The two things we’re watching today

Are Jay and the new QRA

The pundits are out

With nary a doubt

That easing is coming our way

But what if this faith is misplaced

And Jay, at the presser, bald-faced

Says policy ease

Is not what we please

And we’ll not get there in great haste

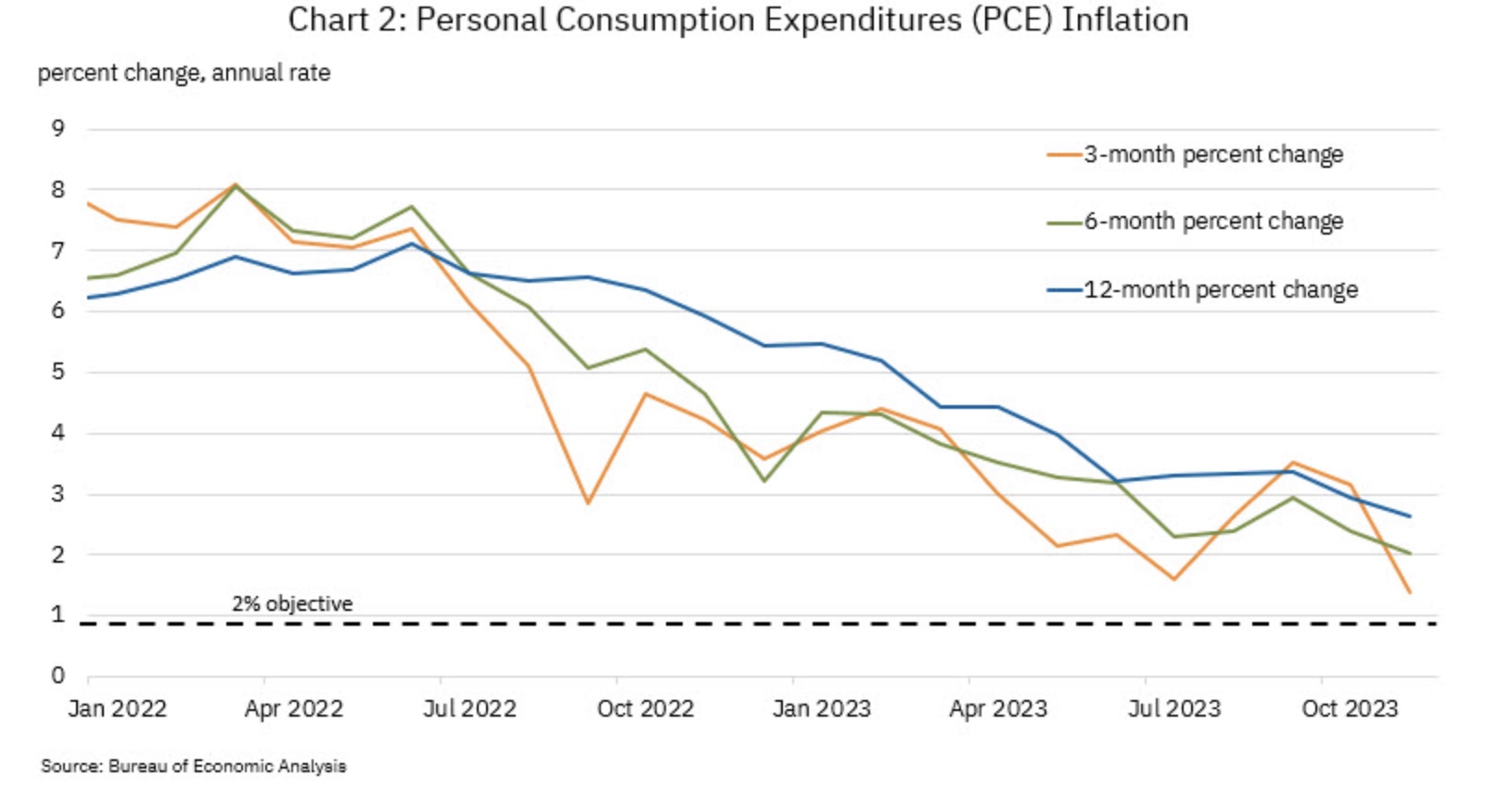

Reading the Fed Whisperer, Nick Timiraos of the WSJ, this morning was enlightening only to the extent that everybody he interviewed demonstrated they have no idea what will happen, and merely described what they would like to see. Now, in fairness, I don’t think Powell himself really knows how things are going to play out as we continue to see mixed pictures on the economy. For every strong datapoint (e.g., GDP, JOLTS, Case Shiller) indicating that there are many potential inflationary pressures extant, we see some softer data points (e.g., PCE, Empire Manufacturing, Dallas Fed) that indicate policy is excessively restrictive. While it is very clear that the Fed will not adjust policy today, a look at Fed funds futures shows that the market is pricing in a 45% chance of a cut in March. A month ago, that was over 70%, so Powell must be a bit happier, but 6 weeks is such a long time in this context, anything can happen between now and then. And, oh yeah, the market is still pricing in 6 cuts this year.

Of course, long before the FOMC statement and Powell presser this afternoon, the Treasury will release its QRA and the market will learn if Secretary Yellen is going to continue down her recent path of leaning toward more T-bills and less coupons. Based on her continuous comments that the soft landing has been achieved and inflation is no longer a problem, it seems quite clear that she wants to see the Fed cut rates soon. After all, lower interest rates take pressure off the budget deficit, which is entirely her baby at this point. Interestingly, she could essentially force Powell’s hand in this situation as follows:

1. Issuing a high percentage of T-bills will lead to

2. Reducing the RRP balances and bank reserves which will

3. Force the Fed to respond by slowing/ending QT to prevent any systemic problems like seen in September 2019

Remember, we have already heard from Powell, as well as Dallas Fed President Lorie Logan, whose previous role was at the NY Fed overseeing the Fed’s reserve portfolio, that the time to discuss slowing or ending QT was fast arriving. By itself, that is a policy ease, but it would also be a signal that further changes were on their way. In fact, a continued heavy reliance on T-bill issuance would have two vectors to support the bond market; ending QT reduces the amount of bonds the market needs to absorb and reducing new supply by itself will do exactly the same thing. At least for as long as inflation remains quiescent. And in the end, that remains the biggest unknown, inflation. All these plans and ideas revolve around the premise that the Fed has won its inflation fight. But I ask you, what if they haven’t?

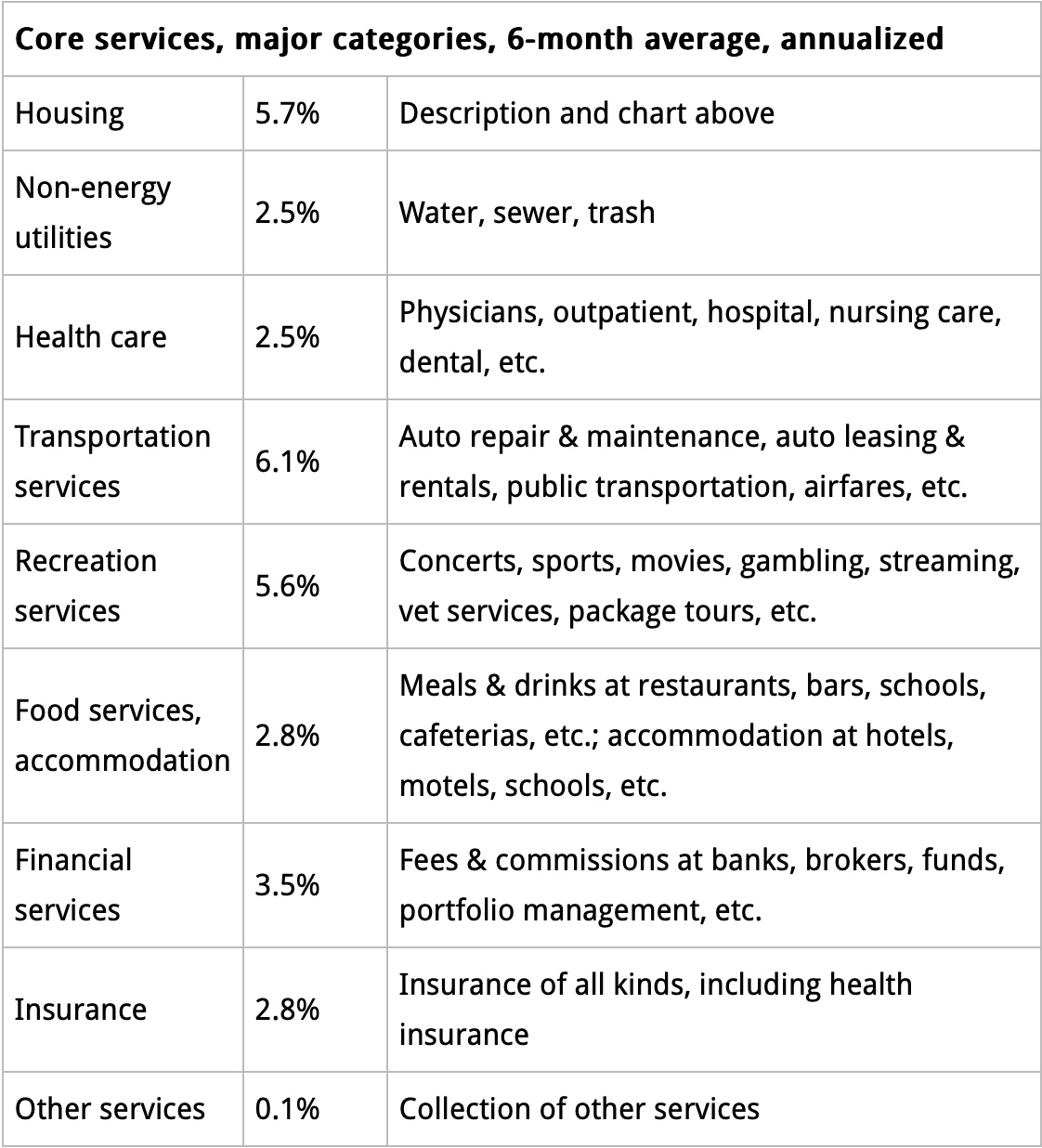

Too much digital ink has been spilled already on the inflation question and the two camps remain at distinct odds. Forgetting all the conspiracy theorists who claim inflation is really 10% or more, and looking only at serious economists and analysts, while all agree that the rate of inflation has fallen from its peak levels in the summer of 2022, there is still a pretty even split between the two sides. While I fall on the side of stickier inflation than the market is pricing, I can understand the other side of the story. But the point is, there are two very real sides to the story and the outcome remains unwritten. However, if inflation does remain stickier than the doves believe, it will destroy their entire thesis of why the Fed should be easing policy. Given the stock market is making new highs regularly, I suspect investors and traders have largely bought into the ‘inflation is over’ view. Just be careful if it’s not.

Ok, as we await today’s activities, let’s look at what happened overnight. Following a mixed session in the US yesterday, Asian markets turned back the clock a few weeks with the Nikkei (+0.6%) continuing its longer-term rally while both the Hang Seng (-1.4%) and CSI 300 (-0.9%) revert to their losing ways. It seems that investors simply do not believe that President Xi has either the ability or willingness to do anything to support the stock market there, at least, if not the economy. I believe it would be a mistake to believe he is not willing, which calls into question exactly what they are going to do to prevent things from starting to impact the economy more negatively. And perhaps we have seen the first steps. The other noteworthy story in the WSJ this morning was about how Chinese authorities are “discouraging” negative takes on the economy from being published and instead telling news outlets to publish stories about the bright prospects there.

Moving on to Europe, the main indices have moved very little thus far today after a mixture of data showing inflation in Germany and France continue to decline but Retail Sales in Germany (-1.6%) and Switzerland (-0.8%) and Industrial Sales in Italy (-1.0%) all falling sharply in December. Given the weak GDP data yesterday on the continent, none of this can be surprising. Finally, US futures are mostly lower this morning, led by the NASDAQ (-1.0%) despite (because of?) what seemed to be solid earnings from Microsoft and Alphabet. In the end, though, I sense that investors are far more focused on the QRA and FOMC right now.

Treasury yields are unchanged this morning but that is after a 4bp decline yesterday and we have seen European sovereign yields slide this morning as well, between 1bp and 3bps, which seems to be a catch up move to the Treasuries. I must mention Australian government bonds, which saw yields tumble 13bps overnight on the back of a much softer than expected CPI reading which has the market talking rate cuts there again. Finally, JGB yields edged 2bps higher, despite weaker than expected Retail Sales and IP data.

Oil prices (-1.1%) are backing off this morning after another positive day yesterday and a very strong month of January, where WTI rose > 9%. (My take is that will not help the CPI data when it comes out in a few weeks’ time.) Meanwhile, metals prices are trading near unchanged on the day as traders here are also awaiting the new information.

It should be no surprise that the dollar is, net, little changed this morning on the same premise of waiting for Godot Powell. Looking at my screen, I don’t see any currency that has moved more than 0.3% in either direction so really no information yet today.

In addition to the QRA and FOMC meeting, we see the ADP Employment Report (exp 145K), the Employment cost Index (1.0%) and Chicago PMI (48.0). Careful attention should be paid to the ECI as the Fed focuses on that metric for wage inflation data. As an indication, prior to the pandemic, that index averaged around 0.6%, but since then, it is more like 1.0% on a quarterly basis. That annualizes to more than 4% and will maintain upward pressure on inflation if it stays there. Just something else to keep in mind.

If pressed, I believe that the QRA will show reduced coupon issuance and Powell will be more dovish than not. While we know the Treasury is political, by definition, and will do everything in its power to stay in power and get re-elected, my take is the Fed is in that camp as well. I would not be surprised to see a more dovish take this afternoon after the QRA this morning. And initially, at least, that tells me the dollar will trade back toward its recent lows ceteris paribus.

Good luck

Adf