In China, Xi’s ‘conomy grew

Quite nicely, but now in Q2

The tariff explosion

Ought lead to erosion

Of growth, lest we see a breakthrough

Chinese economic data was released last night, and the numbers were far better than expected, well most of them were. The below table from tradingecoomics.com highlights the big numbers showing strength in GDP, IP and Retail Sales although Capacity Utilization was soft.

But this is Q1 data, and pretty early at that, just two weeks past the end of the quarter. As well it reflected activity prior to the tariffs imposed by President Trump, and subsequently the Chinese themselves. Just as we saw massive increases in the trade deficit here, as companies were front-running the tariff threat, I imagine we saw a lot more activity brought forward by the Chinese to both satisfy that front-running, as well as some front-running of their own. I guess the question to ask is, how much information does this data provide regarding potential future outcomes and I suspect the answer is, not much.

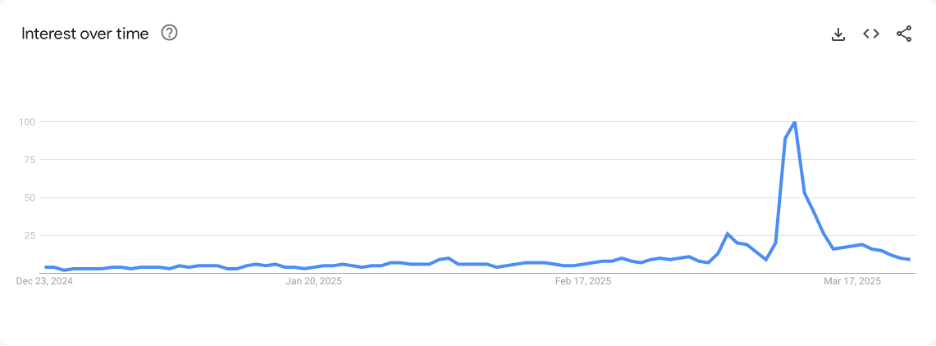

Already we are seeing global economists reducing their forecasts for Chinese annual GDP growth this year, with the lowest number I have seen at 3.5% (Goldman). That is far below the ‘about 5%’ that President Xi targeted back in February and clearly assumes tariffs will remain in place. And perhaps that is the biggest unknown. The current state of play between Trump and Xi is that Trump said, call me, maybe and we can talk while Xi has said, show some respect and we can talk.

At this point, it is all theater, with both men playing to their bases and trying to show strength. I do believe that Trump is seeking to isolate China, but the ultimate end game may well be to get them to alter their behavior. If history is any guide, I imagine that this won’t be settled quickly, but that by summer, both sides will be feeling the heat on the economy. Alas, that’s a long time from now and there is ample opportunity for significant market gyrations between now and then.

Like Fujiyama

Successful trade talks will be

A beautiful thing

On the other side of the tariff sheet is Japan, which is priority number one for the US. PM Ishiba has sent his chief trade negotiator, Ryosei Akazawa, to the US to sit down with Treasury Secretary Bessent who has been named the lead in these negotiations. While there is much discussion on autos, another very sticky subject is rice, on which Japan imposes a very high tariff. President Trump claims it is 700%, others say less, more like 400%, but whatever it is, clearly the Japanese are protecting their rice farmers. Ironically, Japan is in the middle of a rice shortage and has been pulling from strategic stockpiles to prevent prices there from rising too sharply. Meanwhile, the US has ample export capacity. It seems like a win-win opportunity, but politics is convoluted and from what I have read, the Japanese farmers don’t want to cede any market share to imports.

Nonetheless, I expect that this will be a successful outcome as it is too important to fail. While President Trump continues his bluster, he needs a win economically, and if Japanese talks are successful, we will see many more versions completed within the 90-day period in my view. Things won’t go back to the way they were before Liberation Day, but if trade questions are answered, all eyes will turn to the budget, which is going to be a different kind of messy. As I have written before, the greatest potential irony from this tariff war is that we could see lower tariffs around the world, something that all that WTO hobknobbing could never obtain.

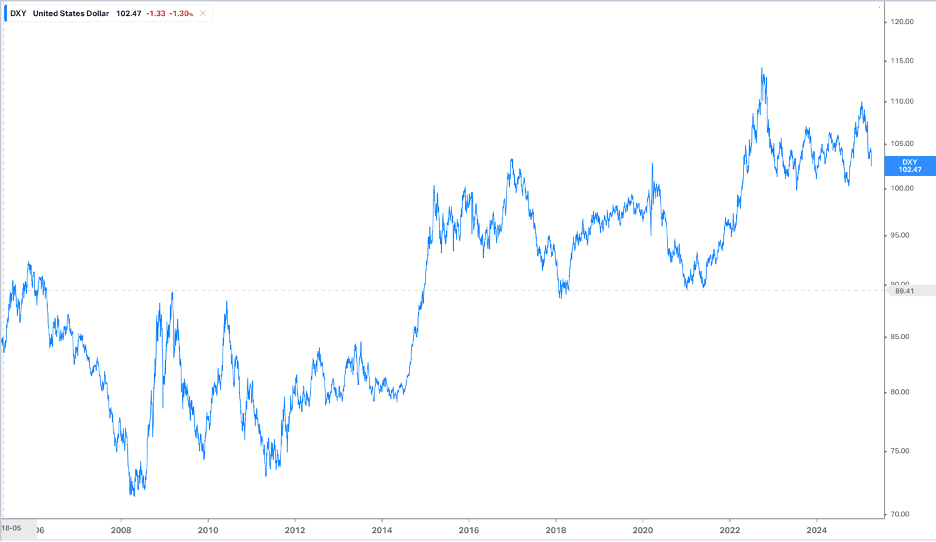

One other mooted issue between the US and Japan is the exchange rate, which, while the yen has strengthened more than 10% since its low (dollar high) back just before the inauguration, remains far above levels seen before the Covid inspired inflation resulted in the Fed tightening policy aggressively. The chart below is quite clear in displaying just how weak, relative to the past 30 years of history, the yen remains. That last little dip is the move so far this year.

Of course, given the yen’s most recent bout of weakness dates from 2022, when US interest rates started to climb, if Treasury Secretary Bessent is successful in getting rates lower, that will be a natural driver of a weaker dollar, stronger yen. Especially if Ueda-san does tighten policy further.

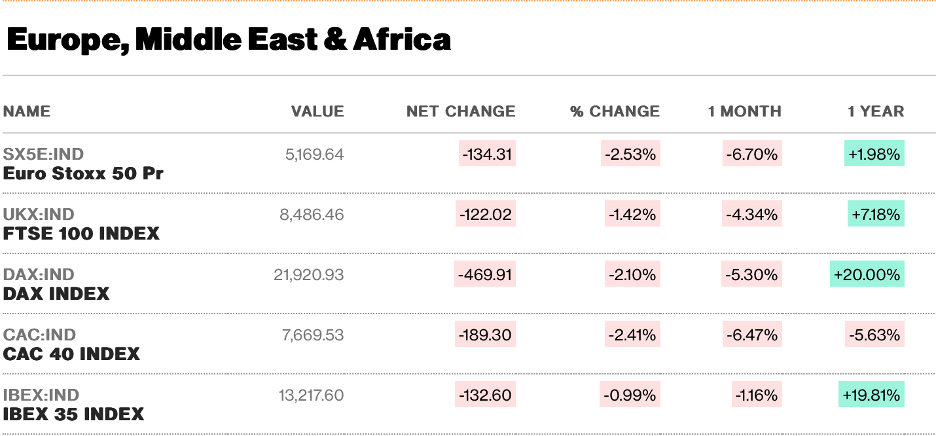

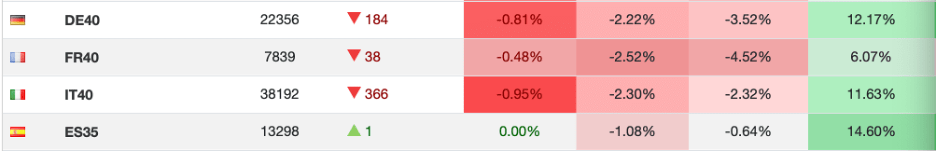

We have much to anticipate as the year progresses. Ok, let’s turn to the overnight session and see what’s happening. Yesterday’s lackluster US equity performance was followed by a terrible earnings discussion for Nvidia and much more extended weakness in Asia. The Nikkei (-1.0%) and Hang Seng (-1.9%) fell sharply as did Korea (-1.2%) and Taiwan (-2.0%). China (+0.3%), however, bucked the trend likely on the support of the plunge protection team there buying to prevent a rout. Certainly, the positive data didn’t hurt, but I doubt that was enough. In Europe, screens are all red as well, with declines on the order of -0.3% (UK and Spain) to -0.6% (Germany and France). It is, however, universal with every market there declining. As to US futures, while the DJIA is unchanged, both the NASDAQ and SPX are down sharply on that Nvidia news.

In the bond market, yields have been edging lower despite (because of?) all the tariff anxiety. While Treasuries are unchanged this morning, they drifted off 3bps yesterday. European sovereign yields are all lower by -2bps to -3bps and the big news was JGB yields tumbling -10bps last night. There continues to be a great deal of discussion about China using its Treasury holdings as a weapon, but I find that highly unlikely. Unless they could literally find a bid for all of them at once, to prevent further losses, it would self-inflict too much damage. My take is they are essentially performing their own version of QT, allowing Treasuries to mature and slowly replacing them with other things, Bunds, gold, oil, copper. One of the biggest problems is there are precious few asset classes that are large enough to absorb all that money, so they will continue to hold Treasuries in some relatively large amount, probably forever.

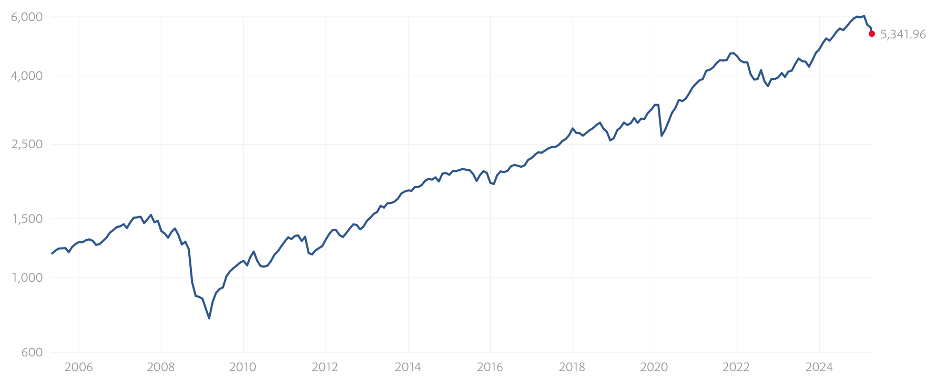

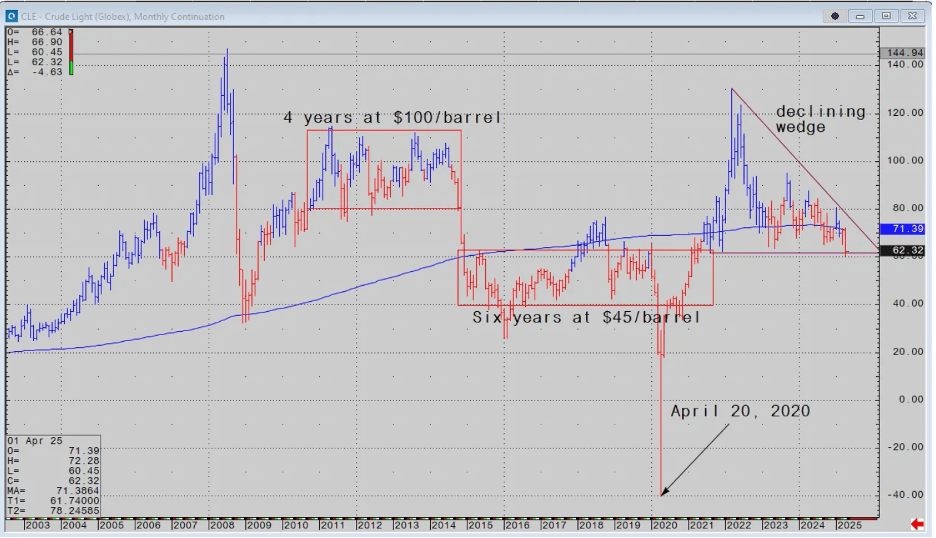

Turning to commodities, oil (+1.0%) continues to trade quietly and hang around just above $60/bbl. It feels to me like there is a lot more room on the downside than the upside, but that is just me. In the metals markets, gold (+1.5%) is glittering again, making yet another new all-time high this morning. Remember a week ago when the market was correcting and there was discussion about gold losing its luster? Me neither!

Source: tradingeconomics.com

This chart is a perfect example of the idea that nothing goes up in a straight line. But the trend here is strong. Silver (+1.6%) is following in gold’s footsteps today but copper (-0.4%) is lagging. No matter, I continue to think commodities have more strength ahead.

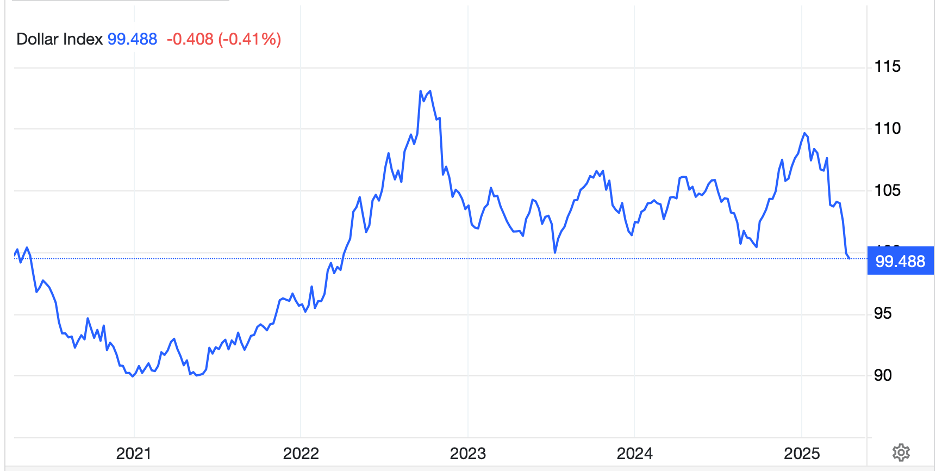

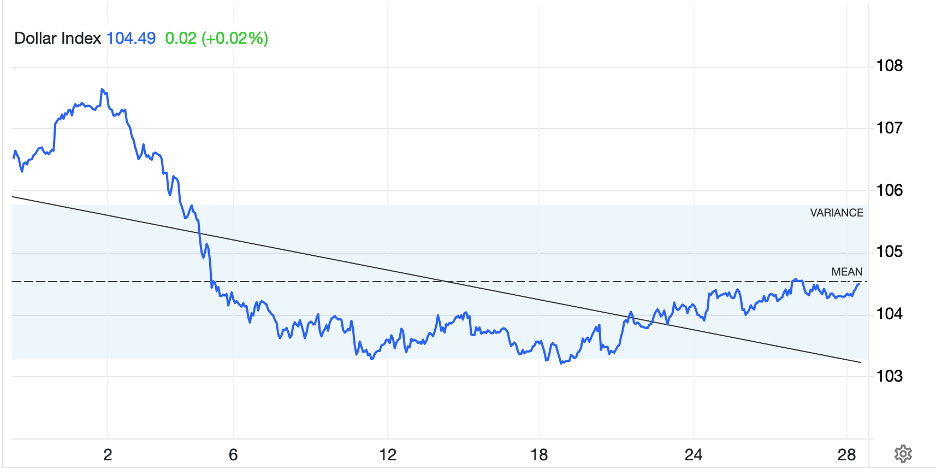

One of the reasons is that the dollar remains under pressure. Last night, further weakness was manifest with the euro trading back close to the highs touched on Friday at the 1.14 level. Prior to Friday, the last time the euro was here was in February 2022. But again, like the yen chart above, the euro’s strength is a very recent, short-term phenomenon. A look at the chart below demonstrates just how “weak” the dollar is vs. the single currency on a long-term basis. The answer is not very.

But overall, the dollar is weaker this morning across the board against both G10 and EMG currencies. I do agree with the idea that foreign investors have been liquidating their US equity holdings slowly and repatriating the funds home. If that continues, and it could, a continued decline in the dollar, especially if US yields slide, is likely.

On the data front, Retail Sales (exp 1.3%, 0.3% ex-autos) is the headliner at 8:30 then IP (-0.2%) and Capacity Utilization (78.0%) at 9:15. We also hear from the BOC, although they are expected to leave their base rate on hold at 2.75%. EIA oil inventory data is due later this morning with a decent sized draw of more than 5mm barrels across products expected. There are Fed speakers including Chair Powell at 1:30 this afternoon, but they have just not had much sway lately, and I think they are ok with that.

Putting it all together, at least in the FX framework, my take is the dollar has further to fall. There is no collapse coming, but steady weakness seems realistic. However, given the overall uncertainty at the current time, I would be maintaining hedges rather than anticipating that weak dollar.

Good luck

Adf