The widow maker

Looks like it is about to

Make some more widows

For those unacquainted with the term as it relates to the financial markets, the widow maker trade has been going short JGB’s and buying JPY under the assumption that at some point, the BOJ would normalize monetary policy. Lately, this trade has been reinvigorated in a major way on the back of the belief that Ueda-san is going to raise the base rate from its current level of -0.10%. Granted, 10-year JGB yields have risen about 35bps since last summer, which given their starting level of 0.35%, is quite a bit. Simultaneously, the yen weakened dramatically, falling more than 8% over the same timeframe. An unstated, but critical, underlying part of the idea was that the Japanese economy was chugging along nicely and would continue to do so. This would pressure wages higher and force the BOJ to join the rest of the world in raising interest rates.

But a funny thing happened to those plans last night when the Japanese government released its latest GDP data showing that Q4 GDP fell -0.1% Q/Q, far below the expected +0.3% gain. This, when combined with Q3’s revised decline of -0.8% Q/Q (also worse than before) is the very definition of a recession. Hence, the problem for all those traders who are short JGB’s and long the yen. If Japan is in recession, it seems highly unlikely that Ueda-san is going to be tightening monetary policy in the near-term. Rather, I would expect more fiscal and monetary stimulus which ought to result in lower yields and a still weaker yen. And this is why the trade is nicknamed the widow maker. It has fooled traders for some 30 years so far, and many have lost fortunes on its back.

One other quirk of this outcome is that Japan, heretofore the world’s third largest economy, has now slipped into fourth place behind Germany. Part of this outcome is due to the fact that the weak yen has altered the calculations such that a given yen amount is worth many fewer dollars. Relatively speaking, the euro has not fallen nearly as much, hence the switch in the rankings. Should the yen regain even a quarter of its losses over the past two years, the two economies are likely to switch back to their old places.

In Europe and in the UK

The story is growth’s gone away

Recession is nigh

And if you ask why

It’s policy blunders at play

It was not just the Japanese who have fallen into a technical recession, the UK has also managed the trick as Q4 GDP data released this morning showed Q/Q growth of -0.3%, which when following Q3’s -0.1% leaves us with two consecutive quarters of negative GDP growth, the same definition of a recession. In fairness, the Eurozone managed to skirt recession, but is there for all intents and purposes. Yesterday, they released their data which showed that Q4 GDP growth was a resounding 0.0% following Q3’s -0.1%, so not a recession, by definition, but certainly a lousy performance.

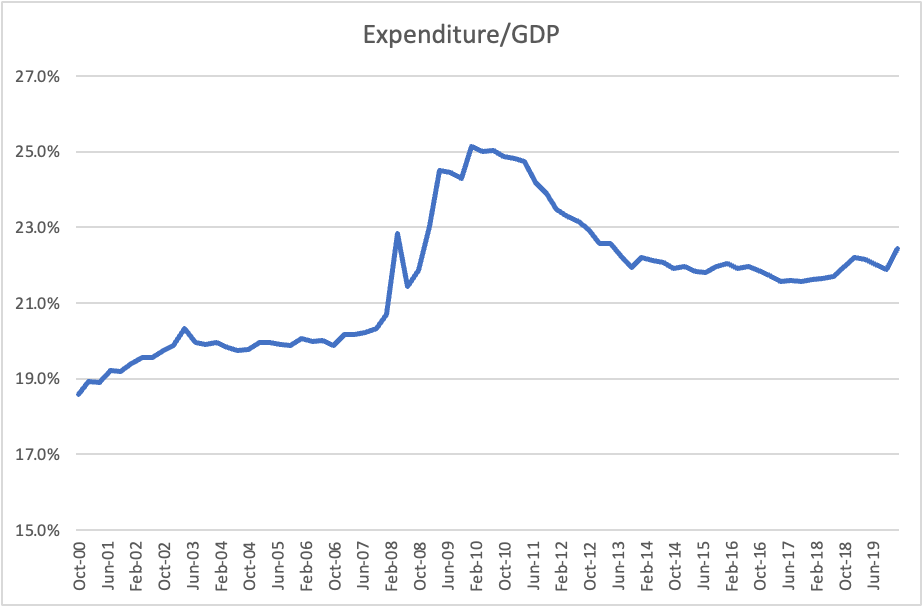

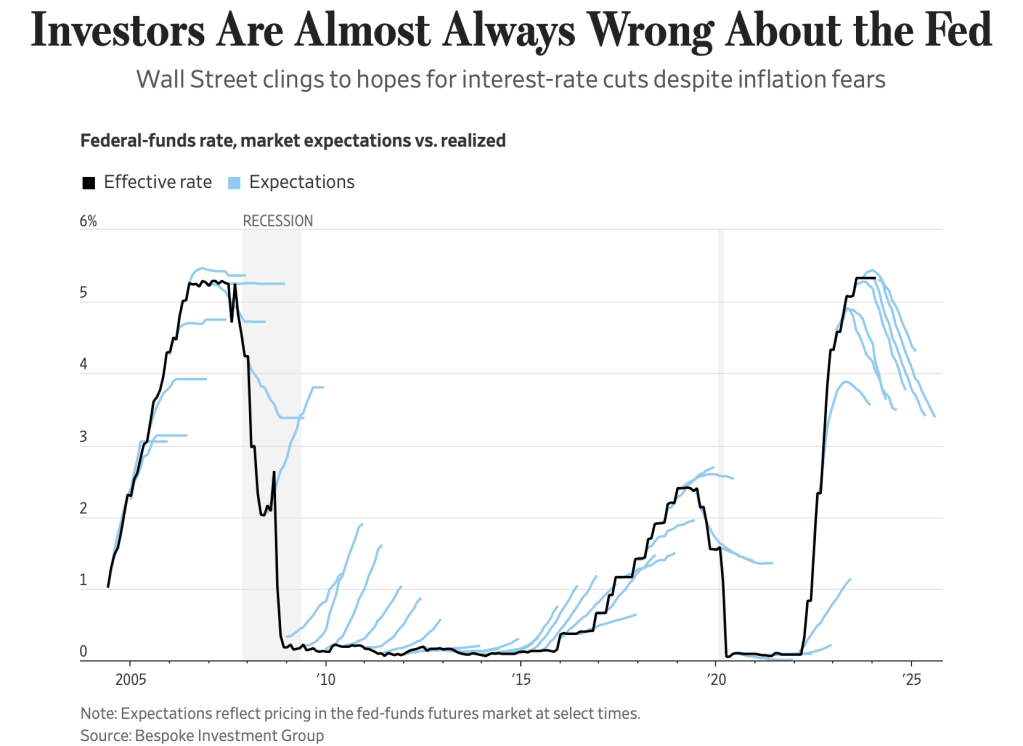

I highlight these outcomes to contrast them with the data from the US, which has shown massive GDP prints over Q3 and Q4 of 1.2% and 0.8% respectively. Now, we have discussed that a key part of this growth is the extraordinary amount of deficit spending that is currently ongoing in the US, far more than anywhere in Europe. But from a monetary policy perspective, it is much easier for the Fed to maintain its current policy stance than it is for either the BOE or the ECB. It is for this reason that I believe we will see continued changes in market pricing for monetary policy easing going forward. I expect that Fed funds futures will continue to reduce the number of cuts as well as push out the timing of the first cut while in both the Eurozone and the UK, we start to see pricing that indicates a cut before the US.

As this process plays out, the impact on financial markets will be significant. Regarding the FX market, this will underpin further strength in the dollar overall. Although it is certainly possible, if not likely, that the BOJ intervenes to prevent, or at least slow down, further weakness in the yen, there will be no such action by the other two banks. Regarding bond markets, much will depend on the timing of the first cuts and the status of inflation. If the pain of economic weakness rises enough to offset the pain of inflation, and cuts come before inflation is under control, look for much steeper yield curves and higher back-end yields. However, if inflation really does decline as currently wished for projected by all these central banks, then look for those curves to bull steepen, with the front end of the curve rallying and the back remaining fairly static. After all, 4% or less for 10-year yields does not seem in appropriate in a 2%-3% inflation world.

Summing it all up, there are many potential paths forward, and as has been the case since 2022, inflation remains the number one driver of everything.

Ok, let’s tour markets quickly. The dip was bought in the US yesterday with decent rebounds in all the major indices. That was followed by further solid gains in Japan (Nikkei +1.2%) and continuing to make new highs for the run, with most of Asia following suit. In Europe, equities are doing pretty well, with gains on the order of +0.75% except in the UK which is flat on the day after the weaker GDP data. As to US futures, at this hour (7:30) they are very slightly firmer, 0.2% across the board.

Bond markets are continuing to rebound from Tuesday’s dramatic declines with yields slipping back further this morning. Treasury yields are lower by 4bps, and now approaching 4.20% from the high side with many traders expecting that level to be technical support. European sovereigns are all seeing yields decline either 2bps or 3bps this morning and overnight we saw JGB yields slip 2bps. Of more note were the moves in Australia (-13bps) and New Zealand (-14bps) after Australian employment data came in a bit soft (Unemployment Rate up to 4.1%) so thoughts of RBA tightening have faded a bit.

Oil prices are continuing yesterday’s slide, -0.7%, after inventory data printed much higher than expected on the back of record US oil production. Meanwhile, metals prices are mixed with gold edging higher on the softer rates story but copper and aluminum giving opposite signals as the former is higher and the latter lower by about 0.6% each.

Finally, the dollar is a touch softer this morning as US yields drift lower. Thus far, it has not returned below key perceived levels with USDJPY still above 150 and the DXY still above 104, but I suspect that if risk appetite continues to reassert itself, the dollar may slide further. The greenback’s movement have been extremely closely tied to 10-year yields of late.

On the data front, we see a bunch of things this morning led by Retail Sales (exp -0.1%, +0.2% ex-autos), Initial Claims (220K), Continuing Claims (1880K), Empire State Manufacturing (-15.0), and Philly Fed (-8.0) all at 8:30. Later on we see IP (0.3%) and Capacity Utilization (78.8%). In addition, we hear from Governor Waller at 1:15 this afternoon, so it will be very interesting to get his take on how the recent data is going to impact the FOMC. There have been no substantive changes in the futures pricing for Fed funds with still less than a 50% probability of a cut in May.

Risk markets were clearly shaken by the CPI data on Tuesday. More hot data today will further impact those assets negatively in my view. In fact, this will continue as long as the market is going to trade on interest rate expectations. At some point, if economic activity manages to continue strongly, it is likely to turn into a positive catalyst for risk assets, but we are not there yet.

Good luck

Adf