Inflation was hot, but not blazing

And so, though I am paraphrasing

A 50 bip cut

Is most likely what

We’ll see next week, ain’t that amazing!

Though futures are not there quite yet

The Claims data’s seen as a threat

It’s been four long years

Since Claims caused such fears

Seems Trump, what he wants he will get

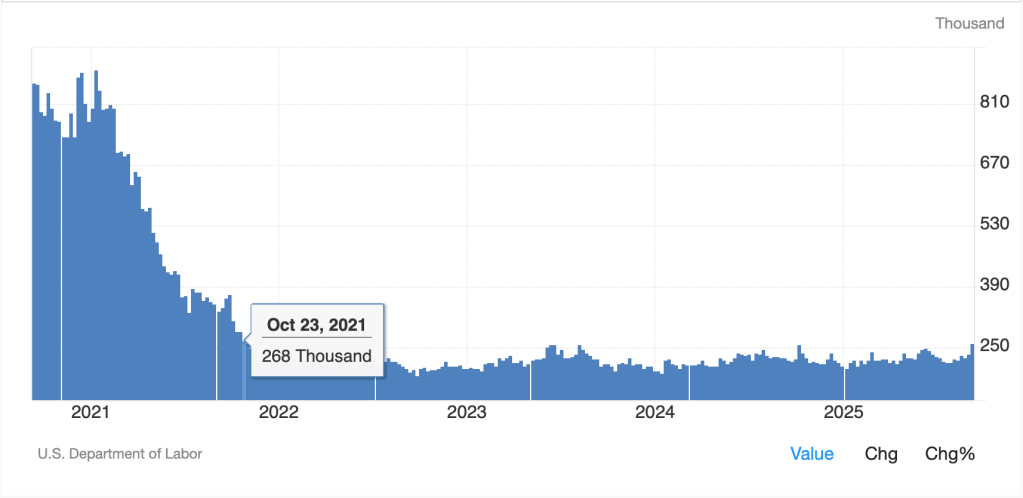

While I spent most of yesterday discussing the CPI data, which came out on the warm side of things with headline rising 0.4% M/M, a tick higher than forecast, although the Y/Y number at 2.9% was as expected, it seems far more attention than normal was paid to the Initial Claims data. As it happens, the last time Initial Claims printed this high, 263K, was October 2021.

Source: tradingeconomics.com.

Now, we all remember last September, just prior to the Fed cutting 50bps in a surprise move, and as it happens, the Claims data the week before that jumped as well, a one-off blip to 259K. Of course, the Fed felt it had a political imperative back then to cut as a means of supporting their preferred candidate for President, VP Harris, but that is another story. Nonetheless, a precedent has been set that a strong claims number with inflation still warm was sufficient to get them to move. So, will they cut 50bps next week?

Right now, the Fed funds futures market is still pricing just an 8% probability of that move, so apparently that is not the market perception. However, this is exactly the time where we should be seeing an article from the Fed Whisperer, Nick Timiraos, at the WSJ (aka Nickileaks), which ought to explain that changes in the labor market are sufficient to overcome any concerns about inflation, especially since there is a growing expectation that a recession is coming. Look for it on Monday.

But let us consider this for another moment. Based on BLS data, the median reading for Initial Claims since January 1967 is 339K, far more than we saw yesterday. In addition, if you look at a long-term chart of the Claims data, or even the shorter-term one above, while it is possible this is the beginning of a trend higher in Claims, there is no evidence yet for that, and blips higher are pretty common throughout the data set.

The one caveat here is that if we look at the recessions highlighted in gray in the above chart, the Claims data didn’t really rise until the end of the recession, so there is a chance that we are seeing the beginnings of bigger problems. Certainly, if Claims data starts to climb further and we see 300K, there will be a stronger case to anticipate a recession. But we haven’t yet seen that. Alas, what we do know from Powell’s last press conference is that the Fed has basically abandoned their inflation target, so despite the fact it has been 54 months (February 2021) since core PCE has been at or below 2.0%, and even though the very idea that rate cuts are appropriate is remarkable, it seems the case for 50bps is strengthening.

Source: tradingeconomics.com

But, as Walter Cronkite used to say, “That’s the way it is.”

So, how have markets been digesting this news? Well, yesterday saw US equity indices make yet another set of new all-time highs on the prospects of a 50bp cut and that has largely fed to other equity markets around the world. Bond yields remain quiescent, at least out to 10 years, although the really long stuff is having a tougher time, and the dollar remains range bound. Aside from equities, the only market really moving is precious metals, which continue to rally nonstop.

Starting in Asia, Tokyo (+0.9%) rallied nicely as a combination of anticipated Fed cuts and the calming of trade tensions with the US has investors there feeling giddy. It, too, has reached new all-time highs. Hong Kong (+1.1%) also had a good session although China (-0.6%) didn’t follow through as profit taking was evident after what has been a very strong run in mainland stocks lately. Elsewhere in the region, only two markets (Singapore and Philippines) lagged, and those were very modest declines of -0.3%. Otherwise, gains of up to 1.5% were the norm.

However, Europe didn’t get that memo this morning with continental bourses all under pressure (DAX -0.3%, CAC -0.5%, IBEX -0.7%) amid a growing realization that the ECB may have finished its cutting cycle, at least according to Madame Lagarde’s comments yesterday expressing confidence the bank is in a “good place”. However, under the rubric bad news is good, UK stocks (+0.3%) are edging higher after data showed GDP flatlined in July with the Trade deficit rising, and IP falling sharply (-0.9%) as traders are becoming more convinced the BOE will cut rates despite much stickier inflation than their target level. Remember, too, the BOE’s mandate is entirely inflation focused, but these days, none of that matters! Finally, US futures are either side of unchanged as I type (7:00).

In the bond market, yields remain in their longer-term downtrend in the US although have edged higher by 1bp overnight. European sovereign yields are higher by 3bps across the board as there are still growing concerns over French fiscal deficits and the fact that the ECB has finished cutting implies less support there. It is interesting to look at the difference in performance between US and French 10-year bonds as per the below, as despite much angst over the US fiscal profligacy, which is well-deserved, investors still feel far more comfortable with Treasuries than with OATs.

Source: tradingeconomics.com

In the commodity markets, oil (+1.3%) is rebounding from yesterday’s decline and, net, continues to go nowhere. Whatever the catalyst is that will change this view, it has not made an appearance yet. Meanwhile, like the broken record I am, I see gold (+0.5%) and silver (+1.9%) continuing to rally as more and more investors around the world flock to the precious metals as they fear the destruction of the value of their fiat currencies. And they are right because there is not a single central bank around (perhaps Switzerland and maybe Norway) that is concerned about inflation as evidenced by the fact that despite the fact inflation rates are running far higher than they had pre-Covid, every central bank is in a cutting cycle except Japan, and they have stopped hiking despite CPI there running at 3.4%!

Finally, the dollar is modestly firmer as I type, although it had been a bit softer overnight, and basically going nowhere fast. If I look at the movement in the major currencies over the past month, only NOK (+3.0%) stands out on the back of higher than anticipated inflation readings and growing expectations that the Norges Bank, which did cut rates a few months ago, will soon have the highest interest rates in the G10 after the Fed cuts next week and they remain on hold. As to today’s movement, JPY (-0.35%), NZD (-0.4%) and NOK (-0.3%) are the largest movers, with the EMG seeing even smaller movement than that. Again, it is difficult to find a compelling short-term story here.

On the data front, this morning brings Michigan Sentiment (exp 58.0) and that’s it. No Fed speakers ahead of the meeting next week, so we will be reliant on either the White House making some new, unexpected, announcement, or the dollar will take its cues from the equity markets. It is interesting that the precious metals complex continues to perform well despite the dollar edging higher. To me, that is the biggest story around.

Good luck and good weekend

Adf