While holding our breath has been fun

For CPI, soon we’ll be done

So far through this year

Each reading’s been dear

Can’t wait to see how today’s spun

A hot reading’s likely to mean

On rate cuts, Jay will be less keen

But if the print’s cool

It’s likely to fuel

A rally like we’ve never seen!

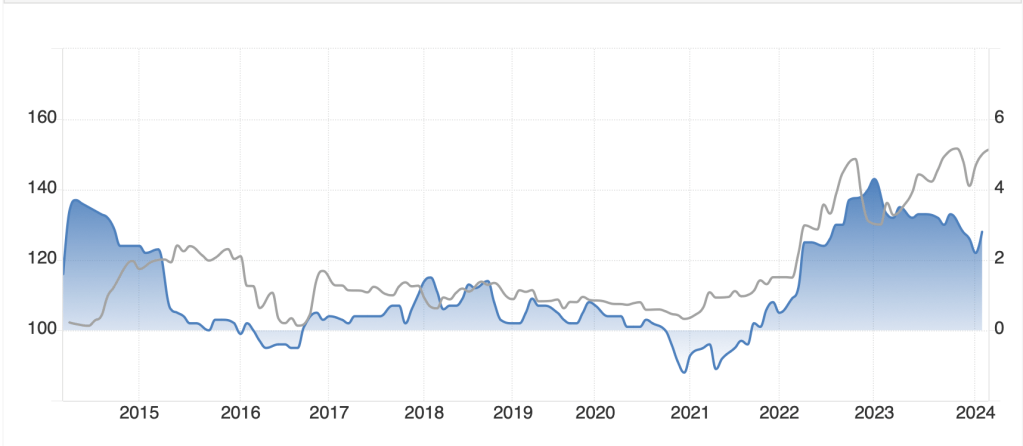

The number we have all been breathlessly awaiting is finally to arrive this morning at 8:30. The March CPI readings are expected as follows: Headline (0.3% M/M, 3.4% Y/Y) and core (0.3% M/M, 3.7% Y/Y). As can be seen in the below chart from the WSJ, the question of whether inflation is continuing its slow decline or has bottomed is like a Rorschach Test. Those who are all-in on the soft-landing thesis, notably every administration economist and spokesperson, see the ongoing decline of the core rate (the purple line) as the direction of travel. However, those who are in the sticky inflation camp and who have made the case that the so-called last mile is going to take much longer than desired look at the headline rate (the gray line) and explain that the bottom seems to be in.

Source: WSJ

Perhaps the most frustrating part of this is that even after the release, neither side will be able to truly declare victory, although I’m sure one side will try to do so. And to add insult to injury, the arguments are going to rely on the second decimal place, a level of precision that is meaningless in the context of economic data collection. So, a 0.33% print will get the hawks all riled up while a 0.27% print will have the doves cooing that cuts are on their way soon. But I challenge anyone to demonstrate that precision of that magnitude has any real meaning. Clearly, the BLS can calculate numbers to whatever level of precision they desire but given the frequency or revisions to the big number, everything else is just narrative.

But this is where we are. My take is that the market response will play out very much as expected, at least initially. This means a hot print, even at the second decimal, will see bonds and equities sell off while the dollar rallies. Funnily, my sense is that commodities will not suffer greatly on this as they are the current vogue for protecting against inflation. Similarly, a cool number will lead to a risk asset rally and a dollar decline. This will probably hurt commodities as well.

One of the interesting things is to observe positioning heading into big data points like this and there are two noteworthy items in the interest rate space. First, yesterday there was a massive SOFR futures trade where one account bought 75,000 December contracts, the largest single trade ever in the contract according to the CME where it trades. (SOFR = Secured Overnight Funding Rate and is the replacement for LIBOR). That is either a very large bet that the data is going to be soft, or somebody covered a very large short position, but either way, they are protecting against cooling inflation. The other interesting thing has been the reduction in short bond positions. There has been a significant decline in the number of short bond futures positions as well as short cash positions in the bond market, again an indication that many are looking for a benign reading this morning.

This poet has no formal inflation model and therefore can only estimate based on personal experience. Ultimately, nothing I have seen indicates that the rate of inflation is decreasing very rapidly at all. As I remain in the sticky camp, my best guess is that we will lean toward the hot side this morning.

Turning to the overnight session, there was some interesting news to cover. In Asia, Fitch put China on negative watch on its recent rise in debt. Not surprisingly, Chinese shares suffered a bit on the news, but HK shares did not, as the Hang Seng (+1.9%) was the leading gainer in the time zone. Elsewhere, the RBNZ left rates on hold, as expected, but the statement indicated zero rate cuts in 2024 and a continued hawkish bias. Surprisingly, NZ equities rallied a bit on the news. Finally, Ueda-san testified to the Diet again and the most interesting thing he said was that while they watch the FX rate, they will not adjust monetary policy simply to address any weakness in the yen. Apparently, stock traders didn’t like that much as the Nikkei fell -0.5% on the session.

The story in Europe, though, is much better as all markets are firmer, somewhere between +0.4% and +0.7%. There was some data released, all of which pointed to slowing growth and inflation and therefore increasing the odds the ECB could act as soon as tomorrow, but certainly by June. Norwegian CPI fell more than expected, Swedish GDP and IP were both quite weak as was Italian Retail Sales. The point is the ongoing reduction in activity across the continent is going to allow (force?) Madame Lagarde to prove she isn’t waiting on the Fed. After another limited movement day yesterday, US futures remain unchanged at this hour (7:00).

In the bond market, while Friday and Monday morning saw a sharp decline in prices and rise in yields, yesterday saw yields drift back further and this morning Treasuries are lower by -1bp with similar price action throughout Europe. Thus far, the net retracement from the yield peak has been 10bps, with all eyes on this morning’s CPI print. One other interesting tidbit is that the Treasury is auctioning $39 billion in 10-year notes today with the yield highly dependent on the CPI data.

Turning to the commodity market, oil (+0.6%) after a slight dip yesterday on a larger than expected inventory build, is rebounding. The EIA released a report increasing expected supply and demand numbers for 2024 and 2025 as well. Gold (-0.25%) is settling in just below its new highs although copper (+0.5%) and aluminum (+1.1%) continue to rally strongly on the rebounding manufacturing story as well as the structural supply shortages.

Finally, the dollar remains in the doldrums, little changed ahead of this morning’s data. The biggest mover is MXN (+0.5%) which is a continuation of its yearlong price activity as Banxico maintains amongst the highest real interest rates around. Surprisingly, NZD (+0.2%) is just barely higher despite the hawkish rhetoric from the central bank last night and after that, pretty much all the movement is +/- 0.1% or less.

In addition to the CPI data this morning, we get the Bank of Canada rate meeting where they are expected to leave policy on hold although given the slowing economy, they may set the table for a rate cut at the next meeting. I would not be surprised to see them cut today, though, in an effort to get ahead of the curve. The FOMC Minutes are also released this afternoon and we hear from Governor Bowman and Chicago Fed president Goolsbee, with both having been amongst the most hawkish Fed speakers lately. Given all the talk from Fed speakers since the March meeting, it is hard to believe that the Minutes will matter that much.

And that’s what we have for today. The CPI will set the tone and we will circle back tomorrow to see how things landed.

Good luck

Adf