The QRA was quite the dud

Though mentioned, in Q3 a flood

Of new bonds are coming

To keep the gov humming

As debt is Ms Yellen’s lifeblood

So, now all eyes turn to the Fed

With doves looking on with much dread

According to Nick

Chair Powell will stick

With Higher for Longer ahead

Below is the actual QRA release from the Treasury which I thought would be useful to help everyone understand how benign the statement seems, although it has great importance.

WASHINGTON – The U.S. Department of the Treasury today announced its current estimates of privately-held net marketable borrowing[1] for the April – June 2024 and July – September 2024 quarters.

- During the April – June 2024 quarter, Treasury expects to borrow $243 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $750 billion.[2] The borrowing estimate is $41 billion higher than announced in January 2024, largely due to lower cash receipts, partially offset by a higher beginning of quarter cash balance.[3]

- During the July – September 2024 quarter, Treasury expects to borrow $847 billion in privately-held net marketable debt, assuming an end-of-September cash balance of $850 billion.

During the January – March 2024 quarter, Treasury borrowed $748 billion in privately-held net marketable debt and ended the quarter with a cash balance of $775 billion. In January 2024, Treasury estimated borrowing of $760 billion and assumed an end-of-March cash balance of $750 billion. Privately-held net marketable borrowing was $12 billion lower largely because higher cash receipts and lower outlays were partially offset by a $25 billion higher ending cash balance.

Additional financing details relating to Treasury’s Quarterly Refunding will be released at 8:30 a.m. on Wednesday, May 1, 2024.

The market response was muted, at best, as bonds barely budged throughout the day. Clearly, the surprise that we received back in October was not part of today’s message. Two things I would note are first, Q3 borrowing is a huge number, $847 billion expected, although it seems to have been largely ignored; and second, the action really comes tomorrow when Yellen will describe the mix of coupons and T-bills that she plans to issue this quarter. However, given the Q2 numbers are so much smaller than either Q1 or Q3, while there may be some signaling effect, the actual impact on the fixed income markets seems likely to be muted.

Which takes us to the FOMC meeting that begins this morning and will conclude tomorrow at 2:00pm with the statement and then Chairman Powell will hold his press conference at 2:30. But I have a funny feeling we already know what is going to happen as this morning’s WSJ had an article from the Fed whisperer, Nick Timiraos, explaining that higher for longer was still the play and that while there was no cause yet to consider rate hikes, the recent inflation data has done nothing to convince the Chairman that cuts are due anytime soon. Now, this seems obvious to those of us paying attention given that the data continues to show a far more robust economy than many had anticipated, and more importantly, there has not been any type of inflation related print that indicated price pressures are abating very quickly. Of course, one never knows what will happen at the presser, but it seems highly unlikely that the committee is in the mood to cut rates.

On this subject, if there is a move toward the dovish side, either with the statement or things Powell says in the press conference, I would take those very seriously as that would imply the Fed is no longer worried about inflation, per se, but more about doing what they perceive will benefit the current administration. That would be hugely negative, in my view, for both the dollar and the bond market, although stocks and commodities would likely benefit greatly. Ironically, it is not clear to me that cutting rates is going to be any help to President Biden as it is not going to change mortgage rates very much, and certainly not going to reduce credit card rates, so all it is likely to do is feed more inflation. But one of the underlying narratives seems to be that a rate cut helps Biden’s election chances.

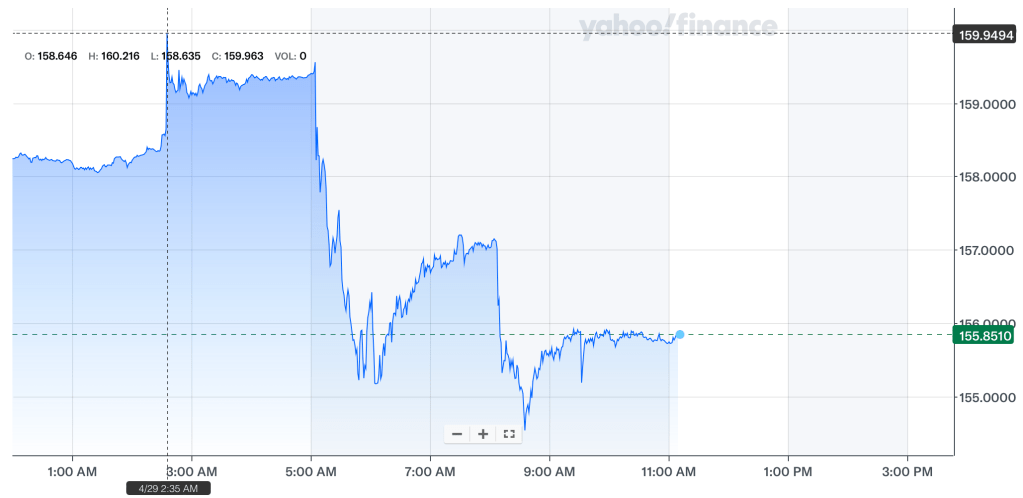

Ok, with the Treasury and Fed out of the way, let’s look at overnight price action. After modest gains in the US yesterday, most Asian equity markets performed well, although mainland Chinese shares were under some pressure (CSI 300 -0.5%). This is interesting given the stories that the Chinese government is considering stepping up its support for the economy there with more borrowing at the national and local levels (total of ~$680B) to support overall activity as well as the property market. I would have thought that was a positive, but I would have been wrong. In Europe, preliminary GDP data showed that the economy across the major nations was not quite as bad as last quarter, but certainly not showing much strength. Perhaps we are bottoming, but there is no V-shaped rebound coming. Ultimately, equity markets on the continent are all lower as a result, with losses ranging from tiny (CAC -0.1%) to larger (IBEX -1.3%). As to US futures, they are essentially unchanged this morning.

Meanwhile, bond yields are edging higher this morning with Treasuries (+1bp) just barely so, but all of Europe seeing yields rise by 3bps. Perhaps investors are growing concerned that a rebound in growth in Europe is going to force rates higher, but the data this morning was really minimal. In truth, I wouldn’t make much of today’s moves and rather focus on the trend since the beginning of the year where yields everywhere have rebounded following Treasuries.

In the commodity markets, oil (+0.4%) is bouncing slightly this morning after a couple of weak sessions as there appears to be a growing narrative that a ceasefire in Gaza is closer to being negotiated. At least that’s the story making the rounds. I will believe it when I see it actually happen. But metals markets are under pressure this morning with all the main ones sharply lower (Au -0.8%, Ag -1.5%, Cu -1.0%, Al -0.5%). Now, given how far these have moved higher over the past month, it should be no surprise there is a correction. Has this changed the longer-term narrative? I think not, but remember, nothing goes up in a straight line.

Finally, the dollar is modestly stronger this morning as the yen (-0.4%) starts to give back some of its intervention inspired gains from yesterday. Apparently, the MOF spent ¥5.5 trillion (~$35B) in their activities yesterday and we are more than 1% lower (dollar higher) than the yen’s post intervention peak. I expect that we will continue to see this move, especially if the Fed maintains its current policy stance. Elsewhere, commodity currencies are under pressure (AUD -0.5%, ZAR -0.4%) on the back of the weaker metals prices while financially oriented currencies have shown much less activity, with all of them somewhere on the order of 0.2% weaker. As I wrote above, a substantive change by the Fed will have an impact on the dollar, I just don’t see that happening this week.

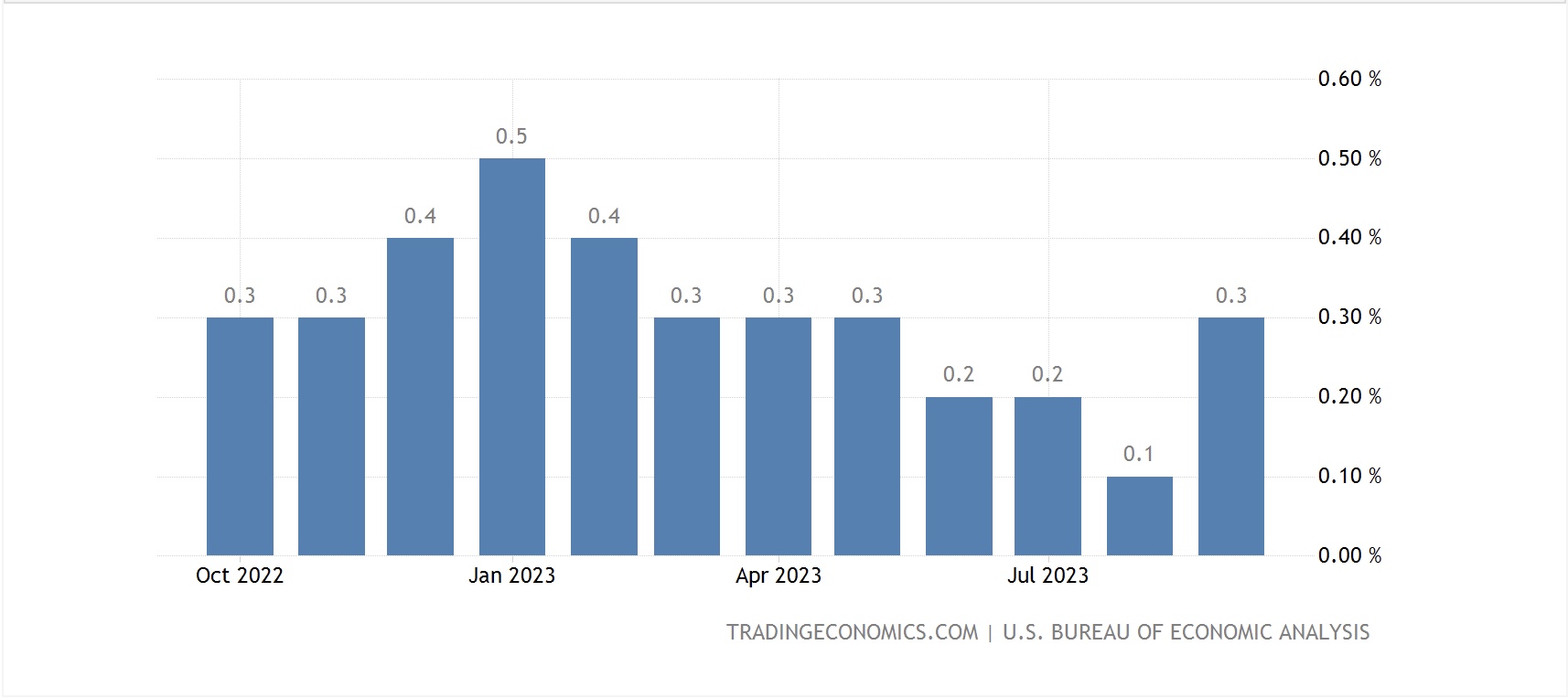

On the data front, there are a few things released this morning as follows: Employment Cost Index (exp +1.0%), Case-Shiller Home Prices (6.7%), Chicago PMI (44.9) and Consumer Confidence (104.0). The ECI is something to which the Fed pays close attention as one of the best measures of the wage situation in the US. As you can see from the below chart, while those costs have been declining, they remain well above the pre-pandemic levels and thus remain a concern for the Fed. And a move back to 1.0% would indicate things have stopped declining.

Source: tradingeconomics.com

That’s really all we have today as the market awaits tomorrow’s Fed as well as Friday’s NFP data. My take is there is very little chance the Japanese come back into the market soon, and so a grind higher in the dollar remains my base case.

Good luck

Adf