In DC, they’re starting to fret

That Trump will make good on his threat

If government closes

The risk that it poses

Is markets become quite upset

There is yet another budget showdown in Washington as the Biden administration never passed the bills necessary to fund the government for the rest of this fiscal year ending on September 30th. The previous continuing resolution (CR) expires at midnight on Saturday and if a new funding law is not enacted, then a government “shutdown” occurs. Now, a government shutdown is not like a company that runs out of money shutting down. Rather roles the President deems essential continue to operate, along with the military, but other roles see the people furloughed until new legislation is passed. Everybody gets paid back wages when things go back to normal.

The situation is that the House of Representatives did pass a CR to fund the government at almost the exact same levels as last year and sent it to the Senate. However, in the Senate, it needs to beat a filibuster, so needs 60 votes to pass and get to President Trump’s desk. However, last night, Senate Minority Leader Shumer declared the Democrats would not support the bill, so would rather have the government shut down. This is a big change from the previous 3 times that there were government shutdowns, because each of those was blamed on Republican intransigence.

In the end, whatever the politics, the market impact has been negative for stocks while bonds held up, even rallied. Of course, previous shutdowns all were amidst very different economic environments as inflation was quiescent and bull markets in both stocks and bonds were extant. As such, arguably, the momentum behind the market was sufficient to offset any concern over the shutdown. But this time markets are already under pressure going into the potential shutdown. I fear that market dislocation, at least in the equity markets, could be far more severe if this one occurs. Something to keep in mind.

The history shows the US

Has long done all things to excess

But now, as they try

With less, to get by

The pundits complain of regress

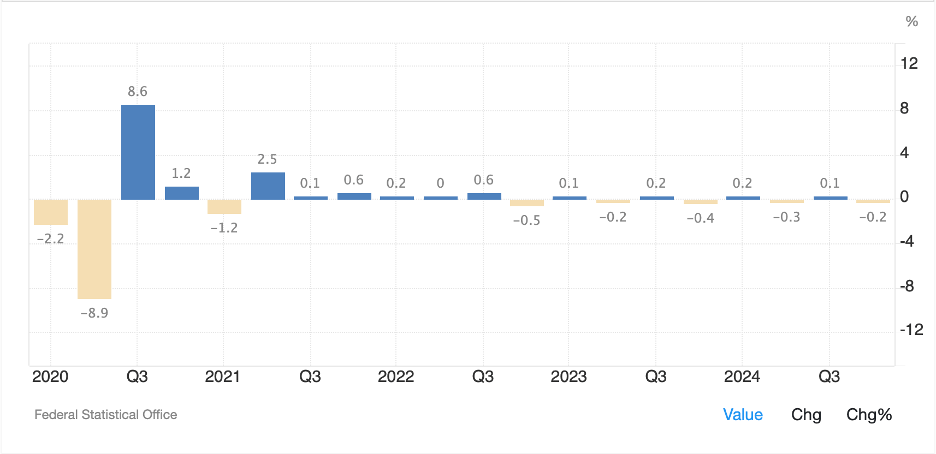

Reading the WSJ this morning, I couldn’t help but think of the George Costanza opposite day episode of Seinfeld when reading the Heard on the Street column decrying the fact that the Trump administration is seeking to rein in fiscal excess. Of course, this is an issue that has been fodder for the punditry for a long time, how the US was living beyond its means and borrowing too much money. But now, this article is concerned about the opposite. The key concern is that if the US government doesn’t continue to run massive deficits, the economy will slow and corporate profits will fall dramatically, resulting in falling equity prices.

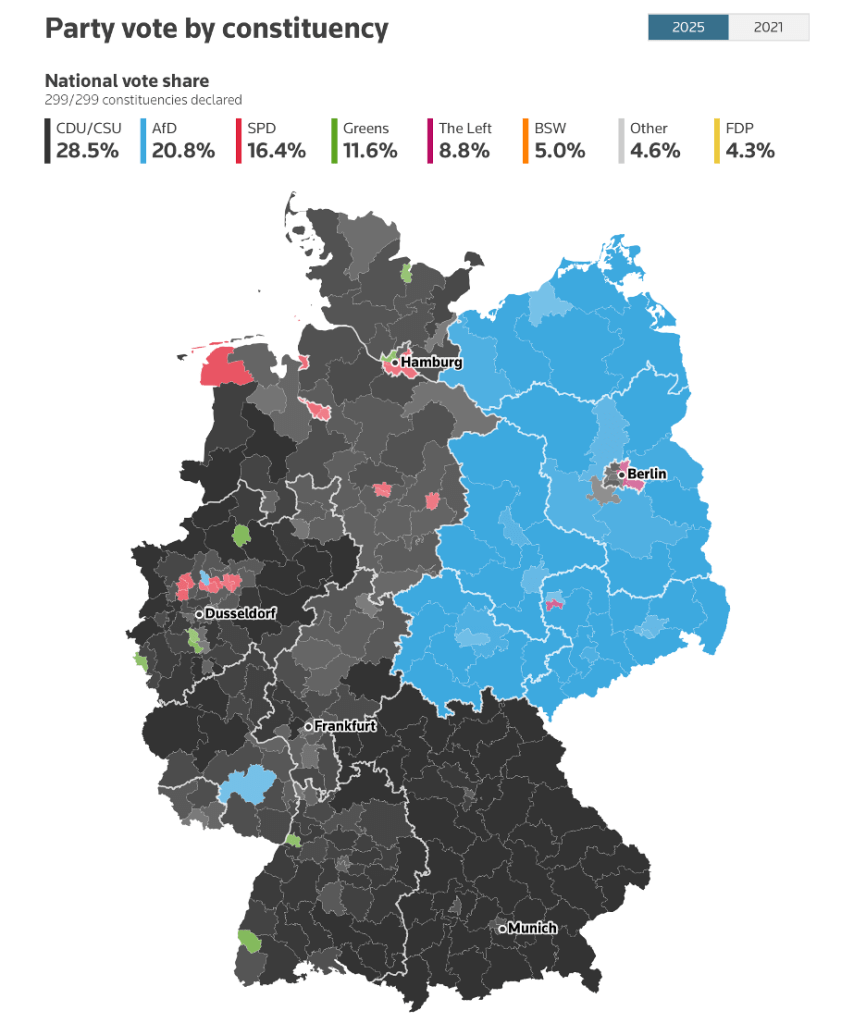

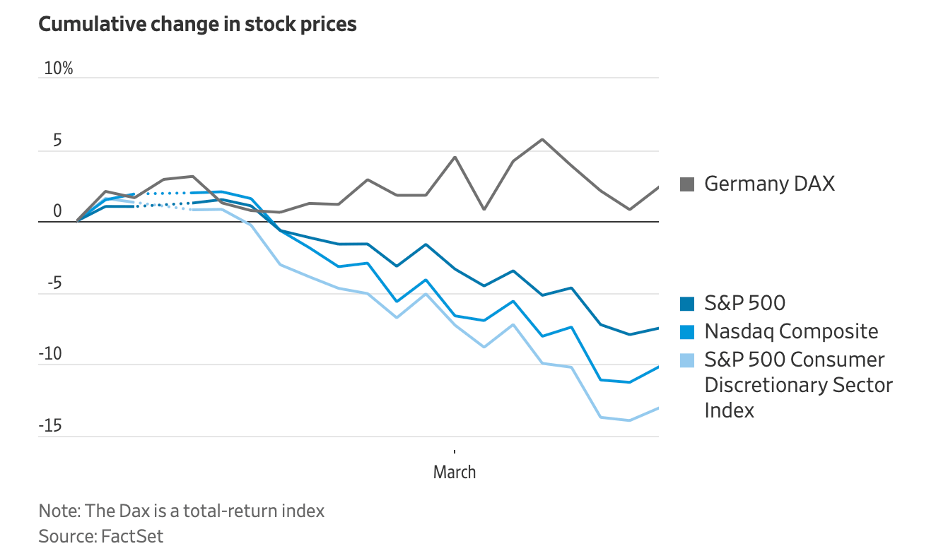

Arguably, this would always be the case if a change of this nature were to be made. And remember, the punditry was all in on making these changes. However, now, they point to Germany and the DAX, which has outperformed US markets over the past several weeks as the model. (chart below from WSJ)

And what is Germany doing so well? Why, they are talking about borrowing an extra €500 billion, eliminating their debt brake that ensures budget deficits remain below 0.35% of GDP, and funding a huge buildup in defense spending. Germany, which has long been seen as the only source of fiscal rectitude is now being lionized for getting rid of that trait. As I said, opposite day!

The lesson, if you haven’t learned it yet, is that the ascendance of Donald Trump to the presidency is going to continuously change many long-held beliefs in governments around the world, as well as in the punditry, who may find that things which seemed great in theory may have consequences previously unconsidered. From a market perspective, this means volatility will continue to be the best estimate for the future.

Ok, let’s turn our attention to markets and see how things performed overnight. After yesterday’s mixed session in the US, where the DJIA could not manage a gain despite cooler than expected CPI readings, overnight saw a mixed picture as well. Japan was either side of unchanged while both Hong Kong (-0.6%) and China (-0.4%) slipped as did most other Asian markets with Malaysia (+1.7%) the true exception. In Europe, though, screens are green as excess government spending is rewarded, although the gains are modest, 0.3% or so.

On the topic of excess spending regarding Germany, I read yesterday that the plan to alter the constitution may have serious problems (meaning that spending may not materialize) because about 50 Bundestag members in the old parliament lost their seats in the election, so it is not clear they will be willing to vote to overturn the constitution during the current lame duck session and allow the debt brake to be set aside for defense purposes. As I said when the story first arose, we are still a long way from Germany paying their own way defensively. US futures, meanwhile, are slightly softer at this hour (7:15).

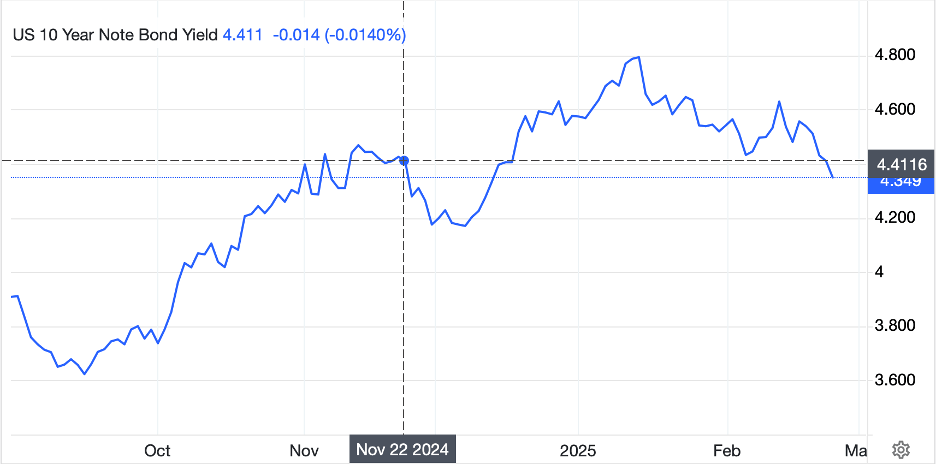

In the bond market, yesterday saw yields climb a few bps and this morning those trends remain with Treasury yields (+2bps) not climbing as much as European sovereigns (+3bps to 4bps) as there appears to still be a level of confidence that all the extra defense spending will happen. One story that should have Europeans concerned is that the European Commission, in their effort to find funding for their newly found defensive aggressiveness, have spied the €10 trillion in savings that European citizens hold. Frau von der Leyen, the European Commission President was quoted as saying, ”we’ll turn private savings into much needed investment.”

Call me crazy but my economics classes taught me the identity that Savings º Investment, so I am not sure why those savings aren’t already being invested. Perhaps European citizens are not investing where Frau von der Leyen wants and that is the problem. At any rate, I suppose even if Germany fails to overcome its constitutional debt brake, the EU will get there anyway.

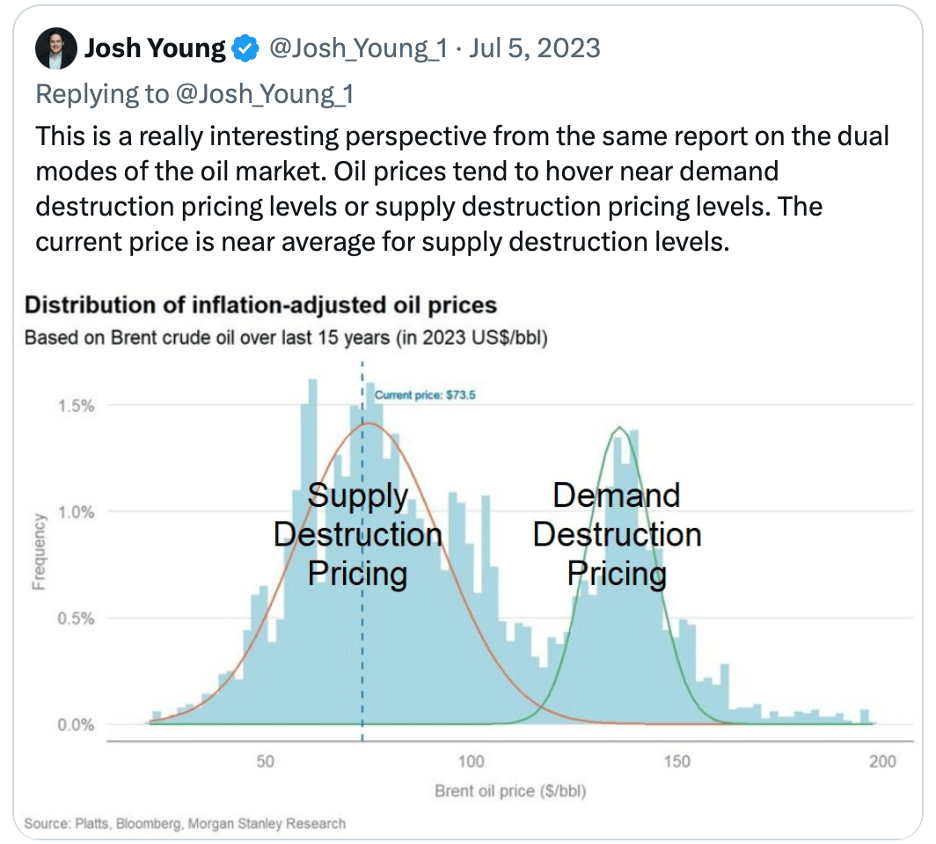

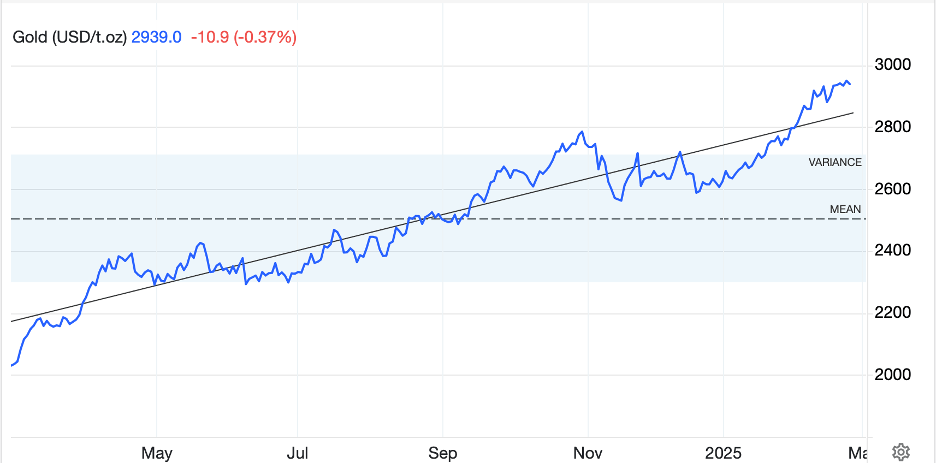

In the commodity markets, oil (-0.3%) is edging lower after a nice run for the past several days as it bounced off the bottom of its trading range. Yesterday’s EIA data showed a large draw in gasoline, but I am given to understand that is a seasonal thing (H/T Alyosha). Meanwhile, nothing has dissuaded investors that gold (+0.25%) is a good thing to hold as it rallied further after yesterday’s gains, although both silver (-0.3%) and copper (-0.4%) are a touch softer this morning.

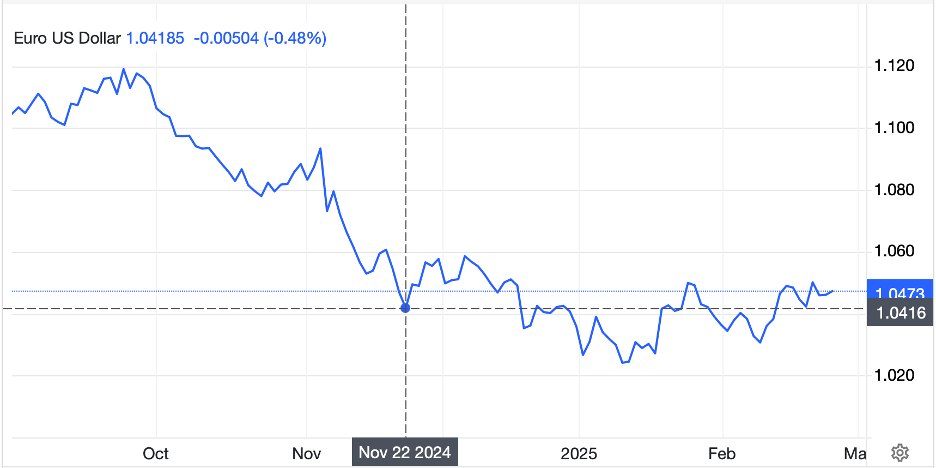

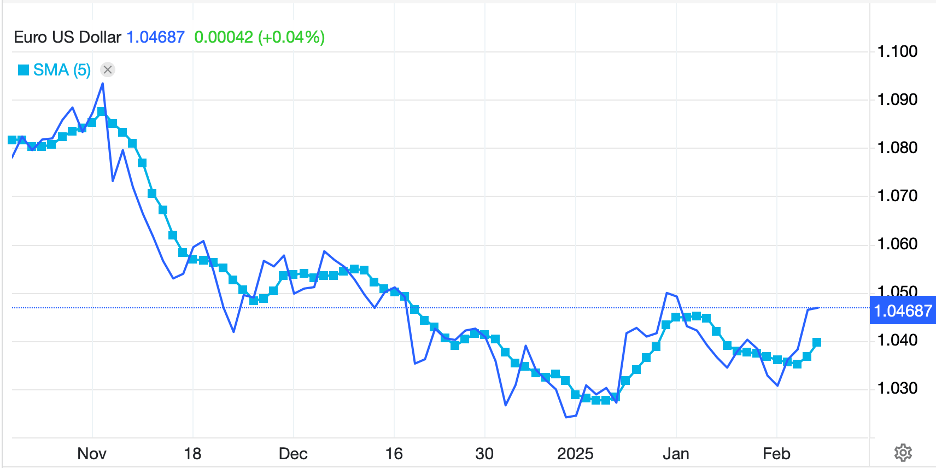

Finally, the dollar is somewhat firmer this morning, albeit not dramatically so. Of course, it has been under significant pressure during the past week+, so this trading response ought be no surprise. SEK (-0.8%) is the laggard in the G10, but you must remember that it has been the leading gainer over the past month. Meanwhile, AUD (-0.5%) and NZD (-0.45%) are also under a bit of pressure this morning, but the rest of this bloc has seen far less movement. In the emerging markets, HUF (-0.6%) is the laggard with the rest of the bloc seeing declines on the order of -0.3% or less. As I said, nothing dramatic here to see.

Yes, yesterday’s CPI data was a bit cooler than anticipated, but as my friend The Inflation Guy™, Mike Ashton, explained here, I wouldn’t get too excited that inflation is collapsing back to the Fed’s 2% target. This morning brings the weekly Initial (exp 225K) and Continuing (1900K) Claims data as well as PPI (headline 0.3%, 3.3% Y/Y; core 0.3%, 3.5% Y/Y). However, given CPI is already out, I don’t think it will have much impact. Rather, as we have observed lately, politics remains the key driver of all market reactions. The unfolding government shutdown in the US and the German debt drama are the two most noteworthy issues right now, but Ukraine and the Middle East are still out there to offer surprises.

Once again, volatility is the only thing about which we can be sure. That said, my confidence is growing that the dollar will decline over time.

Good luck

Adf