Some fractures are starting to show

In markets, as Trump’s blow by blow

Attack on the Danes

And friends, really strains

The view ‘Twenty-Six will lack woe

So, equities worldwide are falling

While bond yields, much higher, are crawling

The buck’s in a rut

While oil’s a glut

Thus, gold is the thing, most enthralling

“Something is rotten in the state of Denmark.” So said Marcellus, when Shakespeare introduced him to the world in 1603(ish) in one of his most brilliant works, Hamlet, and it seems true today, 423 years later. By now, you are likely aware that President Trump has imposed 10% tariffs, to begin on February 1st, on Denmark, Norway, Sweden, France, Germany, Finland, the Netherlands and the UK as he presses his case for US ownership of Greenland. This is not the venue to discuss the relative merits or pitfalls of the strategy, so I won’t bore you with my views on the subject.

Rather, this is a venue to discuss the market impacts and how they may evolve, in one poet’s eyes, going forward given the new starting condition. As I type this morning, investors around the world are extremely unhappy, at least holding paper claims on either assets or governments. However, holding real assets, notably gold (+1.15% and at new all-time highs), silver (+0.9% and at new all-time highs) and platinum (+1.45%, not quite at new highs yet) are feeling much better.

It is interesting to me that the WEF is meeting this week, and likely no coincidence that President Trump escalated things ahead of the meeting where he is scheduled to speak tomorrow. It seems that the protagonists in this latest drama are set to meet while in Davos as well, so all these views are subject to change at a moment’s notice. But for now, since there really is no other story that matters, let’s look at how markets have (mis)behaved since we last saw them here in the US on Friday.

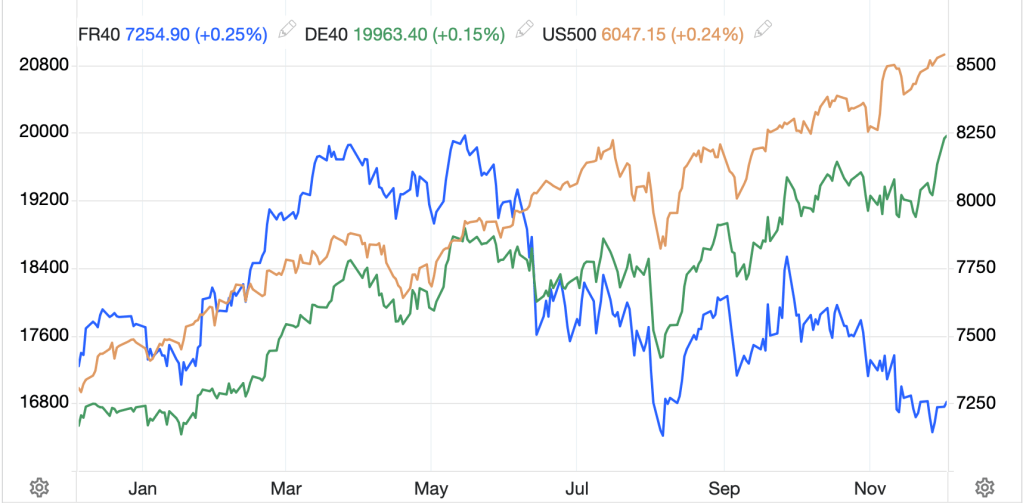

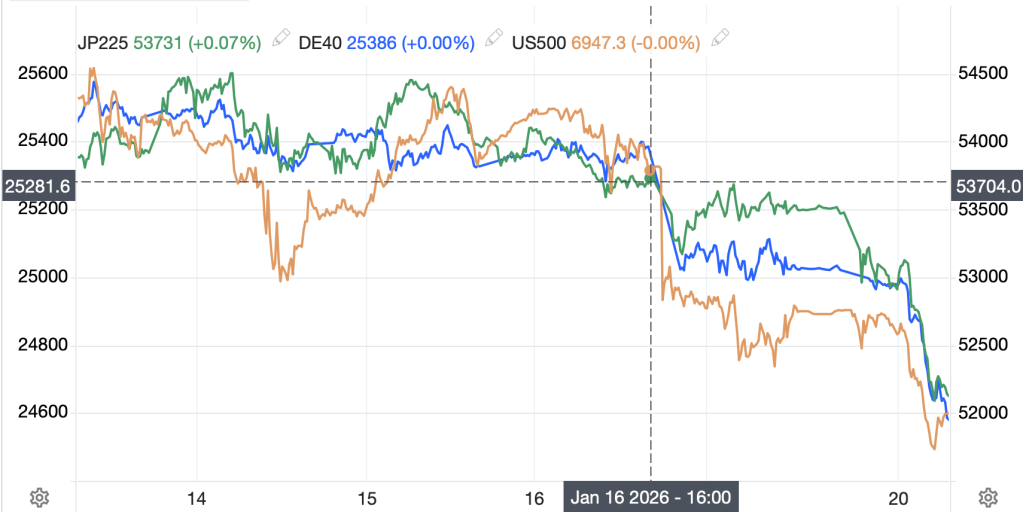

As you can see from the chart below combining the Nikkei 225, the DAX and the S&P 500 futures, the move has been consistent since the close in NY on Friday, with all three main indices lower by between -1.75% (Japan) and -3.1% (Germany), with the US (-2.1%) in the middle.

Source: tradingeconomics.com

In fact, that price action has been widespread across the rest of the G10 markets and many EMG markets as well. Only China (-0.2% since Friday) has bucked the trend and remains little changed. Of course, that makes sense given this spat has nothing to do with China, on the surface. At this point, I expect that all equity markets are going to remain under pressure until there is some resolution. While Europe has threatened to invoke its Anti-Coercion Instrument on the US if those tariffs come into being, one must wonder will that do more damage to the US or Europe? FWIW, I expect some type of resolution to be achieved before the Feb 1 deadline but could easily be wrong about that. One last thing about tariffs; remember last week when expectations were high that the Supreme Court was going to rule on the legality of the ones already imposed? That has suddenly gone very quiet. My take there is the longer we don’t hear anything, the more likely they are not going to stop them.

Perhaps, though, the bond market is the more interesting place to look this morning with government bonds around the world getting sold aggressively. While all eyes have been focused on the US (+6bps and well above the top of the previous range) and Europe (Germany +5bps, UK +7bps, France +6bps) perhaps the real activity is happening in Japan (+9bps). In fact, Japanese 30yr yields have exploded higher by 40 basis points since Friday’s close, and I’m confident that has nothing to do with Greenland!

Source: tradingeconomics.com

In fact, it appears that JGB holders are getting increasingly concerned that PM Takaichi is going to really run it hot, with more unfunded fiscal stimulus and are responding accordingly. The latest Takaichi proposal for the upcoming election is that they are going to remove the GST (VAT tax) on food for 2 years to help alleviate inflation problems. I certainly like that better than capping prices, but fiscally, it’s a tough road to follow.

One other bond market story that is making the rounds is the idea that Europeans would attack the US by simultaneously unloading their US Treasury holdings. We have heard this story before with respect to China, and if you look across all of Europe, between central banks and private investors, there are likely upwards of $2 trillion held there. But the question I ask every time I hear something of this nature is…what will they do with the proceeds if they were somehow able to coordinate the sales? First, in the worst case, the Fed would buy them to prevent the market from collapsing. And second, now they would have a whole lot of dollars that need to be invested elsewhere. Which markets can absorb that amount of flow? US equities? Sure, but would that achieve their goals? I think not. If they converted them into euros, a one-way flow of $2 trillion into euros in short order would pretty much render all European manufacturing uncompetitive right away as the euro rose to 1.50 or 1.60 or higher. Gold? Think $10k/oz or higher. Ain’t gonna happen.

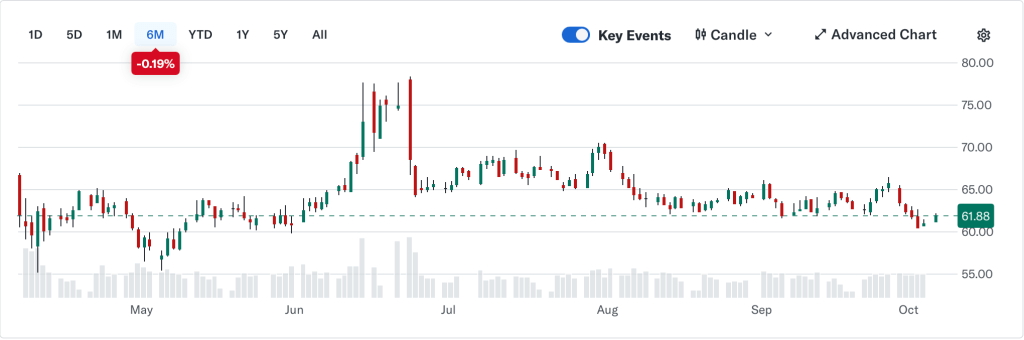

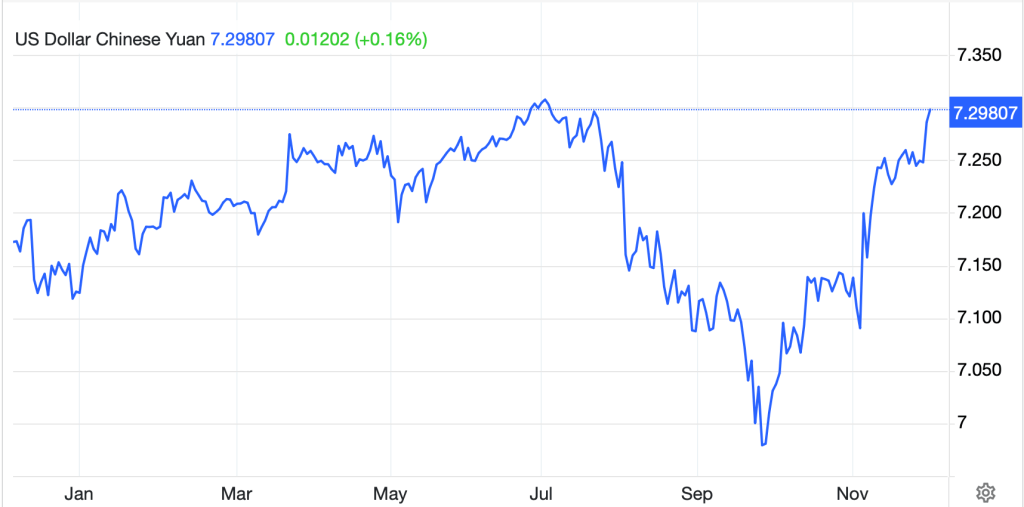

Let’s hit the dollar next, which is under pressure across the board. As I type (7:20), the DXY has fallen -1.0% this morning, a very large move for that index, but remains within the trading range that we have seen since October.

Source: tradingeconomics.com

The sell-off in the dollar is almost universal, although interestingly, ZAR (-0.5%), MXN (-0.3%) and CLP (-0.3%) are all bucking that trend. I understand the nervousness, but it strikes me that none of this conversation is a positive for Europe, excepting the idea they sell all their Treasuries and convert the dollars into euros and pounds, an idea I tried to squash above.

Finally, let’s look at commodities where the metals, as discussed above are soaring while oil (+0.8%) is picking back up off its end of week lows and currently sits just below $60/bbl. The Iran situation remains murky, at best, and my sense is we have not heard the last of the situation there, although from what I have seen on X, the rioting has been quelled to some extent. However, I think there is still enormous pressure on the government there and would not be surprised to see some type of US intrusion.

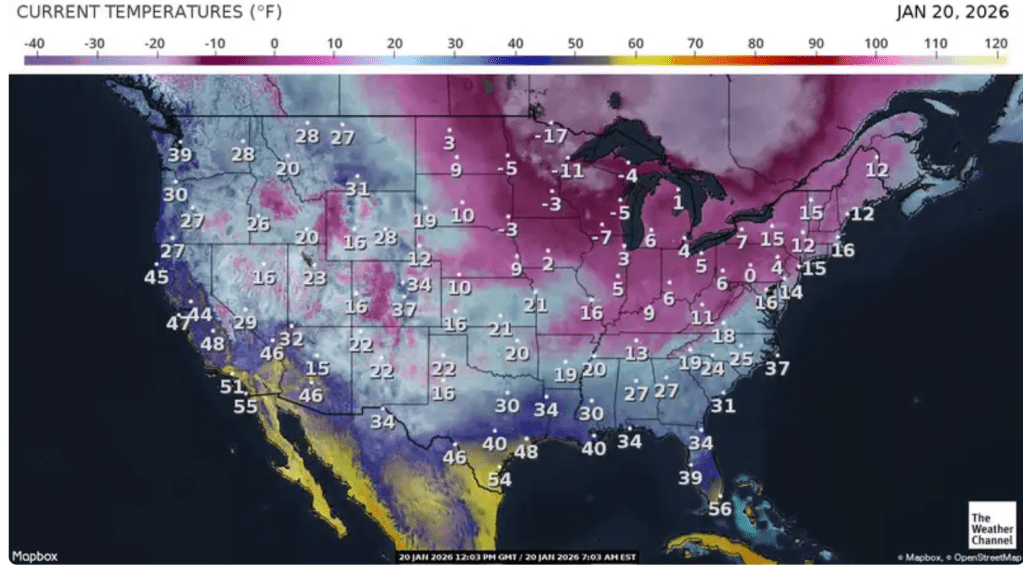

But I’m confident the one thing almost all of you are feeling this morning is the bitter cold that has enveloped most of the US as per the weather.com map below.

Given natural gas is the most common fuel for heating homes, we cannot be surprised that its price has skyrocketed today, jumping 24% in the session so far, although it is now simply back to where it was this time last year. however, a key issue in this market is Europe, which since they virtually shut off Russian gas, is now highly reliant on US LNG to heat their homes. It turns out that their storage has fallen to slightly less than 50% of capacity, well below their average storage level for this date of 60% – 65%. European TTF gas, on a like for like basis, currently costs ~$12.25/MMBtu compared to $3.85/MMBtu in the US, even after the massive jump. Again, Europe has some issues going forward.

On the data front, there is really nothing today or tomorrow of note although Thursday brings GDP amongst other things. I will review them tomorrow because, after all, markets right now are far more beholden to President Trump and Europe than to data.

Fear is growing more widespread and will likely continue to do so until there is some type of resolution over Greenland. But then, it will dissipate quickly as consider, two weeks ago we were all Venezuela experts and today, nobody even cares about that nation anymore!

As to the dollar, I expect that when the resolution arrives, the dollar will make up lost ground, but given we are in the midst of a White House bingo game, one needs to play things close to the vest. Hedges are crucial here.

Good luck

Adf