Though markets are desperate for Jay

To cut, there is fear that he’ll say

It’s not yet the time

In this paradigm

As tariffs have caused disarray

But truly, Chair Jay’s greatest fear

Is that ere October this year

The Prez will have chosen

A new Chair and frozen

Him out with a final Bronx cheer

Yesterday saw the first substantial equity market move in nearly 3 weeks, with the NASDAQ declining 1.5% as concerns arose that the current extremely high valuations would have a more difficult time being maintained if the Fed does not ease policy as widely expected next month. This resulted in all the Mag7 declining, which given they have been the driving force higher in the market, necessarily resulted in overall index declines.

Source: tradingeconomics.com

Of course, the question is, what made yesterday any different than previous sessions. There were no earnings results of note, and arguably, the biggest tech news was the story about the US government taking a stake in Intel, something that seems likely to have been a positive. However, there has been an increase in chatter about what Chair Powell is going to say on Friday at his Jackson Hole speech. Notably, in the SOFR options market, there are a large, and still increasing, number of bets being placed that Powell will indicate 50bps is on the table in September. But Wall St analysts continue to side with the patience crowd, explaining that while the current policy settings may be slightly restrictive, they are hardly suffocating for the economy.

While Powell has repeatedly blamed an uncertain impact of tariffs on his decision to maintain current policy settings, just like everything else, this is becoming extremely political. Trump’s allies are lining up behind him and calling for immediate rate cuts to help support the economy. At the same time, Trump’s political foes remain focused on preventing any Fed action that might help Trump, although they couch their arguments in terms of maintaining Fed ‘independence’.

However, last night was instructive in that two central banks, New Zealand and Indonesia, cut rates further while Sweden’s Riksbank, though standing pat, explained that more cuts are possible, if not likely, later this year. While the PBOC did not cut rates, the pressure there is building as the economic situation is very clearly slowing down, as discussed last week after their data releases. So, with most of the world cutting rates (Japan being the notable exception), pressure continues to mount on Powell and the Fed to pick up where they left off last December.

Hanging over both Powell’s speech and the September rate decision is the fact that Treasury Secretary Bessent explained yesterday that interviews for the next Fed chair would begin around Labor Day, just two weeks from now, and nearly eight months before Powell’s term ends. This will almost certainly weaken Powell as other FOMC members and the market will look to whomever is selected for their views, with Powell serving out his term as a lame duck. In fact, it is for this reason that my take is Powell’s speech at Jackson Hole will be less about policy and more an attempt to burnish his legacy.

And that’s where things stand. With no data of note today, and yesterday’s housing data being mildly positive, but not enough to change macroeconomic opinions, the narrative writers are looking for something to say and Powell’s speech is where they have landed. Absent a run of declining days, I put no stock in a change in the market temperature at this point. So, let’s see how things behaved overnight.

In Asia, the Nikkei (-1.5%) had a rough night in a direct response to the US tech-led selloff. Given that US markets have stabilized this morning, with futures unchanged at this hour (7:25), we need to see a continuation here before expecting a significant further decline there. China (+1.1%), however, bucked that weaker trend, ostensibly on hopes that the ongoing trade talks with the US will prove fruitful. Elsewhere in the region, Korea (-0.7%) and Taiwan (-3.0%) were both hit on the tech selloff blues but other markets, with less exposure to that sector were fine. In Europe, it is a mixed picture with the DAX (-0.4%) the laggard after weaker than expected PPI indicated that current ECB policy needs to be more accommodative to help the country but may not be coming soon. However, the rest of the continent is little changed. surprisingly, UK stocks (+0.3%) are holding up well despite higher-than-expected CPI data which has adjusted analysts’ thoughts on whether the BOE will be able to cut again at their next meeting.

In the bond market, Treasury yields (-1bp) continue to trade in the middle of that band I showed yesterday, while European sovereign yields have also slipped between -1bp and -2bps this morning after the softer German price data. The UK (-4bps) is a surprise as I would not have expected lower yields after a higher inflation reading. Perhaps this is an indication that investors are expecting a much worse economic outcome from the UK going forward.

In the commodity markets, oil (+1.3%) is bouncing, but it remains in a well-defined downtrend for now as per the below chart.

Source: tradingeconomics.com

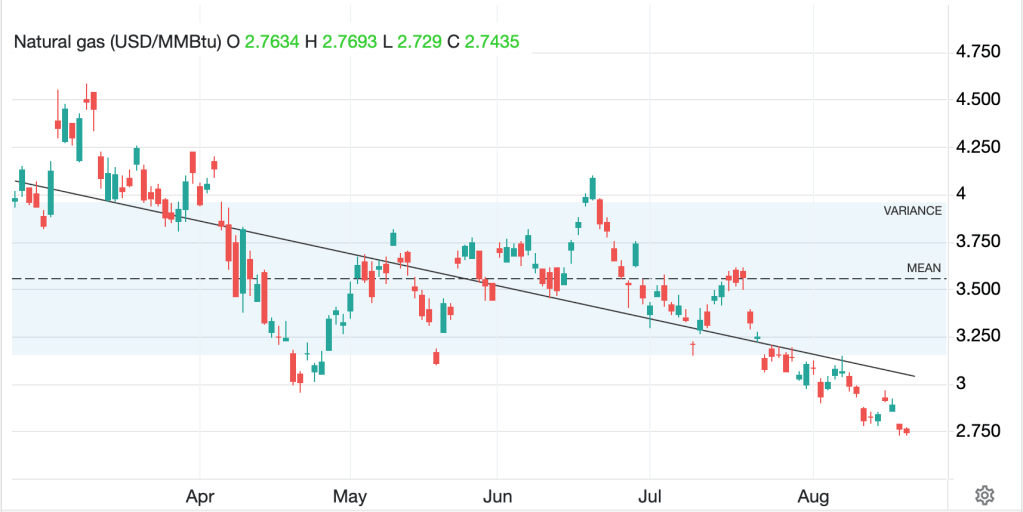

To change this trajectory, we will need to see something alter the production schedule, which with peace on the table in Ukraine seems likely to bring more oil to market not less, or we will need to see a significantly better economic outlook that drives a substantial increase in demand, something which right now seems unlikely as well. I cannot get on board the higher oil price bandwagon at this time. One other thing weighing on oil is the fact that NatGas has been trending lower for the past 6 months and is now at levels not seen since last November. In fact, those two charts look remarkably similar!

Source: tradingeconomcis.com

There is a real substitution effect here and currently oil is trading at a price that is about 4X the energy price of NatGas. Until that arbitrage closes, and it will eventually, oil will have difficulty rallying in my view.

In the metals markets, gold (+0.4%) which sold off a few dollars yesterday is rebounding although both silver and copper are soft this morning. These markets are just not that interesting right now.

Finally, the dollar is little changed this morning with one real outlier, NZD (-1.2%) which responded to the dovish tones of the RBNZ last night and is pricing in more interest rate cuts now. KRW (-0.4%) also fell on concerns over trade and the semiconductor results but otherwise, there is very little ongoing here.

The only data this morning is EIA oil inventories with a small draw anticipated. The FOMC Minutes come at 2:00 and there will be a lot of digging to see if other members seemed to agree with Bowman and Waller in their dissents at the last meeting. Bowman spoke yesterday, but was focused on her role as chief regulator, not monetary policy, although we hear from Waller this morning.

A down day in equities is not the end of the world despite much gnashing of teeth. It remains difficult to get excited about markets right now. Perhaps Mr Powell will shake things up on Friday, but my sense is we will need to wait for the next NFP data to get some action.

Good luck

Adf

PS. A reader explained to me that in Australia, black swans are the norm, not the remarkable case as here in the US. I guess we will need to find a new term to discuss an unexpected surprise.