History has shown

It takes seven steps before

The BOJ acts

Inquiring minds ask

Was last night six or seven?

FinMin’s lips are sealed

I must admit, when I went to bad last night, I thought this morning’s lead discussion would be about gold as it crested $5000/oz given it was trading at $4967 and nothing seemed likely to stop it. But something did, probably some profit taking into the weekend, given it has rallied more than 7% this week.

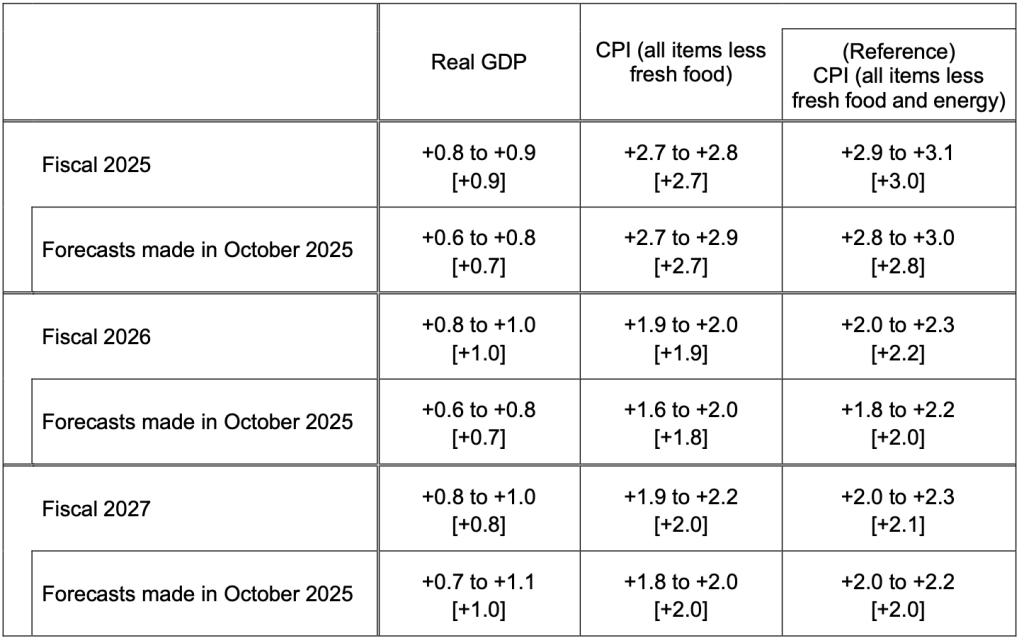

Thus, since there are no new geopolitical stories of note, with everyone still trying to figure out what the past several days means, we look toward the East this morning and start with Japan. The BOJ left policy rates on hold, as widely expected, but Ueda-san also raised the BOJ’s forecasts for inflation (see below from BOJ policy statement).

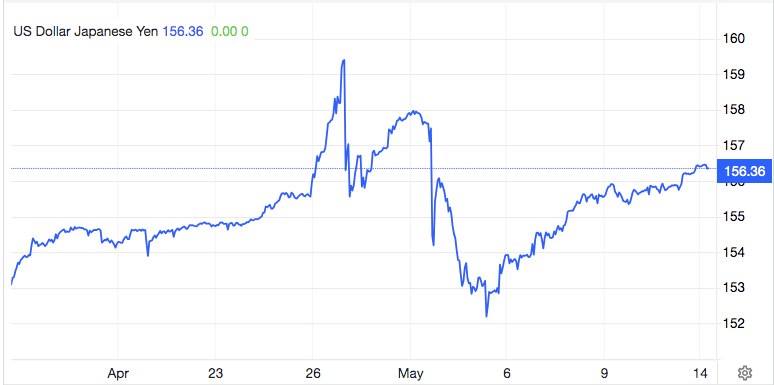

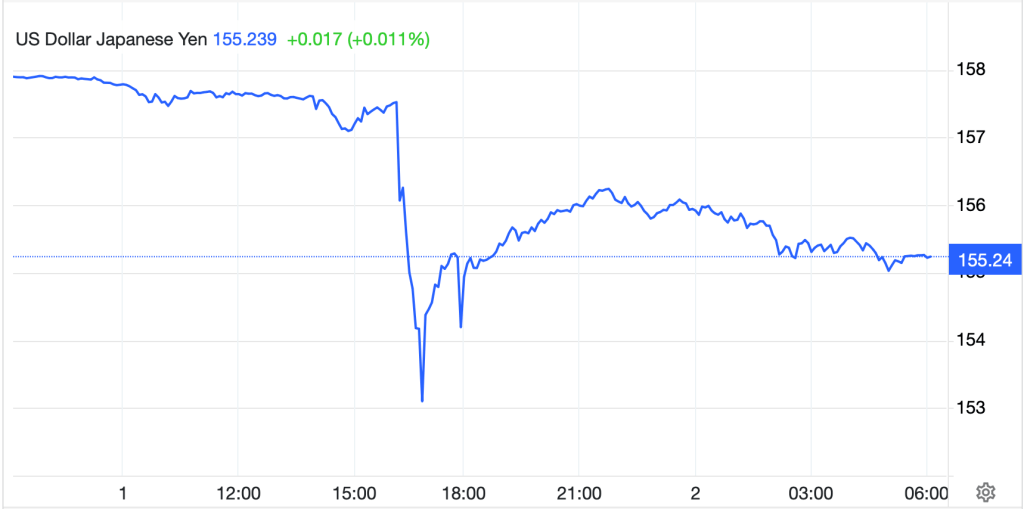

The latter move has been interpreted as offering more flexibility for the BOJ to hike rates further with expectations for a hike next month rising above 60%. But of more interest was the price action seen in the immediate wake of the Ueda comments as seen in the below chart.

Source: tradingeconomics.com

While some have asked if the BOJ intervened last night, I would categorically answer, No. The fact that the dollar’s decline was so short lived indicates that something else was likely the catalyst. On the 7-step road to intervention, step 6 is checking rates. This occurs when the BOJ calls the FX trading desks at banks in Tokyo and asks for prices where they could buy yen, but don’t actually execute the transaction. However, it is a powerful signal that the BOJ, on behalf of the MOF, is growing concerned. The thing is, historically when this happens, it is widely circulated within the market that the BOJ is checking rates.

Thus far, we have not heard that at all from either the banks or the MOF. Rather, FinMin Katayama once more explained, “We’re always watching with a sense of urgency.” (As an aside, I assume this comment is a result of a translation of Japanese that doesn’t fit the English language well as I do not understand how one can watch something ‘urgently’). But that urgency is classic step 5, not step 6, so it is not clear that we are closer to intervention at this point. After all, the dollar’s high last night was not as high as we had seen just 9 days ago, when they first took step 5, and historically, a new high is needed before the next step is taken.

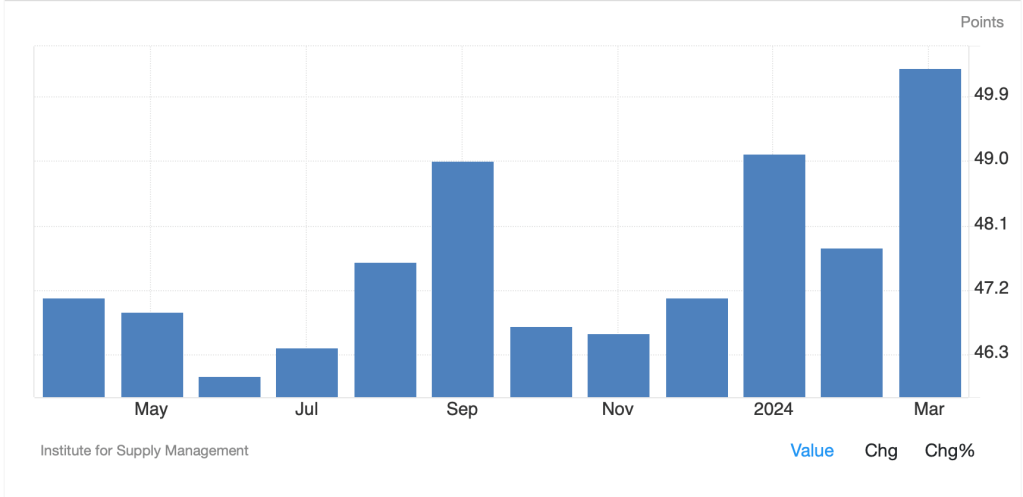

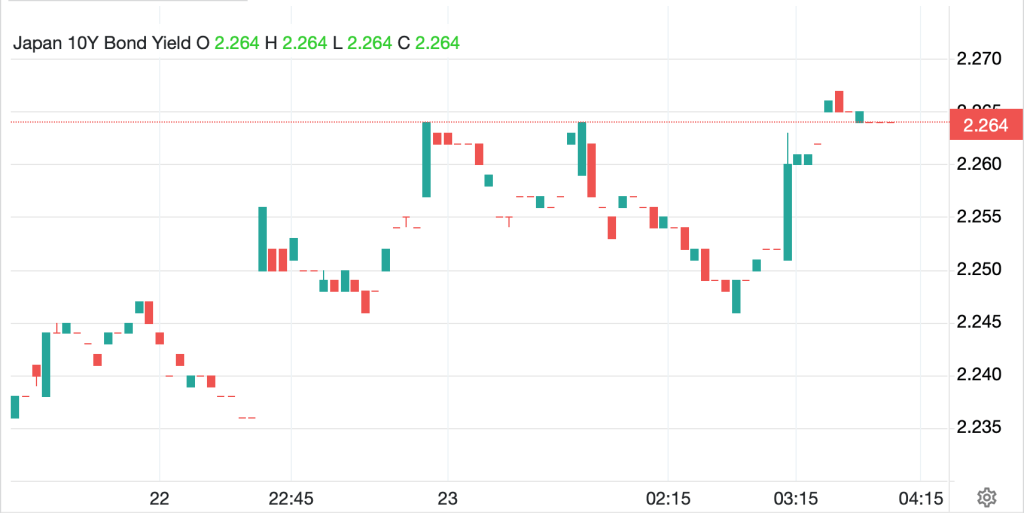

But, getting away from the minutiae of their intervention process, I believe last night’s activities tell us that there is growing concern about the yen’s level and its impact on rising inflation. If Governor Ueda is priming markets for a rate hike sooner than previously anticipated, it tells me that inflation data coming up is going to be higher than previously forecast, and he wants to be prepared. Interestingly, JGB markets did not see the same type of price behavior as you can see below.

Source: tradingeconomics.com

My conclusion is there was no rate checking, but FinMin Katayama’s comments were sufficient to convince some that it was coming soon to a screen near you. Remember, last month, Japanese CPI slipped to 2.1%, its lowest level since March 2022. Given the next release is still nearly a month away, there is no clear consensus as to its reading, but I suspect a rebound is in order. If forecasts start indicating a substantial rise, I expect the yen to initially weaken, and perhaps that will be sufficient for the BOJ to take the 6th step.

But other than that, there seems very little new news to discuss. WEF is over and while there are still numerous analyses about what happened, and how things will evolve from here, consensus conclusions are few and far between. So, let’s see how the rest of the financial markets fared overnight.

Yesterday’s solid US equity performance was followed by a generally solid one in Asia as well. Tokyo (+0.3%) was nonplussed by the intervention discussion, while HK (+0.45%), Korea (+0.8%) and Taiwan (+0.7%) all followed the US higher. However, there were some laggards with China (-0.45%) and India (-0.9%) suffering on what appeared to be some profit taking on the previous day’s gains. Overall, there were more gainers than laggards here. In Europe, the picture is also mixed as the IBEX (-0.4%) and CAC (-0.3%) both suffer after weaker than expected Flash PMI data was released while Germany (+0.1%) and the UK (+0.2%) are benefitting from modestly better numbers there. We continue to hear German Chancellor Merz explain all the things that Germany is going to do to make things better going forward, but the nation has so totally hamstrung itself with its energy policy of the past decade, it is not clear to me they have any opportunity to be successful in the short run. As to US futures, at this hour (7:40), they are pointing slightly lower, -0.15% or so.

In the bond market, yields around the world are within 1 to 2 basis points of yesterday’s closing levels with France (-4bps) the outlier after the weak data and the news that PM LeCornu has survived the first of two no-confidence votes and appears set to get a budget passed, albeit with a 5% deficit forecast. Otherwise, not much here with yesterday’s PCE data unable to move the needle given it was right on forecasts.

In the commodity market, oil (+1.9%) is rallying after President Trump hinted at further Iranian activities when he indicated an armada of US naval vessels is heading there. That has traders nervous, but, of course, with President Trump, it is always difficult to determine his strategy, even if we know the end game is to remove the theocracy if possible. NatGas (-1.6%) is giving back some of its recent gains but given the forecast for a massive arctic blast this weekend, with single digit temperatures and up to two feet of snow on the East coast, I suspect it will maintain its recent gains for a few more days.

In the metals markets, gold is unchanged on the session, although continues to sit tantalizingly close to $5000/oz. Just as remarkable is that silver (+3.1%) is now trading above $99/oz and certainly seems like it is going to crest $100/oz in the very near future. This has helped all metals with both copper (+2.5%) and platinum (+5.2%) to rally with the latter now trading at an all-time high as well.

Finally, the dollar is…doing nothing. While the DXY has sipped -0.07%, we are seeing a mixed picture with the euro slightly softer while the pound (+0.2%) has rallied on the stronger PMI data. In fact, scanning my screens, nothing has moved more than 0.3% (NOK, AUD on the plus side, PLN, INR on the minus side), but indicative that FX remains an afterthought for now (except for the yen).

On the data front, we see the Flash PMI data (exp 52.0 Mfg, 52.8 Services) and Michigan Sentiment (54.0) and that’s it. Given all the excitement from the president’s WEF visit, I think most traders and investors will be happy if we have a quiet session to head into the weekend. As well, if the weather forecasts prove correct, I expect that Monday will be very quiet as many traders will be unable to get into the office.

I don’t know about you, but it is certainly exhausting trying to keep up with the world these days. Hedging remains an important strategy regardless of your asset class, but right now, both equity and metals trends do not appear to be breaking while the dollar and bonds remain trendless.

Good luck and good weekend

Adf