Source: tradingeconomics.com

While no sitting politician is ever willing to cede power easily, and there are indications that Trudeau is going to go down kicking and screaming, ultimately, I expect that Poilievre will be the PM and will develop a strong relationship with the US. As that becomes clearer, I expect to see the CAD appreciate modestly vs. the dollar, but much more so against other G10 currencies.

Once more, what the Chinese have said

Is stimulus is straight ahead

But so far, its talk

They ain’t walked the walk

So, bulls need take care where they tread

Another tidbit this morning comes from Beijing, where the economic planning agency there has indicated that they will expand subsidies for consumer purchases of electronic goods like cellphones, tablets and smart watches, as President Xi continues to watch his nation’s economy grind along far more slowly than he really needs to happen. There was an excellent thread on X this morning by Michael Pettis, one of the best China analysts around, describing the fundamental problem that Xi has and why the slow motion collapse of the property market portends weakness for a long time going forward. As is almost always the case, while tearing the proverbial band aid off quickly can hurt more at the instant, the pain dissipates more quickly. President Xi believes he cannot afford to inflict that much pain, so their problems, which stem from decades of malinvestment in property that inflated a massive bubble, are going to last for a long time. While CNY (+0.4%) is modestly firmer this morning, that is only because the dollar is weaker across the board, and in fact, it is significantly underperforming.

This week, the US Treasury’s Yellen

Much debt, will look forward to sellin’

The market’s responding

By active “de-bonding”

With dollars and bonds both rebellin’

The last big story of the day is clearly the upcoming Treasury auctions this week, where the US is set to sell $119 billion of debt, starting with $58 billions of 3-year notes today. Arguably, market participants have been aware that this was going to be a necessary outcome given the massive deficits that continue to be run by the US. Adding to the broad concept of deficits, the Biden administration appears to be trying to spend every appropriated dollar in the last two weeks in office and that requires actual cash, hence the auctions to raise that cash. In addition, the debt ceiling comes back into force shortly, so they want to get this done before that serves to prevent further issuance.

Now, the yield curve has reverted back to a normal slope with the 2yr-10-yr spread at 34bps and 30yr bonds trading another 22bps higher than 10yr at 4.81% and bringing 5% into view. Here’s the thing about the relationship between the dollar and yields; the dollar is typically far more correlated to short-term yield differentials, not long-term yields. So rising 30yr bond yields is not likely to be a dollar benefit. In fact, just the opposite as international investors will not want to suffer the pain of those bonds declining in price rapidly.

And this is what we are witnessing this morning as the dollar, which rallied sharply at the end of last week, is correcting in a hurry today. As mentioned above, CNY is the laggard with the euro, pound, Aussie, Kiwi and Loonie all firmer by 1% or more this morning and similar gains seen across the emerging markets, with some extending those gains as far as 1.35% or so. Is this the end of the dollar? I would argue absolutely not. However, that doesn’t mean that we won’t see a further decline in the buck before it heads higher again. A quick look at the chart below, which shows the Dollar Index, while it has just touched the steep trend line higher, it remains far above its 50-day and 100-day moving averages. Howe er, it seems that the big story here comes from a report from the Washington Post that Trump is considering much less widespread tariff impositions with only some critical imports to be addressed. As such, given the tariffs = higher dollar consensus, if this is true, you can understand the dollar’s retreat.

Source: tradingeconomics.com

However, today’s story is that of a weak dollar and strong equity markets, well at least in some places. Friday’s US equity rally was not followed by similar enthusiasm in Asia with the Nikkei (-1.5%) leading the way lower while both the Hang Seng (-0.4%) and China (-0.2%) also lagged. Perhaps the mooted China stimulus helped those markets on a relative basis. Europe, however, is in fine fettle (CAC +2.3%, DAX +1.4%, IBEX +0.9%) as PMI data released this morning was solid, if not spectacular, and the weaker dollar seems to be having a net positive impact. US futures are also firmer, with NASDAQ (+1.1%) leading the way.

In the bond market, the big movement was in Asia overnight as JGBs (+4bps) sold off alongside virtually every other Asian bond market except China, which saw yields edge lower by 1bp to a new record low of 1.59%. In Europe, there has been very little movement with yields +/- 1bp at most and Treasury yields, which had been firmer earlier in the overnight session, have actually slipped back at this hour and are lower by 2bps to 4.58%.

In the commodity markets, the weak dollar has helped support prices here with oil (+1.0%) continuing its rally (+9% in the past month) as the combination of Chinese stimulus hopes and cold weather seem to be providing support. Speaking of cold weather, NatGas (+7.4%) is also in demand this morning as winter storm Barrie makes its way across the country. In the metals markets, gold (+0.3%) is the laggard this morning with both silver (+2.3%) and copper (+2.4%) really taking advantage of the dollar’s weakness.

On the data front, there is a ton of stuff this week, culminating in NFP on Friday.

| Today | PMI Services | 58.5 |

| PMI composite | 56.6 | |

| Factory Orders | -0.3% | |

| Tuesday | Trade Balance | -$78.0B |

| ISM Services | 53.0 | |

| JOLTS Job Openings | 7.70M | |

| Wednesday | ADP Employment | 139K |

| Initial Claims | 217K | |

| Continuing Claims | 1848K | |

| Consumer Credit | $12.0B | |

| FOMC Minutes | ||

| Friday | Nonfarm Payrolls | 160K |

| Private Payrolls | 134K | |

| Manufacturing Payrolls | 10K | |

| Unemployment Rate | 4.2% | |

| Average Hourly Earnings | 0.3% (4.0% Y/Y0 | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.8% | |

| Michigan Sentiment | 73.9 |

Source: tradingeconomics.com

In addition to all this, we hear from six more Fed speakers over seven venues with Governor Waller likely the most impactful. Over the weekend, we heard from Governor Kugler and SF President Daly, both explaining that they needed to see more progress on inflation before becoming comfortable that things were ok.

Clearly, the tariff story is the current market driver in the dollar. As I never saw tariffs as the medium-term driver of dollar strength, I don’t think it has as much importance. Plus, this is a report from the Washington Post. There are still two weeks before inauguration and many things can happen between now and then. Nothing has changed my longer-term view that the dollar will be supported as the Fed, which is not tipped to cut rates this month and is seen only to be cutting about 40bps all year will ultimately raise rates as inflation proves far more stubborn than desired. But that is the future. Today, pick spots to establish dollar buys and leave orders.

Good luck

Adf