There once was a time many thought

That equities had to be bought

Then, darn it, Japan

It scuppered the plan

And havoc is all that they wrought

So, last week, not greed, but fear, won

And risk assets ended their run

But now folks are sure

In fact, it’s de jure

That rate cuts, next month, are, deal, done

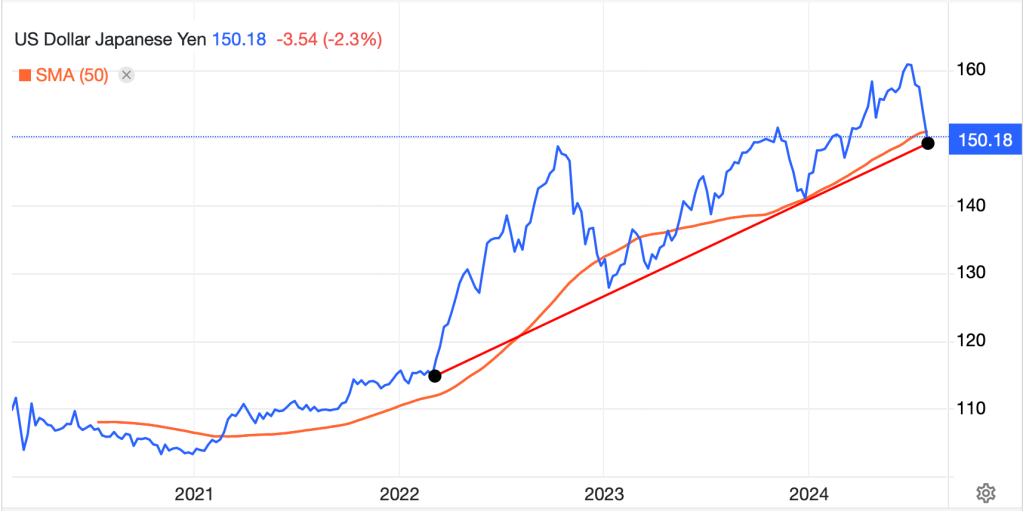

Congratulations everyone. You made it through the end of the world! I must admit, though, that on this side of that extraordinary event, things don’t really seem that different. A quick recap reminds us that on July 31st, the BOJ surprised markets and raised interest rates by 15bps, taking their overnight funding rate to 0.25%, its highest level in 15 years. Twelve hours later, the FOMC did not cut rates, as some had been advocating, but seemed to promise that a cut was coming in September. Then, two days later, the US employment report showed substantially weaker jobs activity than expected. Over the ensuing several sessions, USDJPY declined dramatically, falling nearly 10 big figures as can be seen in the first chart below.

Source: tradingeconomics.com

After an initial reflexive trading bounce, it was starting to slide again when, on August 6th, BOJ vice-governor Ichida explained that the BOJ would not, in fact, be aggressively tightening policy immediately. The result was a relief rally and now USDJPY sits about halfway between the level prior to the rate hike and the low’s plumbed afterwards.

Perhaps just as interesting is the fact that the Nikkei 225 showed virtually the identical trading pattern, with its decline last Monday, August 5th, as the second largest single-day decline in its history.

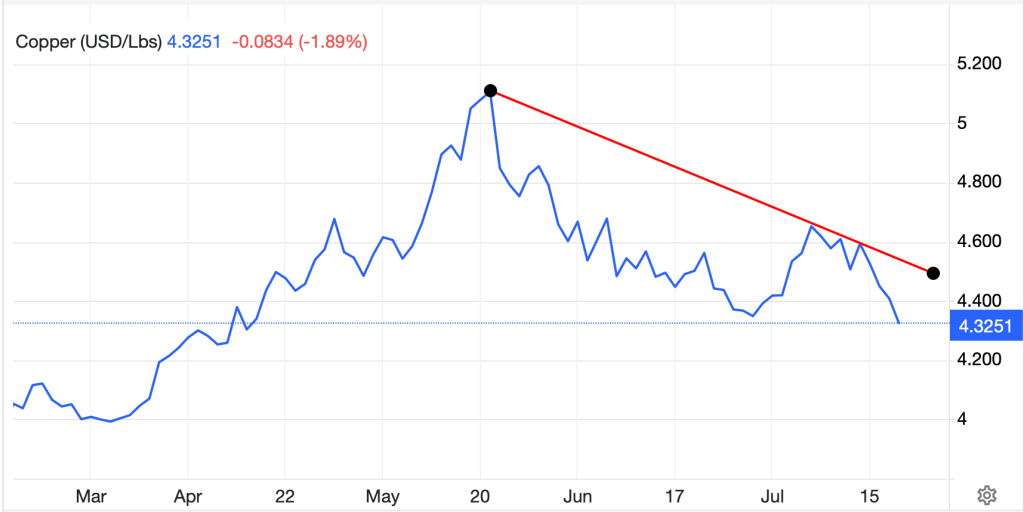

Source: tradingeconomics.com

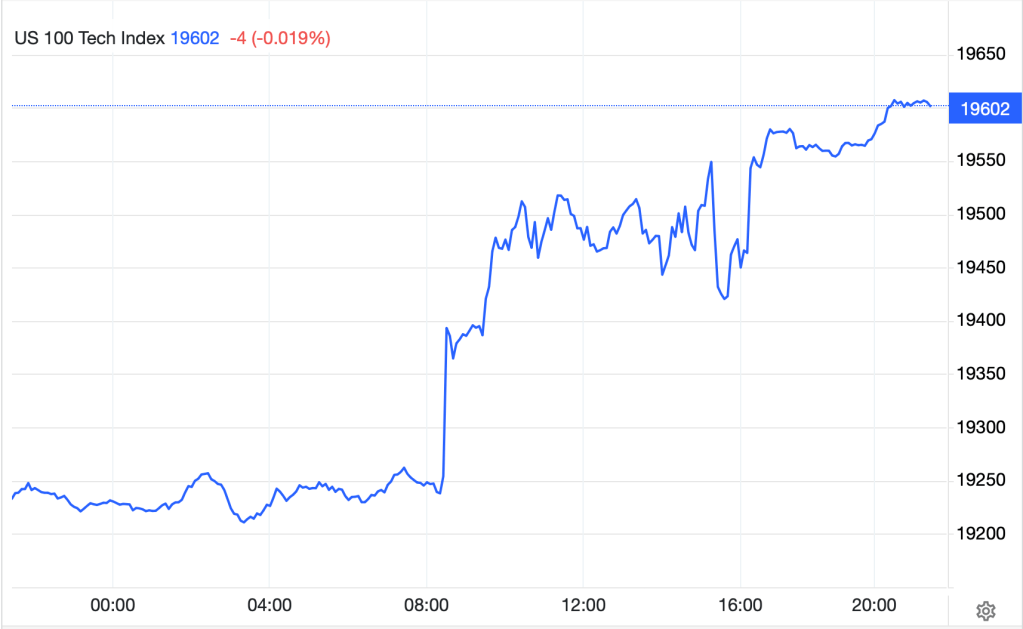

And yet, it is not hard to see that the trading pattern for both the Nikkei 225 and USDJPY are virtually identical, with the same catalysts. In fact, we can look at other markets, 10yr Treasury yields and the NASDAQ come to mind, and see extremely similar price action. (Alas, I couldn’t get the BOJ and Unemployment rate points on the combined chart, but you can see it is the same pattern.)

Source: tradingeconomics.com

The one truism that holds is that during a time of stress, all correlations go to one!

But perhaps it’s time to consider, once again, the idea of recession. As of now, there are still two camps:

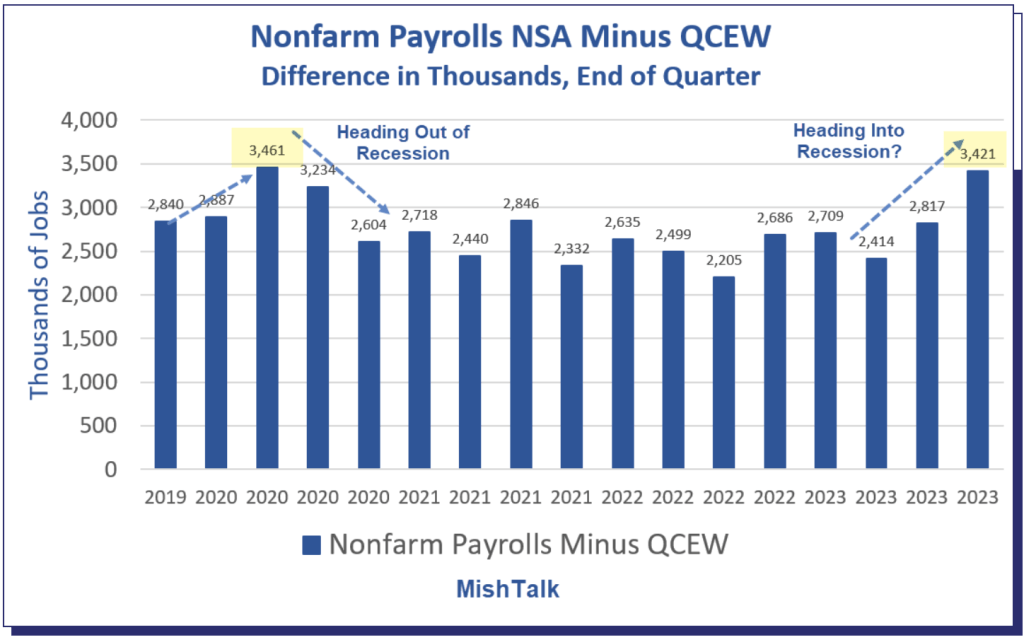

- Recession is already here and started sometime in the late spring. This is based on the declining trend in manufacturing activity, the rise in the unemployment rate (the Sahm Rule), the rising number of bankruptcies and increasing size of household debt along with delinquencies. Constant downward revisions of previous data releases also weigh on the view, and of course, the yield curve continues to point to lower interest rates going forward, the implication being growth is slowing. One last feature is the dramatic difference between GDP and GDI, two different measures of US economic activity that should show the same thing, however currently, GDI (Gross Domestic Income) is printing below 1% real growth.

- Meanwhile, the soft/no-landing scenario remains popular amongst a different set of analysts. Perhaps the most comprehensive discussion comes from Apollo Research’s Torsten Slok as he highlights the fact that real-time indicators like air travel, restaurant seatings, income tax withholdings and Retail Sales remain quite strong. As well, the Atlanta Fed’s GDPNow is currently running at 2.9%, which certainly doesn’t appear to be pointing to a recession.

So, which is it? Of course, that’s the $1 trillion question. However, let us consider a few incontrovertible truths. First, business cycles still exist. Despite all the efforts by finance ministries and central banks to create an ever upward trajectory in economic activity, or more accurately because of those efforts, excesses are created and at some point, that growth is no longer sustainable. In other words, governments and central banks blow bubbles and eventually they pop. Second, not all parts of the economy grow at the same pace and respond to the same catalysts in a similar manner. So, certain parts of the economy may be under pressure while others are doing fine. Third, trees don’t grow to the sky. There are no magic beans which grow that beanstalk ever higher. Rather, at some point, gravity becomes a stronger force, and things return to earth.

From this poet’s viewpoint, we are continuing to see sectoral weakness that has not yet tipped into general weakness. We’ve all heard about commercial real estate and the problems ongoing in that sector. As well, we’ve all heard the excitement about AI and the massive (over)investment that has been focused on that sector, supporting the companies at the heart of the story. In between, there are many shades of grey with some areas holding up better than others. But on an economy-wide basis, it seems likely that given the amount of ongoing fiscal stimulus that is still being pumped into the economy, overall, a recession will still be delayed further.

Perhaps the bigger problem for the economy is that inflation remains a very real phenomenon. As the WSJnoted this morning, it is the prices of things with which we cannot do without (e.g., food, shelter, insurance) that continue to rise, rather than the discretionary items, which seem to see prices ebbing. Ultimately, the downturn will come, but you can be sure that the government, and the Fed, will do all they can to prevent it happening, at least before the election.

Ok, with that in mind, let’s look at markets overnight as well as what this week’s data releases will bring. After modest gains in the US on Friday, with the early part of last week’s dramatic declines essentially elimiated, Asian equity markets were generally stronger (Korea, Taiwan, Australia) although Chinese shares continue to lag (CSI 300 -0.2%) as data showed that investment into China has turned to divestment from China for the second quarter of the past four. (see chart below). This is obviously not a positive story for the Chinese economy or its equity markets. As an aside, Japanese markets were closed for a holiday last night.

Source: Bloomberg.com

Meanwhile, European bourses are generally little changed, +/-0.15% or less except for the UK, where the FTSE 100 is higher by 0.5% despite hawkish comments from BOE member Catherine Mann warning against complacency on inflation and pushing back against the idea of consistent interest rate cuts. Lastly, US futures are edging higher at this hour (7:15), up about 0.2% across the board.

In the bond market, yields are edging back up this morning, with Treasuries higher by 2bps and similar gains across all of Europe. To the extent that government bonds are serving as havens again, the idea that equity markets are rebounding would certainly imply less demand for them. The one place where yields continue to decline is in China, where 10-year yields are trading near the historic lows seen at the end of July, and clearly still trending lower, an indication that growth expectations are falling.

Source: tradingeconomics.com

In the commodity markets, oil (+1.25%) is gaining on the growing expectation that Iran is set to finally respond to Israel and launch a significant assault with fears this can grow into a wider conflagration and impact supply. That fear seems to be bleeding into gold (+0.5%) as well, which is back toward its historic highs, and taking the entire metals complex (Ag +1.8%, Cu +1.1%) with it.

Finally, the dollar is mixed this morning, rising strongly against the yen (-0.7%) and CHF (-0.5%) but lagging the commodity currencies (AUD +0.5%, NZD +0.5%, ZAR +0.6%). As to the more financial currencies, like EUR, GBP, CAD, they are little changed on the session. Ultimately, the story remains driven by expectations of Fed activity with the market currently pricing a 50:50 chance of a 50bp rate cut come September.

On the data front, we do see important things this week as follows:

| Today | NY Fed Inflation Expectations | 3.0% |

| Tuesday | NFIB Small Biz Confidence | 91.7 |

| PPI | 0.1% (2.3% Y/Y) | |

| -ex food & energy | 0.2% (2.7% Y/Y) | |

| Wednesday | CPI | 0.2% (2.9% Y/Y) |

| -ex food & energy | 0.2% (3.2% Y/Y) | |

| Thursday | Initial Claims | 235K |

| Continuing Claims | 1880K | |

| Retail Sales | 0.3% | |

| -ex autos | 0.1% | |

| Empire State Mfg Index | -6.0 | |

| Philly Fed | 7.0 | |

| IP | 0.1% | |

| Capacity Utilization | 78.6% | |

| Friday | Housing Starts | 1.35M |

| Building Permits | 1.44M | |

| Michigan Sentiment | 66.7 |

Source: tradingeconomics.com

In addition, we hear from several Fed speakers, with at least three on the docket, but I imagine we will get more than that. Last week’s fears have been memory-holed. The vibe this morning is that it was all the BOJ’s fault and that everything is going to be great. Maybe that will be the case, but I remain a skeptic. Just consider, if everything is great, why would the Fed cut rates? And the one thing that seems clear to me is that a Fed rate cut is the base case for virtually everyone. I maintain if they cut, especially 50bps, the dollar will fall sharply. But if that recession data doesn’t start to appear soon, some folks are going to need to change their views, and positions, regarding how things unfold.

Good luck

Adf