Inflation was just a touch hot

And certainly more than Jay sought

So, later today

What will the Fed say?

My sense is the doves will be shot

Instead, as Jay’s made manifest

Inflation is quite a tough test

So, higher for longer

Or language much stronger

Is like what he’ll say when he’s pressed

Let’s think a little outside of the box this morning, at least from the perspective of virtually every pundit and their beliefs about what will happen at the FOMC meeting today. At this point, most of the punditry seems to believe that Powell cannot be very much more hawkish, especially since the market is expecting comments like inflation is still too high and the Fed will achieve their goal. So, there is a growing camp that thinks any surprise can only be dovish, since if he doesn’t push back hard enough or talk about loosening financial conditions being a concern, the equity market response will be BUY STONKS!!!

But what if, the thing Powell really wants, or perhaps more accurately needs, is not a soft landing, but a full-blown recession! Think about it. As I have written repeatedly, the idea that the Fed will cut rates by 125bps next year because growth is at 1.5% or 2.0% and inflation has slipped to 2.5% seems like quite an overreaction. But given the current US debt situation ($34 trillion and counting) and the fact that the cost of carrying that debt is rising all the time, what would get the Fed to really cut rates? And the only thing that can do it is a full-blown, multiple quarters of negative GDP growth, rising Unemployment Rate, recession. If come February or March, we start seeing negative NFP numbers, and further layoff announcements as well as declining Retail Sales and production data, that would get the Fed to act.

At least initially, we would likely see inflation slide as well, and with that trend plus definitive weakness in the economy, it would open the door for some real interest rate cuts, 400bps in 100bp increments if necessary. Now, wouldn’t that take a huge amount of pressure off Treasury with respect to their refi costs? And wouldn’t that encourage accounts all over the world to buy Treasuries so there would be no supply issues? All I’m saying is that we cannot rule out that Powell’s master plan to cut rates is to drive the economy into a ditch as quickly as possible so he can get to it. In fact, it would open the door to restart QE as well.

This is not to say that this is what is going to happen, just that it is not impossible, and I would contend is not on anyone’s bingo card. Now, Powell will never say this out loud, but it doesn’t mean it is not the driving force of his actions. Powell is incredibly concerned with his legacy, and he has made abundantly clear that he will not allow his legacy to be the second coming of Arthur Burns. Instead, he has his sights on the second coming of Paul Volcker, the man who killed the 1970s inflation dragon. St Jerome Powell, inflation slayer, is what he wants as his epitaph. And causing a recession to kill inflation and then cut rates is a very clever, non-consensus solution.

How will we be able to tell if I’m completely nuts or if there is a hint of truth to this? It will all depend on just how hard he pushes back on the current narrative. Yesterday’s CPI results could best be described as ‘sticky’, not rebounding but certainly not declining further. Shelter costs continue apace at nearly 6% Y/Y and have done so for more than 2 years. I was amused this morning by a chart on Twitter (I refuse to call it X) that showed CPI less shelter rose at just 1.4% with the implication that the Fed needs to start cutting rates right away. The problem with that mindset is that shelter is something we all pay, and there is scant evidence that housing markets are collapsing. In fact, according to the Case Shiller index, they are rising again. I would contend that there is plenty of evidence to which Powell can point that makes his case for an economy that is still running far too hot to allow inflation to slide back to their target. And that’s what I expect to hear this afternoon.

Speaking of recession, let us consider the situation in China, where despite the CCP’s annual work conference just concluding with some talk of building a “modern industrial system” the number one goal this year, thus boosting domestic demand, they announced exactly zero stimulus measures to help the process. Data from China overnight showed that their monthly financing numbers were all quite disappointing compared to expectations and the upshot was a further decline in Chinese and Hong Kong equity markets. This ongoing economic weakness and the lack of Xi’s ability or willingness to address it continues to speak to my thesis that commodity prices will remain on the back foot. If you combine the high interest rate structure in the G10 with a weaker Chinese economy, the direction of travel for energy and base metals is likely to be lower. The one exception here is Uranium, where there is an absolute shortage of available stocks and a renewed commitment around the world to build more nuclear power plants.

At the same time, Europe remains pretty sick as well, with Germany leading the entire continent into recession, and likely dragging the UK with it. Germany, France, Norway, the UK and others are all sliding into negative growth outcomes. While Chairman Powell will continue to push back on the idea of rate cuts soon, I expect that tomorrow, when both the ECB and BOE meet, they will open the door to rate cuts early next year. Inflation in both places has been falling sharply and there is no evidence that Madame Lagarde or Governor Bailey is seeking to be the next Paul Volcker. Both will blink with the result that both the euro and the pound should feel pressure.

Summing it all up, today I think we get maximum hawkishness from the Fed with Powell pushing back hard on the market pricing. Initially, at least, I expect we could see yields rise a bit and stocks sell off while the dollar continues its overnight rise. But I also know that there are far too many people invested in the idea that the Fed must cut soon, and they will be back shortly, buying that dip until they are definitively proven wrong.

As to the rest of the overnight session, aside from China’s weak performance, South Korea also lagged, but the rest of the APAC region saw modest gains. Europe, meanwhile, is all green, although it is a very pale green with gains on the order of 0.2%, so no great shakes. Finally, US futures are firmer by 0.1% at this hour (7:15) after yesterday’s decent gains.

Bond yields are sliding this morning, down 2bps in the US and falling further in Europe with declines of between -3bps and -6bps on the continent as investors and traders there start to price in a more aggressive downward path for interest rates by the ECB. UK yields are really soft, -9bps, after GDP data this morning was disappointing across the board, especially the manufacturing data.

Oil prices (+0.45%) which got slaughtered yesterday, falling nearly 4%, are stabilizing this morning, as are gold prices, which fell yesterday, but not quite as much as oil. However, the base metals complex continues to feel the pressure of weak Chinese demand. I continue to believe that there are structural supply issues, but right now, the macro view of weak economic activity is the main driver, and it is driving prices lower.

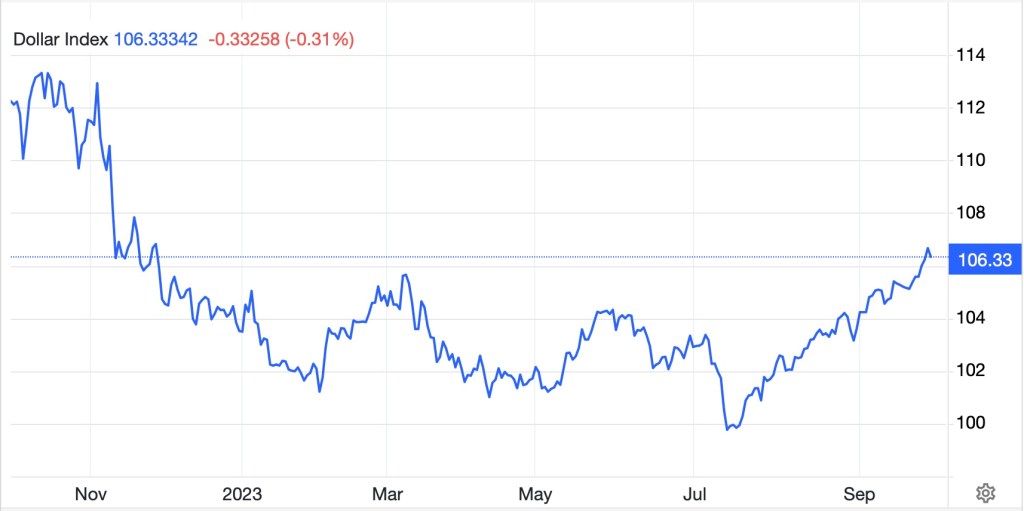

Finally, the dollar is firmer this morning as weakness elsewhere in the world leaves fewer choices for where to park funds. While the movement has not been overly large, it is quite uniform across both G10 and EMG currencies. The laggards have been NZD (-0.6%) after a softer than expected CPI reading and ZAR (-0.6%) on the back of weakening metals prices. If I am correct about the path going forward, the dollar should perform well right up until the Fed responds to much weaker economic activity and starts to cut rates aggressively. At that point, we can see a much sharper decline in the greenback.

Ahead of the FOMC meeting, this morning we get November PPI (exp 1.0%, 2.2% core) which would represent a small decline from last month’s data. We will also see the EIA oil inventory data, which has shown a recent history of builds helping to drive the oversupply narrative there.

At this point, it is all up to Jay. I suspect that markets will be quiet until then, and it will all depend on the statement, the dot plot and the presser.

Good luck

Adf