The one thing about which we’re sure

Is risk assets lost their allure

It’s not clear quite yet

How big a reset

Is coming, and what we’ll endure

Now, I don’t think its end of days

And this could be quite a short phase

But don’t be surprised

If answers devised

Result in a lack of real praise

Chaos continues to reign in the markets as volatility across all asset classes has risen substantially. Perhaps the best known indicator, the VIX, is back at levels seen last during the Covid pandemic. Remember, the VIX is a compilation of the implied volatility of short-term equity options, 1mo – 3mo. While markets can technically be volatile moving in either direction, the VIX has earned the sobriquet of ‘fear index’ as equity volatility most typically rises when stock markets fall. As you can see from the below chart, the movement has not only been large, but very quick as well.

Source: finance.yahoo.com

The key thing to remember is that while volatility levels can rise very quickly, as the chart demonstrates, their retracement can take quite a long time to play out. Part of that is that even when things start to calm down, many investors and traders are worried about getting burnt again, so prefer holding options to underlying cash positions. At least until the time decay becomes too great. My point is that look for trepidation amidst the trading community and markets in general for a while yet, even if by Friday, the tariff situation is made perfectly clear. Of course, with that as background, we cannot be surprised that the Fear & Greed Index has made new lows.

Source: cnn.com

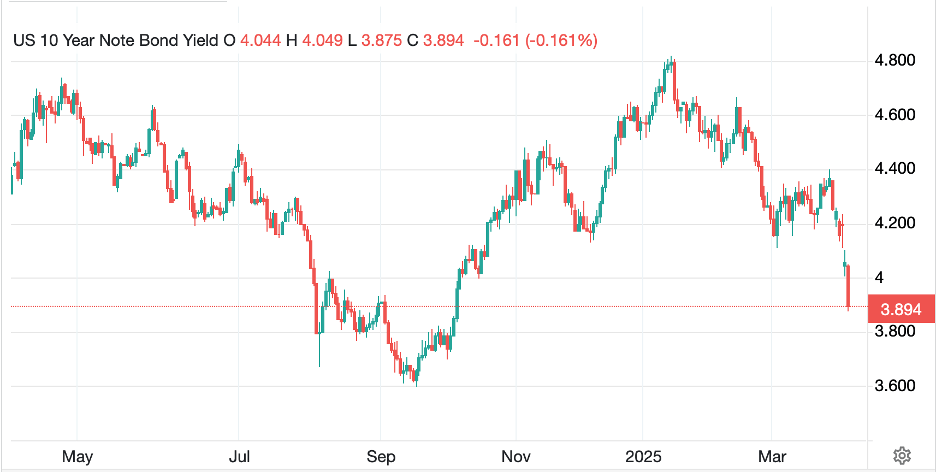

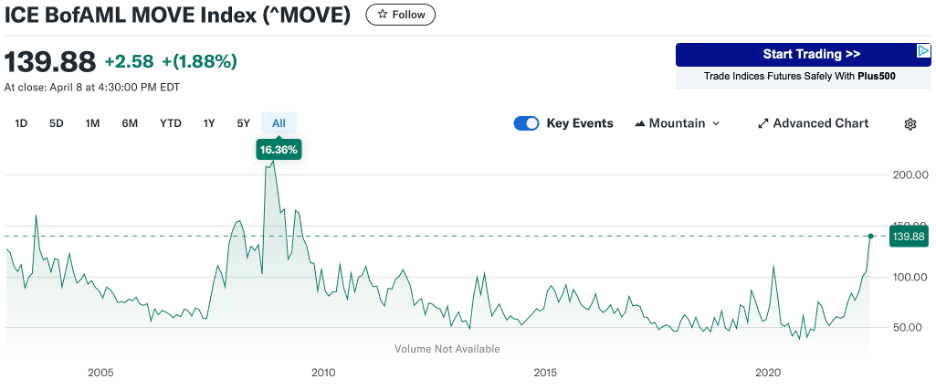

However, arguably of more concern is the price action in US Treasuries, which despite the havoc in the market, are not playing their historical safe haven role. Instead, Treasury bond yields are rising, actually trading as high as 4.50% around midnight last night although they have since retraced a bit. The bond market has a generic volatility index as well, the MOVE index, and it, too, is trading at very high levels, the highest since the GFC.

Source: finance.yahoo.com

In many ways, this is of much greater concern to markets, as well as both the Treasury and the Fed. The 10-year US Treasury is the benchmark long-term rate for the entire world. A rise in the MOVE index may indicate that there is something wrong with the bond market and its inner workings, or it may be an indication that inflation expectations are rising quickly. Whatever the reason, you can be certain the Fed is watching this far more carefully than the VIX.

I have heard two explanations for the bond market’s recent performance as follows: first, there are those who are saying that China is selling its Treasury bonds and using the dollar proceeds to buy gold. Now, while their holdings have been slowly shrinking, they still have just under $800 billion, so that is a lot of paper and would clearly have an impact. The thing about this thesis is we will be able to determine its reality when China next reports their reserve numbers next month.

The other explanation rings truer to me and that is the bond basis trade may be unwinding. Briefly, the bond basis trade is when investors, typically hedge funds, arbitrage the difference in price between cash Treasury bonds and Treasury bond futures on the exchange. The current positioning is these funds are long cash and short futures, and since it is a basis trade, they typically lever it up significantly, with leverage ratios of up to 100x I understand. The total size of this trade is estimated at > $1 trillion. Now, if this arbitrage disappears, or these funds are forced to liquidate this strategy quickly, it could be a real problem for the Treasury market.

Ever since the GFC and the Dodd-Frank legislative response, banks no longer carry large bond risk positions and are not able to absorb large transactions seamlessly. During Covid, you may remember that Treasury yields were all over the map, crashing and then exploding higher one day to the next, and that was caused by this basis trade unwind. Back then, the Fed purchased nearly $1.7 trillion in QE to stabilize the market, and by all accounts, the basis trade was half the size then that it is now.

Remember, too, arguably the most important part of the Fed’s mandate is to maintain Treasury bond market stability. Without this, the US will not be able to fund its debt and deficits. So, whatever your view of how Chairman Powell may respond to the tariff story, which seems to be patience for now, if the bond market starts to break, you can be sure the Fed will step in. QT will reverse to QE in a heartbeat as they offset the impact of this position unwinding. If that is the case, I anticipate we will see further weakness in equities and the dollar, while gold will truly shine both literally and figuratively. I’m not saying this is what is going to happen, just that this explanation makes more sense to me.

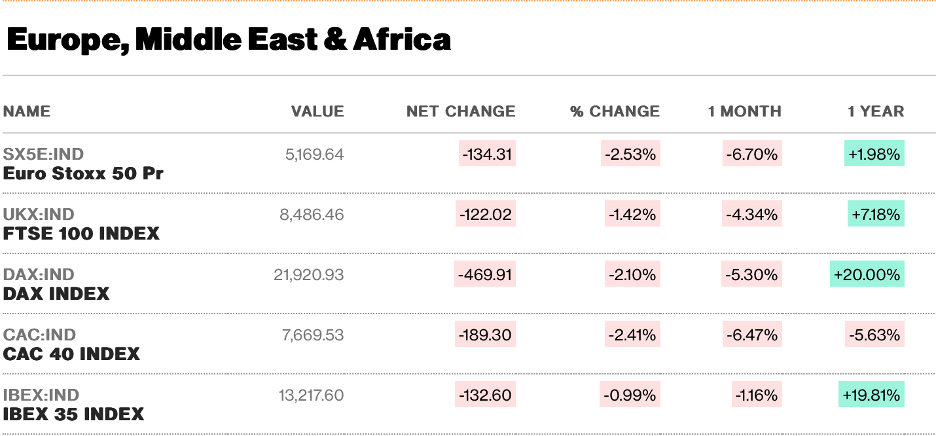

Ok, now that tariffs have officially kicked in as of midnight last night, let’s see how markets are responding this morning. Most equity markets continue to struggle after yesterday’s disappointing US session, where higher opens eroded all day with the major indices all closing on their session lows. This bled into Asia where Japan (-3.9%) gave up most of yesterday’s gains although both China (+1.0%) and Hong Kong (+0.7%) held up well amid government support. As to the rest of the region, Taiwan (-5.8%) was worst off, but other than Thailand and the Philippines, both of which managed gains, every other index was lower, often sharply. In Europe, the realization of the tariffs is hurting with declines of -3.0% to -4.0% across the board. As to the US futures market, at this hour (7:25), all three major indices are lower by at least -1.0%.

Bond yields are all over the place this morning with Treasuries (+8bps) continuing their recent climb amid the fears discussed above. However, in Europe, things are such that German yields (-1bp) are doing fine while UK Gilts (+9bps) are suffering along with Treasuries. The rest of the continent, save the Netherlands, has also seen yields rise, but much less, between 2bps and 5bps. Overnight, JGB yields were unchanged as players are uncertain as to the next steps by the BOJ there.

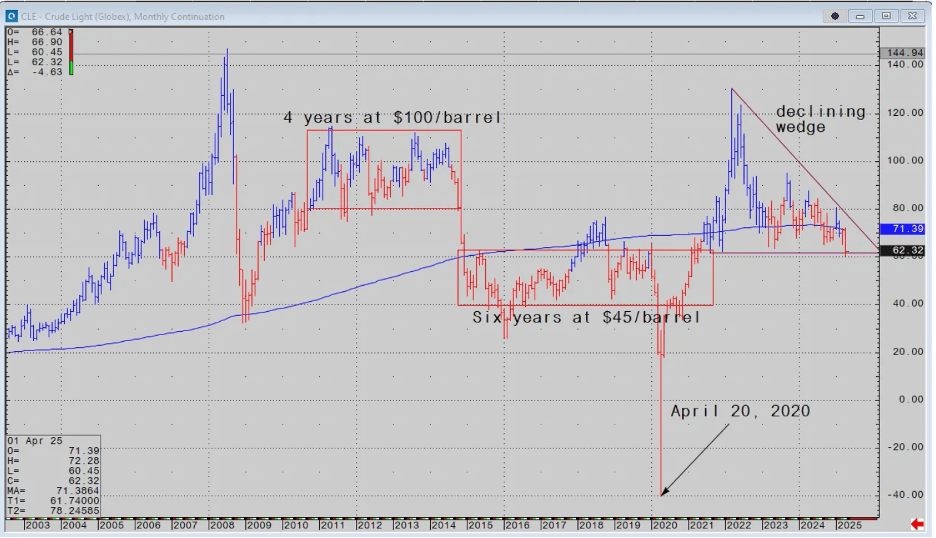

In the commodity market, oil (-5.6%) is once again under major pressure. This feels like a confluence of both technical factors (the price has broken below long-term support at $60/bbl and is now testing for lows) and fundamental factors, with OPEC raising output and the mooted recession likely to reduce demand. Interestingly, lower oil prices are a tremendous geopolitical weapon for the US as both Russia and Iran are entirely reliant on them for financing their activities. As to the metals complex, gold as regained its luster (sorry 😁) rallying 2.8% and well above the $3000/oz level. This has taken silver (+3.1%) and copper (+3.5%) along for the ride. It seems to me the copper story is not in sync with the oil story as a recession would likely drive copper prices lower, but that is this morning’s movement.

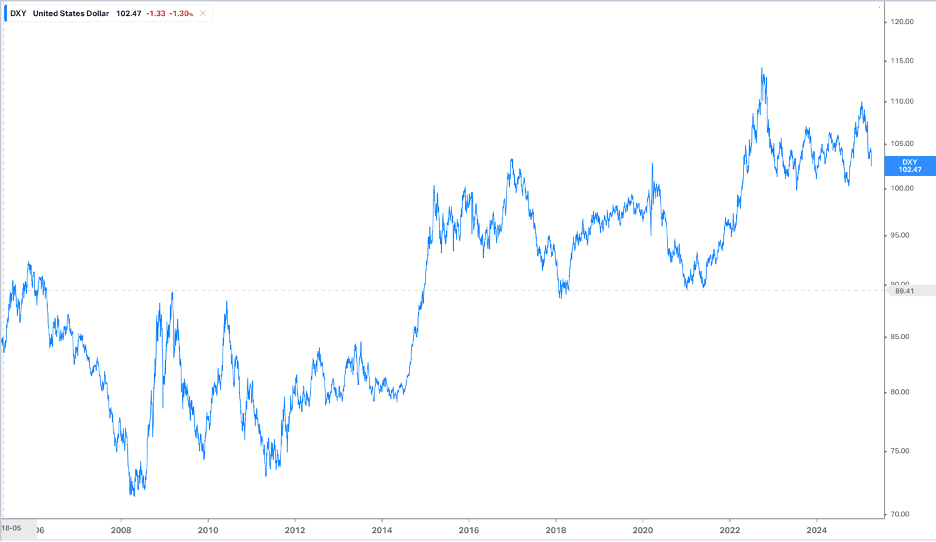

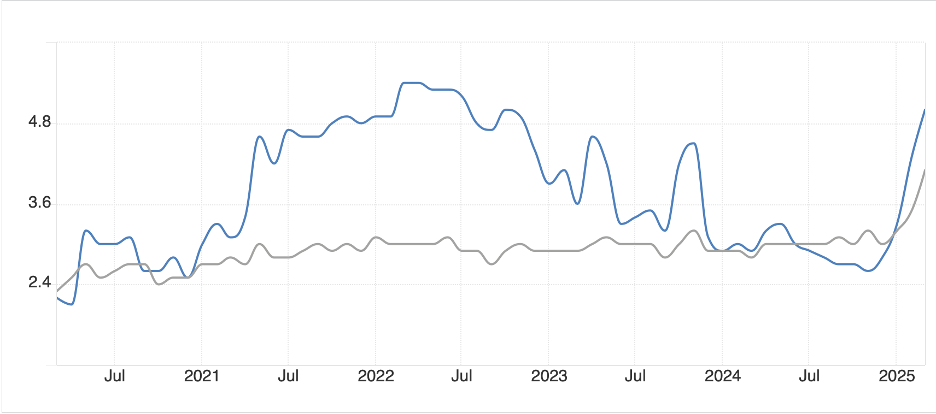

Finally, the dollar is softer again this morning with the euro (+0.8%) trading through 1.10 and the yen (+1.0%) back below 145.00. It’s interesting because there was a story last night about how the new Mr Yen, Atsushi Mimura, was speaking to the BOJ amid concerns that the yen has been too volatile. However, to my eye the movement has been relatively sedate, strengthening gradually and still, as can be seen in the chart below, substantially weaker than for the many years prior to the Fed beginning to tighten policy in 2022.

Source: finance.yahoo.com

The other noteworthy move is CNY (+0.5%) which after slipping to levels not seen since 2007, has retraced somewhat. If Treasury bonds are not seen as haven assets for now, the dollar has further to fall.

On the data front, the FOMC Minutes at 2:00pm are released, but given all that has happened since then, it is hard to get excited that we will learn very much new. We also see EIA oil inventories with a modest build expected, but this market seems likely to have adjusted those numbers outside any forecasting error bars.

The tariff story will continue to drive markets for now as investors try to determine the best way to protect themselves until things settle down. And things will settle down, but when that will happen is the $64 trillion question. FWIW, which is probably not much, my sense is that we have a few more weeks of significant chop, as we await clarity on the tariff policy (meaning its goals). I still believe there will be a number of deals that will reduce the initial numbers, but the ultimate goal is to isolate China. It is going to be messy for a while yet. As to the dollar through all this, my sense is lower, but not dramatically so.

Good luck

Adf