The feud between Elon and Trump

Show’s Musk has become a mugwump

But though there’s much drama

It’s not clear there’s trauma

As markets continue to pump

So, turning our eyes toward today’s

Report about jobs, let’s appraise

The call for recession

That’s been an obsession

Of some for six months of Sundays

Clearly the big headlines are all about the escalating war of words between President Trump and Elon Musk. I guess it was inevitable that two men with immense wealth and power would ultimately have to demonstrate that one of them was king. But other than the initial impact on Tesla’s stock price, it is not clear to me what the market impacts are going to be here. After all, President Trump has attacked others aggressively in the past when they didn’t toe his line, and it is not a general market problem, only potentially the company with which that person is associated. As such, I don’t think this is the place to hash out the issue.

However, I think it is worth addressing one point that Musk raised regarding the Big Beautiful Bill. The thing about reconciliation is it only addresses non-discretionary spending, meaning Social Security, Medicare, Medicaid and the interest on the debt. All the other stuff that DOGE made headlines for, USAID etc., could never be part of this bill. That requires recission packages where Congress specifically passes laws rescinding the previously enacted payments. So, if this was a part of the blowup, it was senseless. I will say, though, that the Trump administration did not communicate this fact effectively as I read all over how people are upset that Congress is not addressing these other things. At any rate, this is not a political commentary, but I thought it was worth understanding because I only learned of this in the past weeks and I don’t believe it is widely understood.

Onward to the major market news today, the payroll report. As of this morning, according to tradingeconomics.com, here are the forecast outcomes:

| Nonfarm Payrolls | 130K |

| Private Payrolls | 120K |

| Manufacturing Payrolls | -1K |

| Unemployment Rate | 4.2% |

| Average Hourly Earnings | 0.3% (3.7% Y/Y) |

| Average Weekly Hours | 34.3 |

| Participation Rate | 62.6% |

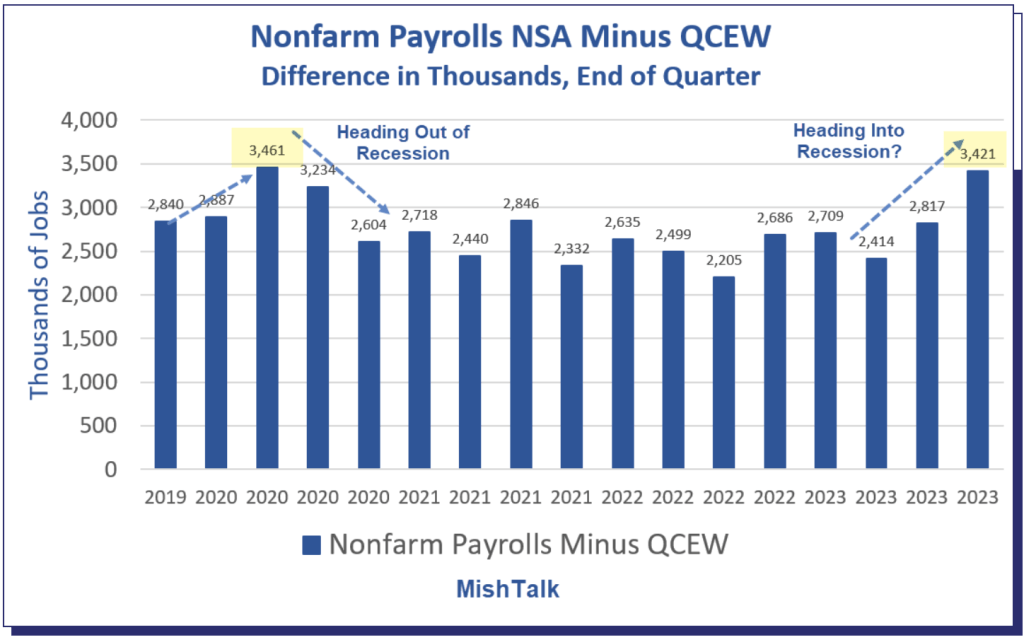

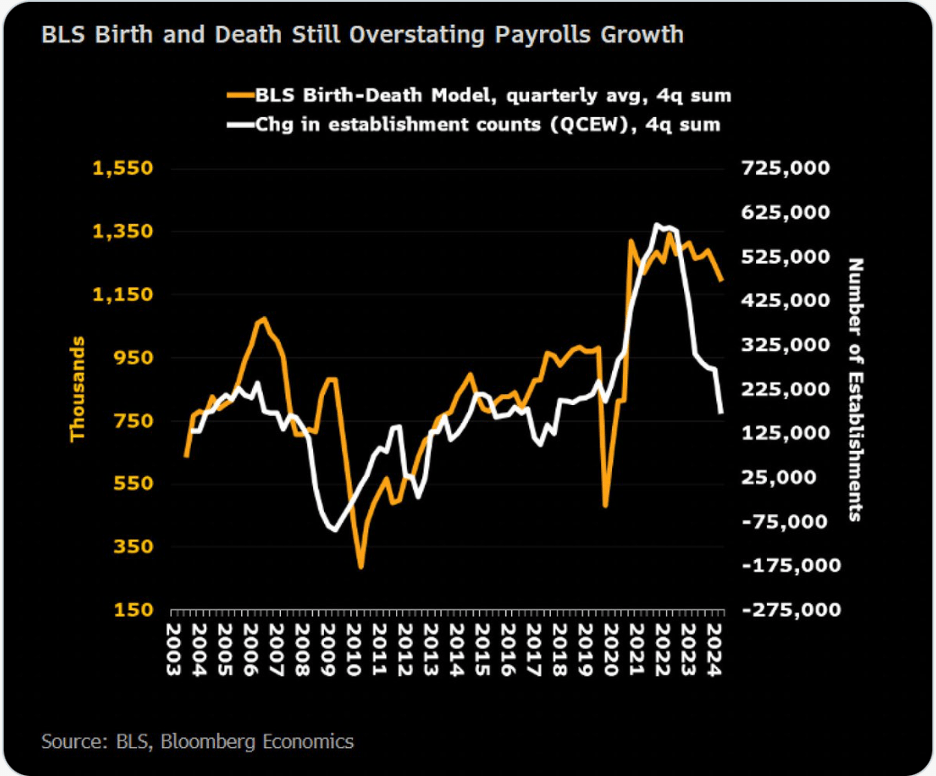

Of course, Wednesday’s ADP Employment number was MUCH lower than expected, so the whispers appear to be for a smaller outcome. As well, the key wildcard in this data is the BLS Birth-Death model which is how the BLS estimates the number of jobs that have been created by small businesses which aren’t surveyed directly. As with every model, especially post-Covid, what used to be is not necessarily what currently is. The most accurate, after the fact, representation of employment is the Quarterly Census of Employment and Wages (QCEW) but that isn’t released until 6 months after the quarter it is addressing, so it is not much of a timing tool. It is also the genesis of all the revisions.

Here’s the thing, a look at the chart below shows that the BLS Birth-Death model appears to still be substantially overstating the payroll situation. Given the datedness of its model, that cannot be a real surprise, but I assure you, if there is a major revision lower in that number, and NFP prints negative, it WILL be a surprise to markets. I am not forecasting such an occurrence, merely highlighting the risk.

If that were to be the case, I imagine the market reaction would be quite negative for stocks and the dollar, positive for bonds (lower yields) and likely continue to push precious metals higher, although oil would likely suffer. I guess we will all have to wait and see at 8:30 how things go.

In the meantime, ahead of the weekend, let’s see how markets behaved overnight. Yesterday’s modest sell-off in the US was followed by a mixed session in Asia (Nikkei +0.5%, Hang Seng -0.5%, CSI 300 -0.1%) but strength in Korea (+1.5%) and India (+0.9%). Trade discussions still hang over the market and there are increasing bets that both India and Korea are going to be amongst the first to come to the table. As well, the RBI cut rates by 50bps last night with the market only expecting 25bps, so that clearly supported the SENSEX. In Europe, no major index has moved even 0.2% in either direction as positive European GDP data was unable to get people excited and there is now talk that the ECB will not cut rates again until September. As to US futures, at this hour (6:50) they are pointing higher by about 0.3% across the board. It appears that the Tesla fears are abating.

In the bond market, yields continue to slide with Treasuries falling -1bp and European sovereign yields down between -3bps and -5bps despite the stronger than expected Eurozone data which also included Retail Sales (+2.3%) growing more rapidly than expected. But this is a global trend as recession discussions increase while we also saw JGB yields slip -2bps overnight. It feels like the bond markets around the world are anticipating much slower economic activity.

In the commodity space, oil (0.0%) is unchanged this morning and continuing to hang around at its recent highs, but unable to break above that $63+ level. It strikes me that if slower economic activity is on the horizon, that should push oil prices lower as there appears to be ample supply. But I read that Spain has stopped importing Venezuelan crude as US secondary sanctions are about to come into effect there. As to the metals markets, silver (+1.5%) and platinum (+2.6%) have been the leaders for the past few sessions although gold (+0.2%) continues to grind higher. The loser here has been copper (-0.8%) which if the economic forecasts of slowing growth are correct, makes some sense. Of course, there is a strong underlying narrative about insufficient copper supplies for the electrification of everything, but right now, payroll concerns are the story.

Finally, the dollar is a bit firmer this morning, but only just, with G10 currencies slipping between -0.2% and -0.3% while EMG currencies have shown even less movement. INR (+0.25%) stands out for being the only currency strengthening vs. the dollar after the rate cut and positive growth story, but otherwise, this is a market waiting for its next cue.

In addition to the payroll report, we get Consumer Credit (exp $10.85B) a number which gets little attention but may grow in importance if economic activity does start to decline. As well, I cannot ignore yesterday’s Trade data which saw the deficit fall much more than expected, to -$61.6B, its smallest outturn since September 2023. While I didn’t see any White House comments on the subject, I expect that President Trump is happy about that number.

Are we headed into a recession or not? Will today’s data give us a stronger sense of that? These are the questions that we hope to answer later this morning. FWIW, which is probably not that much, my take is while economic activity has likely slowed a bit, I do not believe a recession is upon us, and as I do believe the reconciliation bill will be passed which extends the tax cuts, as well as adds a few like no tax on tips or Social Security, I expect that will turn any weakness around quickly. What does that mean for the dollar? Right now, it is piling up haters so a further decline is possible, but I cannot rule out a reversal if/when the tax legislation is finalized.

Good luck and good weekend

Adf