There once was a time in the past

When Vene-zu-ela was cast

As queen of the ball

With Maduro’s fall

But life around Trump moves so fast

He’s already moved to expand

His target to Denmark’s Greenland

The EU’s gone crazy

And called Trump fugazy

While claiming that they’ll take a stand

But really, the Doctrine, Donroe

Explains that the US most grow

Its regional strength

And keep at arm’s length

It’s foes from Beijing to Moscow

It is truly difficult to keep up with all the things that are ongoing in the world these days as so much is happening so quickly. It is very easy to understand Lenin’s quote, “there are decades where nothing happens; and there are weeks where decades happen” given recent events. This is clearly one of the latter weeks.

So, Trump, after successfully taking down Maduro has turned his sights on Greenland, something he has discussed from Day 1 of this administration, but apparently now, there seems to be a willingness to discuss things on the other side. At the same time, from what I read on X, the city of Abadan in Iran has basically ‘fallen’, at least with respect to the Iranian regime’s control as the police are marching with the protestors now. The rumors are that the Ayatollah has already made escape plans to Moscow.

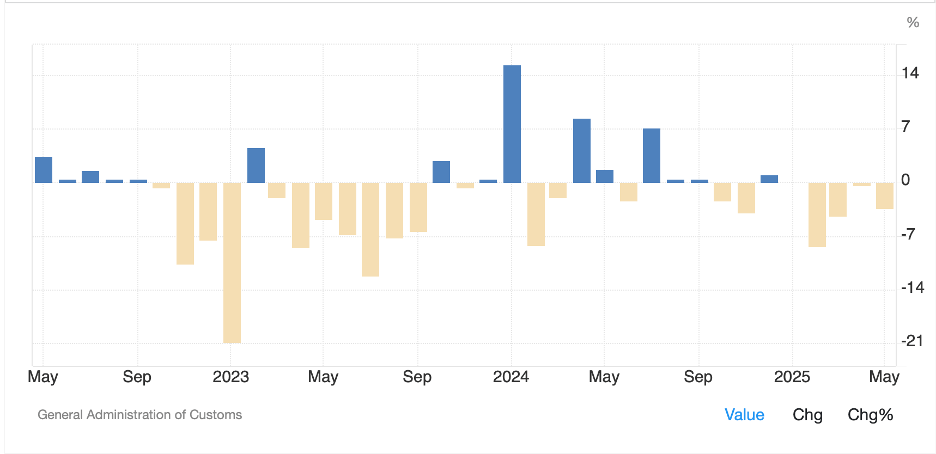

From a geopolitical perspective, if Iran sees a regime change, which appears increasingly likely, and if the US throws its support behind the replacement regime, it would appear to be a significant power play against China. After all, if sanctioned Iranian and Venezuelan oil was no longer being sold on the cheap to China, two places where they receive a significant amount of their daily requirements, (between 20% – 25% according to Grok) it would be a major blow.

But from our lens in markets, if the Iranian regime falls and sanctions are lifted, suddenly there is much more unsanctioned oil available, and its price is likely to decline further. This morning, oil (-0.6%) is slipping further after a sharp decline yesterday with Monday’s rally a wispy memory. I have maintained the trend here remains lower, and that was without government changes in sanctioned nations. As you can see from the chart below, nothing about this story has changed.

Source: tradingeconomics.com

In the meantime, be prepared for all those who had just shown their new bona fides about Venezuela to be explaining the Greenland story from their newly acquired “deep” knowledge. This poet certainly doesn’t know enough about Greenland to make any prognostications, but it would not surprise me if within a matter of weeks, we reach an accord with the territory where the US plays a much greater role in its activities while increasing its military presence on the island.

And to think, we are just finishing the first week of 2026. Do not be surprised if, as the year progresses, there are more government changes in Europe as the current leadership there has been shown to be weak and ineffective, and an increasing number of people are unhappy with the situation. While fears over the fall of NATO are rife now, if Germany, France and the UK wind up having snap elections, a distinct possibility at this point, and the new regimes are AfD, RN and Reform UK led, there could well be much greater agreement on the way forward for the alliance.

However, like most of you, I am neither a politician nor geopolitical analyst, I’m just a poet who watches the world and tries to make sense of how it impacts markets. So, let’s go down that road.

After another strong equity session in the US, where both the DJIA and S&P 500 made new all-time highs, the story in Asia seemed to be one of some early profit-taking after strong rallies. So, Japan (-1.1%), China (-0.3%) and HK (-0.9%) all slipped during the session with generally less excitement seen overnight than earlier in the week. India (-0.1%) continues to lag, and while Korea (+0.6%) managed to maintain its upward momentum, the rest of the region was relegated to +/- 0.4% or less in their movement.

As to Europe, only the DAX (+0.6%) is showing any positivity this morning, mostly on defense names still performing well, while the UK (-0.6%) is lagging after weaker than expected Construction PMI data (40.1 vs. 42.5 exp) and the rest of the continental bourses are little changed overall. Eurozone inflation was confirmed at 2.0%, cementing the idea that the ECB will remain on hold, so I suspect opportunities here will rely on global trends. As to US futures, at this hour (7:10) they are mixed, but with movement less than 0.2% in either direction.

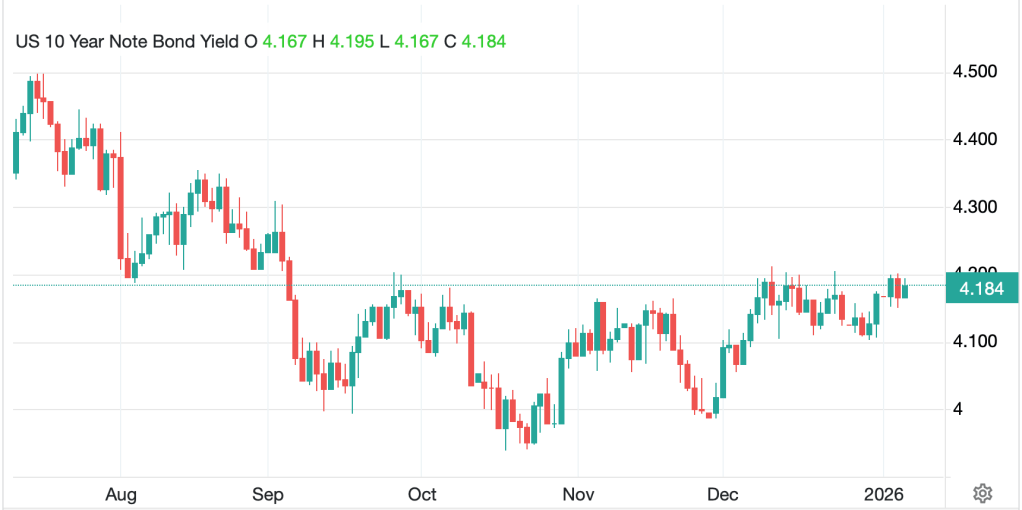

In the bond market, yields are sliding around the world, perhaps on the understanding that oil prices are likely to slide given the potential for new, unsanctioned supply hitting the market. Certainly, there is no indication that government spending anywhere in the world is going to slow down, so that avenue is still closed. But, recapping, Treasury yields (-3bps) are not declining as much as most of Europe (-4bps to -5bps) or the UK (-8bps after the weak data). I continue to believe that this year is going to be extremely dull in bond land as central bank support is going to offset additional issuance.

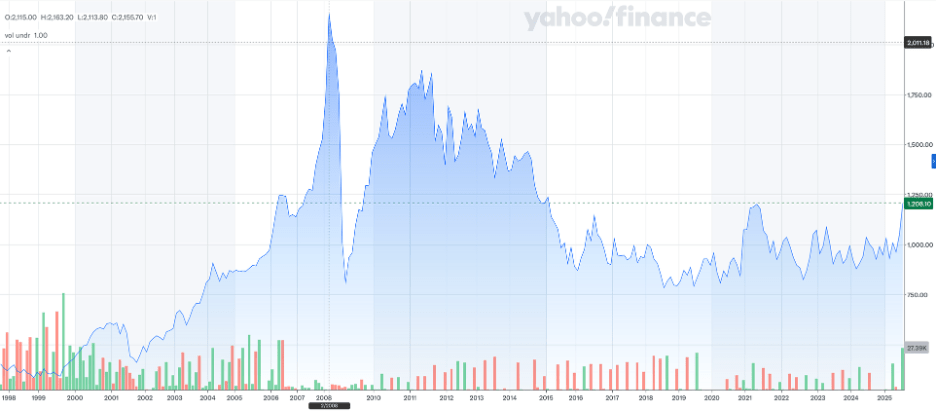

We’ve already discussed oil, but metals, which is where the real action has been, are all lower this morning, very clearly on profit taking activity. Consider that gold (chart below from tradingeconomics.com) has been the least remarkable and still rallied 4% since the beginning of the year, so slipping -1.2% this morning can be no surprise.

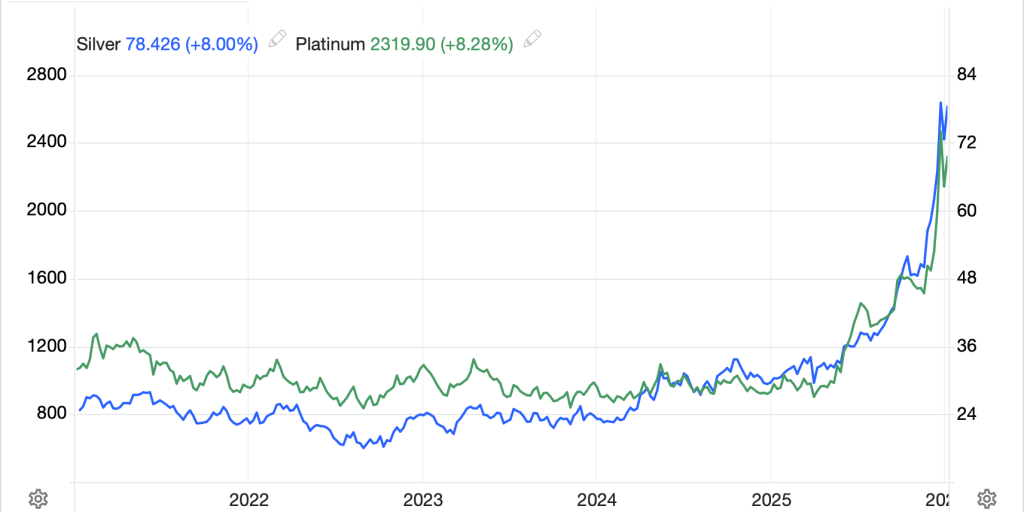

Meanwhile platinum (-6.1%) which is the least liquid of all the precious metals, saw a nearly 20% gain this week prior to today’s decline. The chart below is not for the faint of heart!

Source: tradingeconmics.com

Silver (-3.1%) is somewhere in between these two, but the story has not changed at all. There continues to be significant demand for physical metals with paper futures no longer able to control the price action. One way to follow this is to look at the price on the Shanghai Futures Exchange where it is all delivery settlement and where the price trades at a substantial premium to the COMEX, on the order of $3-$4/oz.

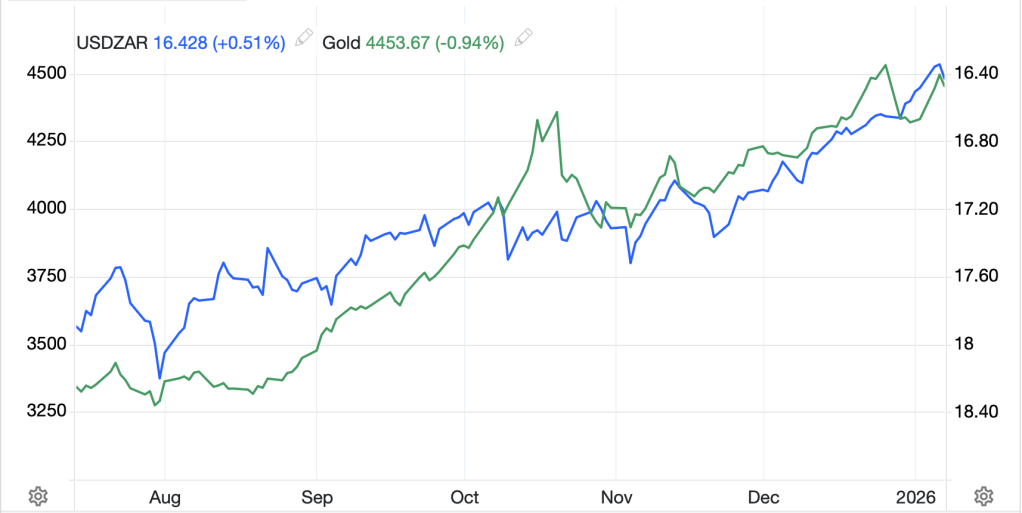

Finally, the dollar is still there, and vs. most of its counterparts, doing very little this morning. the outlier today is ZAR (-0.5%) which is obviously hurting on the back of gold and platinum’s weakness. In fact, it is worth looking at the relationship between ZAR and gold, as per the below chart, to help you understand just how closely tied is the price action between the two.

The other currency that has been trending steadily is CNY, with it breaching the 7.00 level at the end of 2025 for the first time since September 2024. While this trend has been steady for the past year, a look at the longer-term chart shows the renminbi is nowhere near an extreme in either direction.

Source: tradingeconomics.com

I maintain my view that if China really does create domestic demand for its products, the renminbi will continue this rally and strengthen further. But we have heard this same story of Chinese government support for the domestic economy for at least a decade, and it hasn’t shown up yet.

On the data front, ADP Employment (exp 47K), JOLTs Job Openings (7.6M), ISM Services (52.3) and Factory Orders (-1.2%, -0.3% ex Transport) are the key releases this morning. we also get EIA oil inventory data with expectations for a decent build. There is only one Fed speaker, Governor Bowman, but the Fed just doesn’t seem as important this year as last.

The dollar is not the focus right now, neither are bonds. Metals remain top of mind with oil a close second. While recent price action in the former has been extremely volatile, nothing has changed my view that the long-term trend remains higher there. Similarly for oil, the long-term trend remains lower with recent events simply adding to the weight.

Good luck

Adf