The narrative which had been forming

Was prices were constantly warming

While job growth was strong

The bears were all wrong

And buyers of stocks were now swarming

But Friday the data was less

Impressive, and kind of a mess

At first, NFP

Was weak, all agree

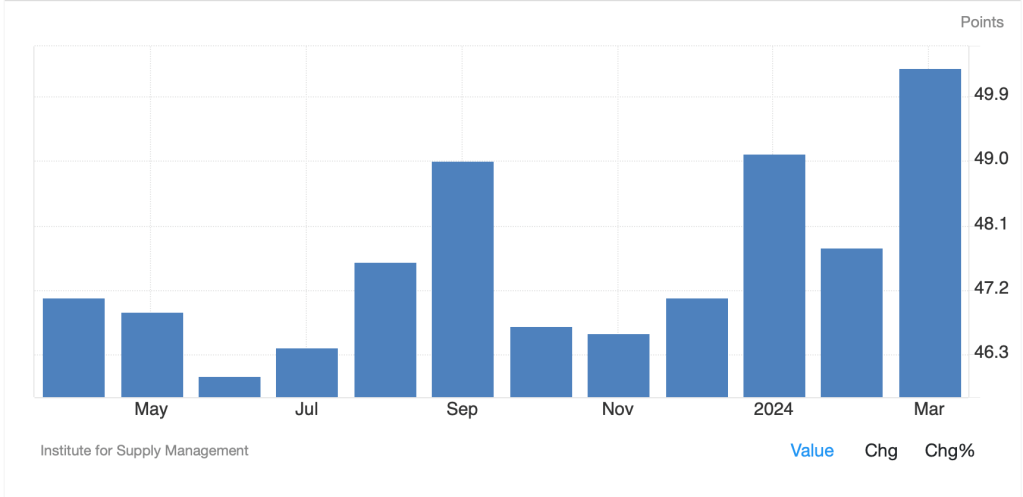

Then ISM caused more distress

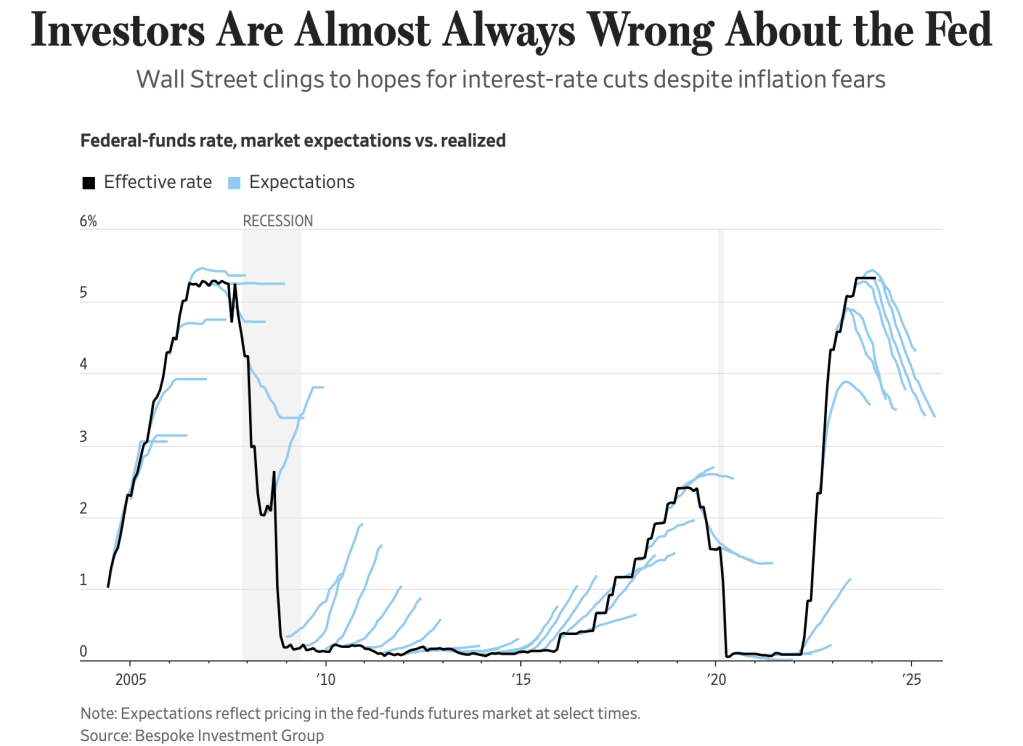

It is remarkable how quickly a narrative can change, that’s all I can say! One week ago, the story was all about how the economy continued to perform well overall, that inflation remained sticky at levels higher than targeted and that the Fed would stick with higher for longer with a chance of a rate hike on the table. This morning, in the wake of a clearly dovish Powell press conference and softer than expected ISM and employment data, the narrative appears to be coalescing around the idea that cuts are back on the table while a recession can no longer be ruled out.

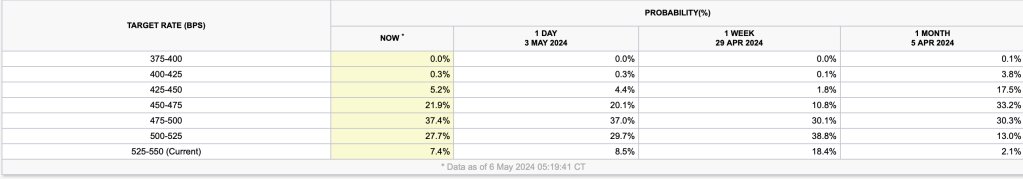

The table below, courtesy of the Chicago Mercantile Exchange, shows the current probabilities for Fed funds based on futures pricing for the December 2024 contract as well as how they have evolved over the past week and month.

Source: CME

When calculating how much is priced into the market, one simply multiplies the size of the cut by its stated probability and voila, the answer appears. To save you the trouble of doing the math, the current market pricing shows that as of this morning, the market is pricing in 47.6bps of cuts by year-end, so essentially two cuts. One week ago, that number was 34.8bps while one month ago it was 65.7bps. in other words, we have seen a bit of movement in this sentiment indicator. And really, that’s exactly what this is, a measure of the market’s sentiment and expectations of how Fed funds are going to evolve over time.

What should we make of this information? Well, anecdotally, for the past several weeks I have not been reading about recession at all. The no-landing scenario seemed to be the favorite as the soft-landing idea ebbed amid too high inflation readings. But this morning, in concert with the Fed funds futures market, I have seen several stories discussing that a recession is on the horizon now and coming into view. The ISM data was clearly a problem as both the Manufacturing (49.2) and Services (49.4) numbers slipped below the 50.0 boom/bust line while the Chicago PMI release was abysmal at 37.9. Even worse, the Prices paid data for both Manufacturing (60.9) and Services (59.2) rose sharply, exactly what Chair Powell did not want to see. In fact, this data rhymes with the Q1 GDP data which showed the mix of activity was turning toward less growth (1.6%) and more inflation (3.7%) for a given amount of activity.

Now, Powell was very clear that he saw neither the ‘stag’ nor the ‘flation’ sides of the idea that the US was slipping into stagflation, and certainly compared to the situation in the 1970’s, we are nowhere near that type of situation. But there is a bit of whistling past the graveyard here, I believe, as slowing real growth and rising prices are not the combination that any central bank wants to have to fight. When Mr Volcker took over the role as Fed Chair in 1979, he pretty quickly decided that it was more important to fight inflation first, and deal with any recession later, hence the double-dip recessions of 1980 and 1982. But that set the stage for structurally lower interest rates for two generations.

Based on Powell’s press conference comments as well as the tone of many of the mainstream media stories that are currently in print regarding the economic situation, it appears to this poet as though Mr Powell may be far more willing to allow inflation to run hotter than target for longer as he tries to prevent a sharp recession, especially ahead of the presidential election. With rate hikes no longer an option, any semblance of higher inflation will be met with words alone, and that will not do the trick. I have maintained for a long time that if the Fed eased policy before inflation was squashed, it would be bad for bonds, bad for the dollar and good for commodities and stocks. I am now coming to believe that we are entering this environment, and that while the initial move in bonds may be higher (lower yields) as it becomes clear that inflation remains with us, bond investors will quickly decide that the risk/reward in an inflationary environment is quite poor, and we will see the back end of the curve sell off.

After those cheery thoughts for a Monday morning, let’s look at how markets have behaved overnight. Friday’s rip-roaring rally in the US was mostly followed by strength throughout Asia where markets were open (Japan and South Korea were closed) with China, Hong Kong, Australia, and Taiwan all having good sessions, up between 0.75% and 1.25%. It should also be no surprise that European bourses are all in the green this morning as rate pressures eased and adding to the happiness were PMI Services reports that were generally on target or slightly better than the flash numbers. In other words, all is right with the world! Finally, US futures are also firmer by a bit this morning, up 0.2% or so with the main talk still about Apple’s massive stock repurchase program as well as the Berkshire Hathaway AGM this past weekend.

Of course, bonds were the big mover on Friday, with yields plummeting in the wake of the softer than expected NFP data, where not only were claims lower, but so was earnings data and the Unemployment Rate ticked up to 3.9%. The initial move was a 9bp decline in the 10yr and and 10bps in the 2yr although by Friday’s close, both markets had retraced half of those declines. This morning, though, yields are sliding again with 10yr Treasuries down 3bps and all European sovereigns following suit, falling 4bps. (As an aside, on Friday, the European yields followed Treasuries tick for tick.). With Japan closed, there was no JGB movement overnight.

In the commodity markets, crude oil (+1.0%) is bouncing today from yet another weak performance on Friday as the weaker economic data is weighing on the demand story there. However, regarding geopolitics and the middle east, this morning’s headlines regarding Israel telling Palestinians to leave Rafah has the market on edge. But metals markets are back on fire this morning with both precious (Au +0.7%, Ag +2.1%) and industrial (Cu +2.0%, Al +1.1%) rallying on the lower interest rate, higher inflation story that is percolating through markets.

Finally, the dollar, too, is under pressure this morning continuing its trend from last week, although it is not collapsing by any stretch with the DXY still trading just above 105.00. There is a great deal of discussion as to whether the BOJ/MOF have been successful in their efforts to stem the yen’s decline permanently. It is clear that their two bouts of intervention (neither officially admitted) has done a good job in the short run. The story here, though, is all about interest rates. If, and this is a big if, the Fed is truly turning their sights on cutting rates with any help at all from inflation showing signs of ebbing again, then the higher dollar thesis is going to run into real trouble. I have made no bones about the idea that the dollar’s strength was entirely reliant on the fact that the Fed was the most hawkish of all the main central banks. If that is no longer the case, then the dollar is going to come under universal pressure and the yen probably has the most to recover.

**This is really critical for JPY asset and receivables hedgers. There is no better time to consider using purchased options or zero premium collars than right now. If the recent movement is a head fake, and the inflation story in the US grows such that the Fed puts hikes back on the table, then you will have put hedges in place. But…if this is the beginning of a truly new narrative, where US rates are going to decline, USDJPY can fall a very long way in a very short time. Look at the 5-year chart of USDJPY below. It was in 2022 when USDJPY was trading at 115 and that had been the level for several years. we can go back there in a hurry, believe me!**

Source: tradingeconomics.com

As to the rest of the currencies out there, you will not be surprised that ZAR (+0.5%) is top of the heap this morning although a thought must be given to CLP’s 2.25% gain on Friday (market not open yet) as it rallied alongside copper’s rally. Ironically, the one currency that is under pressure this morning is JPY (-0.5%), but remember, it has risen 4% from the levels when the BOJ first intervened, so a little bounce is no surprise.

Turning to the data this week, it is an incredibly light week, with CPI not coming until next week.

| Tuesday | Consumer Credit | $15B |

| Thursday | Initial Claims | 212K |

| Continuing Claims | 1895K | |

| Friday | Michigan Sentiment | 77.0 |

As well, we have eight Fed speakers including NY president Williams and vice-Chair Jefferson. It will be very interesting to hear how they play the apparent pivot. While I expect that the governors are all on board, the regional presidents will have more leeway to speak their mind I believe.

And that’s what we have for today. I believe that things have changed and that the Fed is now very clearly far more willing to allow inflation to run hotter. Be very wary of your bond positions and watch for the dollar to remain under pressure until something else changes.

Good luck

Adf