Suzuki-san and

Ueda-san are clearly

Flocking together

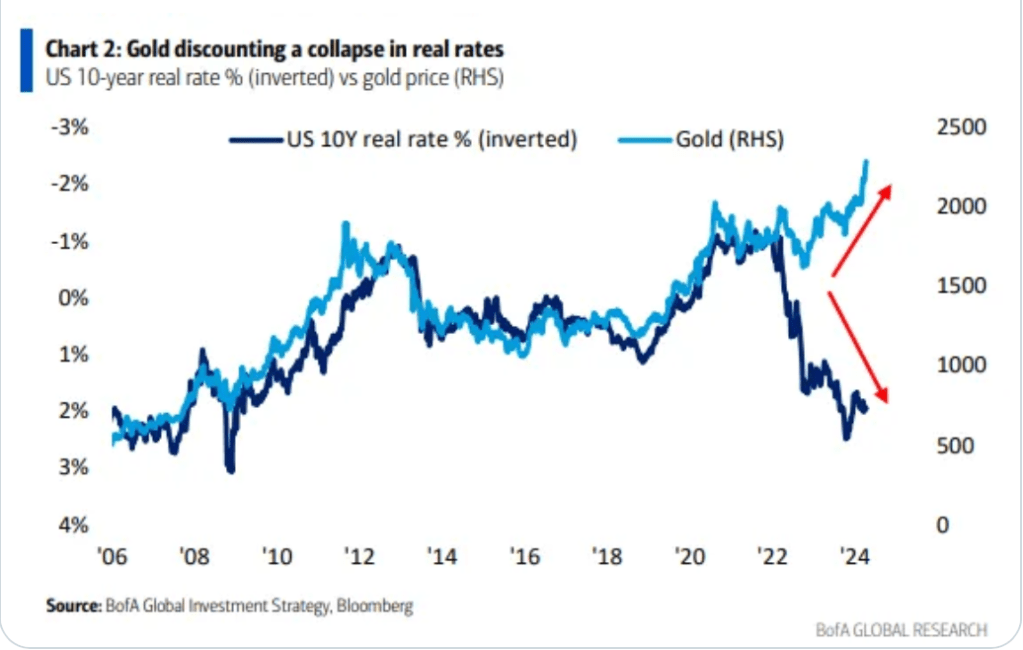

Events continue to unfold in Japan that appear to point to a more concerted effort to address the still weakening yen. The problem, thus far, is that it hasn’t yet really worked, absent the direct intervention we saw at the beginning of the month. For instance, last night, 10-yr JGB yields rose to their highest level since June 2012, trading up to 0.969% and finally looking like they are going to breech that 1.00% level that had so much focus back in October. At the same time, the two key players in this drama, FinMin Suzuki and BOJ Governor Ueda are actively speaking to each other as they try to coordinate policy. The problem for Suzuki-san is that Q1 GDP fell back into negative territory again, thus bringing two of the past three quarters down below zero. While that is not the technical definition of a recession, it certainly doesn’t look very good.

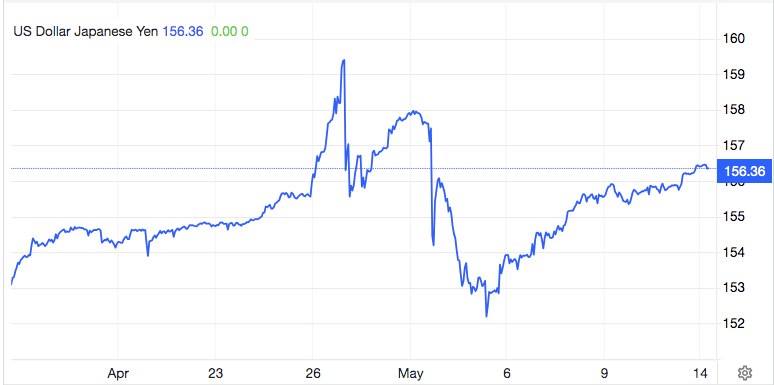

And yet, the yen remains under pressure, slipping another 0.1% last night, and as can be seen from the chart below, continuing its steady decline (dollar rise) from the levels seen immediately in the wake of the intervention.

Source: tradingeconomics.com

Another interesting thing is that our esteemed Treasury Secretary, Janet Yellen, seems to be concerned over any intervention carried out by the Japanese, at least based on comments she recently made in a Bloomberg interview, “It’s possible for countries to intervene. It doesn’t always work without more fundamental changes in policy, but we believe that it should happen very rarely and be communicated to trade partners if it does.”

There have been several analysts of late who have made the case that Yellen’s trip to Asia last month included a ‘secret’ Plaza Accord II type arrangement, where there was widespread agreement that the dollar needed to come down in value. First off, secrets like that are extremely difficult to keep secret, and history shows that doesn’t happen very frequently. But more importantly, based on the fact that inflation is one of the biggest problems that her boss has leading up to the election, a weaker dollar is the last thing she would want. I suspect if we continue to see the yen decline, the BOJ/MOF will be back at the intervention game again, but the US will not be helping. Keep in mind, though, Japanese yields. If the BOJ is truly going to allow yields to rise in Japan, that would have a significant impact on the yen’s value in the FX markets. While 1.00% is a big round number, I think we will need to see the BOJ demonstrate a more aggressive stance overall…or we need to see the data turn softer in the US to allow the Fed to get on with their much-desired rate cuts. We will need to watch this closely going forward.

While everyone’s waiting to see

How high CPI just might be

One cannot rule out

An outcome less stout

Where bond and stock bulls are set free

Which brings us to the inflation story. By this time, everyone is aware that tomorrow’s CPI data is seen as a critical piece of the puzzle. I continue to read coherent arguments on both sides of the debate regarding the trend going forward. (Let’s face it, the error bars are far too wide to be confident in a specific forecast.) For the inflationistas, they continue to look at things like the housing market, which while frequently expected to see declining price pressures, has maintained an upward trend for the past several years. As well, things like the dramatic rise in certain commodity prices (coffee comes to mind) and the substantial rise in the price of insurance (something of which I speak from personal experience!), there is ample evidence that prices continue to climb.

Part of this puzzle may be the result of the fact that companies continue to successfully raise prices, or at least had been doing so for the past two years, as evidenced by the continued strong earnings, and more importantly, still high gross margins they are able to achieve. So, as input prices have risen, they have passed those costs along to the consumer quite successfully. Now, the comments from Starbucks and McDonalds at their earnings reports indicating business is slowing down and attributing that slowdown to rising prices may well be a harbinger that companies have lost the ability to keep this up. But two companies, even large ones, are not nearly the whole economy. As well, much has been made, lately, of the K-shaped economy, where the haves continue to benefit from the rise in asset prices and are far less impacted by rising prices as they can afford them. This has led to continued strong demand for luxury goods, which while a smaller sector of the economy, remain highly visible. Meanwhile, the less fortunate lower 90% of the population find themselves struggling to make ends meet as real wages remain stagnant and there continues to be a switch from full-time to part-time employment ongoing as companies adjust their staffing needs. PS, those part time jobs don’t pay as well and generally don’t have benefits, so any price increases are very tough to swallow. In the end, it appears that housing, insurance services and food remain in upward price trends.

On the flipside, there are many who see that while Q1’s inflation data was sticky on the high side, things should begin to improve going forward. They point to things like M2, which has fallen dramatically over the past two years, although has recently inflected higher again. However, the argument is that the lag between the movement in M2 and inflation is somewhere in the 16-24-month period, and we are now due to see prices decline. In addition, they point to things like loan impairments and credit card delinquencies rising as signs that companies have lost their pricing power and prices will reflect that by slowing their ascent.

Now, today we see the PPI, which may give clues as to tomorrow’s outcome and the following are the median expectations: headline 0.3% M/M, 2.2% Y/Y; core 0.2% M/M, 2.4% Y/Y. Looking at the chart, it certainly appears that this statistic has bottomed out just like CPI.

Source: tradingeconomics.com

But here’s the thing…I have a feeling that regardless of the outcome, the market is going to rally in both stocks and bonds. Certainly, if it is a softer than forecast number, the rate cut narrative is going to be going gangbusters and stocks will rocket while yields fall. If it is on the money, my sense is the market is still in the camp that despite what we continue to hear, especially with Powell having removed the possibility of a rate hike, that the view will turn to rate cuts are coming as the Fed’s underlying dovishness will prevail. But if the numbers are hot, while the initial reaction will almost certainly be a decline in risk asset prices, I have a feeling it will be short-lived. Positioning is not overly long here, at least according to the fear/greed indicators, and the theme that the administration will do all it can to get re-elected, meaning lots more fiscal support, is going to work in favor of risk assets. One other thing, if there is some trouble in the bond market, the one thing we know for sure is that Powell will come to the rescue and support the whole structure.

Net, while the timing of each outcome may differ, I sense the end result will be the same. As to the dollar, I remain in the camp that international investors will continue to buy dollars to buy the S&P. As well, given it seems very clear that both the ECB and BOE are going to cut rates in June while the Fed remains a much lower probability to do so, that should prevent any sharp dollar decline, although it may not push it any higher.

Overnight, basically nothing happened as everybody is holding their collective breath for tomorrow. Maybe today will be a harbinger, but I expect a generally slow session overall absent a HUGE surprise in PPI.

Good luck

adf