As so often has been the case

The market is in Trump’s embrace

Will he make a deal

And sell it with zeal

Or will Putin spit in his face

Because of the focus on this

Though PPI data did miss

Most markets held tight

With highs still in sight

As naysayers seek the abyss

Based on the fact that equity markets in the US were all essentially unchanged yesterday, I think it is reasonable to assume that investors are waiting to see the outcome of today’s Trump-Putin meeting in Alaska. I have no opinion on how things will work out, although I am certainly rooting for a result that includes a ceasefire and the next steps toward a lasting peace. From a direct market perspective, arguably oil (-0.75% this morning) is the one place where the outcome will have an impact. Any type of deal that results in the promised end to sanctions on Russian oil seem likely to push prices lower. In this vein, we continue to see the IEA and EIA reduce their demand forecasts (although some of this is because they keep expecting BEVs to replace ICE engines and that is not happening at the pace they would like to see). However, away from oil, I expect that this will be much more important to overall sentiment than anything else.

But sentiment matters a lot. As does the attention span of traders, which as we already know, approximates the life of a fruit fly. For instance, yesterday’s PPI data was unambiguously hotter than expected, with both headline and core monthly jumps of 0.9%. Surprisingly for many economists, it was not goods prices that rose so much, but rather the price of services. For the narrative, it is much harder to blame service price hikes on tariffs, than goods price hikes, but not to worry, economists are working hard to make that case. As well, the near universal claim is that CPI is going to rise much more quickly going forward as evidenced by this rise in PPI. A quick look at the chart below of annualized PPI shows that we are starting to rise above levels last seen in 2018, but if you recall, CPI then was very low, sub 2.0%. The relationship between the two, CPI and PPI, is not as strong as you might expect.

The contra argument here is that corporations, which were able to raise prices rapidly during the pandemic response are finding it more difficult to do so now. We have discussed several times how corporate profit margins remain extremely high relative to history and what we may be seeing is the beginnings of those margins starting to compress as companies absorb more of the costs, be they tariffs or labor. I also couldn’t help but notice the article in the WSJ this morning working to explain why tariffs haven’t boosted inflation as much as many economists expected. Their answer at least according to this research, is that the many exemptions have resulted in tariffs being collected on only about half of imports, which despite all the headlines touting tariffs are now, on average, somewhere near 18%, makes the effective rate below 10%, higher than in the past, but not devastatingly so. And remember, imports represent about 14% of GDP. Let’s do that math. If half of imports are excluded and the average tariff is more like 9%, we’re looking at 60 basis points of price increases, of which corporates are absorbing a great deal.

One other thing in the article was how it highlighted the exact result that President Trump is seeking when explaining that more companies are searching for alternative sources of goods in the US.

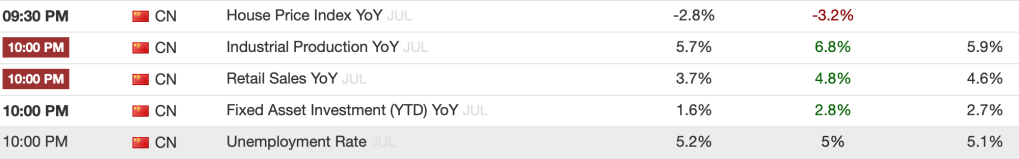

The tariffs, are however, impacting other nations with China last night reporting a much weaker batch of data as per the below:

Actual Previous Forecast

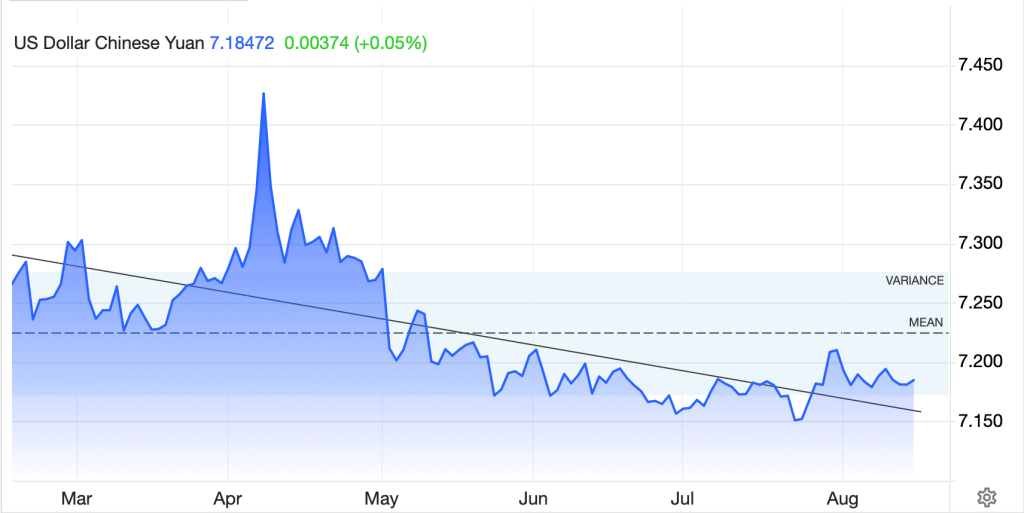

The property market there continues to drag on the economy, but government efforts to prop up consumption seem to be failing and clearly tariffs are impacting IP as less orders from the US result in less production. Arguably, though, President Xi’s greatest worry is the rise in Unemployment as the one thing he REALLY doesn’t want is a lot of unemployed young males as that is what foments a revolution. The interesting thing about the market response here is that while the Hang Seng (-1.0%) fell sharply, the CSI 300 (+0.7%) rallied, seemingly on hopes of additional stimulus being necessary and implemented. One other thing to note about Chinese markets is that yesterday, 40-year Chinese government yields fell below 30-year Japanese yields for the first time ever, a sign that expectations of future Chinese activity are waning. With this in mind, even though the renminbi has been gradually appreciating this year (even if we ignore the April Liberation Day spike), the Chinese playbook remains mercantilist at its heart. I would look for a weaker CNY going forward, although the overnight move was just -0.1%.

Source: tradingeconomics.com

Ok, let’s look at the rest of markets ahead of the Alaska summit and today’s data. Tokyo (+1.7%) had a strong session as GDP data from Japan was stronger than expected allaying worries that the tariffs would crush the economy there and bringing rate hikes back onto the table. Australia (+0.7%), too, had a good session on solid corporate and bank earnings but the rest of the region was pretty nondescript with marginal moves in both directions. In Europe, gains are the order of the day on the continent (DAX +0.3%, CAC 0.65%, IBEX +0.35%, FTSE MIB +1.1%) as hopes for a formalized trade deal being finalized grow. However, UK stocks are unchanged on the session as investors here seem to be biding their time ahead of the Trump-Putin summit. US futures are higher led by DJIA (+0.7%) although that appears to be on news that Berkshire Hathaway has taken a stake in United Health after the stock’s recent beatdown.

In the bond markets, Treasury yields are unchanged this morning although they reversed course yesterday, closing higher by 5bps rather than the -3bp opening, pre-PPI, levels. But that rebound in yields has been seen throughout Europe where sovereigns on the continent are higher by between 3bps and 4bps and JGB yields (+2bps) rose overnight after the stronger than expected GDP data.

Away from oil, metals markets are doing very little this morning as it appears much of the activity has to do with option expirations in the ETFs SLV and GLD, so price action is likely to be choppy, but not instructive.

Finally, the dollar is softer this morning despite the higher Treasury yields. One of the interesting things is that despite the hotter PPI data, the probability for a September cut, while falling from a chance of 50bps, to a 92.6% probability of a 25bp cut, is still pricing in an almost certain cut. Remember, we are still a month away from that meeting and we have Jackson Hole in between as well as another NFP and CPI report so lots of potential drivers to change views. And there is still a lot of talk of a 50bp cut, although for the life of me, I don’t understand the economic rationale there. But softer the dollar is, falling against all its G10 brethren, on the order of 0.25% or so, and most EMG counterparts, with many having gained 0.4% or so. But this is a dollar story today.

On the data front, ahead of the summit, which I believe starts at 2:30pm Eastern time, we see Retail Sales (exp 0.5%, 0.3% -ex autos, 0.4% Control Group) and Empire State Mfg (0.0) at 8:30, as well as IP (0.0%), Capacity Utilization (77.5%) at 9:15 and then Michigan Sentiment (62.0) at 10:00. Retail Sales should matter most as a strong number there will encourage the equity bulls while a weak number will surely bring out the naysayers. I still have a bad feeling about markets here, but that is my gut, not based on the data right now. As to the dollar, there are still huge short positions out there and if rate cuts become further priced in, it can certainly decline further.

Good luck and good weekend

Adf