Though yesterday equities fell

The trend that most pundits foretell

Is higher and higher

As AI’s on fire

And it would be crazy to sell

And, too, precious metals keep soaring

A sign of investors abhorring

The chaos extant

Which serves as a taunt

To those who prefer markets boring

My friend JJ (Alyosha at Market Vibes on Substack) made a very interesting point about recent markets, which I have felt, but not effectively articulated until he pointed it out; the correlation of pretty much all markets is approaching one, but they are rallying. Historically, every market has its own drivers and tends to trade somewhat independently of other markets, at least across asset classes. While it is certainly common to see equity indices rise and fall together, we have all become used to bond markets moving in the opposite direction while commodity and FX markets tend to follow completely different drummers. After all, while there are certainly big unifying themes, each of these markets, and the components that make them up, all have idiosyncratic drivers of price.

Again, historically, the only time this changes is when there is a crisis, at which point the correlation between markets tends to one (or minus one) as panic selling of risk assets and buying of perceived havens becomes the ONLY trade of interest.

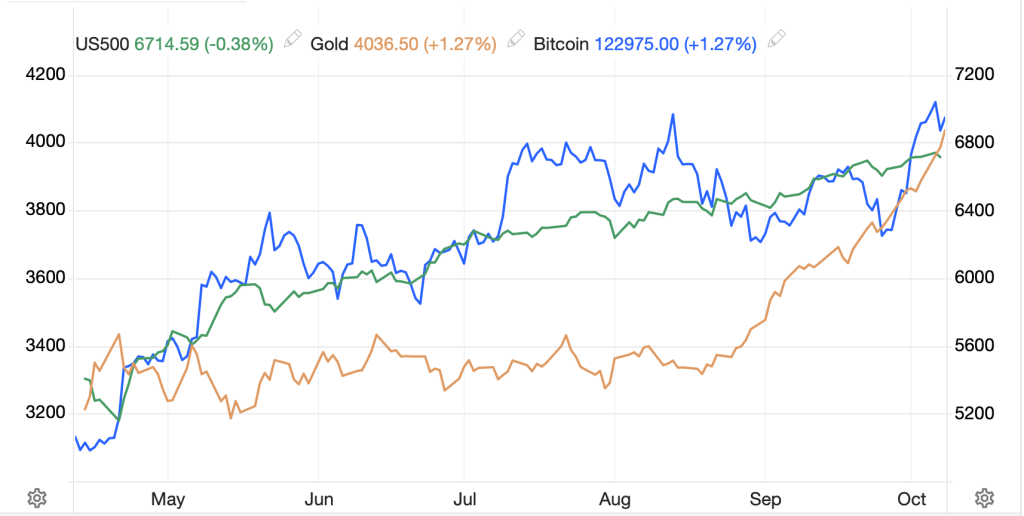

However, what we have observed over the past several weeks is that virtually all risk assets are rising simultaneously, with equities, gold and bitcoin all on a tear as you can see below.

Source: tradingeconomics.com

In other words, their correlations are approaching one. The odd thing about this is that equity markets tend to reflect expectations for the future of economic activity along the following line of reasoning; strong economic growth leads to strong earnings leads to higher equity prices. At least that has been the history. Meanwhile, gold, and more recently bitcoin, have served as the antithesis of that trade, increasing concern over weaker economic outcomes which results in increased demand for haven assets that can buck that trend.

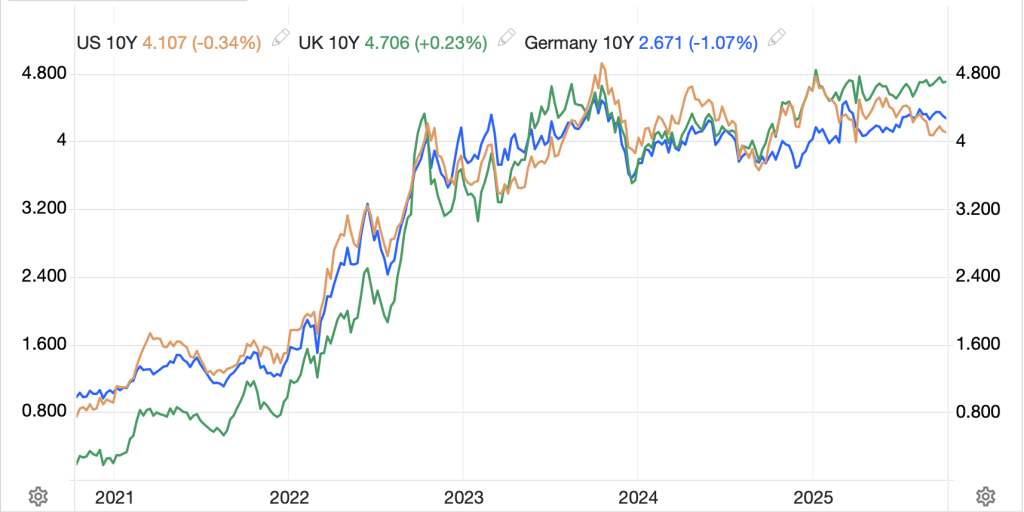

Of course, historically there has been another asset class seen as protection, bonds, but those are in a tough spot right now as the ongoing massive increases in issuance by countries all over the world has investors somewhat concerned about their safety. This has been especially true in Japan, where JGB yields last night traded to their highest level since 2008 at 1.70%.

Source: marketwatch.com

But my observation is that investors elsewhere are uncertain how to proceed as yields, though higher than seen several years ago, are not increasing dramatically despite the narrative of fiat debasement, increased inflation and major fiscal problems building around the world.

Source: tradingeconomics.com

The explanation that makes the most sense to me is the concept that governments around the world are going to ‘run it hot’ as they seek faster economic growth at the expense of all else and will only pay lip service to trying to fight inflation. The result is fiscal spending will continue to prime the pump, whether on purely domestic issues or things like defense, debt issuance will tend toward shorter dates as there is a much greater appetite for T-bills than bonds given the inflation concerns, and so stock markets will benefit, but perceived inflation hedges like gold and bitcoin, will also benefit. (At this point, I will insert a plug: If you want to protect against inflation, at least against CPI’s rise, while maintaining liquidity, USDi, the only inflation tracking cryptocurrency is a very good idea for some portion of your portfolio. Check out http://www.USDicoin.com).

The concern about this entire story is that when things change, and they always do at some point, all these assets that are rising in sync will fall in sync, and remember, falling markets tend to move a lot faster than rising ones. I’m not saying this is imminent, just that the setup feels concerning, at least to my eyes and my gut.

Meanwhile, let’s look at how markets behaved overnight. Yesterday saw US equity markets slip a bit, although they closed well off their early morning lows and futures this morning are pointing higher by a small amount, 0.2%. Asian markets saw Japan (-0.5%) and HK (-0.5%) both slide as well, following the US while China remained closed for the holiday but will reopen this evening. Elsewhere in the region, for those markets that were open (Australia, India, Taiwan were the majors) modest weakness was also the story.

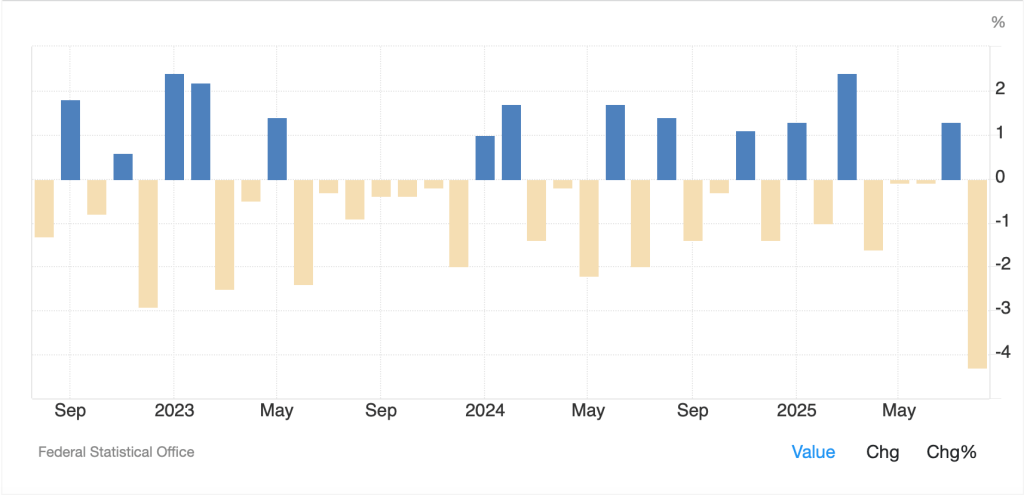

Europe, though, is a bit of a conundrum as it is having a very positive session (UK +0.9%, Germany +0.7%, France +0.8%, Spain +0.6%) despite the fact that data there continues to disappoint (German IP -4.3%) which as you can see from the below chart continues a three year run of pretty horrible outcomes.

Source: tradingeconomics.com

As well, France has no government, and the UK government is seeing its support erode dramatically. But looking at the ECB, there is no expectation priced into the market for further rate cuts, so I am baffled as to why European equity markets are performing well.

Perhaps it is because the dollar is strengthening, which is the recent trend with the euro slipping another -0.25% overnight and trading back to its lowest level in a month. Too, the pound (-0.2%), CHF (-0.2%) and JPY (-0.6%) have all suffered pushing the DXY up toward 99.00. Does a strong dollar help foreign markets? I always thought the story was it hurt them as funding USD debt became more difficult for foreign companies. Something doesn’t make sense here. As to EMG markets, they are also seeing their currencies slip, mostly in a similar fashion to the euro, down about -0.2%, although KRW (-0.6%) is the laggard as they have been unsuccessful in getting any tariff relief from President Trump.

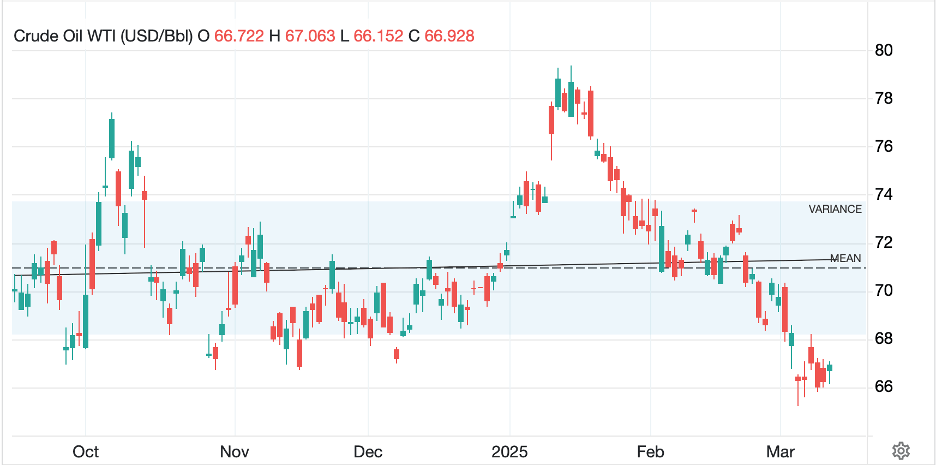

Finally, commodity prices continue their remarkable rally, at least metals prices are on a remarkable rally with gold (+1.3% or $50/oz) and silver (+2.5%, now at $49/oz) driving the bus and taking copper (+0.7%) and platinum (+1.8%) along for the ride. While gold has rallied more than 53% so far this year, it has not been a US investor focus until recently. I think it has further to run, a lot further. As to oil (+1.5%), it continues to bounce from last week’s lows but remains well within its recent trading range. Ukrainian attacks have been successful in reducing Russian output and OPEC+ only raised production by 137K barrels at their last meeting, less than had been rumored. However, as I observe this market, it needs a large external catalyst to breech the range in my view, and if war doesn’t do the job, I’m not sure what will.

And that’s really it for the day. Government data remains on hiatus and even though Fed speakers are polluting the airwaves, nobody is listening. The government has been shut down for a week, and I think that most people just don’t care. In fact, if the result was less government expenditure for less government service, I think many would make the tradeoff. The upshot is, the larger trend of equity and commodity rallies remain in place, and the dollar continues to look a lot better than most other fiat currencies.

Good luck

Adf