When Ueda-san

Raised rates, stocks responded by

Falling like a stone

Now Ueda-san

Is treading lightly, lest an

Avalanche begins

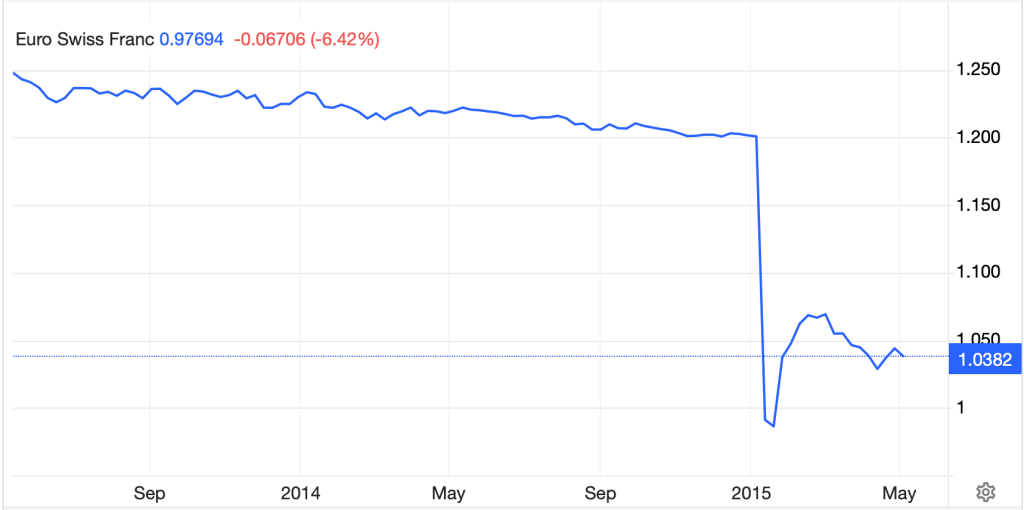

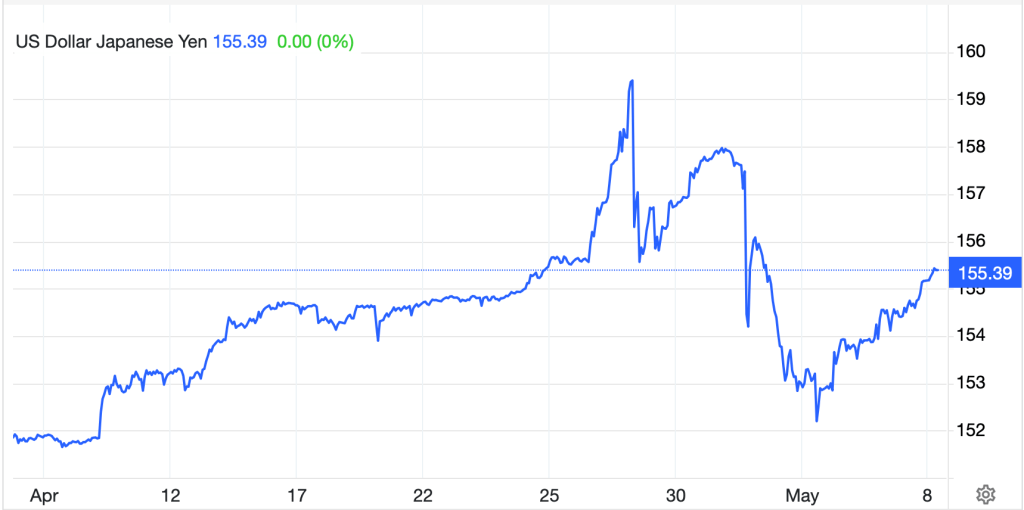

I’m sure we all remember the day, just three weeks ago, when the Nikkei Index fell more than 12% leading to a global rout in stocks. At that time, the proximate cause was claimed to be the combination of a more hawkish BOJ and a less dovish FOMC leading to a massive unwinding of the yen carry trade. It was a great story, and almost certainly contained much truth. But was it really the only thing going on?

It seems quite plausible that the dramatic market reactions at that time may have been sparked by that combination of central bank events, but the sole reason the moves were so dramatic was the fact that leverage in the markets has become a key driving force in everything that occurs. This is the reason that central banks around the world, which continue to try to reduce their balance sheets, are forced to move so slowly. There have already been two noteworthy accidents in balance sheet reduction processes; the September 2019 repo problem in the US and the October 2022 UK pension problem, both of which were exacerbated, if not specifically driven, by excess leverage.

With this in mind, the most recent market dislocation was the main topic of discussion last night in Tokyo when BOJ Governor Ueda was called on the carpet in a special session of the Diet to explain what he’s doing. (As an aside, the underlying premise that cannot be forgotten is that despite all the alleged focus on economic outcomes, the only thing that gets governments exorcised is when stock markets fall sharply. At that point, inquiries are opened!)

At any rate, last night, Ueda-san explained the following: “If we are able to confirm a rising certainty that the economy and prices will stay in line with forecasts, there’s no change to our stance that we’ll continue to adjust the degree of easing.” He followed that with, “We will watch financial markets with an extremely high sense of urgency for the time being.” In other words, the BOJ is still set on tightening monetary policy but will continue with their major goal, which is to prevent significant market dislocation (read declines).

The upshot here is that nothing has really changed, at least at the BOJ. Given the pace with which the BOJ acts on a regular basis, it is not surprising that they expect to continue to tighten policy very gradually and will adjust the pace to prevent major financial market moves. The market response to these comments was for the yen to rally initially, with the dollar falling nearly one full yen, but then reversing course as Ueda backed away from excessive hawkishness.

Source: tradingeconomics.com

Which takes us to Chairman Powell and his speech this morning.

There once was a banker named Jay

Whose goal was for both sides to play

When joblessness rose

The question he’d pose

Was, see how inflation’s at bay?

It is somewhat ironic to me that the most recent market ructions were a response to the combined efforts of the BOJ on a Tuesday night and the Fed on a Wednesday morning, less than 12 hours apart. And here we are this morning with Ueda-san having spoken on a Thursday night with Chair Powell slated to speak Friday morning, although this time a bit more like 15 hours apart. Should we be concerned that more ructions are coming?

As per the above, it seems as though the BOJ is going to make every effort to tighten policy, albeit slowly, given that the inflation picture in Japan is not improving in the manner they would like to see. In fact, last night, the latest figures were released showing that headline inflation remained at 2.8% and core rose a tick to 2.7%, although that was the expected outcome. The one bright spot was their “super-core” reading fell to 1.9%. In the past, I was given to understand that super-core was the number that mattered the most to the BOJ, but given Ueda seems keen to continue to tighten policy, I suspect it will not be the focus for now.

Which takes us to the other side of this equation, the Fed. What will Chairman Powell tell us today? Well, yesterday we heard both sides of the argument from FOMC members with Boston’s Susan Collins and Philadelphia’s Patrick Harker both explaining that the time for cutting rates was coming soon and that the process would be gradual. On the other side, the host of the Jackson Hole shindig, newly named KC Fed president Jeffrey Schmid, explained, “It makes sense for me to really look at some of the data that comes in the next few weeks. Before we act — at least before I act, or recommend acting — I think we need to see a little bit more.”

Based on the Minutes released on Wednesday, it certainly appears that the committee is ready to cut rates next month. The real question is at what pace will they continue once they start. Despite all the hubbub about the NFP revisions in the Twitterverse, none of the FOMC members interviewed explained that it altered their opinions about the economy. As I type, three hours before Powell speaks, the Fed funds futures market is pricing a 26.5% probability of a 50bp hike with a 25bp hike fully priced in. I have read arguments by some analysts that they need to start with 50bps because the payroll revisions paint a less positive picture of the economy. But it is hard for me to believe that Powell will want to act more than gradually absent a major dislocation in the data still due between now and the next meeting. If NFP is <50K or the Unemployment Rate jumps to 4.5% or 4.6%, that could see a 50bp cut, but otherwise, I believe Powell will be measured and not really give us anything new today.

Ok, let’s look at how markets have behaved ahead of his speech. After yesterday’s disappointing US session, the Nikkei shook off any initial concerns about Ueda’s hawkishness and rallied 0.4% on the session. But most of the rest of the region was in the red, with Hong Kong, Korea and Australia all sliding although the CSI 300 managed a 0.4% gain. In Europe, though, green is the theme with every major market firmer this morning led by Spain’s IBEX (+0.7%) and Germany’s DAX (+0.65%). There was no notable data, so it is not clear the driver here. Of course, US futures are rallying at this hour as well, with the NASDAQ futures higher by 1.0% leading the way. Based on these markets, there is clearly a belief that Powell will be dovish.

In the bond markets, Treasury yields have slipped 1bp this morning but have been hanging around the 3.85% level for several sessions. There was a dip on Wednesday after the Minutes seemed dovish, but that reversed course before the day ended and we have done nothing since. In Europe, investors and traders are also biding their time with virtually no change in yields there. Finally, JGB yields did rise by 3bps in response to Ueda’s marginal hawkishness.

In the commodity markets, oil (+1.3%) is continuing to rebound from its recent lows in what looks like a technical trading bounce although the EIA data on Wednesday did show more inventory draws than expected. In the metals markets, while yesterday was a terrible day in the space, with metals selling off hard during the NY session, this morning they have rebounded and are higher across the board. Nothing has changed my view that if the Fed turns dovish, metals markets, and commodities in general, will rally sharply.

Finally, the dollar is under pressure this morning, slipping broadly, but not deeply. The euro is unchanged, while the pound (+0.2%) and AUD (+0.4%) pace the gainers in the G10. In the EMG bloc, ZAR (+0.4%), MXN (+0.3%) and KRW (+0.3%) all showed modest strength as it appears traders are looking for a somewhat dovish Powell speech as well. The dollar will be quite reactive to Powell, I believe, so watch closely.

In addition to Powell, and any other FOMC members that are interviewed at the symposium, we only see New Home Sales (exp 630K). Yesterday, Existing Home Sales stopped their declines and printed as expected at 3.95M. Claims data was also as expected although the Chicago Fed National Activity Index printed at a much lower than expected -0.34 after a revision lower to the previous month. That is a negative economic indicator.

This poet’s view is Powell will try to be as middle of the road as possible, acknowledging the likelihood of a cut in September but not promising anything beyond that. That said, I believe the market is looking for a much more dovish speech. If he does not provide that, I expect that we could see some market negativity overall with the dollar rebounding.

Good luck and good weekend

Adf