Said Waller, I have no regrets

For things are “as good as it gets”

We’ve been quite outstanding

And reached that soft landing

Though rate cut forecasts won’t be met

Wow is all I can say. While Treasury Secretary Yellen was brasher last week by explicitly saying they have achieved the mythical soft landing, Governor Waller’s speech yesterday went into great detail about his work in 2022 on Beveridge curve analysis that almost perfectly forecast the current situation. I certainly hope he didn’t sprain his arm patting himself on the back. The certitude that has been coming from Fed speakers and their acolytes, like ex Fed economist @claudia_sahm, is remarkable to me. After literally a century of having no great insight into the workings of inflation, the Fed has now declared they have it under control because the past 6 months have seen price increases rise at a slowing pace.

Key Waller comments were as follows, “By late November, the latest economic data left me encouraged that there were signs of moderating economic activity in the fourth quarter, but inflation was still too high. As of today, the data has come in even better. Real gross domestic product (GDP) is expected to have grown between 1 and 2 percent in the fourth quarter, unemployment is still below 4 percent, and core personal consumption expenditure (PCE) inflation has been running close to 2 percent for the last 6 months. For a macroeconomist, this is almost as good as it gets.”

He finished with this comment, although interestingly, the market did not applaud, “As long as inflation doesn’t rebound and stay elevated, I believe the FOMC will be able to lower the target range for the federal funds rate this year. This view is consistent with the FOMC’s economic projections in December, in which the median projection was three 25-basis-point cuts in 2024.”

Maybe the Fed really has stuck the landing and inflation is going to smoothly slide back to 2% and stay there while the economy ticks over at 2%-3% GDP growth. Certainly, if the fiscal impulse continues to run at deficit levels of 8% of GDP, I would hope we could get 3% growth. But to my understanding of the way the economy responds to policy actions, that 8% deficit is going to find itself into rising prices across the economy. But then again, I’m just an FX guy.

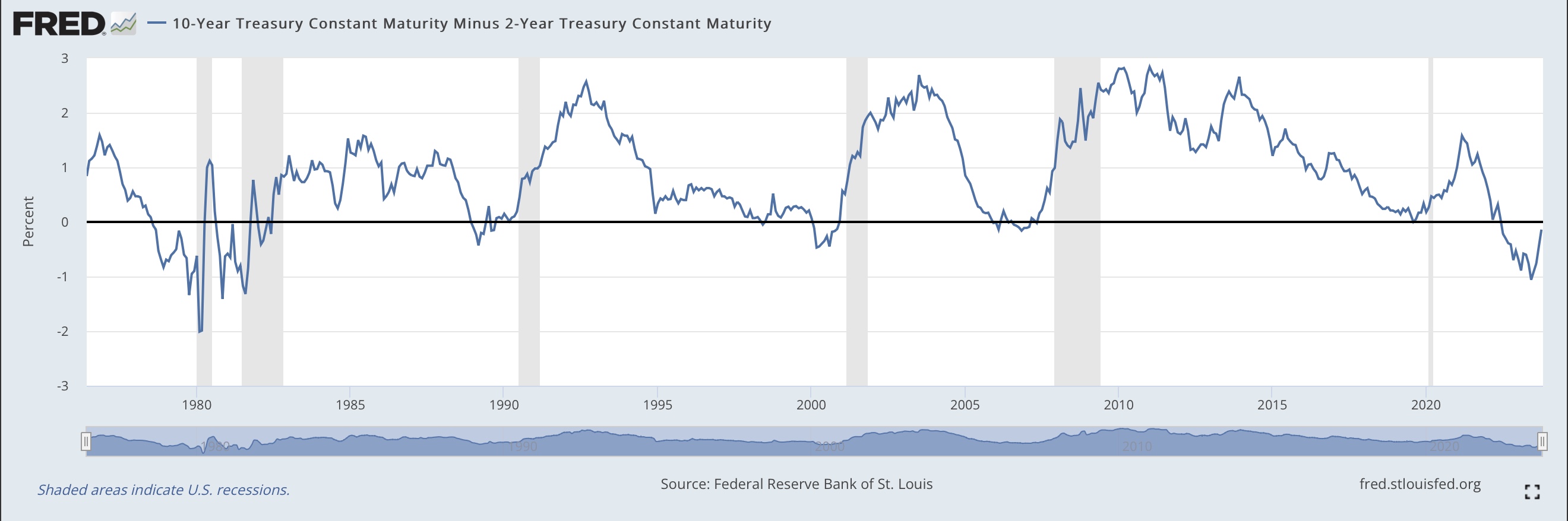

In the end, the market heard Waller and decided that maybe higher for longer was still a thing. The Fed funds futures market reduced its probability of a March rate cut to 60% from 70% before the speech and the bond market sold off pretty hard with yields closing at 4.07%, their highest level since the day before that December FOMC meeting when everybody was certain that the Fed had pivoted. It seems the question now is, have they actually pivoted?

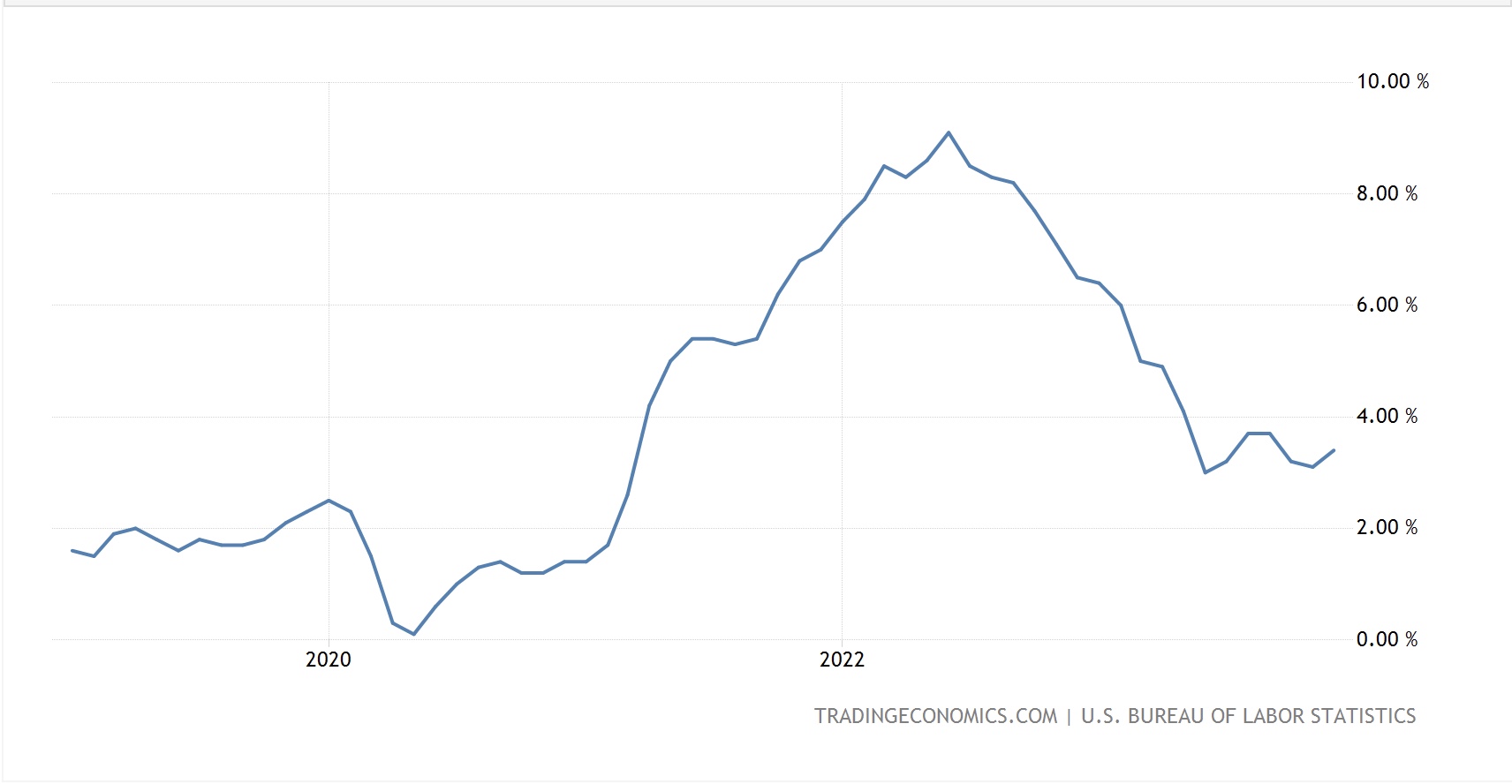

One of the problems they have is that the inflation data last month indicated the pace of price increases could be stabilizing around the 3.0%-3.5% level, rather than their target 2.0% level. We have very consistently heard from all the acolytes that if you annualize the past 3 or 6 months’ worth of data, the Y/Y rate is pushing to 2.0%. This, they claim, means the Fed has achieved their goal. The problem with this argument is that the Fed’s goal is not simply touching a 2.0% inflation rate, it is to maintain it at that level over time. That is a much more difficult landing to stick, and there is no evidence things will work out that way especially given we haven’t even reached a Y/Y rate of 2.0%!

Here’s another problem for that crew, inflation elsewhere in the world is not continuing its recent decline. Yesterday, Canadian CPI data showed that the trend numbers, Trimmed-Mean (3.7%) and Median (3.6%) were both higher than forecast and higher than last month. This morning, from the UK we learned that CPI rose 0.4% M/M, far more than expected with the Y/Y data rising to 4.0% headline and 5.1% core. In both these nations, the recent trend had been lower but has now reversed. While we have seen a significant rebalancing of markets and measured inflation has clearly fallen from its levels of the past two years, I would argue the evidence is scant that this trend is necessarily going to continue. Wage growth continues to hold up as employees try to catch up to the huge price increases since 2019. With the Unemployment Rate remaining near multi-decade lows, absent a major recession it appears it will be very difficult to continue to squeeze prices lower. And this doesn’t even consider the fact that increased tensions in the Middle East and the rerouting of ships around the Cape of Good Hope in South Africa, is adding weeks and costs to any movement of goods or oil, and could last for a considerable length of time.

We have consistently heard from ECB members that rate cuts are not coming soon. We have had a lot of pushback lately from FOMC members about the timing of any rate cuts with both sets of speakers explicitly saying the market is overexuberant in their current pricing. As I wrote yesterday, I think we are looking at a bimodal outcome, either virtually no rate cuts, or many more because we are in a recession. In either case, I think equity markets will need to reprice lower. However, the impact of these two situations will be different on the dollar, the bond market and commodities. We will discuss those outcomes tomorrow.

In the meantime, overnight was a sea of red (as opposed to the Red Sea) in equity markets with the Hang Seng (-3.7%) leading the way lower but weakness on the mainland as well (CSI -2.2%) and throughout the region. Japanese stocks (Nikkei -0.4%) were actually the leaders in the space. The China story was informed by their monthly data dump which showed GDP grew at a slightly weaker than forecast 5.2%, while IP (6.8%), Retail Sales (7.4%) and Fixed Asset Investment (3.0%) were all around expectations, but still soft overall and compared to last month. The Unemployment Rate there ticked higher to 5.1%, and they put out a new version of the youth unemployment rate at 14.9%, which they insist is a better measure than the old one which was screaming higher and was discontinued when it breached 21%.

European equity markets are also under pressure, mostly down about -1.0% on the continent and lower by -1.75% in the UK after the data releases. As to the US, after a lackluster session that was saved by a late day rally yesterday, futures this morning are lower by about -0.25% at 7:30.

In the bond market, after the large move yesterday, Treasury yields are unchanged on the day and European yields have edged up by about 1bp across the board with UK Gilts the exception, having jumped 10bps after the inflation readings. JGBs continue their lackluster activity and while they rose 2bps overnight, they remain below 0.60% overall. Again, slowing inflation there indicates little reason to believe they are going to change their monetary policy anytime soon.

On the commodity front, oil (-1.8%) is showing a lot more concern over demand destruction after the modestly weaker Chinese data than concern over supply issues from Middle East tensions. Plus, with US rates higher, commodity prices tend to suffer anyway. Gold, which got crushed yesterday amid the repricing of interest rates is unchanged this morning, licking its wounds while copper and aluminum trade either side of unchanged as the economic situation remains so uncertain right now.

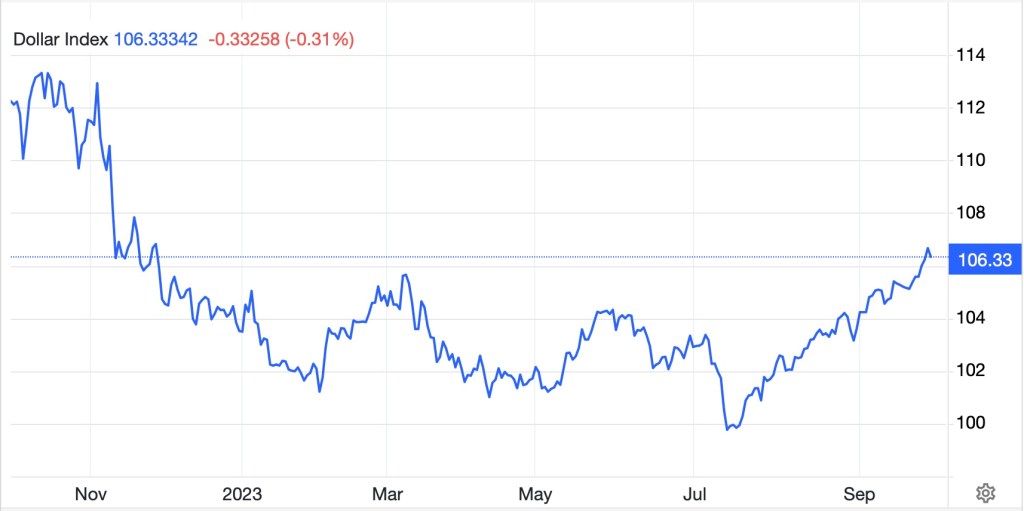

Finally, the dollar remains king of all it sees this morning, rallying further after yesterday’s rally and now has retraced virtually all the weakness that came from Powell’s December “pivot”. This has been true in both the G10 and EMG blocs as the dollar is almost universally higher this morning. The one exception is the pound, which has managed a 0.35% rally on the back of the move in UK interest rates after the higher inflation data print this morning. The key to remember here is that despite a great deal of chatter about the dollar’s demise, the reality is that it has moved very little, net, over the past year and is far higher than where it was 5 years ago. If the Fed really is going to maintain higher for longer, which if inflation continues its rebound seems likely to me, then the dollar has to benefit.

Turning to the data, this morning we see Retail Sales (exp 0.4%, 0.2% ex autos), IP (0.0%) and Capacity Utilization (78.7%). In addition, we have three Fed speakers this morning and then this afternoon we get the Fed’s Beige Book and NY Fed president Williams speaks. Given what appears to be a change in tone from Waller, it will be interesting to see if the others follow his lead or push back. I have to believe that we are going to see more higher for longer talk and how it is premature to talk about rate cuts in March. If that is the case, the dollar should retain its recent strength and I expect risk assets to come under further pressure.

Good luck

Adf