Said Goolsbee, I’m, processing, still Why bond yields keep moving uphill Perhaps he should look At Yellen’s full book Of issuance, three extra trill So, with the third quarter now ending And core PCE, today, pending The hope and the dream Is next quarter’s theme Will be ‘bout risk assets ascending

In a speech yesterday at the Peterson Institute for International Economics, Chicago Fed President Austan Goolsbee laid out his current views on the US economic situation, which he thought was generally in good shape, and warned about overtightening. He also noted the Fed has a rare opportunity to achieve a soft landing. All that is ordinary enough. The odd comment came when he mentioned that he was “still processing’ why bond yields were rising so much recently. It is always disconcerting to me when the so-called best and brightest who lead our key institutions expose themselves as being clueless in their main role.

As I have discussed in the past, it is not very difficult to determine why long-term yields are rising in the US, it is a combination of two absolutes and one likelihood. The absolutes are the amount of supply hitting the market and the reduced demand. Treasury Secretary Yellen has indicated in Q4 there will be new issuance of ~$852 billion on top of current refinancing of >$1.3 trillion, hitting the market. At the same time, the Fed continues its QT program reducing demand by $180 billion in Q4 and both China and Japan, the two largest holders of Treasuries have been slowly reducing their positions. The point is excess supply and reduced demand will drive prices lower. The likelihood is that the private sector that will be required to purchase these bonds is wary of inflation rebounding on the back of higher energy prices and increasing wage costs (between the UAW strike and the latest law in California that mandates a $20/hour minimum wage for fast food workers, wages seem set to rise further still), and so are demanding to be paid more to buy the paper. It is not really that complex.

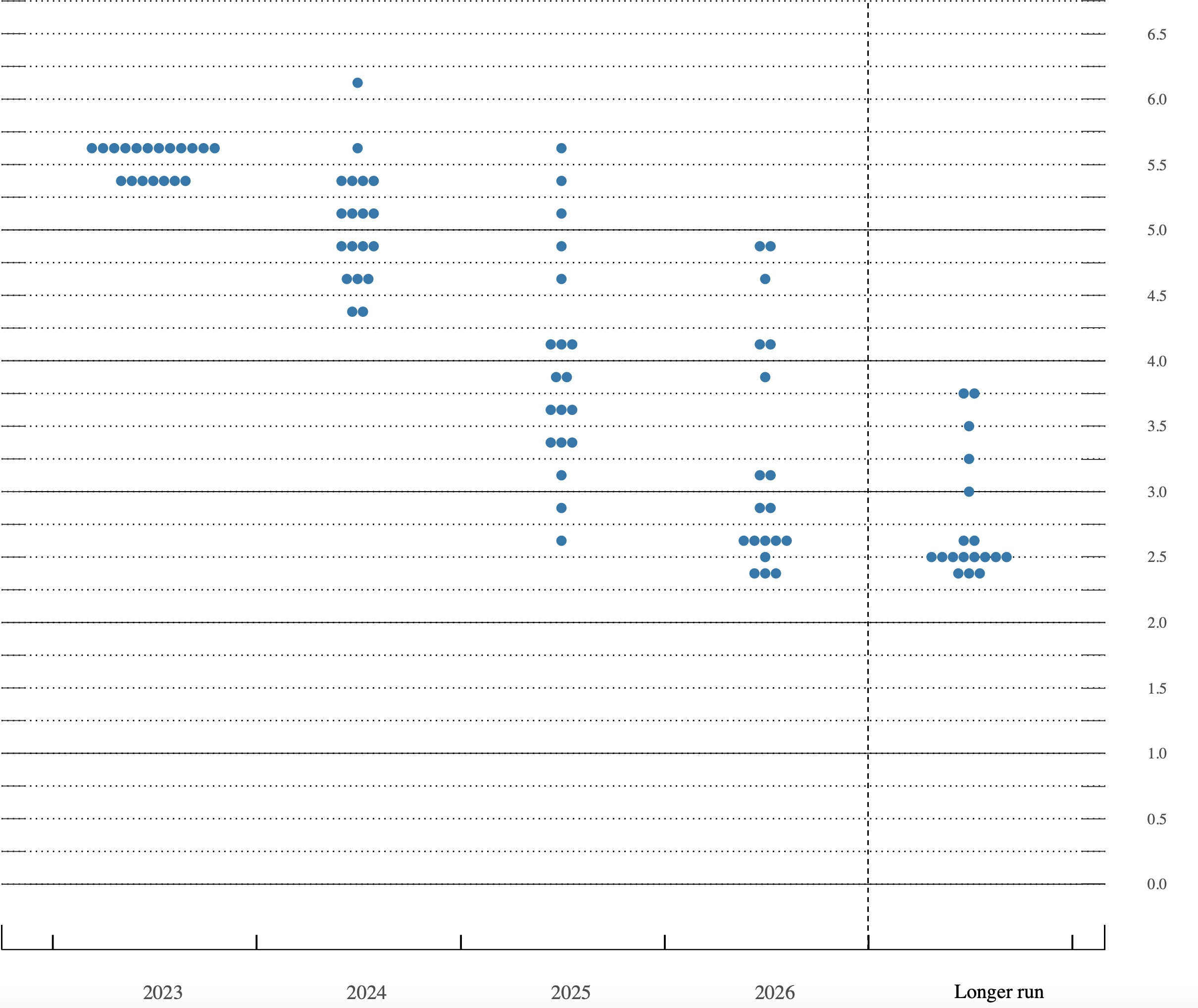

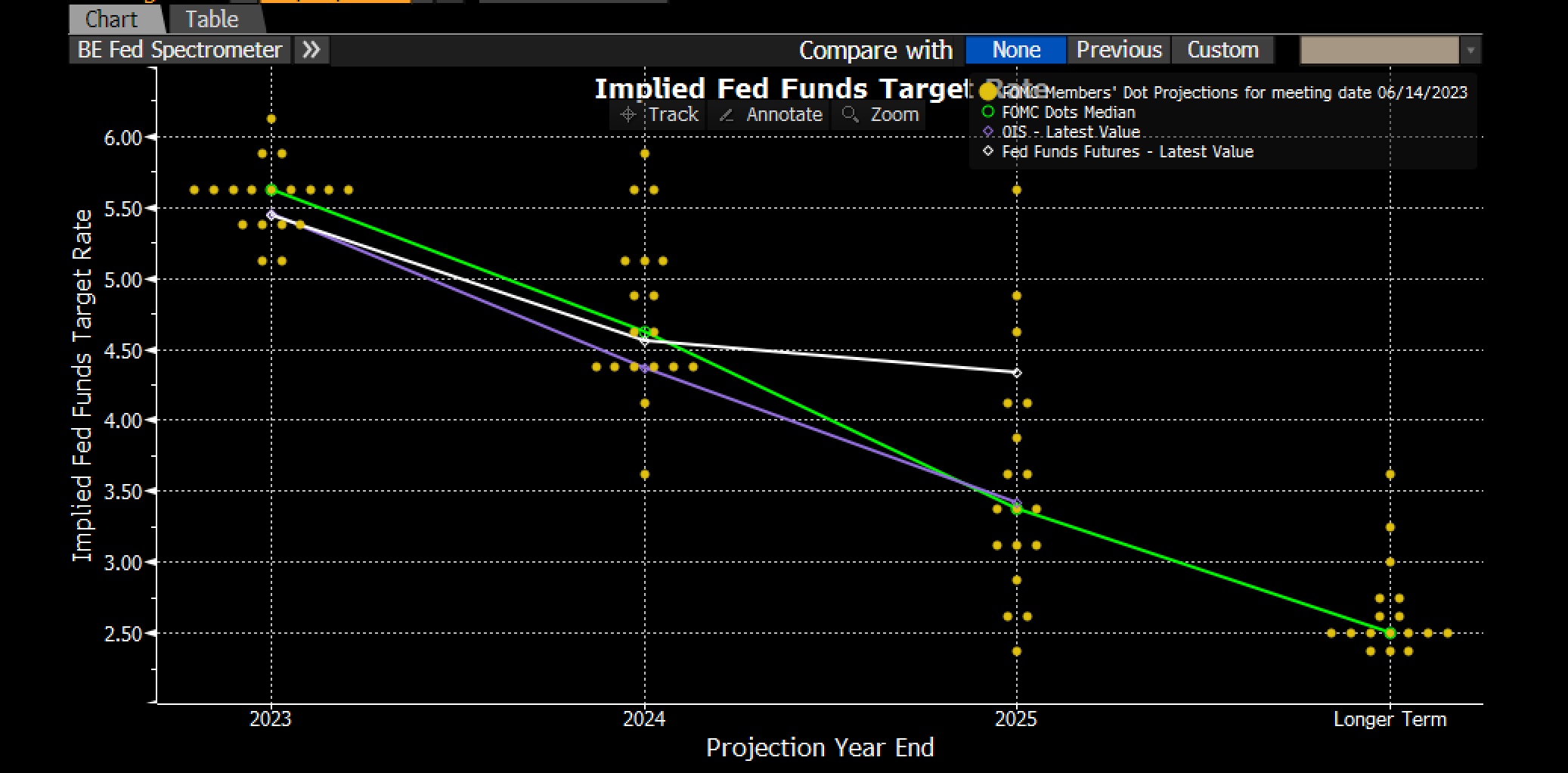

Yesterday, after printing at 4.68%, a new high for the move, the 10-year yield fell back a bit, which is much more about market technicals and an oversold condition rather than a change in the underlying issues discussed above. This morning, that yield is lower still, but just by 2bps and currently trading at 4.55%. Of equal interest is the fact that the yield curve continues to bear steepen with the 2yr-10yr curve inversion now down to -50bps. While we are likely to see a little trading bounce, this trend remains clear, and the fundamentals support higher yields. I expect the 10-year yield to reach 5% by the end of 2023 and somewhere between 5.5% and 6.0% by the election next year.

If we look elsewhere in the world, we are seeing yields rise right alongside Treasury yields. Perhaps the only place that is lagging is Japan, where the BOJ executed an unscheduled JGB buying operation last night of¥300 billion to help moderate recent movement. This was interesting given the data out of Japan last night, notably weaker Retail Sales and a lower-than-expected Tokyo CPI at 2.8% (2.5% core) implies that the BOJ is not likely to feel much pressure to tighten. With the Fed still all-in on higher for longer and the BOJ able to point to softening inflation as a reason to continue QE and loose policy, USDJPY will continue to be the outlet valve in the economy, and it should rise (yen weaken) still further.

Meanwhile, the most important spread in Europe, the bund-BTP spread in the 10-year space is back to 200bps. This is the level at which the ECB has demonstrated concern in the past and I am confident that there is much discussion ongoing today. We did hear from one of the ECB hawks overnight, Nagel, who was clear that another rate hike might be appropriate, but I assure you, if that spread widens much further, rate hikes are not going to be the ECB’s approach. All in all, we are likely to see much future stress in bond markets. And to think, none of this even touches on the potential government shutdown tomorrow!

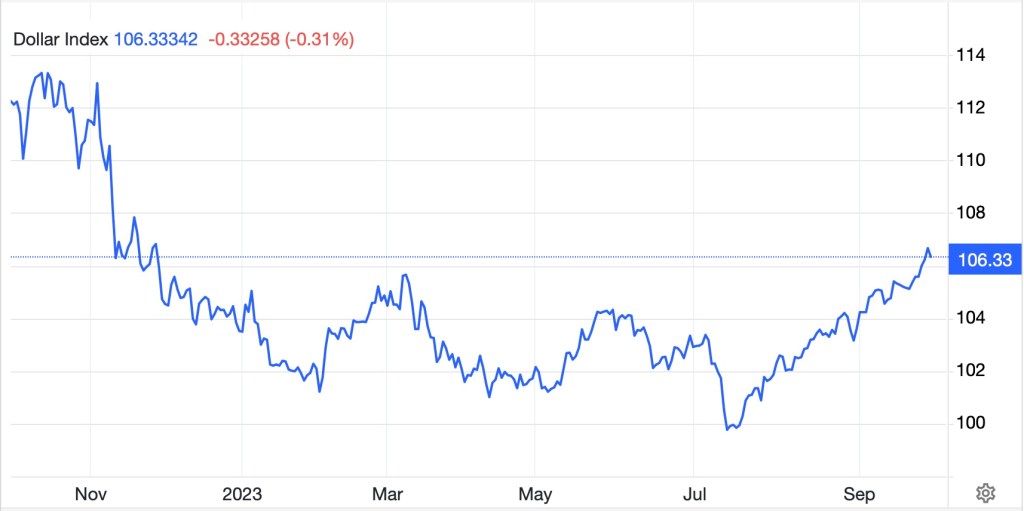

And yet, equity markets bounced yesterday into month/quarter end and European bourses and US futures are all in the green today as the bulls are now telling us that things are oversold, and a rip-roaring rally is imminent. Clearly, we have seen some pretty weak behavior in the risk asset space lately and a technical bounce is not surprising. However, it remains very difficult for me to see the upside for stocks as long as bond yields are rising along with oil and inflation remains sticky. Too, the dollar, while it also reversed course yesterday after a remarkable run higher over the past two plus months, is still quite firm overall, and as long as US yields rise, I look for the dollar to follow.

On the lighter side, the best non-sequitur correlation I have seen is that Top Gun was released in May 1986 and Black Monday, which saw the largest equity market selloff in history occurred in October 1987. Well, Top Gun II was released in May 2022. Should we be looking for a massive market decline in the next two weeks? The starting conditions are not actually that different with an overvalued stock market, rising rates, rising oil prices and a rising dollar. Just sayin!

As we look to the calendar today, the Core PCE data is set to be released at 8:30 and expected at 0.2% M/M, 3.9% Y/Y. Many analysts continue to use the concept of annualizing last month’s data and pointing to the Fed achieving its target, or excluding the rise in prices of certain segments beyond food and energy and claiming not only is inflation falling, but deflation is coming. Clearly, if you exclude the prices that are rising in the index, then the index will demonstrate falling prices, however it is not clear to me what that tells us. We also get the Goods Trade Balance (exp -$95.0B), that excludes services, and we see Chicago PMI (47.6) and Michigan Sentiment (67.7). Yesterday’s GDP data was a touch softer than expected at 2.1% with the most concerning part that Real Consumer Spending rose only 0.8% Q/Q, half the level of forecasts and down from 3.8% in Q1. On the flipside, Initial Claims fell to 204K, back to levels seen in January, and certainly no indication of economic weakness.

And that’s how we are heading into the weekend. While yesterday saw trading reversals of the recent trends, there is no indication that those trends have ended. The reversal and consolidation may last through today’s quarter end trading and into early next week but look for the longer term trends of a higher dollar, higher bond yields, higher oil prices and lower risk asset prices to resume before too long.

Good luck and good weekend

Adf