Inflation is not quite yet dead And that has some thinking the Fed May now have concern That there’ll be no turn And possibly more hikes instead Last week, though, more Fedspeak, we heard And three speakers’ comments sent word That higher long rates Have altered the fates Now they think hikes could be deferred

Before I touch on the markets, I must acknowledge the heinous acts that occurred last weekend in Israel. It is abundantly clear that this will not be ending soon, and it seems likely that it may ultimately have an impact on financial markets. However, this commentary revolves around how global markets move, what new catalysts are driving things and how we might consider all the information when trying to determine the best way to hedge outstanding FX exposures.

So, before we talk about the overnight session, let’s quickly recap my week away. Inflation, in both the guise of PPI and CPI, was a bit hotter than expected which has put a crimp in the Paul Krugman ‘inflation battle is won’ narrative. I am constantly amazed at the disingenuity of analysts explaining that if you ignore food, energy, rent, used cars and any other thing that rose, then inflation is back at the Fed’s target. It is not clear to me if they don’t eat, use energy, or pay for living expenses, but that is simply ridiculous. The consumer confidence data makes clear that folks are extremely unhappy with the current economic situation and too high inflation remains the primary cause. Regardless of the data points, people are feeling it when they buy gas and groceries, or if they go out for dinner, let alone buying other stuff.

I have maintained this is not going to end soon and that 3.5% – 4.0% is going to be the new normal inflation rate. While Daly, Logan and Jefferson all explained that the steepening of the yield curve with long end rates rising more rapidly than short end rates was helping the Fed’s cause, not one of them indicated they were even thinking about thinking about cutting rates. In fact, my money is on at least one more hike, probably in December at this point, and I cannot rule out further hikes in 2024. And folks, higher rates are going to wind up breaking more things. Do not believe the soft-landing narrative, things are going to get worse, almost certainly. Arguably, that sums up last week.

Turning to the overnight session, there was limited new news in the way of data or commentary. Market participants continue to focus on central banks and any potential adjustments in their policies, economic data and clues as to whether the long-anticipated recession is finally coming, and the trajectory of inflation and whether the price of oil is going to have a longer-term impact on that trajectory.

Regarding the first of these issues, in addition to the above-mentioned Fedspeak, the market is anxiously awaiting Chairman Powell’s comments to be made Thursday afternoon just before the Fed’s quiet period begins. While we will hear from ten other Fed speakers over sixteen different venues (!), the reality is that Powell’s words are the most important. However, given the seeming unanimity in the new message about the long end of the curve helping the Fed, I suspect that Powell will touch on that subject as well. To my mind, this is not an indication they are unhappy with the bond market selloff, rather that they are quite comfortable and will not do anything to stop it. That could well give the bond market vigilantes a signal to sell even more aggressively so be prepared.

Last night we did hear from Kanda-san of the MOF who explained that rate hikes are one option when excessive forex moves are seen. Now, that seems a bit of a surprise in that the BOJ is ostensibly the one controlling interest rates, but this shows that the concept of central bank independence is quite tenuous in Japan, and probably in most places. You may recall a few weeks ago when USDJPY touched 150 and immediately reversed and fell 2% in mysterious fashion as no intervention was confirmed. Do not be surprised if we see similar price action at various levels higher in the dollar, although helpfully, there was a comment that the fundamentals (meaning interest rate differentials) were responsible for much of the movement in FX. Nothing has changed my view that USDJPY has higher to go.

On the economic data front, obviously last week’s inflation data had an impact with Treasury yields shaking off their safe-haven bid due to the Israeli-Palastinian conflict and rising again this morning. While they are not yet back at the highest levels seen two weeks ago, I expect we will get back there and move higher still going forward. This week’s Retail Sales data (exp 0.3%, 0.2% ex autos) is the big print and recall, it has been running hotter than expected for a while now. Understand that Retail Sales counts the dollars spent, not the items bought, so rising inflation will drive this number higher even if things aren’t improving. But for now, there is scant evidence that the economy is slowing rapidly, at least based on the headline data we have been seeing for the past months.

Finally, the inflation story is part and parcel of all the discussions. Oil’s rise on the back of the Israeli-Palestinian conflict has been pronounced and this morning it remains some 7% higher than before things started there. There is a growing concern that if the conflict widens, OPEC could consider an embargo of some sort, just like in 1973 in the wake of the Yom Kippur War, which would likely drive oil prices much higher, at least to $150/bbl. Obviously, that would have a dramatic impact on financial markets as well as on our everyday lives. It would also have a dramatic impact on inflationary readings. But the other concern is that despite some of the more Pollyanna-ish narratives about the Fed has already achieved its goals, the reality appears to be that core inflation is simply not falling any further and ultimately, this is going to weigh on equity multiples and earnings as well as further on bond prices. I would contend that inflation remains the primary issue for the foreseeable future.

With all this in mind, a quick look at the overnight session shows that after a mixed session in the US on Friday, Asian equity markets were all lower by at least -1.0%. European bourses, however, have managed to eke out very modest gains, on the order of 0.2% and US futures are currently (7:30) higher by about 0.25%.

Meanwhile, Treasury yields are higher by 9bps this morning and we are seeing yields on European sovereigns all higher by between 4bps and 5bps. Clearly inflation concerns are rampant, as are concerns over continuing increases in supply as every major nation runs a growing budget deficit. Of course, the exception to this rule is Japan, where yields are unchanged on the day and currently sitting at 0.75%, their high point for the past decade, although still well below the current YCC cap of 1.00%.

Turning to commodities, with oil quiet this morning focus is turning to the metals markets where gold (-0.8%) is retracing some of last week’s 5.0% rally as the combination of rising inflation and fear seems to have underpinned the barbarous relic. As to base metals, they are mixed this morning with copper a touch higher and aluminum a touch lower, a perfect metaphor for the confusion on the economic situation.

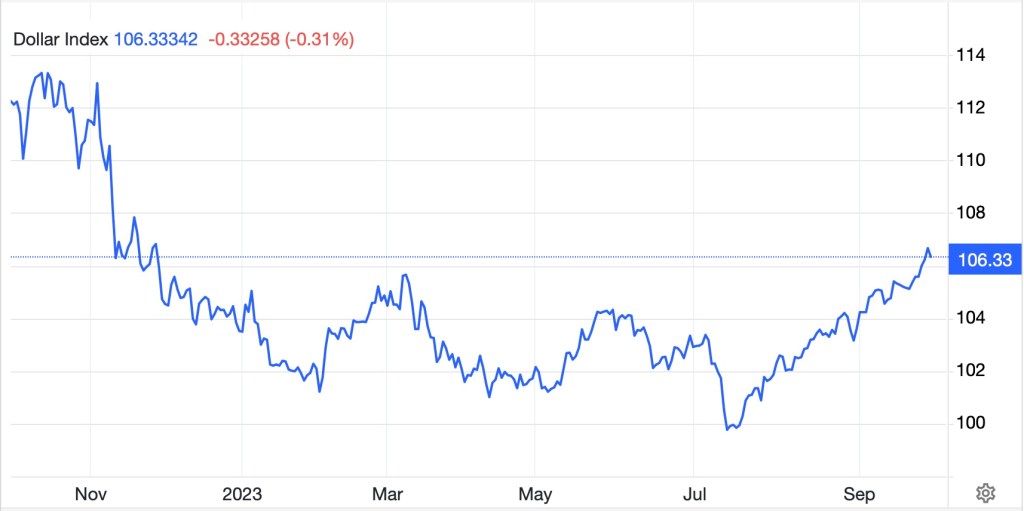

Finally, the dollar is clearly not dead yet. While this morning it is consolidating last week’s gains and has edged lower about 0.15%, last week saw gains in excess of 1% vs. most major counterparts. The dollar, despite all the problems in the US, continues to be the haven of choice for most investors.

On the data front, aside from Retail Sales and the remarkable amount of Fedspeak, we see the following:

| Today | Empire Manufacturing | -7 |

| Tuesday | Retail Sales | 0.3% |

| -ex autos | 0.2% | |

| IP | 0.0% | |

| Capacity Utilization | 79.6% | |

| Wednesday | Housing Starts | 1.38M |

| Building Permits | 1.455M | |

| Thursday | Initial Claims | 213K |

| Continuing Claims | 1707K | |

| Philly Fed | 11.1 | |

| Existing Home Sales | 3.89M |

Source: TradingEconomics.com

For my money, barring something surprising from the Middle East, like an OPEC move, I expect that the market will be entirely focused on Powell’s speech Thursday at noon. We are also at the beginning of earnings season, so we could get some surprises there. However, the big picture remains sticky inflation, massive new supply of Treasuries and higher yields along with a higher dollar overall.

Good luck

Adf