The boy who cried wolf

Better known as, Mr Yen

Is crying again

Masato Kanda, the vice finance minister for international affairs, also known as ‘Mr Yen’ was interviewed last night regarding the recent yen’s recent weakness. “I strongly feel the recent sharp depreciation of the yen is unusual, given fundamentals such as the inflation trend and outlook, as well as the direction of monetary policy and yields in Japan and the US. Many people think the yen is now moving in the opposite direction of where it should be going. We are currently monitoring developments in the foreign exchange market with a high sense of urgency. We will take appropriate measures against excessive foreign exchange moves without ruling out any options.”

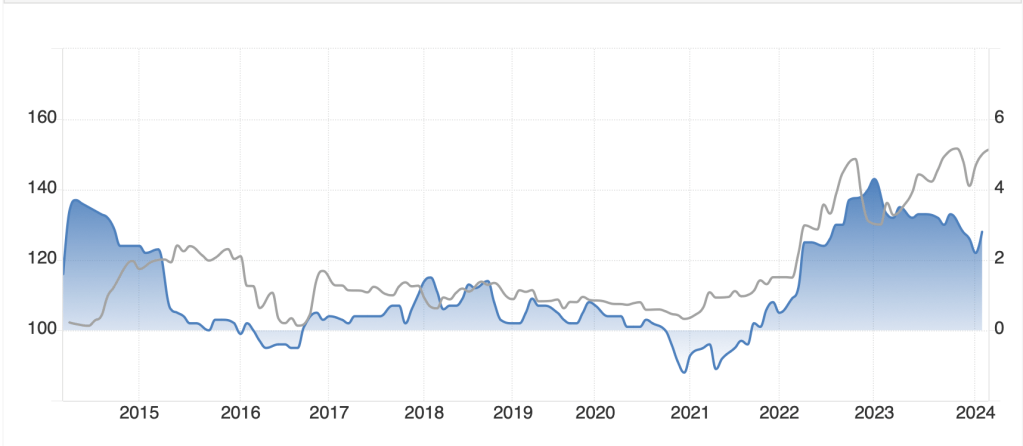

His comments [emphasis added] are consistent with what we have heard from FinMin Suzuki, PM Kishida and from him previously. What makes this so interesting is that USDJPY is essentially unchanged from its level 10 days ago, immediately in the wake of the BOJ meeting. While we did touch a new yen low (dollar high) earlier this week, that level was just a single pip weaker than the level seen back in 2022 (grey line) that seemed to be the intervention trigger at the time. And consider, much has passed between then and now, with inflation in Japan (blue shaded area) having fallen back to levels last seen at that time, but now trending in the opposite direction.

Source: tradingeconomics.com

It is abundantly clear that the MOF is concerned over a sharp decline in the yen. It is also clear that the monetary policy differences between the US and Japan are such that there is very little reason for the yen to appreciate at the current time. This is especially true since the US commentary we have heard lately, with Waller’s comments on Wednesday the most recent, indicate that the long-awaited Fed pivot continues to be a distant prospect, while Ueda-san made it clear that the BOJ was going to maintain easy money conditions despite having exited NIRP.

FWIW, absent a sudden sharp move above 153, my take is the MOF/BOJ simply continue to jawbone the market. However, if something changes and we rip higher in USDJPY, that would change my views.

Though holiday markets abound

The info today could astound

At first, PCE

With fears it’s o’er three

Then Powell with words quite profound

And what, you might ask, could cause such a move in the FX markets? Well, despite the fact that all of Europe and Canada are closed as well as both equity and futures exchanges in the US in observance of the Good Friday holiday, this morning we have critical US economic data being released at 8:30 as well as a speech by Chairman Powell at 11:30. Liquidity is abysmal, which means that if the data is a surprise in either direction, we could see an outsized move in the dollar. And then, Powell’s timing is such that even the skeleton staffs at European banks are likely to have gone home by the time he speaks.

Given the recent commentary we have heard from other FOMC members, it is almost a certainty that there will be some movement. Consider, if Powell pushes back and sounds dovish, that will change attitudes that have been adjusting to a more hawkish view. At the same time, if he comes across as hawkish, that will be seen as confirmation that the Fed is on hold for much longer, and markets will continue to price out rate cuts. Do not be surprised to see different prices on your screen when you come in on Monday. Recognize, too, that Easter Monday is a holiday in many Eurozone countries as well, so liquidity will still not be back to normal. It is for these situations that a consistent hedging program is needed.

Ok, that pretty much sums up the overnight session as well as a peek at what’s in store. Asian equity markets were firmer overnight as the weak yen continues to support the Nikkei, while Chinese shares have benefitted from a story making the rounds that Xi Jinpeng, in an unpublished speech from last October, explained he thought the PBOC needed to consider QE, at least that’s the context. He didn’t actually use the term QE. But if that is the case, that is a huge consideration for Chinese asset prices. We shall see. Meanwhile, European bourses are all closed as are US futures markets.

Not surprisingly, bond markets have also been closed in Europe but it is noteworthy that Chinese 10-year yields fell to 2.20%, a new all-time low, on the back of the QE story.

Commodity markets are also shut, but I must explain that yesterday, gold rose 1.75% to yet another new high price at $2232/oz. I believe its performance is quite a condemnation of the current monetary and fiscal policy stances around the world as investors, both public and private, are growing increasingly concerned that there is going to be a comeuppance in the future.

Finally, the FX markets are really the only ones that are open, and the dollar has continued to edge higher overall. The euro is below 1.08, its lowest level in a month while USDJPY hovers just below its recent highs and USDCNY similarly hovers below its recent highs with both longer term trends clearly higher. I repeat, this is all policy driven and until policies change, neither will these trends.

Let’s look at what the consensus views are for this morning’s data.

| Personal Income | 0.4% |

| Personal Spending | 0.5% |

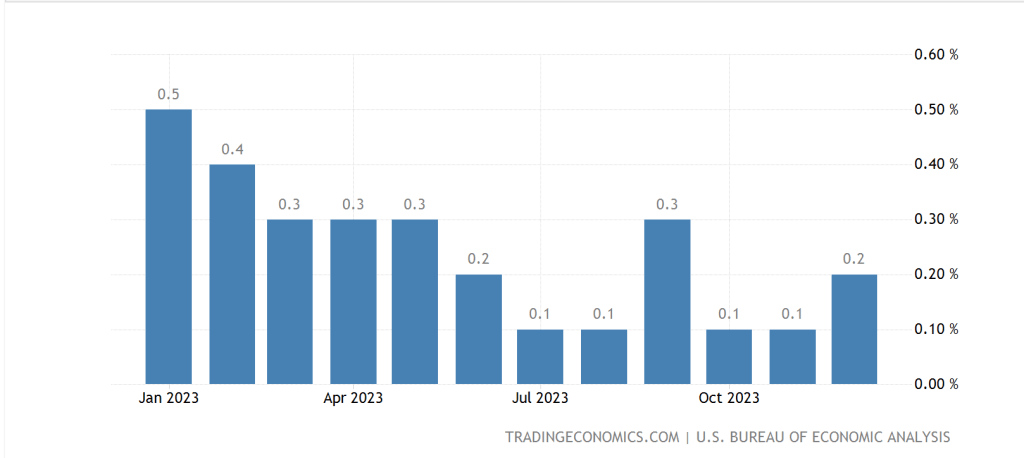

| PCE | 0.4% (2.5% Y/Y) |

| Core PCE | 0.3% (2.8% Y/Y) |

While those Y/Y numbers are not terribly high, the problem is they have stopped trending lower. Based on the CPI data from earlier in the month, another 0.4% print in the headline will more convincingly turn that trend back higher and that is exactly what frightens the Fed. And if it’s a tick higher, heads will explode as their confidence in achieving their mooted goal of 2% will take a major hit. I think the response here will be completely as one would expect; hot print means stronger dollar; cool print means weaker dollar, in-line print means no movement ahead of Powell’s speech. Let’s see what happens!

Good luck and good weekend

Adf