A question on analysts’ lips

Is whether Jay can come to grips

With job growth expanding

While he was demanding

A rate cut of fifty whole bips

Concerns are beginning to rise

That voters will soon recognize

Inflation’s returning

And they will be yearning

For change of a Trumpian size

By now, I am guessing you are aware that the payroll report on Friday was significantly better than expected. Nonfarm Payrolls rose 254K, much higher than the 140K expected, and adding to the gains were revisions higher for the previous three months of 55K. The Unemployment Rate fell to 4.051%, rounding to 4.1%, lower than expected and another encouraging sign for the economy. You may remember the discussion of the Sahm Rule, which claims that if the 3-month average Unemployment Rate rises 0.5% from its low in the previous 12 months, history has shown the US is already in recession at that point. Well, ostensibly that rule was triggered two months ago, and the Unemployment Rate has now fallen 0.25% since then with a gain of over 400K jobs since then. Those are not recessionary sounding numbers.

The upshot is that the market got busy adjusting its views with the dollar continuing to rebound against most currencies, equity markets rejoicing in the renewed growth story and bond markets getting hammered with 10-year yields rising sharply in the US (10bps Friday and 4bps more this morning) with moves higher everywhere else in the world. In fact, this morning, European sovereign yields are also higher by between 3bps and 5bps and we saw JGB yields jump 5bps overnight. The end of inflation story is having a tough time.

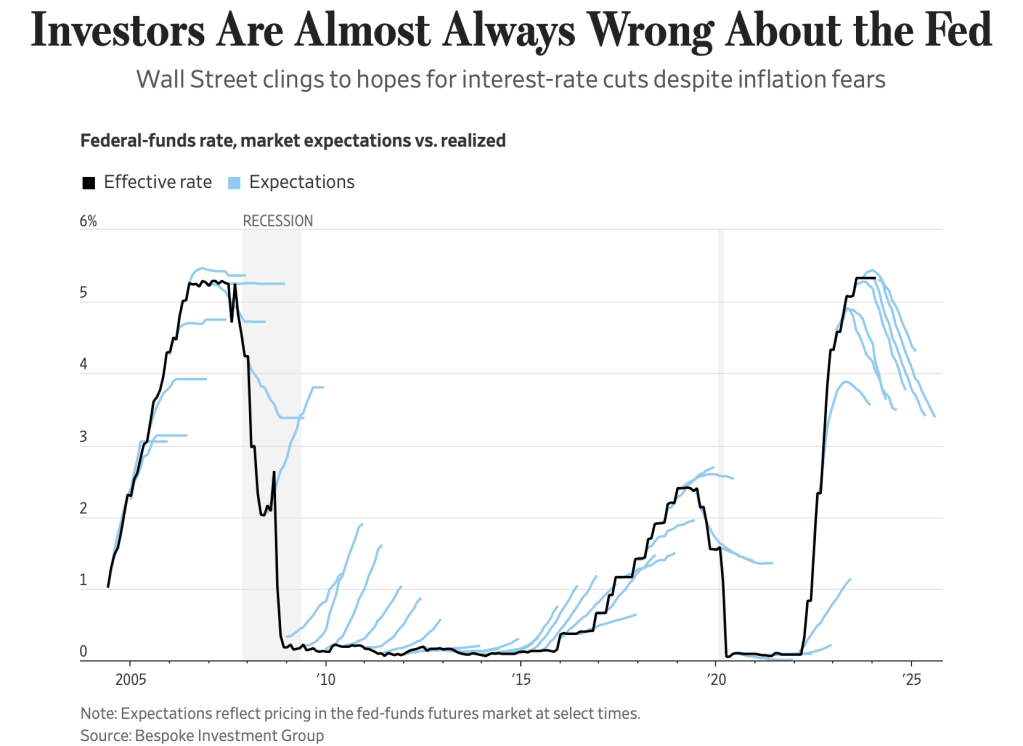

Perhaps the best depiction of things comes from the Fed funds futures markets where now there is only an 85% probability priced for a 25bp cut and a 15% probability of no cut at all. Look at the table below the bar chart to show how much things have changed in the past week. Jumbo rate cuts are no longer a consideration. It will be very interesting to see how the Fed speakers adjust their tone going forward as there were many who seemed all-in on another 50bp cut as soon as next month.

Source: cmegroup.com

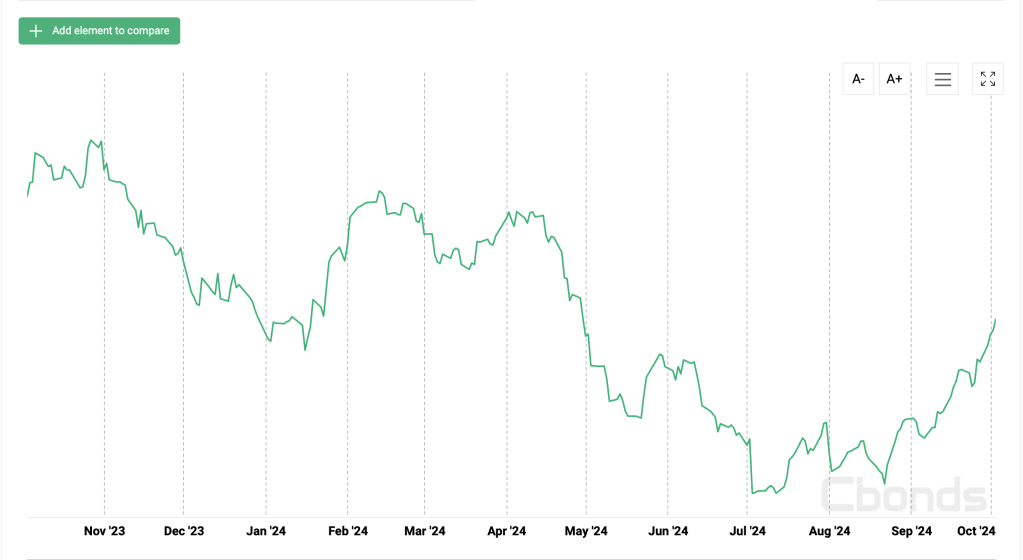

So, is this the new reality? Recession is out and another up-cycle is with us? Certainly, recent data has been quite positive as evidenced by the Citi Surprise Index, seen below courtesy of cbonds.com, which has shown a positive trend since early July.

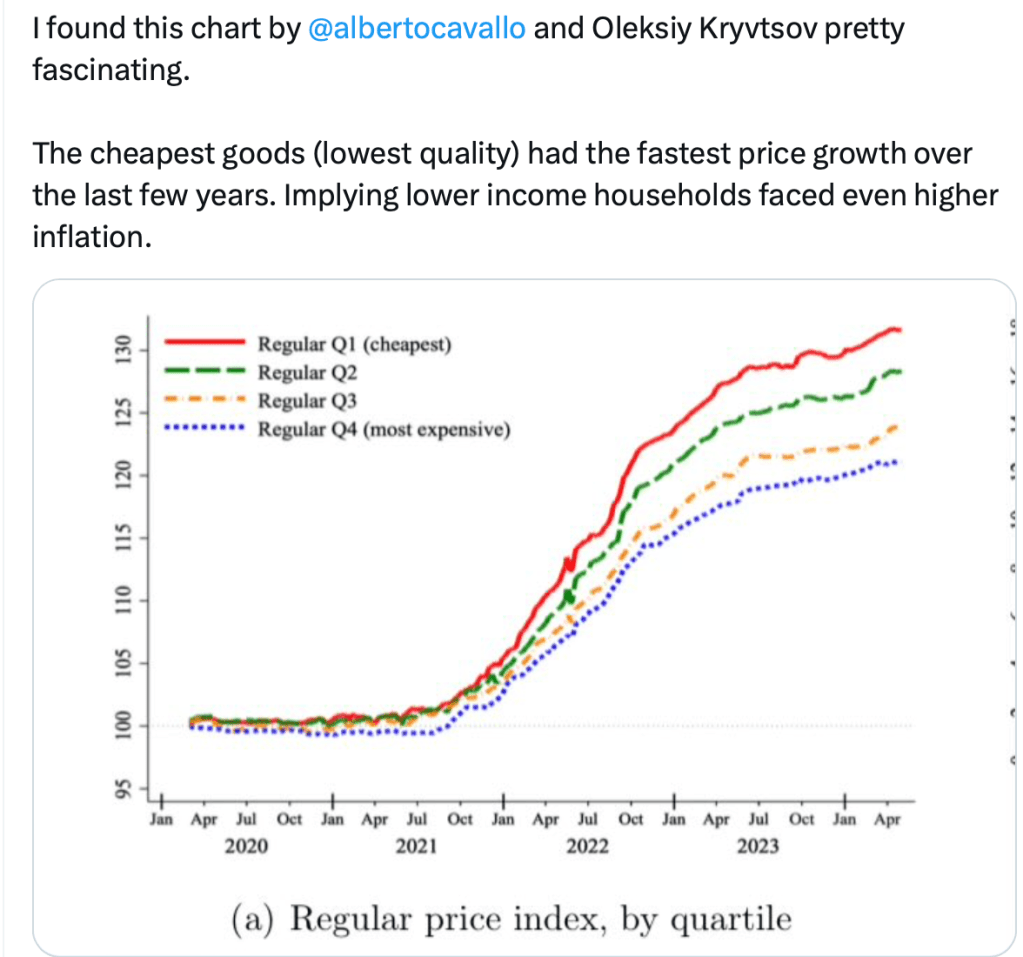

This index is a measure of the actual data releases compared to consensus market forecasts ahead of the release. When it is rising, the implication is that the economy is outperforming expectations and therefore is growing more rapidly than previously priced by markets. Again, the point is the recessionistas are having a hard time making their case. However, for the inflationistas, it is a different story. With the employment situation improving greatly and last week’s Services ISM data showing real strength, the inflation narrative is regaining momentum. Recall, the Fed’s rationale for cutting 50bps was that they had beaten inflation and were much more concerned about the employment situation where things seemed to be cooling. That line of reasoning has now been called into question and the market is awaiting Powell’s answers.

Remember the time

The yen carry trade was dead?

Nobody else does!

While it may seem like this is ancient history, it was less than a month ago when the market was convinced that the yen carry trade (shorting yen to go long higher yielding assets) was dead, killed by the combination of a dovish Fed and a hawkish BOJ. Oops! It turns out that story may not have been completely accurate, although it was a wonderful discussion at the time. As you can see from the chart below, the yen peaked two days ahead of the FOMC meeting, as those assumptions about both central banks reached their apex and has been steadily weakening ever since. In fact, late last week I saw an article somewhere discussing how the carry trade was back! The thing to understand is the carry trade never left. It has been a popular hedge fund positioning strategy for a decade, made even more popular by the Fed’s aggressive rate hiking cycle. While latecomers to the trade may have been forced out in the past several months, I am confident the position remains widely held. And, based on the recent price action in USDJPY, it is growing again.

Source: tradingeconomics.com

And I believe those are the key drivers of markets this morning. Fortunately, the Middle East situation does not appear to have gotten worse although oil (+2.6%) is trading like something is about to blow up. The rest of the noteworthy news shows that Germany remains in a funk with Factory Orders falling sharply, -5.8%, just another indication that growth on the continent is going to struggle going forward.

Ok, let’s tour the markets we have not yet touched upon. While Chinese markets remain closed (the holiday ended today and markets there reopen tomorrow), the Nikkei (+1.8%) continues to rebound alongside USDJPY and amid stories that new PM Ishiba has dramatically moderated his hawkish views ahead of the snap election called for the end of the month. The Hang Seng (+1.6%) also had a strong session, with rumors of still more Chinese stimulus to be announced tonight. The combination of positive US growth news and the Chinese stimulus news helped virtually every market in Asia save India (-0.8%), which has been singing a different tune consistently. In Europe, it should be no surprise the DAX (-0.3%) is softer, although there are some gainers on the continent (Spain +0.4%, Hungary (+0.4%) and other laggards (Norway -0.7%, Netherlands (-0.3%). Overall, it is hard to get excited about the European scene this morning. Alas, US futures are pointing lower this morning, down -0.5% at this hour (6:30).

We’ve already discussed the bond market and oil, but metals markets show a split this morning with gold (+0.2%) seeming to find haven support while both silver (-0.7%) and copper (-0.3%) are under modest pressure. Remember, though, if the economic growth story is real, these metals should climb further.

Finally, the dollar is continuing its climb alongside US rates with the pound (-0.4%) the G10 laggard of note. Most other G10 currencies are softer by a lesser amount although the yen (+0.1%) and NOK (+0.1%) are pushing slightly the other way, the former on a haven trade with the latter following oil. The EMG bloc is more mixed with ZAR (+0.5%) actually the biggest mover as investors continue to flock toward the stock market there on the back of positivity of a change in the trajectory of the economy from the new government.

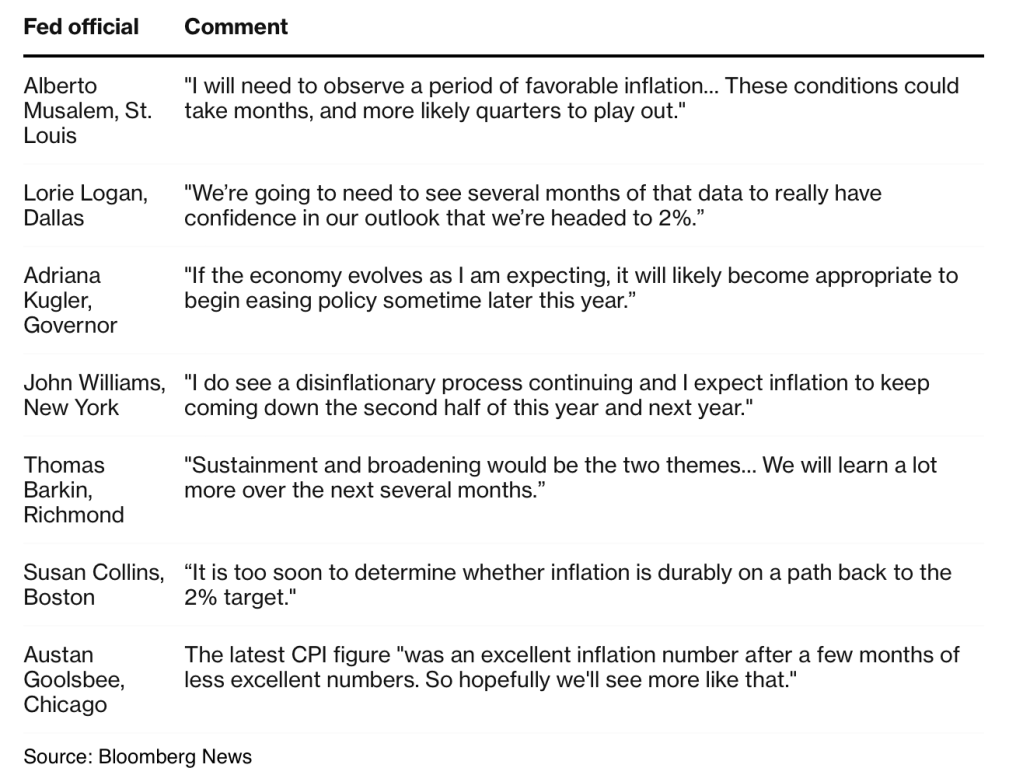

On the data front, the biggest number this week is CPI, but of real note are the 13(!) Fed speakers over 20 different venues this week. I don’t know if I’ve ever seen that many on the calendar for such a short period. It strikes me that they understand they need to tweak their message after the recent data. It will be very interesting to see if they fight the data and stay the course for another cut in November or whether they walk it back completely. After all, they claim to be data dependent, and if the data points to growth, why cut?

Here is the rest of the data:

| Today | Consumer Credit | $12B |

| Tuesday | NFIB Small Biz Optimism | 91.7 |

| Trade Balance | -$70.4B | |

| Wednesday | FOMC Minutes | |

| Thursday | Initial Claims | 230K |

| Continuing Claims | 1829K | |

| CPI | 0.1% (2.3% Y/Y) | |

| -ex food & energy | 0.2% (3.2% Y/Y) | |

| Friday | PPI | 0.1% (1.6% y/Y) |

| -ex food & energy | 0.2% (2.7% Y/Y) | |

| Michigan Sentiment | 71.0 |

Source: tradingeconomics.com

And that’s how we start the week. Whatever your personal view of the economy, the recent data certainly points to more strength than had been anticipated previously and markets are responding to that news. For equities and the dollar, good news is good, but there seems to be a lot of time between now and Thursday’s CPI reading for attitudes to change.

Good luck

Adf