A second rate hike

By Japan has resulted

In strong like bull yen

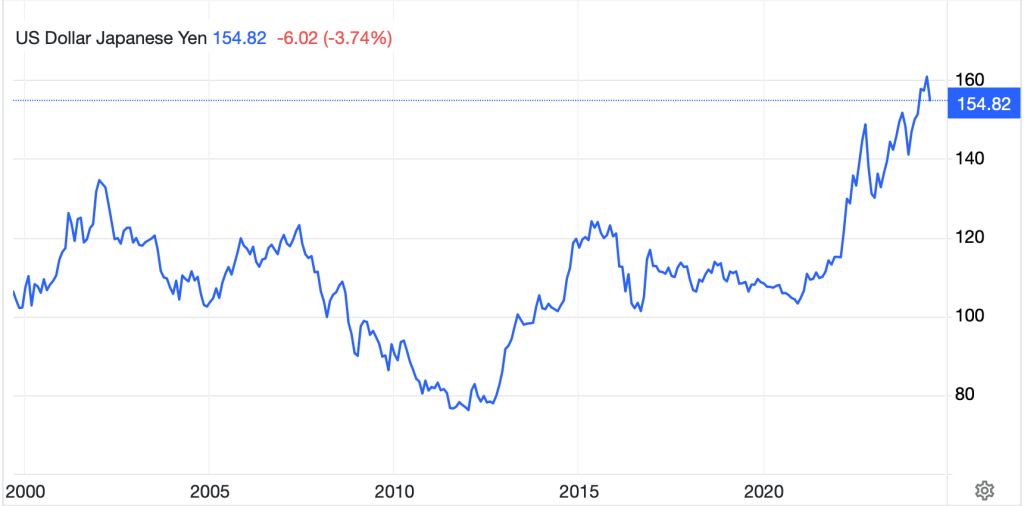

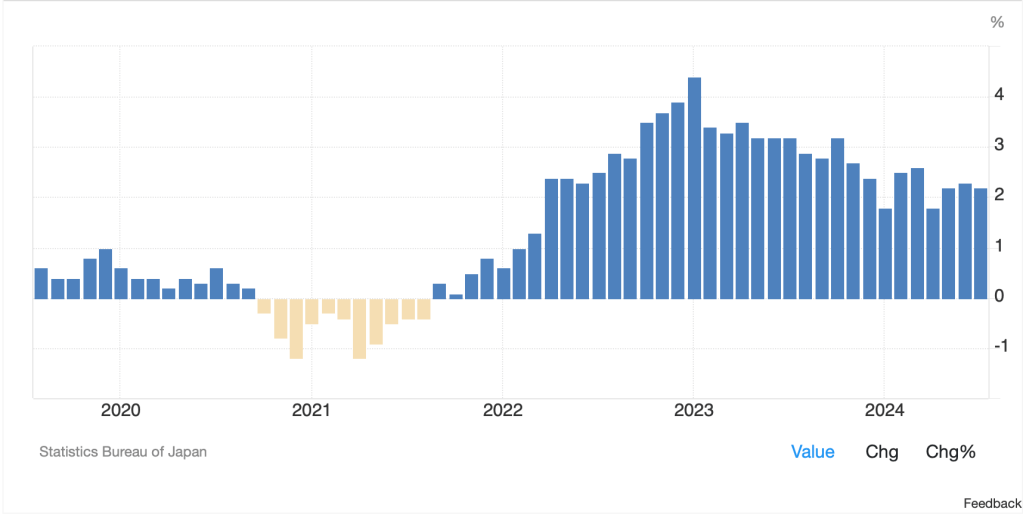

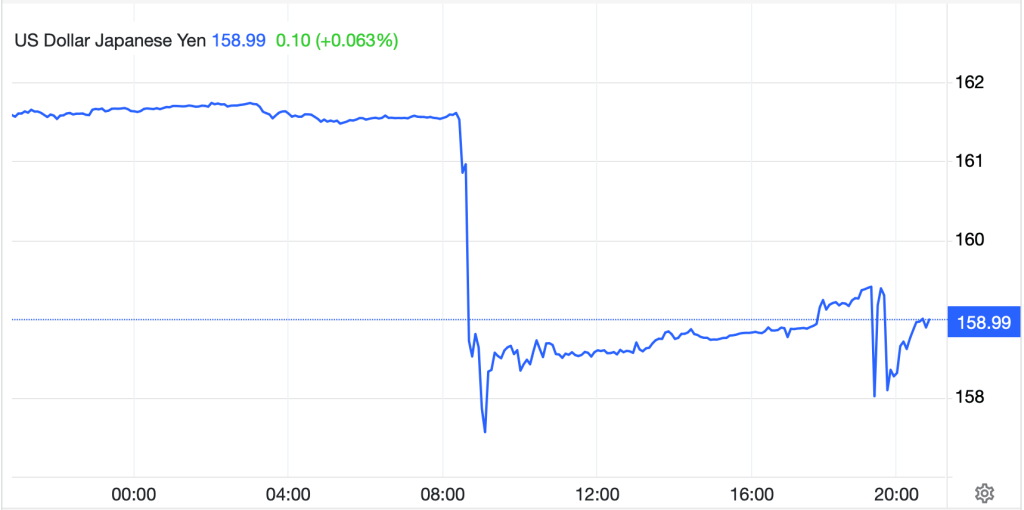

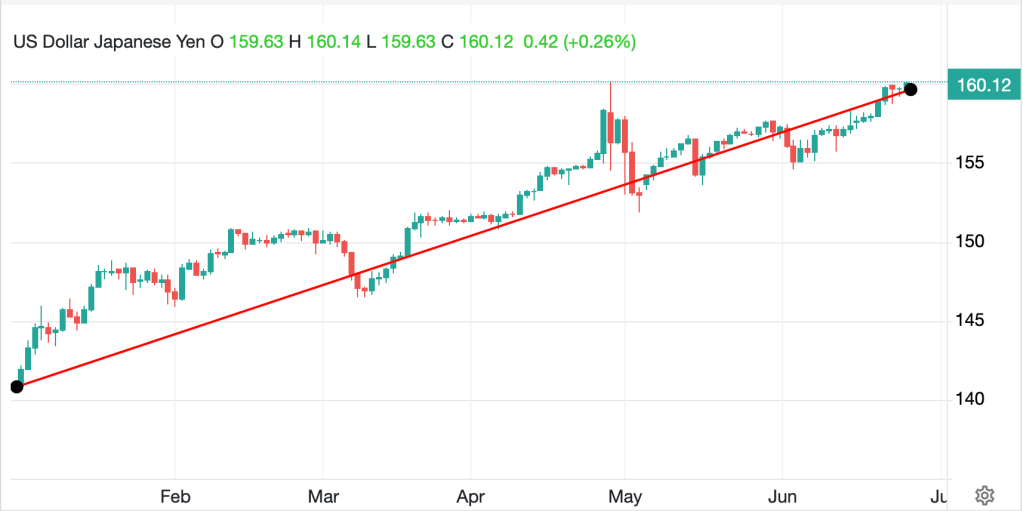

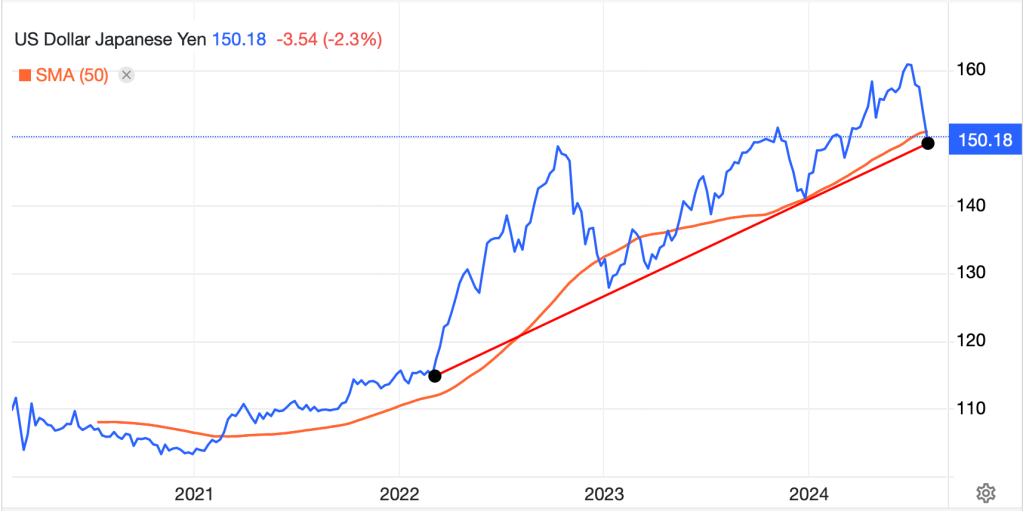

Last night, Governor Kazuo Ueda and the BOJ raised their overnight call rate to 0.25% from the previous level of between 0.00% and 0.10%. This move was forecast by several analysts but was certainly not the base case for most, nor what this poet expected. However, it appears that the gradual slowing in inflation in Japan was not seen as sufficient and so they moved. By far, the biggest reaction came in the FX markets where the yen jumped sharply, now higher by 1.5% compared to yesterday’s NY close. A look at the longer-term chart of USDJPY below shows that at its current level just above 150.00 (obviously a big round number), the currency has reached a double support level based on its 50-week moving average (the curved line) and the trend line that starts from the time the Fed began raising interest rates in March 2022.

Source: tradingeconomics.com

Surprisingly, given the sharp move seen overnight, there has been virtually no discussion as to whether the MOF asked the BOJ to intervene and further push the yen higher (dollar lower) in concert with its recent strategy of pushing a market that is moving in its favor rather than fighting a market that is moving against its goals. Regardless, the 150 level is going to be a very important technical support, and any break below may open up another 10 yen decline in the dollar.

What, you may ask, would lead to such a move? How about the Fed?

The pundits are holding their breath

With “cut Jay” their new shibboleth

But will Chairman Powell

Now throw in the towel

On prices and channel Macbeth?

Of course, this afternoon, the big news is the FOMC meeting wraps up and at 2:00 they release their statement which is followed by the Chairman’s press conference at 2:30. As of this morning, the probability of a cut today is down to 3.1% according to the CME’s futures market. However, that market has a 25bp cut locked in for September with a further 10% probability of a 50bp cut then and is pricing in a total of 66bps of cuts by the December meeting, so, a bit more than a 60% probability of three 25bp cuts by the end of the year. That pricing continues to feel aggressive to this poet as the data has not yet shown that the economy is clearly in trouble. Remember, too, the Fed is always reactive, despite any of their comments on trying to get ahead of the curve.

Continuing our observations of mixed data, yesterday saw that home prices, as per the Case-Shiller Index, remain robust, rising 6.8% in May (this data is always lagging), but there is little indication that the shelter component of the inflation statistics is set to decline sharply. As well, the JOLTs Job Openings data printed at a higher than expected 8.184M, indicating that there is still labor demand out there. Finally, the Consumer Confidence number rose a touch more than expected to 100.3. My point is there continues to be strength in many parts of the economy and prices are nowhere near declining. Granted, this Friday’s NFP report will take on added importance as if the numbers there start to decline and Unemployment continues its recent trend higher, there will be far more urgency to cut rates. Perhaps this morning’s ADP Employment report (exp 150K) will help clear up some things, but I’m not confident that is the case.

Interestingly, there are still a number of analysts who are clamoring for the Fed to cut today, claiming they can get ahead of the curve and stick the soft landing. However, history has shown that the Fed lives its life behind the curve, and there is no indication that is about to change.

There is one other thing to consider, though, and that is the politics of the situation. While the Fed is adamant they are apolitical and only trying to achieve their mandated goals, we all know that in order to even be considered to reach the FOMC as a named member of the committee, one needs to be highly political. Does that mean that partisan politics enters the arena? These days, it is almost impossible for that not to be the case.

The current narrative on this subject is that a rate cut will help the current administration, and by extension the candidacy of VP Harris. I’m not sure I understand that given inflation, which remains a major topic of conversation around the country, especially at the proverbial kitchen table, is so widely hated across the board. The most interesting poll results I saw were that a majority of those questioned indicated they hated inflation far more than a recession. This surprised the economic PhD set, but as inflation is an insidious cancer on everyone’s wellbeing, it is no surprise to this poet. My point is that a rate cut now will do exactly zero to help support growth before the election, but it will almost certainly boost the price of commodities, notably energy and gasoline, and that will show up in inflation post haste. Thus, does the narrative even make sense? If Powell is truly partisan (and I don’t think that is the case), he would refrain from cutting rates until September as any impact, other than in financial markets, will not be felt until long after the election. FWIW, I agree with the market there will be no cut today, but absent a major decline in the employment situation by September, I see only 25bps there.

Ok, a bit too long to start today, but obviously there is much of importance to understand. So, let’s look at how markets have responded to the BOJ while they await the FOMC. As earnings season continues, the tech sector in the US continues to struggle as evidenced by the sharp decline in the NASDAQ yesterday, although the DJIA managed to gain 0.5%. In Asia, though, tech concerns were overwhelmed by the excitement of the BOJ’s action and the strength in the yen. Perhaps the surprising thing is the Nikkei (+1.5%) rose so much given a strong yen generally undermines the index, but the rate hike boosted bank shares by 5% or more across the board. And that strong yen was welcomed everywhere else in Asia with Chinese shares (Hang Seng +2.0%, CSI 300 +2.2%) and almost every regional exchange gaining real ground on the back of a less competitive Japan given the higher yen.

In Europe, most markets are much firmer as well this morning, led by the CAC (+1.4%) and FTSE 100 (+1.4%) although Spain’s IBEX (-1.0%) is lagging on uninspiring corporate earnings results. I would contend these markets are being helped by that stronger yen as well, given Japan’s status as a major exporter. Lastly, US futures are higher at this hour (7:20) after some better-than-expected results from chipmaker AMD, although MSFT’s numbers were less impressive. Net, though, NASDAQ futures are up 1.6% this morning dragging everything else along for the ride.

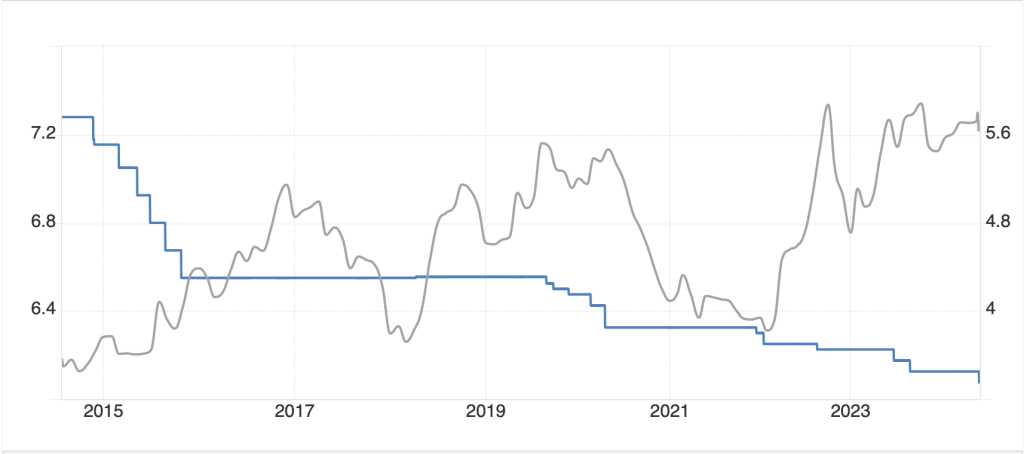

In the bond market, Treasury yields continue to edge lower, down -1bp this morning and European sovereign yields are all lower by between -2bps and-3bps. That is somewhat interesting given the flash Eurozone inflation data printed higher than expected at 2.6% headline, 2.9% core, but the market is clearly going all-in on the rate cutting narrative. The big moves in this market, though, came in Asia with JGB yields jumping 5bps after the rate hike and the BOJ’s announcement they would be reducing their monthly purchases by 50%…OVER THE NEXT TWO YEARS! They are not exactly rushing to tighten policy. However, even more impressive was the -16bp decline in Australian 10yr bond yields after softer than expected inflation data overnight got the market thinking about rate cuts instead of the previous view of rate hikes being the next move.

In the commodity markets, things have really broken out. Oil (+3.5%) is finally paying attention to the escalation of hostilities in the Middle East after Hamas leader Haniyeh was killed while in Iran. While Israel has not officially claimed the act, that is the assumption and concerns are elevated that there will be a more dramatic response impacting many oil producing nations. This has encouraged the rally in precious metals with gold (+0.4%) continuing its rally after a >1% gain yesterday, and support for both silver and copper as well. Frankly, the copper story doesn’t make that much sense given the ongoing lackluster economic growth story, but with the metal’s recent sharp decline, this could simply be a trading bounce.

Finally, the dollar is all over the place this morning. As mentioned above, the yen is today’s big winner, but we have seen strength in CNY (+0.25%) and KRW (+0.85%) as well, with both those currencies directly aided by yen strength. Meanwhile, AUD (-0.5%) has responded to the quickly evolving rate story Down Under and is cementing its position as the worst performing G10 currency in July. Not surprisingly, the commodity linked currencies are having a good day with ZAR (+0.6%) and NOK (+0.5%) both stronger, but after that, the financially linked currencies are not doing very much, so the euro, pound, Loonie and Swiss franc are all only marginally changed on the day.

In addition to the ADP and the FOMC, this morning also brings the Treasury’s QRA, although there is little interest in that report this time around as expectations remain that there will be no major change to the recent mix of debt, i.e., mostly T-bills. We also see Chicago PMI (exp 44.5) and get the EIA oil data, although the latter will have a hard time competing with a pending war in the Middle East.

All told, not only has a lot happened, but there is also room for a lot more to occur before we go home today. Quite frankly, I don’t see anything extraordinary coming from Powell, but the risk, to me, is he is more dovish than required and the dollar falls more broadly while commodity prices rise. Keep your eye on that 150 level in USDJPY, as a break there can really get things moving.

Good luck

Adf