Ahead of the holiday flight The payroll report is in sight This week we have seen A crack in the sheen That everything still is alright So right now, bad news is all good But there seems a high likelihood That worsening data Could impact the beta And bad news turn bad, understood?

As we wake up on this Payrolls Friday, the market is biding its time ahead of the release this morning. As I have been writing for a number of months now, I continue to believe the NFP number is the most important on the Fed’s radar as its continued strength has given Chairman Powell all the cover he needs to continue tightening monetary policy. If job growth is averaging near 200K per month and the Unemployment Rate has a 3 handle, the doves have no solid case to make that policy is too tight. With that in mind, here are the current median analyst expectations according to Bloomberg:

| Nonfarm Payrolls | 170K |

| Private Payrolls | 148K |

| Manufacturing Payrolls | 0K |

| Unemployment Rate | 3.5% |

| Average Hourly Earnings | 0.3% (4.3% y/Y) |

| Average Weekly Hours | 34.3 |

| Participation Rate | 62.6% |

| ISM Manufacturing | 47.0 |

| ISM Prices Paid | 44.0 |

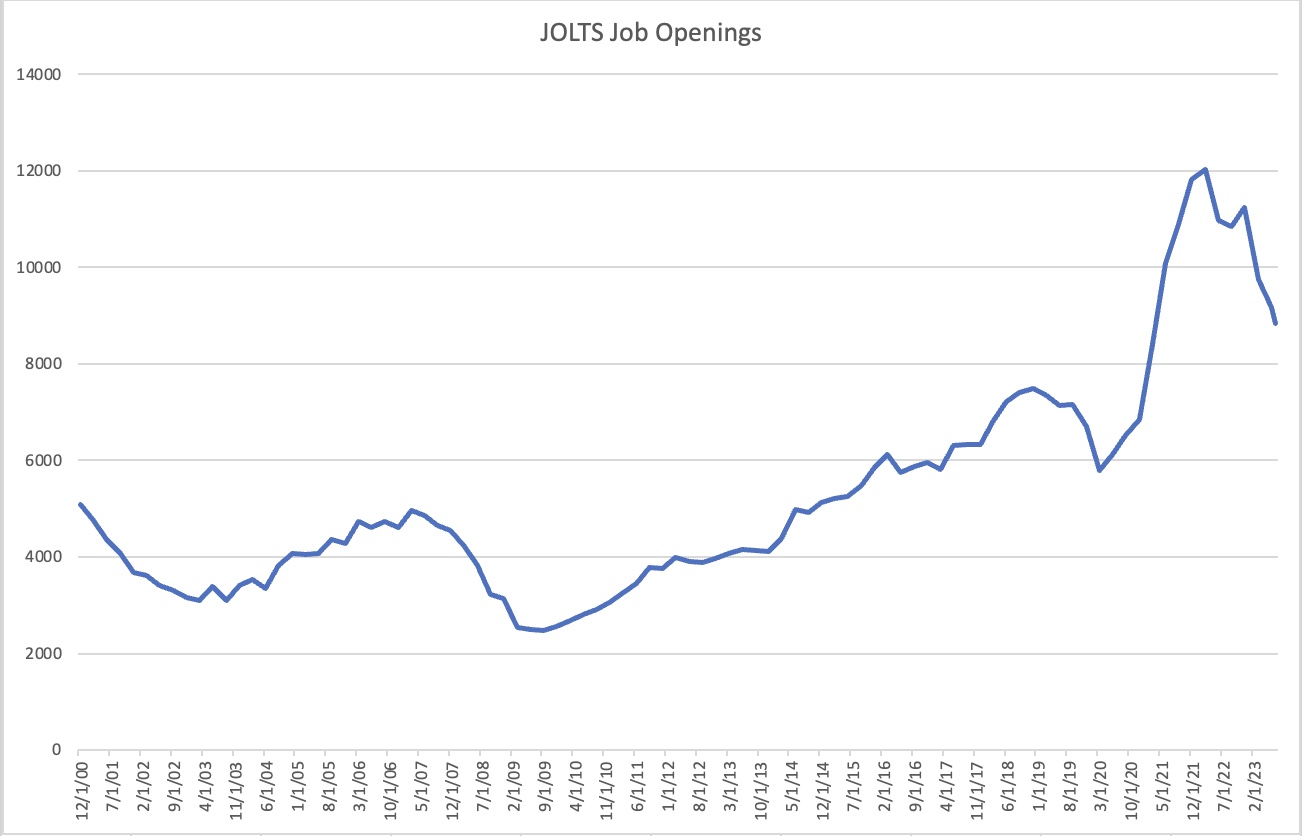

So far this week, we have received three pieces of employment data with a mixed outcome. JOLTS Job Openings was much lower than expected and that encouraged the bad news is good phenomenon. ADP Employment was weaker on the headline by a bit but had a very large revision higher to last month, so mixed news. Meanwhile, Initial Claims were lower than expected and any sense of a trend higher in this series is very difficult to discern. Anecdotally, I have to say I expect a softer number today, not a firmer one, but I believe it is anybody’s guess.

With that in mind, I believe a weak number, whether lower payrolls or a jump in the Unemployment Rate, will be met with an equity rally into the holiday weekend. Investors are looking for ‘proof’ that the Fed is done so they can get on with rate cuts and support the stock market. However, remember, if the data is weak and we are heading into recession sooner rather than later, all that bad news will likely not be taken well by equity investors as money will flow back to bonds as a haven. At least, that has been the history. So, a really bad number could well result in ‘bad news is bad’ and an equity market decline. Alas, nothing is straightforward in markets.

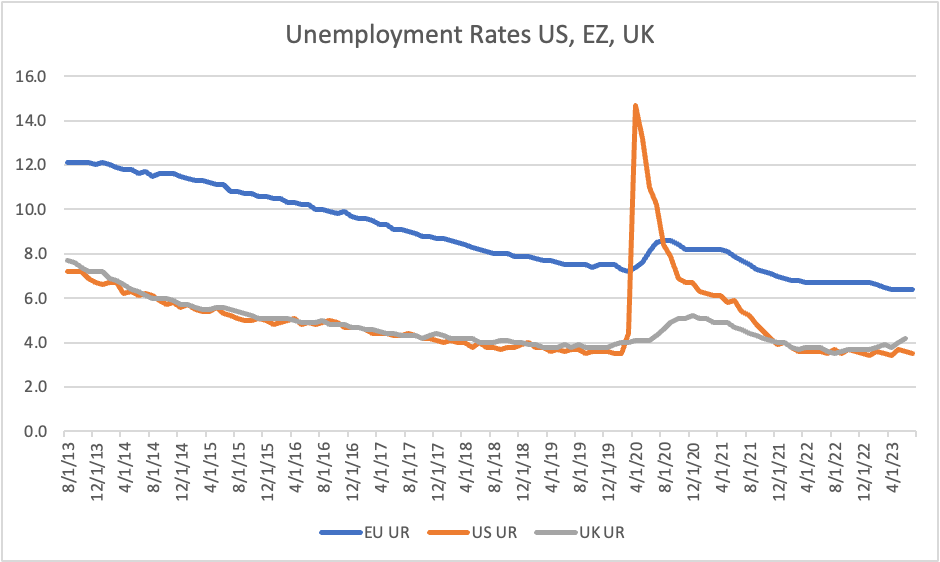

One other thing to keep in mind is the relative Unemployment situation which can be seen below in the chart created with data from Bloomberg. Structural unemployment in the Eurozone remains substantially higher than in either the US or the UK. If you are wondering why I continue to have a favorable outlook on the dollar, this is one part of that puzzle. Despite all the policy blunders questions that have been raised, things in the US remain far better than elsewhere.

In China, despite what they’ve done To try to support the short-run It’s not been enough So, they did more stuff Last night, though investors still shun

It wouldn’t be a day in the markets if there wasn’t yet another action by the Chinese to try to fix their myriad problems. Today is not different as last night the PBOC reduced the FX RRR to 4% from its previous level of 6%. This required reserve ratio defines the amount of reserves Chinese banks need to hold against their FX positions. Reducing that number effectively boosts the amount of foreign currency available locally, and therefore takes pressure off market participants to horde their dollars, thus weakening the buck.

And it worked…for about an hour as the renminbi initially rallied about 0.5%. However, it has since ceded all those gains and is essentially unchanged on the day. At the same time, the government has reduced the size of the down payment needed to buy a home while encouraging banks to lend more to home buyers to try to support the crumbling property market. While certainly welcome relief to an extent, it does not appear to be enough to change the current trajectory, which is definitely lower. At this point, we know that the PBOC is quite concerned over potential renminbi weakness and the central government is quite concerned over broad economic weakness led by the property sector. We have not seen the last of these moves.

President Xi did, however, get one piece of positive news overnight, the Caixin Manufacturing PMI rose to 51.0, up 2 points from last month and well above expectations. The combination of those factors helped the CSI 300 gain 0.7% last night, but that seems weak sauce overall. As to the rest of the market’s risk appetite, I guess you would consider things mildly bullish. While Hong Kong was weaker, the Nikkei managed a small gain and most of Europe is in the green, notably the UK (+0.7%) after weaker than expected House Price data encouraged belief that inflation may be ebbing sooner than previously expected. As well, the UK revised higher its GDP data to show that they have, in fact, recovered all the Covid related losses. US futures, meanwhile, are edging higher at this hour (7:00).

Bond yields are mixed this morning, but the moves have been small, generally +/- 1bp from yesterday’s close. And yesterday’s closing levels, at least in Treasuries, was little changed from Wednesday. Granted, European sovereigns saw yields decline yesterday on the order of 5bps, so this morning’s 1bp rise is not that impactful I would contend.

Turning to the commodity markets, they have embraced the Chinese stimulus efforts with oil (+1.5%) rising again and pushing close to $85/bbl, while metals markets are also robust with gold (+0.25%), copper (+1.6%) and aluminum (+1.3%) all seeing demand this morning. While I have doubts about the effectiveness of the Chinese moves, for now the market is quite pleased.

Finally, the dollar is mixed and little changed net this morning. In the G10, not surprisingly, NOK (+0.3%) is the leading gainer on the back of oil’s rally, but the rest of the bloc is +/- 0.1% or less, so essentially unchanged. In the EMG bloc, I guess there are a few more laggards than gainers with HUF (-0.6%) the worst performer as traders prepare for a ratings downgrade from Moody’s after the close today, while MXN (-0.6%) suffered after Banxico indicated it would be winding down its forward FX program where it consistently supplied the market with dollars, buying pesos. On the plus side, ZAR (+0.8%) is the lone outlier on the back of the commodities rally.

We hear from Bostic and Mester today, with Bostic already having told us he thinks it’s time to pause, although I doubt we will hear the same from Mester. But in reality, it is all about the employment report. For now, I believe bad news is good and vice versa, but that is subject to change with enough bad news.

Good luck and have a good holiday weekend. There will be no poetry on Monday.

Adf