With Jay and the Fed finally passed

All eyes are on jobs, at long last

These readings of late

Have all had the trait

Of rising more than the forecast

But now that Chair Powell has said

No rate hikes are likely ahead

If NFP’s hot

While stocks will be bought

Will bond markets trade in the red?

As we are another day removed from the FOMC meeting, perhaps we can get a better sense of what investors believe the future will bring. But the clear dovishness that Powell expressed, while a positive for markets yesterday, will force many to rethink the Fed’s reaction function to data going forward. And there is no single piece of data that garners more reaction than the payroll report. So, let’s start with a look at current median expectations:

| Nonfarm Payrolls | 243K |

| Private Payrolls | 190K |

| Manufacturing Payrolls | 5K |

| Unemployment Rate | 3.8% |

| Average Hourly Earnings | 0.3% (4.0% Y/Y) |

| Average Weekly Hours | 34.4 |

| Participation Rate | 62.7% |

| ISM Services | 52.0 |

Source: tradingeconomics.com

Nine of the past twelve months have resulted in headline numbers higher than the forecast and the recent trend remains for substantial growth. Certainly, there has been limited indication based on this data, that the job market is under significant negative pressure. Clearly, that is one of the keys for the Fed’s maintenance of their higher for longer stance as both inflation and the job market remain hot.

But now that Powell has taken a rate hike off the table, or at least raised the bar dramatically, how will markets respond to a hot number? In the past, another big beat would likely have seen the bond market sell off quickly and equities suffer on the thesis that not only was no rate relief going to be coming anytime soon, but that higher rates could be in the cards. However, most investors appear to have made their peace with the current interest rate framework and if they are no longer concerned about even higher funding costs, a hot number may simply be seen as an indication that profitability is going to continue to improve, and stocks are a raging buy. At the same time, while the long end of the yield curve is likely to suffer somewhat on a big beat, the front end is now anchored by Powell’s comments. In essence, we could easily see the yield curve bear steepen as inflation concerns grow and bond investors reduce duration risk while the front end of the curve remains relatively static.

Of course, despite the recent past, this morning’s data could be soft with a much lower print. In that case, given Powell’s clear dovish bias, I suspect the bond market would rally sharply, as it would really change the calculus on the timing of that first rate cut, and stocks would be flying along with commodities. In fact, the only loser in this scenario would be the dollar.

As it currently stands, the Fed funds futures market is now pricing just a 14% probability of a cut in June and still about 40bps of cuts total for the rest of the year. On a timing basis, September is now the estimated first chance for a cut. But a soft number, anything below 200K I think, is very likely to see that June probability jump substantially. In fact, it would not surprise me if that type of print resulted in a one-third probability of a June cut by the end of the session. Many people really want to see the Fed cut, and so they will push on any chance to drive the narrative.

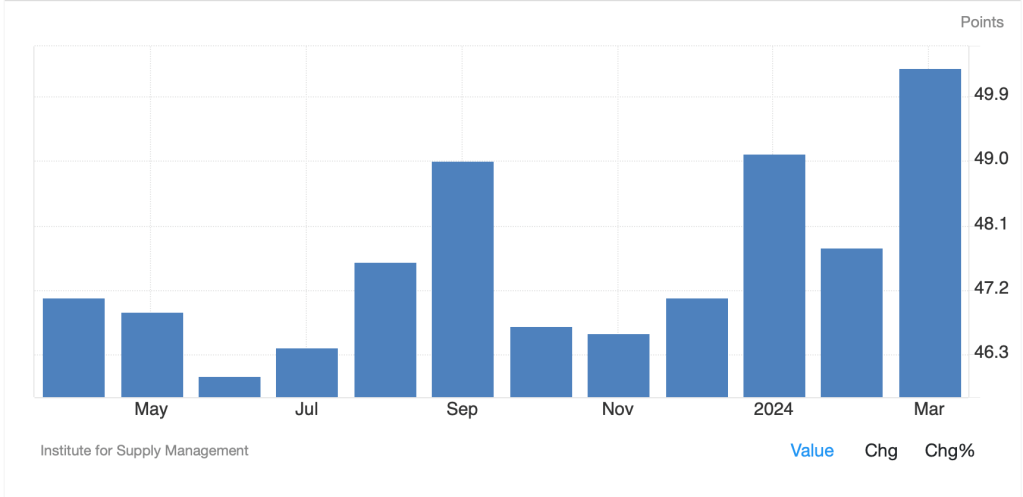

To complete the discussion on the US session, we also see the ISM Services data at 10:00 and included with that will be the prices paid data. That has been an important data point for many analysts when trying to determine the future course of inflation. As can be seen from the chart below, unlike many other inflation readings, this one has the look of a still intact downtrend.

Source: tradingeconomics.com

And finally, we hear from our first Fed speakers post Wednesday’s meeting, with Goolsbee, Williams and Cook all on the calendar. As always, it is a mug’s game to try to guesstimate what this morning’s data is going to be like numerically, but based on the recent overall trend in data, I have a feeling that we are going to continue with strong results, and a continued risk rally.

A quick peak at the overnight session shows that while Japan and China remain closed, there was more green than red in Asia with the Hang Seng (+1.5%) leading the way higher, but gains, too, in Taiwan, Australia, New Zealand and Indonesia. Alas, both South Korea and India were under pressure, so not as universal a positive as might be hoped. In Europe, though, it is unanimous with every market higher, mostly by about 0.5%, clearly following yesterday’s US outcome as there was virtually no data or commentary to note there other than the Norgesbank leaving their base rate on hold as expected. As to US futures this morning, they are higher on the strength of Apple’s positive earnings report, and perhaps more importantly its newest buyback plan of $110 billion this year!

In the bond market, after rates declined yesterday despite data indicating higher prices (Unit Labor Costs +4.7%) along with weaker activity (Productivity 0.3%), it is clear that investors are simply paying attention to the Chairman’s messaging. So, yields fell across the board yesterday, with 2yr yields sliding 8bps while 10yrs fell only 5bps. That is the exact response you would expect given the end of any thoughts of a rate hike. European bond yields fell yesterday as well on the order of 4bps and this morning, everything, Treasuries and European sovereigns, are all seeing yields lower by one more basis point.

In the commodity markets, oil (+0.3%) is edging higher today after a pretty flat day yesterday, although remains more than 5% lower than when the week began. It appears that we have seen substantial position reductions here, but they seem to be finished for now. However, the surprising inventory builds of the past few weeks are likely to keep a lid on the price. Metals markets, too, were benign yesterday although this morning, copper (+1.2%) is showing some life. My take is the investment community here is waiting to get a better sense of the pace of interest rate adjustments (aka cuts) since that is what everybody is assuming. As well, metals prices have rocketed higher over the past several months, so this corrective price action can be no surprise.

Finally, the dollar is a touch softer this morning, arguably on the back of the recent decline in yields. The outlier here continues to be the yen, which is consolidating near 153 now, well below the initial levels seen on Monday that inspired the first wave of intervention. Remember, Japanese markets are closed, so liquidity there is suspect but more importantly, as the narrative adjusts to the idea that US rates will not be rising from here, that reduces substantial pressure on the yen. One other noteworthy mover yesterday was BRL, which rallied 1.5% on the back of an improved economic outlook helping to allay concerns of rate cuts coming soon. Away from those two, though, the overnight session has seen generally modest USD weakness pretty much across the board.

And that’s really all we have for today. As I said before, I expect the data will be above the median forecast based on the fact that has been its recent trend as well as the other solid data we have seen.

Good luck and good weekend

Adf