The Chinese returned from vacation

But hopes for more subsidization

Were rapidly dashed

With early gains trashed

And Hong Kong condemned to damnation

Meanwhile, what we heard from the Fed

Was further rate cuts are ahead

They all still believe

That they will achieve

Their goal and inflation is dead

Talk about buzzkill. The Chinese Golden Week holiday is over and all the hopes that the National Development and Reform Commission Briefing would highlight new stimulus as well as further details of the programs announced prior to the holiday week were dashed. Instead, this group simply confirmed that they were going to implement the previously announced plans and insisted that it would be enough to get the economy back to its target growth rate of 5.0%. You may recall that the government had promised funds to support the stock market and some efforts to support the housing market, but there was little in the way of direct support for consumers. While the initial market response to the stimulus measures was quite positive, there is a rapidly growing concern that those measures will now fall short. In the end, much of the joy attached to the stimulus story has evaporated.

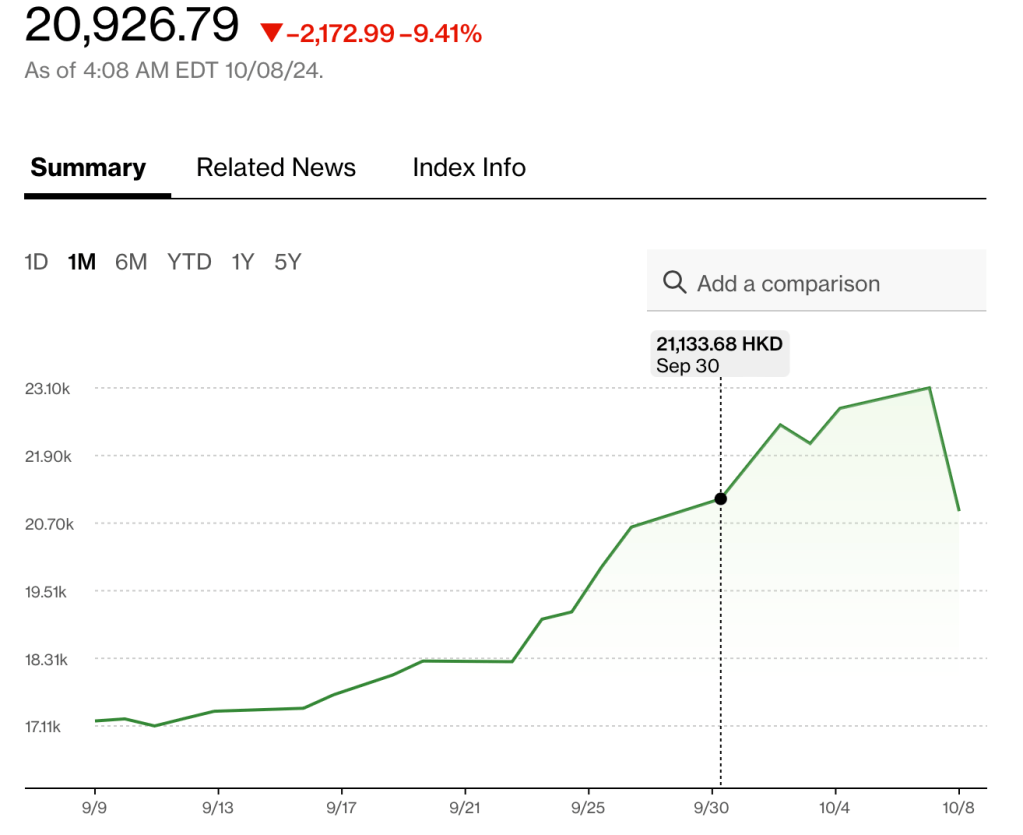

The market response was telling as while onshore stocks rallied (CSI 300 +5.9%) they closed far below their early session highs and the Hang Seng (-9.4%) in Hong Kong, which had been open all during the Golden Week holiday and rallied steadily through that time, retraced sharply, giving back all those gains and then some (see below).

Source: Bloomberg.com

In the end, it is difficult to look at the Chinese story and feel confident that the currently announced stimulus packages are going to be sufficient to make a major dent in the problems there. It appears that the limits of a command economy may have been reached, a situation that will not benefit anyone.

Turning to the first batch of Fed speakers, yesterday we heard from Governor Adriana Kugler, St Louis Fed president Alberto Musalem and Chicago Fed president Austan Goolsbee. While Mr Goolsbee explained, “I am not seeing signs of resurgent inflation,” it does not appear he is really looking. As to Ms Kugler, she “strongly supported” the 50bp cut and when asked about the strong NFP report explained that looking through the data, “several metrics point toward labor-market cooling”, despite the strong report. Finally, Mr Musalem, although he supported the 50bp cut, remarked, “Given where the economy is today, I view the costs of easing too much too soon as greater than the costs of easing too little too late.”

Net, it appears that recent data upticks have not had any impact on their views that they must cut rates further and are prepared to do so every meeting going forward. The Fed funds futures market has now priced 25bp rate cuts into both the November and December meetings, although that is reduced significantly from the nearly 100bps that was priced prior to the NFP report.

Away from those stories, though, there was not much other news of note overnight. Russia/Ukraine has moved to page 32 of the newspapers and is not even discussed anymore. Israel/Hamas/Hezbollah/Iran has more tongues wagging but at this point, it has become a waiting game for Israel to respond to the missile barrage from Iran last week. Given we are between Rosh Hashanah and Yom Kippur, it seems unlikely to me that we will see anything prior to the weekend. China fizzled after vacation. The US election remains a tight race at this point with no clear outcome. Hurricane Helene and the aftermath is being superseded by Hurricane Milton, due to hit the Tampa area shortly, but again, the latter two, while horrific tragedies, or potential tragedies, are not really market stories.

So, what’s driving things? Arguably, interest rate policies and bond markets are having the biggest impact on financial markets right now. With that in mind, the fact that 10-year Treasury yields are now back above 4.0% for the first time since August seems to be the main event. Why, you may ask, would bond yields have backed up so far so fast? Ultimately, it appears that bond investors are losing confidence in the central bank inflation story, the idea that they have it under control. First off, oil prices, though lower today by -1.9%, have still gained more than 8.3% in the past week with gasoline prices higher by nearly 7% in the same period. This does not bode well for lower inflation prints going forward. Second, the combination of the much stronger than expected NFP report and the Fed’s willful ignorance of the implications is also tipping the marginal investor toward seeing more inflation going forward.

Ok, so how have these things impacted markets? Well, aside from China/HK and following yesterday’s US declines, there were far more laggards (Japan, Singapore, Korea, Australia) than leaders (India) across Asia with Tokyo (-1.0%) the next worst performer. In Europe, all the screens are red this morning led by the UK (-1.1%) but with losses between -0.2% in Germany after a much better than expected IP reading, to -0.6% in France. Oftentimes, it seems like Europe is trading on yesterday’s US news, and that is the case today as US futures are pointing higher by about 0.4% at this hour (7:40).

Bond yields, which have been climbing for the past week, are little changed this morning, with neither Treasuries nor European sovereigns showing any movement of note. However, one need only look at the chart below to see the trend over the past month.

Source: tradingeconomics.com

Aside from the oil retreat mentioned above, which seems to be a response to the absence of that Israeli action so widely expected, copper (-2.6%) is the laggard as disappointment over the Chinese stimulus dud pushed down demand expectations. Gold (+0.3%) though, remains in demand and is hovering just below its recent all-time highs.

Finally, the dollar is backing off a bit this morning, although as evidenced by the chart below of the DXY, it has been on a bit of a tear for the past week, so consolidation should not be a surprise.

Source: tradingeconomics.com

However, overall, today’s price activity has been relatively muted with all G10 currencies within 0.2% of yesterday’s closing levels and the biggest movers in the EMG bloc (PLN +0.4%, ZAR -0.4%) hardly showing much more motion. One exception is IDR, where the central bank intervened overnight after six consecutive days of rupiah weakness which saw the currency decline -4.5%.

On the data front this morning, the NFIB Small Business Optimism Index was released at a slightly softer than expected 91.5 although the Uncertainty sub index it a record high of 103 indicating small businesses are in a tough spot. Otherwise, the only number is the Trade Balance (exp -$70.6B) and then a bunch more Fed speakers, all different ones than yesterday. We also see the 3-year Note auction, so that may give us some clues as to the demand story for Treasuries ahead of the CPI data on Thursday.

The ongoing conflicting data has many, if not most, investors confused. I believe that people will be seeking more clarity on Thursday and so until then, absent another geopolitical shock, we are likely to see modest market movements overall. However, with the Fed hell-bent on cutting, I continue to fear inflation starting to reaccelerate and the dollar starting a more substantive decline.

Good luck

Adf