Winter approaches

Both cold weather and cold growth

Plague Japan’s future

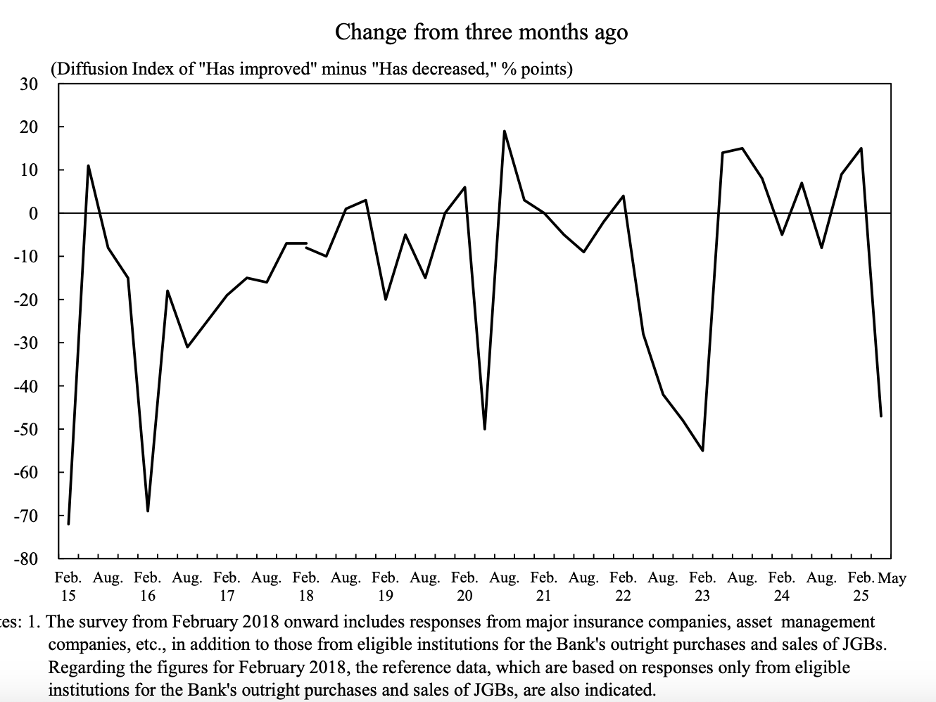

It’s not a pretty picture, that’s for sure. A raft of Japanese data was released early Sunday evening with GDP revised lower (-0.6% Q/Q, -2.6% Y/Y) and as you can see from the Q/Q chart below, it is hard to get excited about prospects there.

Source: tradingeconomics.com

Of course, this is what makes it so difficult to estimate how Ueda-san will act in a little less than two weeks’ time. On the one hand, inflation remains a problem, currently running at 3.0% and showing no signs of declining. Recall, the BOJ has a firm 2.0% target, so they are way off base here. Add to that the fact that inflation in Japan had been virtually zero for the prior 15 years and the population is starting to get antsy. However, if growth is retreating, how can Ueda-san justify raising rates?

In the meantime, the punditry is having a field day discussing the yen and its broad weakness, although for the past three weeks, it has rebounded some 2% in a steady manner as per the below chart,

Source: tradingeconomics.com

As well, much digital ink has been spilled regarding the 30-year JGB yield which has traded to historic highs as per the below chart from cnbc.com.

There are many pundits who have the view that the Japanese situation is getting out of control. They cite the massive public debt (240% of GDP), the fact that the BOJ holds 50% of the JGB market, the fact that the yen has declined to its lowest level (highest dollar value) since a brief spike in 1990 and before that since 1986 when it was falling in the wake of the Plaza Accord.

Source: cnbc.com

Add in weakening economic growth and growing tensions with China and you have the makings of a crisis, right? But ask yourself this, what if this isn’t a crisis, but part of a plan. Remember, the carry trade remains extant and is unlikely to disappear just because the BOJ raises rates to 0.75% in two weeks. This means that Japanese investors are still enamored of US assets, notably Treasuries, but also stocks and real estate, as a weakening yen flatters their holdings. Too, it helps Japanese companies compete more effectively with Chinese competitors who benefit from a too weak renminbi as part of China’s mercantilist model. Michael Nicoletos, one of the many very smart Substack writers, wrote a very interesting piece on this subject, and I think it is well worth a read. In the end, none of us know exactly what’s happening but it is not hard to accept that some portion of this theory is correct as well. The one thing of which I am confident is the end is not nigh. There is still a long time before things really become problematic.

And the yen? In the medium term I still think it weakens further, but if the Fed gets very aggressive cutting rates, that will likely result in a short-term rally. But much lower than USDJPY at 145-150 is hard for me to foresee.

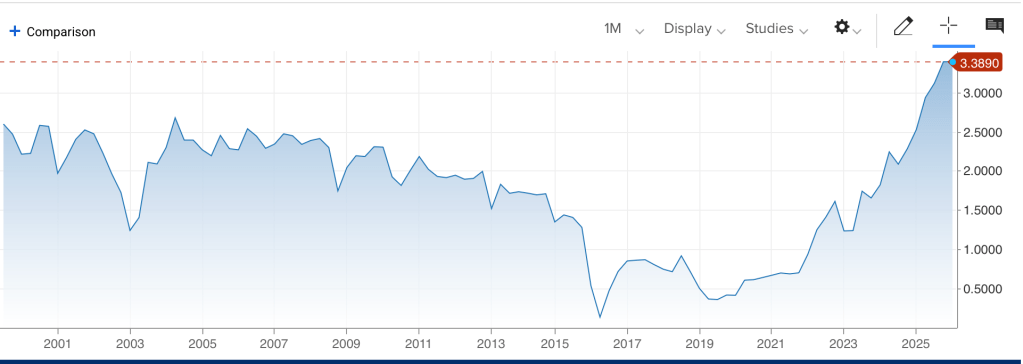

Turning to the other noteworthy news of the evening, the Chinese trade surplus has risen above $1 trillion so far in 2025, with one month left to go in the year. This is a new record and highlights the fact that despite much talk about the Chinese focusing more on domestic consumption, their entire economic model is mercantilist and so they continue to double down on this feature. While Chinese exports to the US fell by 29% in November, and about 19% year-to-date, they are still $426 billion. However, China’s exports to the rest of the world have grown dramatically as follows: Africa 26%, Southeast Asia 14% and Latin America 7.1%. Too, French president Emanuel Macron just returned from a trip to Beijing, meeting with President Xi, and called out the Chinese for their export policies, indicating that Europe needed to take actions (raise tariffs or restrict access) before European manufacturing completely disappears. (And you thought only President Trump would suggest such things!)

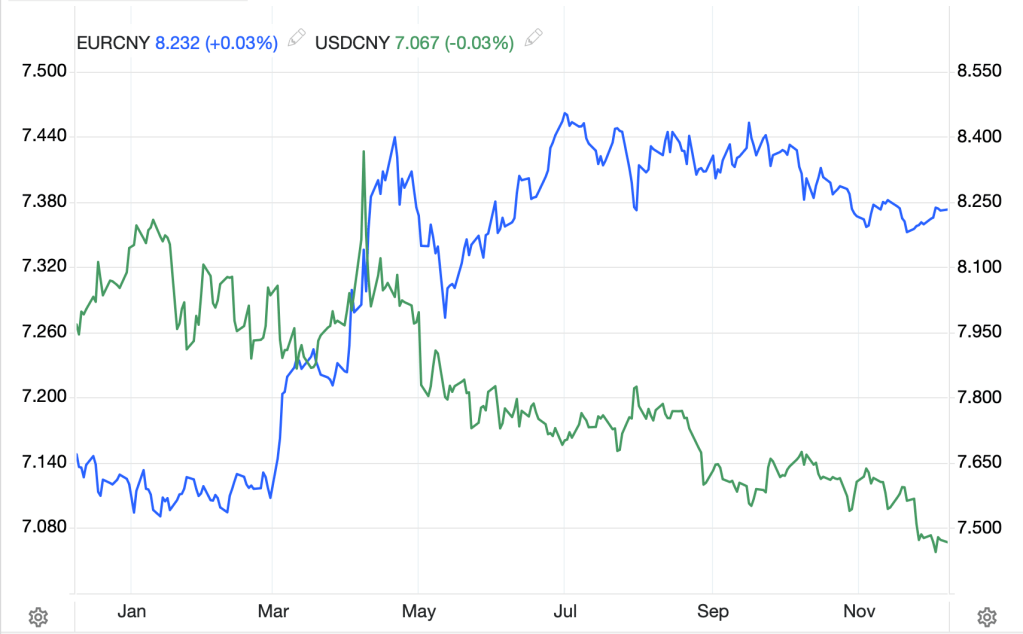

So, how did markets respond to this? Well, the CSI 300 rose 0.8% (although HK fell -1.2%) and the renminbi was unchanged. But I think it is worth looking at the renminbi’s performance vs. other currencies, notably the euro, to understand Monsieur Macron’s concerns.

Source: tradingeconomics.com

It turns out that the CNY has weakened by nearly 7.5% vs. the euro this year, a key driver of the growing Chinese trade surplus with Europe (and now you better understand the Japanese comfort with a weaker JPY). My observation is that the pressure on Chinese exports is going to continue to grow going forward, especially from the other G10 nations. Expect to hear more about this through 2026. It is also why I see the eventual split of a USD/CNY world.

Ok, let’s look around elsewhere to see what happened overnight. Elsewhere in Asia, things were mixed with Tokyo (+0.2%) up small, Korea (+1.3%) having a solid session along with Taiwan (+1.2%) although India (-0.7%) went the other way. As to the smaller, regional exchanges, they were mixed with small gains and losses. In Europe, it is hard to get excited this morning with minimal movement, less than +/- 0.2% across the board. And at this hour (7:25) US futures are little changed.

In the bond market, yields are continuing to rise around the world. Treasury yields (+2bps) are actually lagging as Europe (+4bps to +6bps on the continent and the UK) and Japan (+3bps) are all on the way up this morning. This is Fed week, so perhaps that is part of the story, although the cut is baked in (90% probability). Perhaps this is a global investor revolt at the fact that there is exactly zero evidence that any government is going to do anything other than spend as much money as they can to ensure that GDP continues to grow. QE will be making another appearance sooner rather than later, in my view, and on a worldwide basis.

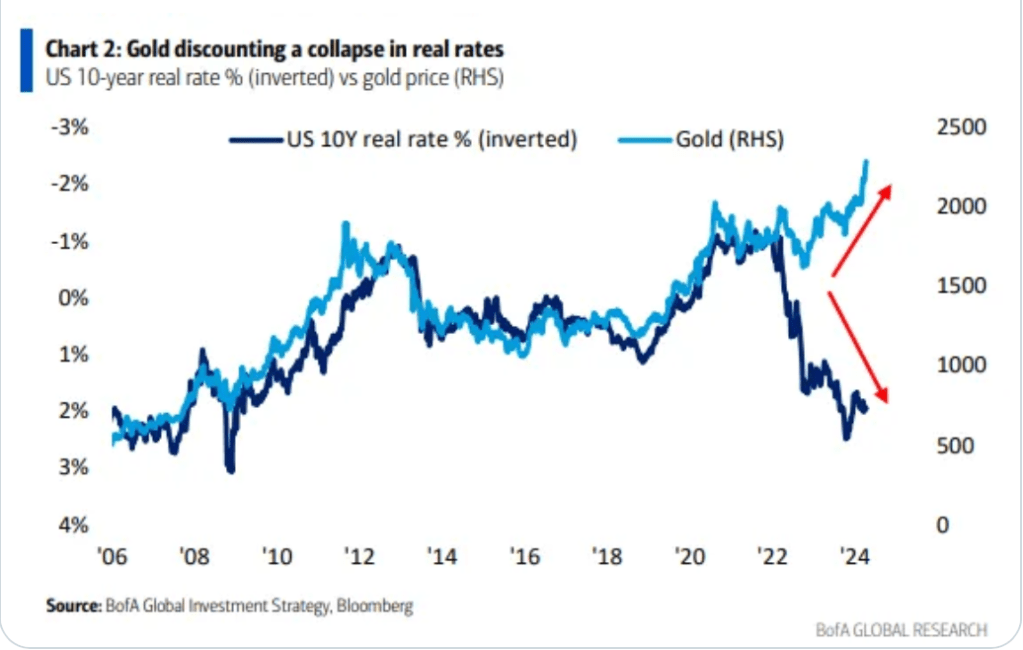

When we see that, commodity prices seem likely to rise even further, at least metals prices will and this morning that is true across the precious metals space (Au +0.3%, Ag +0.3%, Pt +1.2%) although copper is unchanged on the day. Oil (-1.2%) though is not feeling the love this morning despite growing concerns of a US invasion of Venezuela, ongoing Ukrainian strikes against Russian oil infrastructure and the prospects of central bank rate cuts to stimulate economic activity. One thing to note in the oil market is that China has been a major buyer lately, filling its own SPR to the brim, so buying far more than they consume. If that facility is full, then perhaps a key supporter of prices is gone. I maintain my view that there is plenty of oil around and prices will continue to trend lower as they have been all year as per the below chart.

Source: tradingeconomics.com

Finally, nobody really cares about the FX markets this morning with the DXY exactly unchanged and all major markets, other than KRW (+0.5%) within 0.2% of Friday’s closing levels. There is a lot of central bank activity upcoming, and I suppose traders are waiting for any sense that things may change. It is worth noting that a second ECB member, traditional hawk Olli Rehn, was out this morning discussing the potential need for lower rates as Eurozone growth slows further and he becomes less concerned about inflation. Expect to hear more ECB members say the same thing going forward.

On the data front, things are still messed up from the government shutdown, but here we go:

| Tuesday | RBA Rate Decision | 3.6% (unchanged) |

| NFIB Small Biz Optimism | 98.4 | |

| JOLTS Job Openings (Sept) | 7.2M | |

| Wednesday | Employment Cost Index (Q3) | 0.9% |

| Bank of Canada Rate Decision | 2.25% (unchanged) | |

| FOMC Rate Decision | 3.75% (-25bps) | |

| Thursday | Trade Balance (Sept) | -$61.5B |

| Initial Claims | 221K | |

| Continuing Claims | 1943K |

Source: tradingeconomics.com

There is still a tremendous amount of data that has not been compiled and released and has no date yet to do so. Of course, once the FOMC meeting is done on Wednesday, we will start to hear from Fed speakers again, and Friday there are three scheduled (Paulson, Hammack and Goolsbee).

As we start a new week, I expect things will be relatively quiet until the Fed on Wednesday and then, if necessary, a new narrative will be created. Remember, the continuing resolution only goes until late January, so we will need to see some movement by Congress if we are not going to have that crop up again. In the meantime, there is lots of talk of a Santa rally in stocks and if I am right and ‘run it hot’ is the process going forward, that has legs. It should help the dollar too.

Good luck

Adf