Takaichi’s learned

Her chalice contained poison

Thus, her yen weakens

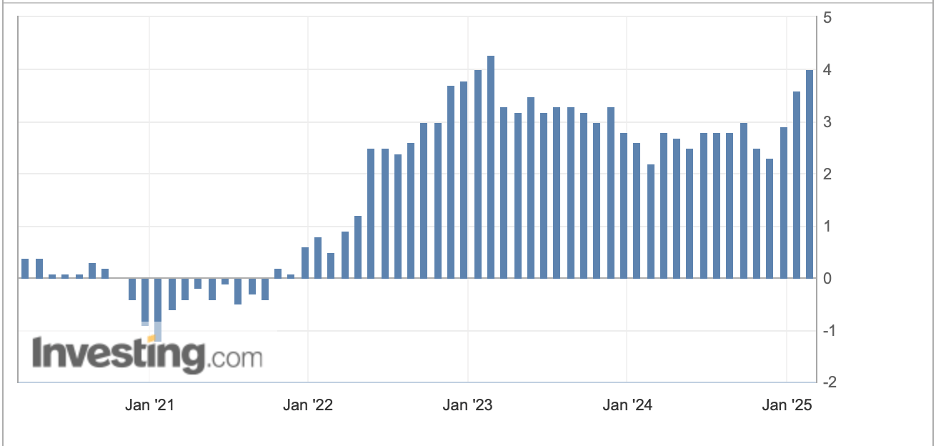

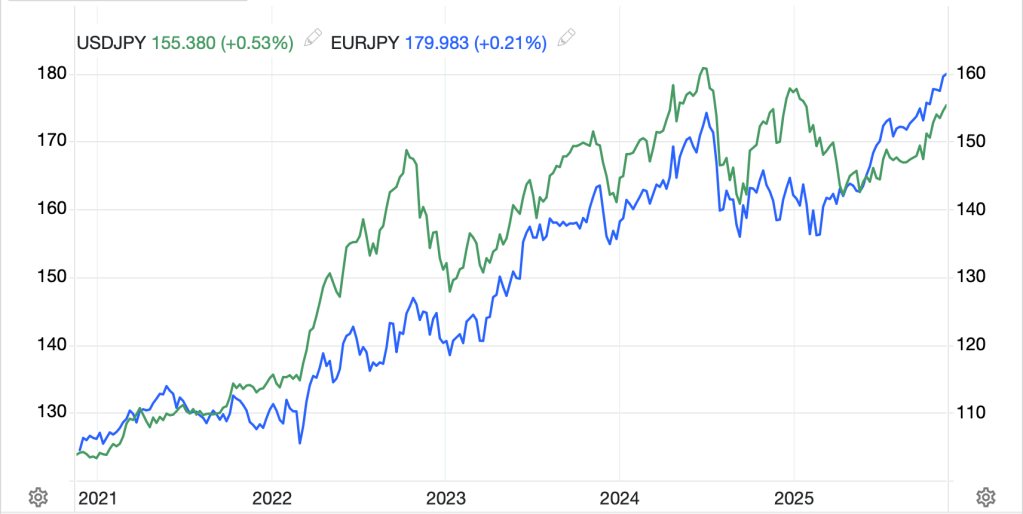

If one needed proof that interest rates are not the only determining factor in FX markets, look no further than Japan these days where JGB yields across the board, from 2yr to 40yr are trading at decade plus highs while the yen continues to decline on a regular basis. This morning, the yen has traded through 155.00 vs. the dollar, and through 180.00 vs. the euro with the latter being a record low for the yen vs. the single currency since the euro was formed in 1999.

Source: tradingeconomics.com

Meanwhile, JGB yields continue to rise unabated on the back of growing concerns that Takaichi-san’s government is going to be issuing still more unfunded debt to pay for a massive new supplementary fiscal package rumored to be ¥17 trillion (~$109 billion). While we may have many fiscal problems in the US, it is clear Japan should not be our fiscal role model.

Source: tradingeconomics.com

This market movement has led to the second step of the seven-step program of verbal intervention by Japanese FinMins and their subordinates. Last night, FinMin Satsuki Katayama explained [emphasis added], “I’m seeing extremely one-sided and rapid movements in the currency market. I’m deeply concerned about the situation.” Rapid and one-sided are the key words to note here. History has shown the Japanese are not yet ready to intervene, but they are warming to the task. My sense is we will need to see 160 trade again before they enter the market. However, while that will have a short-term impact, it will not change the relative fiscal realities between the US and Japan, so any retreat is likely to be a dollar (or euro) buying opportunity.

As to the BOJ, after a highly anticipated meeting between Takaichi-san and Ueda-san, the BOJ Governor told a press conference, “The mechanism for inflation and wages to grow together is recovering. Given this, I told the prime minister that we are in the process of making gradual adjustments to the degree of monetary easing.” Alas for the yen, I don’t think it will be enough to halt the slide. That is a fiscal issue, and one not likely to be addressed anytime soon.

The screens everywhere have turned red

As folks have lost faith that the Fed,

Next month, will cut rates

Thus, leave to the fates

A stock market now left for dead

Yesterday, I showed the Fear & Greed Index and marveled at how it was pointing to so much fear despite equity markets trading within a few percentage points of all time highs. Well, today it’s even worse! This morning the index has fallen from 22 to 13 and is now pushing toward the lows seen last April when it reached 4 just ahead of Liberation Day.

In fact, it is worthwhile looking at a history of this index over the past year and remembering what happened in the wake of that all-time low reading.

Source: cnn.com

Now look at the S&P500 over the same timeline and see if you notice any similarities.

Source: tradingeconomics.com

It is certainly not a perfect match, but the dramatic rise in both indices from the bottom and through June is no coincidence. The other interesting thing is that the fear index managed to decline so sharply despite the current pretty modest equity market decline. After all, from the top, even after yesterday’s decline, we are less than 4% from record highs in the S&P 500.

Analysts discuss the ‘wall of worry’ when equity markets rise despite negative narratives. Too, historically, when the fear index falls to current levels, it tends to presage a rally. Yet, if we have only fallen 4% from the peak, it would appear that positions remain relatively robust in sizing. In fact, BoA indicated that cash positions by investors have fallen to just 3.7%, the lowest level in the past 15 years. So, everyone is fully invested, yet everyone is terrified. Something’s gotta give! In this poet’s eyes, the likely direction of travel in the short run is lower for equities, and a correction of 10% or so in total makes sense. But at that point, especially if bonds are under pressure as well, I would look for the Fed to step in and not only cut rates but start expanding its balance sheet once again. QT was nice while it lasted, but its time has passed. One poet’s view.

Ok, following the sharp decline in US equity markets yesterday on weak tech shares, the bottom really fell out in Asia and Europe. Japan (-3.2%) got crushed between worries about fiscal profligacy discussed above and the tech selloff. China (-0.65%) and HK (-1.7%) followed suit as did every market in Asia (Korea -3.3%, Taiwan -2.5%, India -0.3%, Australia -1.9%). You get the idea. In Europe, the picture is no brighter, although the damage is less dramatic given the complete lack of tech companies based on the continent. But Germany (-1.2%), France (-1.3%), Spain (-1.6%), Italy (-1.7%) and the UK (-1.3%) have led the way lower where all indices are in the red. US futures, at this hour (7:15) are also pointing lower, although on the order of -0.5% right now.

In the bond market, Treasury yields, after edging higher yesterday are lower by -4bps this morning, and back at 4.10%, their ‘home’ for the past two months as per the below chart from tradingeconomics.com.

As to European sovereigns, they are not getting quite as much love with some yields unchanged (UK, Italy) and some slipping slightly, down -2bps (Germany, Netherlands), and that covers the entire movement today. We’ve already discussed JGBs above.

In the commodity space, oil (-0.2%) continues to trade either side of $60/bbl and it remains unclear what type of catalyst is required to move us away from this level. Interestingly, precious metals have lost a bit of their luster despite the fear with gold (-0.25%), silver (-0.2%) and platinum (-0.2%) all treading water rather than being the recipient of flows based on fear. Granted, compared to the crypto realm, where BTC (-1.0%, -16% in the past month) has suffered far more dramatically, this isn’t too bad. But you have to ask, if investors are bailing on risk assets like equities, and bonds are not rallying sharply, while gold is slipping a bit, where is the money going?

Perhaps a look at the currency market will help us answer that question. Alas, I don’t think that is the case as while the dollar had a good day yesterday, and is holding those gains this morning, if investors around the world are buying dollars, where are they putting them? I suppose money market funds are going to be the main recipient of the funds taken out of longer-term investments. One thing we have learned, though, is that the yen appears to have lost its haven status given its continued weakening (-3.0% in the past month) despite growing fears around the world.

On the data front, yesterday saw Empire State Manufacturing print a very solid 18.7 and, weirdly, this morning at 5am the BLS released the Initial Claims data from October 18th at 232K, although there is not much context for that given the absence of other weeks’ data around it. Later this morning we are due the ADP Weekly number, Factory Orders (exp 1.4%) and another Fed speaker, Governor Barr. Yesterday’s Fed speakers left us with several calling for a cut in December, and several calling for no move with the former (Waller, Bowman and Miran) focused on the tenuous employment situation while the latter (Williams, Jeffereson, Kashkari and Logan) worried about inflation. Personally, I’m with the latter group as the correct policy, but futures are still a coin toss and there is too much time before the next meeting to take a strong stand in either direction.

The world appears more confusing than usual right now, perhaps why that Fear index is so low. With that in mind, regarding the dollar, despite all the troubles extant in the US, it is hard to look around and find someplace else with better prospects right now. I still like it in the medium and long term.

Good luck

Adf