Call rates will remain

Zero to Point-one percent

We’ll still purchase bonds

In a move that clearly captured my heart, the BOJ left policy on hold last night, as widely expected. But the key is that the policy statement, in its entirety, is as follows:

I would contend they could have used my haiku above and completely gotten the message across! This is the best central bank move I have seen in forever, an economy of words with limited discussion about their views of the future. But that the Fed would be so terse in their statements. By forcing investors and traders to consider all the issues and the best, or at least possible, ways in which the central bank can achieve their stated goals, positioning would be substantially reduced because nobody would think the central bank ‘had their back’. This would prevent another SVB-type collapse, and probably go a long way to reducing the massive wealth inequalities that central banks have fostered since the GFC. Just sayin’!

The market response to this, and the subsequent Ueda press conference was to sell the yen even more aggressively, with USDJPY touching yet further new 34-year highs at 156.80, higher by more than one full yen (0.7%) and JGB yields climbed to 0.92%, slowly approaching the big round number of 1.00%. FinMin Suzuki was out trying to talk the yen higher (dollar lower) with the following comments, “the weak yen has both positive and negative impacts, but we are more concerned about the negative effects right now.” Those comments were sufficient to drive USDJPY down about 90 pips in a few minutes, but as of right now (6:20), the dollar is back to its highs. As long as the Fed and the BOJ remain on different wavelengths, the yen will not be able to rally, trust me.

The GDP data surprised

By showing less strength than surmised

But really, for Jay

The prob yesterday

Was PCE so energized

This brings us to the GDP data yesterday, which missed badly at 1.6%. However, that was not the worst part of the report. Alongside the GDP data, there is a PCE calculation, that while not the one on which the Fed focuses, is still a harbinger of how things are going. That number was higher than expected with the Core rising 3.7% Q/Q, up from 2.0% in Q4. The upshot of this data was that growth is slowing and inflation is rising, exactly the opposite of the Fed’s (and the administration’s) goals and moving toward the concept of stagflation.

While quoting oneself is not the best etiquette, I think it makes some sense here as I described this exact situation back in January as follows:

Stagflation is an awful word as it describes a state

Where prices rise too fast while growth just cannot germinate.

And this, dear friends, is what I fear will come to pass this year

By Christmas, bonds and stocks will fall while metals hit high gear.

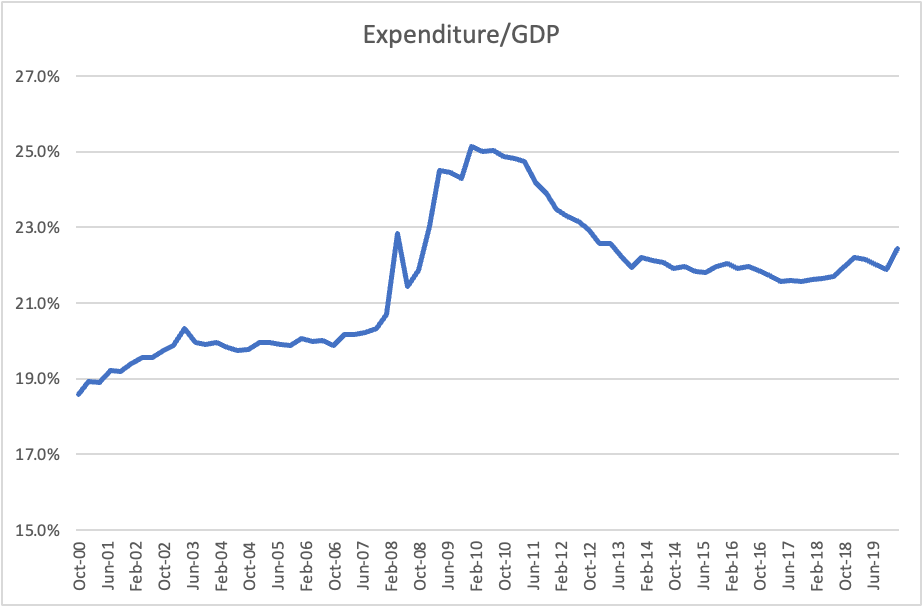

It should be no surprise that both bonds and stocks fell yesterday as market participants are growing concerned that the Fed has lost control of the narrative. After all, the last time we had stagflation, Chairman Volcker chose to fight inflation first by raising the Fed funds rate to 21% and driving the economy into a double-dip recession from 1980-1982. But the debt/GDP ratio at the time was just 30% or so and the government could afford it. That is not the case today, and quite frankly, there are exactly zero politicians on either side of the aisle who can tolerate a recession of any type, let alone a double dip. My guess is that all hands will be pushing to increase the rate of growth and let inflation rip because given the current drivers of inflation (commodity prices, near-shoring and demographics), it is not clear the Fed can do anything about it anyway. Don’t you feel better now?

All this leads us to this morning’s PCE data (exp 0.3% M/M for both headline and core, 2.6% Y/Y for both readings) as well as Personal Income (0.5%) and Personal Spending (0.6%). Given yesterday’s outcomes and the fact that the Bureau of Economic Analysis produces both sets of numbers, the whisper number is clearly higher. If that should manifest, I suspect that the price action from yesterday, lower stocks and bonds, is very likely to continue despite the after-market rally of both Google and Microsoft on better-than-expected earnings data. I also suspect that before noon, the Fed whisperer, Nick Timiraos, will have an article out in the WSJ to give some Fed perspective as they are currently muzzled in their quiet period.

I don’t think there’s anything else to say about this, so let me recap the overnight session, at least the parts I have not yet discussed. While the US equity session did not finish on its lows, all three major indices were lower by at least -0.5% on the day. However, the same was not true in Asia with the Nikkei (+0.8%) responding positively to the fact that tighter monetary policy was not on its way, while Chinese (+1.5%) and Hong Kong (+2.1%) shares positively ripped on the back of the strong tech earnings in the US. As to European bourses, they are all in the green this morning, with Spain (+1.1%) leading the way but all higher by at least +0.5%. Lastly, US futures are pointing higher as well after the strong earnings numbers overnight, up by +1.0% or so at this hour (7:20).

After jumping 8bps in the wake of the GDP data yesterday, 10-year Treasury yields slid a bit and finished the day up 5bps. This morning, they have given back two more basis points, but still trade right at 4.70%. If this morning’s data is 0.4%, watch for another sharp move higher in yields today. European yields pretty much followed the US yesterday, all closing higher by between 4bps and 6bps, and this morning they are lower by similar amounts, right back to where they started.

Oil prices (+0.5%) are climbing higher again, seeming to have found a recent bottom and looking like they are set to push back toward $90/bbl by summer. While the real GDP data was softer, nominal remains solid and that is what drives demand. In the metals markets, they all jumped on the data release and this morning are continuing higher (Au +0.7%, Ag +0.8%, Cu +0.8%, Al +0.9%). In the industrial metals, inventories are dropping while the precious space is clearly responding to the inflation fears.

Finally, the dollar is little changed overall this morning. while it has rallied sharply vs. the yen, ZAR (+0.85%) is gaining on metal market strength as an offset and pretty much everything else is +/- 0.25% or less. My take is everyone is waiting for this morning’s data to determine if the Fed is going to become even more hawkish, or if there will be a reprieve.

In addition to the PCE data, we get Michigan Sentiment at 10:00 (exp 77.8, down from 79.4). Right now, players are holding their collective breath for the numbers. After the release, it’s all about the results. Given that every recent inflation print has been on the high side, I expect this to be no different. Bonds should suffer, commodities should outperform, and I expect the dollar to do well.

Good luck and good weekend

Adf