Intervention is

The last bastion of tortured

Finance ministers

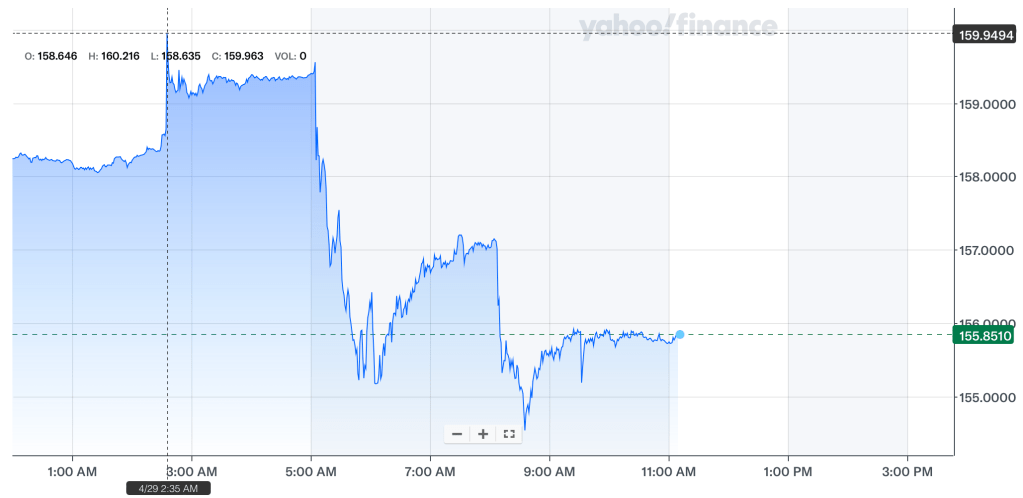

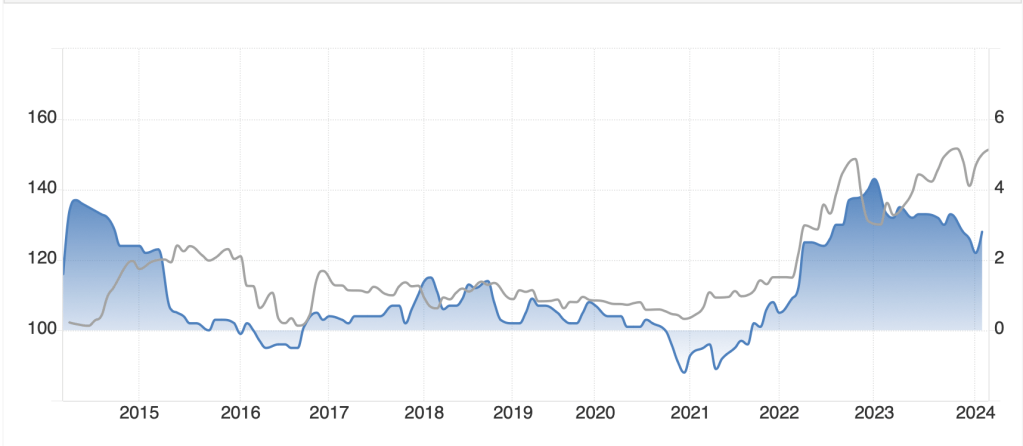

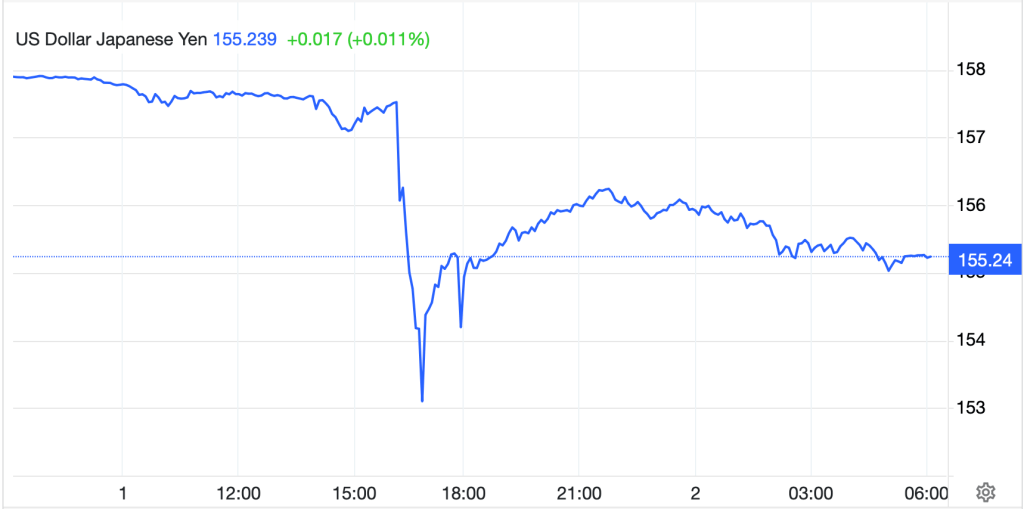

Apparently, Japanese FinMin Suzuki did not want the spotlight to remain on Chairman Powell and the Fed so last night, in what was surprising timing given the absence of additional jawboning ahead of the move, it appears there was a second round of intervention orchestrated by the MOF and executed by the BOJ. Looking at the chart below, courtesy of tradingeconomics.com, it is pretty clear as to the activity and timing, although as is often the case, 50% of the move has already been retraced.

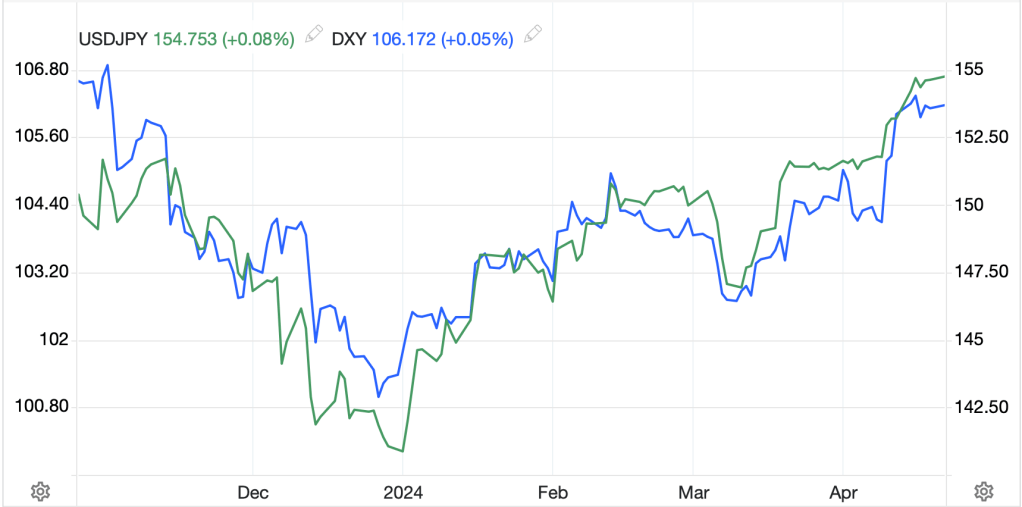

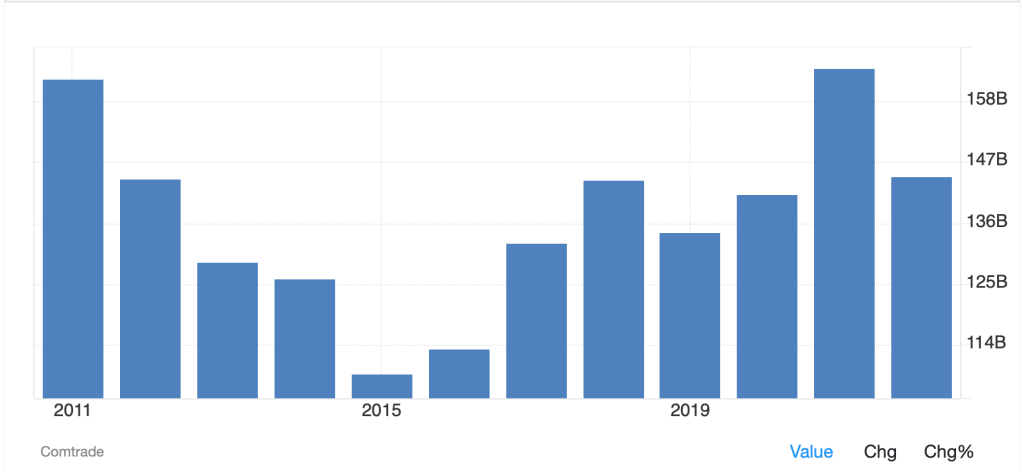

According to Bloomberg’s calculations, they spent an additional ¥3.5 (~$22B) in the effort, so smaller than last time, but still a pretty decent amount of cash. As of yet, there has been no affirmation by the MOF that they did intervene, although the price chart alone is strong evidence of the action. Will it matter? In the long run, not at all. The only thing that will change the ultimate trajectory of the yen’s exchange rate is a policy change and based on last week’s BOJ meeting, there is no evidence a monetary policy change is in the offing. Therefore, we need to see a US policy change and based on yesterday’s FOMC meeting and the following press conference, that doesn’t seem to be coming anytime soon either. To my eye, the yen will continue to weaken until something changes. This could take a few more years and USDJPY could wind up a lot higher than 160.

Said Jay, it is, frankly, absurd

A rate hike will soon be preferred

But neither will we

Soon cut, we agree

While ‘flation’s decline is deferred

To me, the encapsulation of the entire FOMC statement and Powell press conference can be summed up in the following two quotes from the Chairman while answering questions. “I think it’s unlikely that the next policy rate move will be a hike,” and “inflation has shown a lack of further progress… and gaining confidence to cut will take longer than thought.” In other words, we are not likely to change policy anytime soon absent a complete black swan event.

Since the press conference ended, there has been an enormous amount of speculation regarding what message Powell was trying to send. I would argue the consensus is that he wants to cut but the data is just not in a place that would allow the Fed to go down that path without destroying what’s left of their credibility. To me, the question is, why is he so anxious to cut rates? Arguably, an unbiased Fed chair would simply ‘want’ to follow whatever is the appropriate course to achieve the mandate.

One of the popular views is that there is substantial pressure from the White House to cut as the Biden administration believes lower rates will help Biden’s reelection bid, however Powell, when asked about the political issue, was explicit in rejecting that hypothesis and claiming that politics is never even part of the conversation, let alone the decision. I accept that at face value, although certainly all 17 members of the FOMC have political biases that drive their actions. But here is a take I have not heard elsewhere. Perhaps Powell is keen to cut because it will help the private equity sphere, the place where he not only made his fortune, but where he also maintains a large social circle and he simply wants to help his friends. There is no doubt that lower rates help the PE space! Regardless of why, I have to agree that it appears he is leaning in that direction.

There was one other thing that was a minor surprise and that had to do with the balance sheet program. As expected, the Fed explained they would be reducing the pace of QT starting in June, but they would be doing so by more than anticipated, slowing the runoff to $25 billion/month of Treasuries before reinvesting, down from the current level of $60 billion/month. For MBS, the runoff remains at $35 billion/month, although if that number is exceeded, they would replace the MBS with Treasuries so allow the MBS portion of the portfolio (currently $2.38 trillion) to slowly disappear. The operative word here, though, is slowly, as they have not come close to seeing that $35 billion since the program started. After all, nobody is refinancing their mortgage with current rates thus reducing the churn in that part of the portfolio. At any rate, that was very mildly dovish, I believe.

The market response to the entire show was quite positive with equity investors taking the dovish message to heart and equities and bonds both rallied in the immediate wake of the meeting, although the equity markets sold off on the close and wound up slightly lower for the session. Not so bonds, where yields fell and continue at those levels, down about 5bps on the day.

So how have things fared overnight since the Fed? Well, the Hang Seng (+2.5%) was the big winner as investors there took Powell’s dovishness to heart and that combined with confirmation that the Chinese Plenary meeting would be occurring in July, thus a chance for more stimulus to come, got investors excited. However, the mainland was closed. Japanese shares were basically unchanged after the intervention and the story throughout the rest of the region was mixed with some gainers (Australia, India) and some laggards (South Korea, Indonesia).

In Europe, it is also a mixed picture as investors respond to the PMI data releases, which were also a mixed bag. For instance, Spain saw a jump in PMI and the IBEX is firmer by 0.3% while France saw a 1-point decline in the index and the CAC is down by -0.7%. Looking at the overall mix of data, it appears that European economic activity is bumping along the bottom, although not yet clearly turning higher. Arguably that is a big reason the ECB has penciled in that June rate cut. Finally, US futures are pointing higher at this hour (7:00) between 0.5% and 1.0%, so quite solidly so.

In the bond market, the doves are still in charge as Treasury yields have drifted lower by another 2bps and are back to 4.60%. but in Europe, the story is even better with yields down between 4bps and 7bps as the modest growth outturn added to oil’s recent price declines has investors gaining confidence that inflation there, at least, is truly on its way back to target. As to JGB’s, a 1bp rise overnight has yields back to 0.90%, obviously much closer to the previous limit at 1.0%, but still not moving there rapidly.

Going back to oil prices, while they have bounced 0.5% this morning, they are down more than 5.2% in the past week as rising inventories and growing hopes of a ceasefire in Gaza have been enough to get the CTAs and hedge funds to close their positions. In something of a surprise to me based on the ostensible dovish tone of the Fed, metals markets are back under pressure after yesterday’s bounce so all of them, both precious and industrial, are lower by about -1.0% this morning.

Finally, the dollar, aside from the yen, is edging higher this morning, although edging is the key term here. Against most majors it is firmer by just a bit, 0.15% or so, although in the G10 there are two outliers, CHF (+0.45%) which rallied after their CPI release this morning was much hotter than expected at 0.3% M/M indicating the SNB may be holding off on its next rate cut, and NOK (-0.6%) which is continuing to suffer from the oil decline in the past week. It should also be no surprise that ZAR (-0.5%) is under pressure given the metals movement. But elsewhere, things are far less interesting with modest dollar gains the rule today. This seems at odds with the ostensible dovish Fed tone, but there you have it.

On the data front, we see Initial (exp 212K) and Continuing (1800K) Claims as always on a Thursday, as well as the Trade Balance (-$69.1B) and then Nonfarm Productivity (0.8%) and Unit Labor Costs (3.3%) all at 8:30 with Factory Orders (1.6%) coming at 10:00. As of now, there are no Fed speakers on the docket, but I would not be surprised to see an interview pop up. The Fed will be closely watching the productivity data as that is an important part of the macro equation regarding sustainable growth and inflation. Certainly, the expectations do not bode well for a dovish stance.

Explain to me that policy has changed, and I will accept that it is time to change my view. However, at this point, the dollar still gets the benefit of the doubt.

Good luck

Adf