In NY, the jury has spoken

And folks who run risk have awoken

Now looking ahead

Investors may dread

That property rights have been broken

For markets, what this may entail

Is loss of the ocular veil

The full faith and credit

Of Treasury debit

Just might not be seen as so hale

If you have suffered through my daily writings long enough, at least past the poetry up front, you have probably surmised that my views are in accord with free markets and capitalism. In addition, regardless of the political insanity that continues to top headlines in every publication in the US, and across much of the world, I only try to touch on it if I believe it is going to have an impact on market behavior, whether short or long term. For instance, during the runup to Brexit, I focused on the issue because I felt certain the outcome would impact the value of the pound as well as UK interest rates and equity markets.

Well, I might argue that another Rubicon has been crossed in the US, and one that I fear may have negative long-term implications for US assets of all stripes. The guilty verdicts that were announced yesterday afternoon against former President Donald Trump are a new, and very disturbing outcome. Whatever your view of the man, and whether you would like to see him be re-elected or not, the idea that a sitting government in the US would throw all its effort into imprisoning its major opponent seems far more akin to the actions of dictators like Vladimir Putin, Nicolas Maduro and Xi Jinping. And yet here we are today with that being the biggest story in the world.

What, you may ask, is the market angle here? Consider the other thing that has happened during this administration with respect to the Russian central bank’s reserve assets at the time of Russia’s invasion of Ukraine in the winter of 2022. While freezing them was the first step, recent comments by Treasury secretary Yellen and her compatriots in the G7 indicate that they are going to start to confiscate those assets and give them to Ukraine to help them fight the war against Russia. Irony aside, the bigger picture, which has been discussed numerous times since the initial action, is that the move calls into question the safety of foreign government assets held in the US and other G7 nations, especially those held in the most liquid, and ostensibly safest, debt instruments in the world, US Treasury securities. If other nations begin to worry that the full faith and credit concept has a political angle, rather than purely a financial one, it will change asset allocations all over the world.

We have seen this already as China and Russia have been transacting between themselves in CNY, and we have seen India seek to pay Russia in rupees for the oil they have been buying. Saudi Arabia has also been willing to accept CNY for oil sales in a major change to agreements made back in the 1970’s between the US and the Kingdom. Of course, this has been the genesis of all the talk of the end of the dollar and dollar hegemony, and the idea that an alternative reserve currency will soon be coming to fruition.

Let me give you my take, at least at this early stage. The connection between the Trump verdict and the Russian reserves is that arguably the bedrock of the US economy and one of the fundamental keys to its long-term success has been the knowledge, by friend and foe alike, that the rule of law is deeply imbedded into all business dealings here. We know that other nations can be capricious and confiscate foreign-owned assets, or stomp on domestic businesses for political reasons. But in the US, historically, while politics was part of the economic process, that strand was never before in doubt. I fear that has changed irreparably now with the Trump verdict in combination with the Russian reserve assets decisions.

Going forward, will foreign investors truly believe that the rule of law, as written in the Constitution protecting property rights, is sacrosanct? And if that is not the case, or there is doubt that is the case, will foreign investors (and domestic ones for that matter) be as anxious to purchase and hold US assets, whether they are equities or debt? It is way too early to answer that question, but the fact that it needs to be asked is an entirely new and disconcerting situation.

I know this may seem like a big assertion based on limited evidence. This will especially be true if you are of the belief that Trump is a crook, the NY DA was exactly correct, and the trial outcome was appropriate. However, I am confident that this outcome will be seen very differently than that by many citizens and investors around the world and that very question of property rights and the rule of law will be raised again and again. And that cannot be good for US risk assets.

If we add this new political angle to what has been a recent spate of weaker than expected economic data, it is quite possible, and I believe we are already moving in this direction, that soon, “bad news will be bad”. This means that weak economic data will not encourage the bulls to buy quickly on the thesis that the Fed is going to start cutting rates sooner than the current view, but rather that a weak economy with still sticky inflation means that company earnings are going to suffer greatly, and equity multiples will rerate lower to reflect that. Not necessarily today or Monday, but over time. I am going to go out on a limb and predict that the highs for US equities are now in. So, S&P 500 at 5341, DJIA at 40,077 and NASDAQ 100 at 17,032 are all we are going to get in this move with a substantial correction far more likely than a rally extension. I also believe that the dollar will start to suffer more aggressively going forward, that the Treasury market will suffer as well, so much so that the Fed is going to be buying bonds again before the year ends, and that commodities are going to trade much higher.

Back in January, my view was just this, that we would peak around mid-year, that the Fed might get one rate cut in, but that was all, and that risk assets would finish the year much lower. That was based on a belief that the economy would roll over. Now, clearly the economy, while softening a bit, is not showing signs of a significant downturn. After all, given how much money the government is pumping into it, it would be difficult to wind up with nominal GDP falling much at all. But this is an entirely different reason, and one that is far more worrisome in my eyes, and likely to be more gradual in its impact, but more long-lasting. As I said, a Rubicon has been crossed and not in a good way!

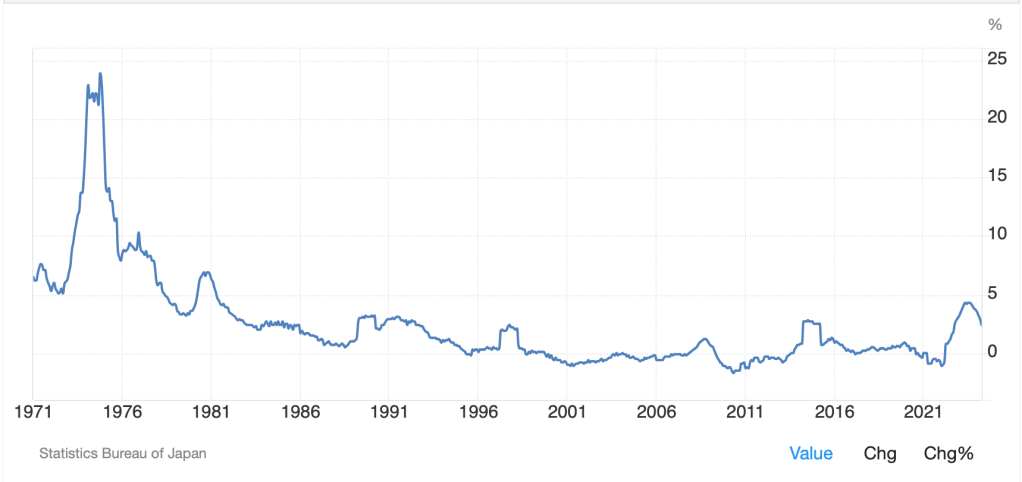

My apologies for that rant, but I am truly concerned for the way that things play out going forward. However, let’s turn to the financial and economic issues rather than the political now. US equities were under pressure all day yesterday, closing lower across the board as concerns over a lack of Fed policy ease joined with additional weaker-than-expected US data. While the GDP revision was exactly as expected, Final Sales and Real Consumer Spending were both softer than forecast, and in the end, those are the critical drivers of economic activity. The Trump verdict was released after the market close, so had no direct impact. But following the US session, Asian stocks went their own way. The Nikkei (+1.1%) performed well despite (because?) Tokyo CPI -ex food & energy printed at 2.2%, higher than last month, but continuing its broad downtrend from early last year. Australia and New Zealand also performed quite well, but the rest of the region had a tougher time with both Hong Kong (-0.8%) and Mainland (-0.4%) shares under pressure and losses almost everywhere else in Asia.

In Europe, the picture is one of mostly very small declines with the UK (+0.3%) the outlier in response to some solid UK housing data as well as growth in Mortgage Lending. As to US futures, at this hour (6:00) they are little changed as we all await the PCE data.

In the bond markets, yesterday’s decline in yields is being reversed this morning as Treasuries creep back higher by 1bp while European sovereigns are seeing more selling pressure after Eurozone CPI was released at a hotter than forecast 2.6% (2.9% core). While all the ECB commentary is still focused on a cut next week, this cannot have been a welcome result for the doves there.

Turning to the commodity markets, oil is slightly lower this morning following yesterday’s decline that was based on the significant build in gasoline inventories. This was quite the surprise given the start of the summer driving season and may reflect softer overall demand (remember the weak GDP data). As to the metals markets, gold, after a modest bounce yesterday is unchanged while silver (+0.25%) and copper (-0.5%) are responding differently to yesterday’s declines and weak data. However, as I indicated earlier, I foresee these seeing continued structural strength.

Finally, the dollar fell yesterday on the back of softer US yields, at least versus the G10 currencies. As I highlighted yesterday, several EMG currencies are also under pressure and we continue to see that this morning, notably KRW (-0.7%) which cannot get out of its own way as worries over Chinese growth (last night Chinese PMI data was weak across the board with Manufacturing printing at 49.5) continue to weigh on its export prospects. But I would say that broadly, the dollar is on its back foot right now and unless US yields start to climb again, will remain so.

This morning’s key data is, of course, PCE (exp 0.3% M/M for both Headline and Core with 2.7% and 2.8% expectations for the Y/Y respectively.) As well we see Personal Income (0.3%), Personal Spending (0.3%) and Chicago PMI (41.0). Finally, the last Fed speaker before the quiet period will be Raphael Bostic from the Atlanta Fed, whom we have heard half a dozen times in the past two weeks and seems unlikely to change his tune. However, I must note that there is some dissent on the FOMC as evidenced by dueling comments yesterday from Dallas’s Lorie Logan and NY’s Jonathan Williams. Logan continues to be concerned over the pace of decline in inflation and exhorts the committee to remain flexible and consider hikes if necessary. Williams was adamant that inflation would achieve their target by next year and easing policy was appropriate. In truth, that has been the most dovish commentary we have heard from a Fed speaker in a while.

One last thing regarding elections. Yesterday’s South African results show that the ANC, which has led the country since Apartheid, is now scrambling to put together a coalition government which will be much weaker, or at least less able, when it comes to implementing any agenda. Meanwhile, this weekend, Mexico goes to the polls and AMLO’s hand-chosen successor, Claudia Sheinbaum, seems set to win in a landslide with very little change in the nation’s international stance.

As I said at the top, the changes I foresee will be gradual, but I believe the direction of travel has changed. Today will be a response to the PCE data, where a hot number is very likely to see concerns rise over the Fed’s future actions and risky assets decline, while a cooler than forecast number could well see a short-term rally. But do not lose sight of the big picture.

Good luck and good weekend

Adf