Remember when riots were seen

Across every TV’s flat screen?

Well, that’s in the past

As news of a blast

In Tehran, just one thing, can mean

The Middle East just got much hotter

And now every armchair war plotter

Will offer their views

Of which side will lose

So, traders, keep watch o’er your blotter

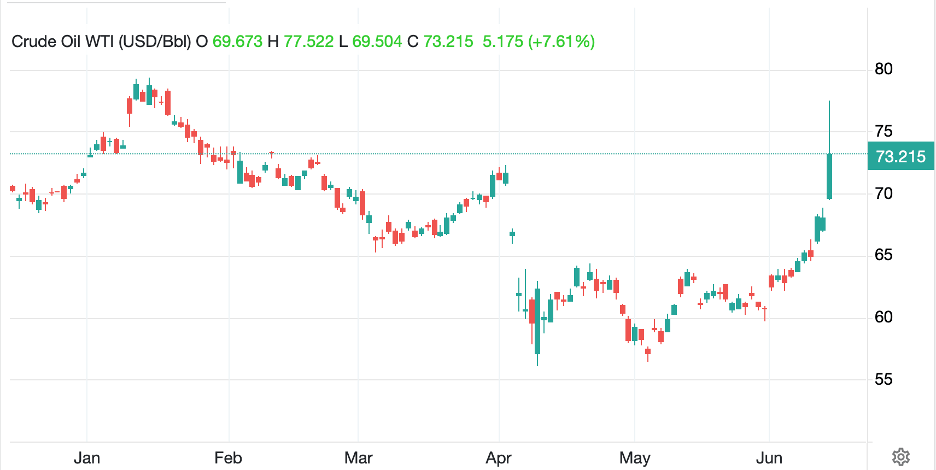

Is it a coincidence that Israel’s attack on Iran’s nuclear sites occurred on Friday the 13th, or was it meant as a message that luck, both good and bad, can be manufactured? Whatever the driver, the market reaction has been instantaneous. Here is a look at the five-minute chart in oil with the black sticky stuff jumping more than 8% on the news.

Source: tradingeconomics.com

Too, gold jumped (+1.2%) as did the dollar (EUR -0.4%, AUD -1.0%) although both JPY (+0.3%) and CHF (+0.4%) showed their haven characteristics. Treasury bonds rallied with yields slipping an additional -3bps in the evening session on top of the -5bp decline during the day, and stock futures are under pressure around the world (S&P500 -1.6%, Nikkei -1.5%, DAX -1.5%). This was the early price action.

Those were last night’s initial moves and thus far, things have moderated a bit. For instance, oil has fallen back about 1%, though remains higher by 7.3% and that big gap down on the charts from April has been filled.

Source: tradingeconomics.com

Of course, there is now a new gap below the markets to fill, but that is a story for another day. Equity markets are also finding their footing, bouncing off their lows as the 20-day moving average has held and dip buyers see this as an opportunity. However, the dollar is little changed from its initial moves as is gold, and overall, not surprisingly, risk-off defines the overnight session and likely will be today’s focus.

Now, there is nothing funny about this situation with more death and destruction occurring and likely in our immediate future. However, I could not help but chuckle at the Russian statement that Israel’s actions were “unprovoked” and “a violation of UN principles and international law.” Of course, I guess President Putin would know all about unprovoked attacks and violating UN principles and international law given his ongoing efforts in Ukraine.

Ok, I am not a war plotter, nor a war monger, so let’s see how this and any other things are developing in the markets. While the war discussion will dominate the headlines, there are other things ongoing that are worth considering. For instance, though the dollar is performing as its historical safe haven this morning, SocGen analysts highlighted a very interesting relationship that has developed in the dollar with respect to inflation surprises over the past four months. As you can see in the chart below, it appears that as we have seen a series of lower-than-expected inflation readings, the dollar has fallen in step. Now, correlation is not causality but one could make the case that reduced inflation will lead to a more aggressive easing policy by the Fed and that could be the mechanism by which this relationship operates.

Along the same lines, there have been more stories regarding the softening in the US labor market and at what point the Fed is going to need to focus on that, rather than inflation, as they consider their policy objectives. As well, the large contingent of analysts who expect the US to enter a recession soon have pointed to the labor market and the fact that much of the underlying data appears to show a less robust situation than the headlines have thus far revealed.

I have two anecdotes to recount here, neither of which indicates the labor market is softening. First, the local pizza parlor is at wits’ end trying to hire people to work there, a common high school summer or after school job but there are no takers. Second, my daughter works for a TMT consulting firm in HR, and they are seeking to hire several new analysts and junior consultants, jobs that pay six figures out of college, and they, too, are having difficulty filling the roles.

I know that anecdata is not definitive, but two very disparate service industries are facing the same issue, and it is not a question as to whether to reduce headcount. Consider the idea that the recent declines in inflation readings are a short-term outcome and that underlying inflation remains in the 3.5%-4.0% range. Given median CPI is still running at 3.5%, that is entirely feasible. If, as we go forward, we start to see high side surprises in inflation, and this relationship has meaning, that could well imply we are looking at a short-term dip in the dollar and that as the year progresses, this will reverse. My take is that the Fed will only consider cutting rates, at least as long as Powell is Chair, if inflation remains quiescent and unemployment starts to rise. But if inflation rebounds, I believe they will be reluctant to go there.

Now, as the morning progresses, the dollar is picking up steam with the euro (-0.8%), pound (-.6%) and JPY (-0.6%) all falling, even the havens yen and CHF (-0.5%). In fact, looking across the board, every major currency is weaker vs. the dollar at this point in the morning (7:15). As the US has awakened, it seems that the haven status of the dollar is reasserting itself.

Perhaps more surprisingly, Treasury yields have turned around and are now higher by 2bps, which has dragged all European sovereigns along for the ride. In fact, the weakest nations (Italy +4bps, Spain +5bps) are faring even worse, as is the UK (Gilts +5bps). Apparently, the recent ideas of the BOE getting more aggressive in its rate cutting is no longer the idea du jour.

In the equity markets, red remains the only color on the screen with Asian markets (Nikkei -0.9%, Hang Seng -0.6%, CSI 300 -0.7%) all rebounding from their early worst levels, but slipping on the day, nonetheless. I guess there are dip buyers in every market 😃. In Europe, continental bourses are all sharply lower (DAX -1.4%, CAC -1.1%, IBEX -1.6%) although the FTSE 100 (-0.4%) is holding up better. As to US futures, they have rebounded slightly from their earliest lows and are now down about -1.0% at 7:20. Wouldn’t it be something if they closed the day higher? I don’t think we can rule that out!

Finally, commodities continue to show oil much higher, no retracement there, and gold also holding its gains although copper (-2.5%) is under pressure. This is a bit odd to me as I would have thought war would bring more copper demand to a market that is physically undersupplied, but then the LME price of copper and the COMEX price of copper seem unrelated to the industrial flows of late. At this time, everyone is waiting for the Iranian response, although apparently, the first response, a wave of drone attacks on Israel, was completely thwarted. Not only did Israel destroy some key nuclear sites, but they were able to eliminate almost the entire leadership of the Iranian army and special forces, so any response is likely to take a little time to be created. No oil facilities were targeted, although the Strait of Hormuz is a key chokepoint in the oil market and Iran is likely able to disrupt the flow of tankers through there for now. What we know is that everyone who was short oil as a trade has likely been stopped out. It will likely take a little time before new shorts come back to play, so I expect a few days of prices at these levels. However, the longer-term trend remains lower, so absent a destruction of oil producing fields, I expect that prices will retreat ahead.

On the data front, this morning brings only Michigan Consumer Sentiment (exp 53.5) and with it the inflation expectations piece, although that has been shown to be a political statement, not an economic one. I cannot shake the feeling that by the time we head to the weekend, equities will have recovered their early losses, and the dollar will cede some of its gains.

Good luck and good weekend

Adf