Said Janet, we need to watch out

‘Cause bank fraud is starting to sprout

So maybe I’ll make

Another mistake

And drive banking stocks to a rout

“I absolutely agree with the premise — which is that fraud is becoming a huge problem.” These sage wordsfrom our esteemed Treasury Secretary have made headlines and also raised some alarms. After all, was not Madam Yellen in charge of bank regulation not that long ago? Did she not receive millions of dollars in speaking fees from those same banks before being named Treasury Secretary? It is difficult to listen to the recent change in tone without considering the fact that she is concerned if the election results in a Trump victory, her time at Treasury may come under deeper scrutiny so she is starting to spill a few beans to show she was on the ball.

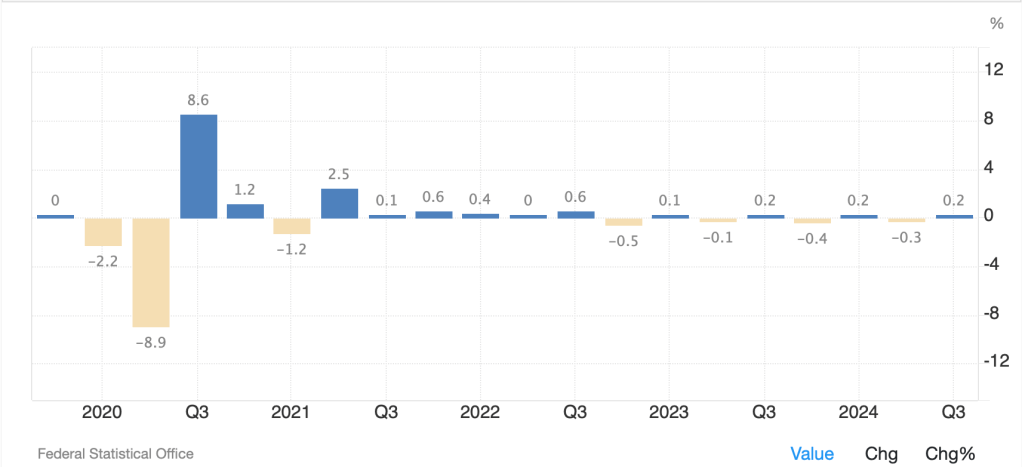

But arguably, the biggest issue is not that fraud is rampant in banking, with action around government checks being the most fertile area, the biggest issue remains the nonstop borrowing that continues as the US government debt continues to grow aggressively each day. There have been several recent commentaries by some very smart guys, Luke Gromen and Bob Elliott, regarding the coincidence of rising interest rates in the US and almost every other G10 economy despite significant differences regarding the economic situation and borrowing patterns. One conclusion is that owning government debt from any western government, at least debt with any significant duration, is losing its luster quickly. This is a valid explanation of why yields continue to rise despite the Fed’s, and other central banks’, recent rate cuts.

Of course, there is another popular explanation about the recent rise in yields; the prospects of a Trump victory and corresponding sweep in the House and Senate is seen as growing substantially. The thesis is that if that is the outcome, the budget deficit will grow even larger as the tax cuts due to expire next year will very likely be rolled over, and there is no indication there will be a reduction in spending (the Republicans merely have different spending priorities). Hence, deficits will continue to grow, Treasury debt will continue to increase, and yields will increase as well. At least, that’s the thesis.

One thing which is undoubtedly true is that if there is an increase in volatility in government bond markets, the dollar is going to be one of the beneficiaries. Keep that in mind going forward.

Though views about Europe were dire

Today, GDP printed higher

While Italy sank

They’ve Germans to thank

For being the major highflier

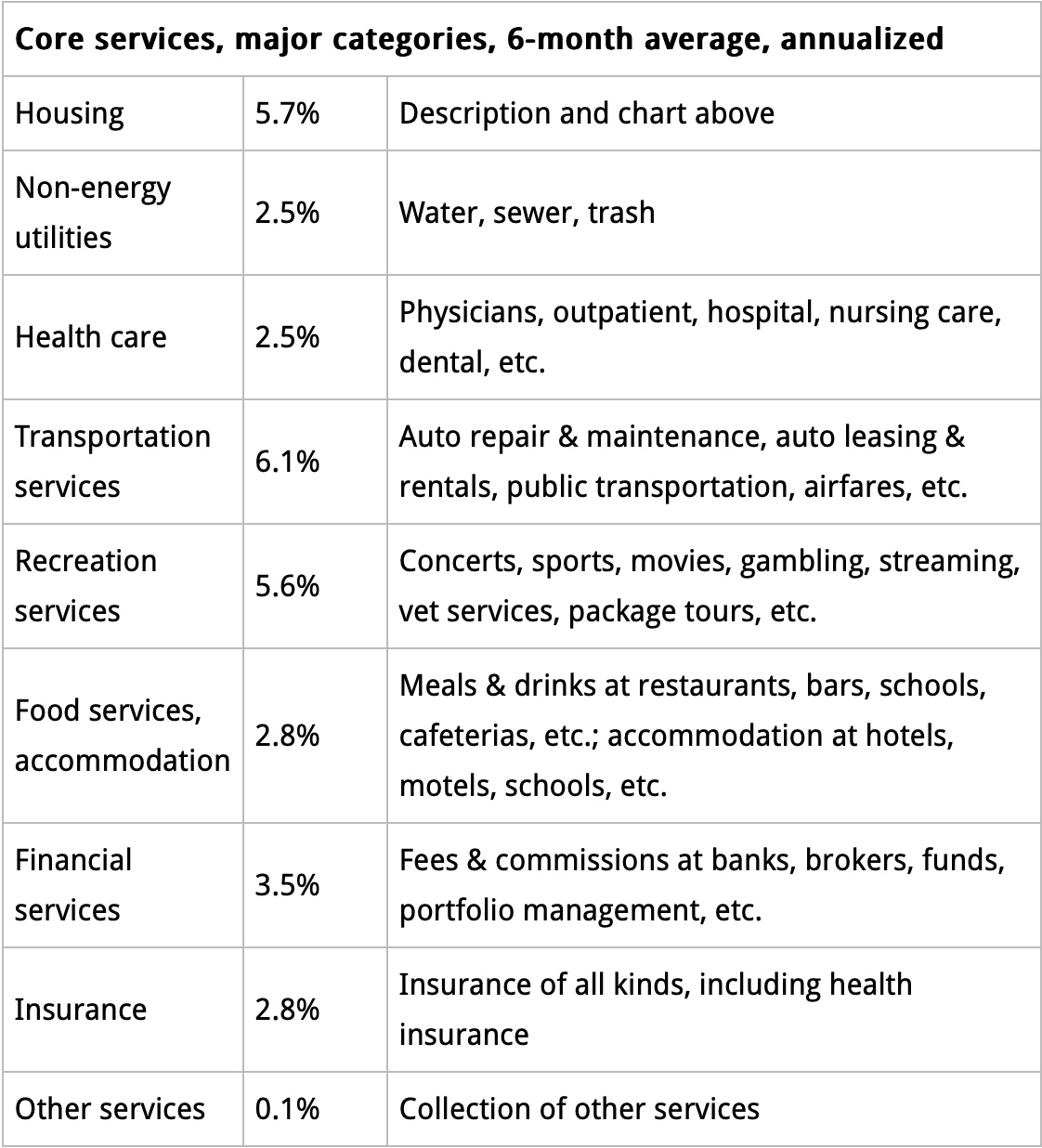

The other story of note this morning is the Eurozone GDP report alongside GDP readings from several key nations. At the Eurozone level, GDP surprised everyone with a 0.4% Q/Q print and a 0.9% Y/Y print, higher than the 0.2%/0.8% expectations. Now, in the big scheme of things, those numbers are not that great, but better than expected is certainly worth something. Germany was the key driver as they avoided a technical recession by growing 0.2% in Q3. What is little noted is that Q2’s data was revised lower from -0.1% to -0.3%, so it is fair to say that things have not been great there. In fact, below is a chart of the past 5 years’ worth of quarterly results in Germany and you can see that the concept of a growth impulse there, at least since the beginning of 2022, has largely been absent.

Source: tradingeconomics.com

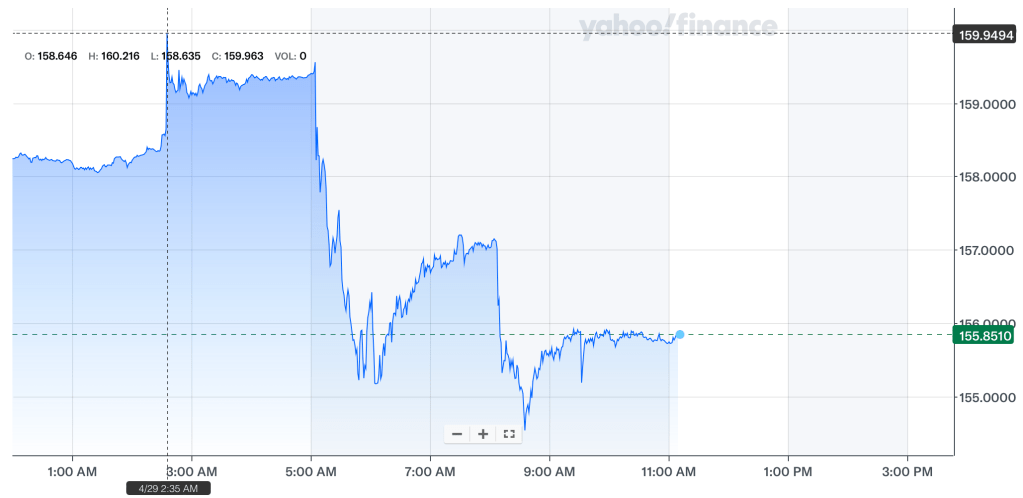

Another telling sign that the headline may not be a true reflection of the situation on the ground there is that the Eurozone also released a series of sentiment indicators, almost all of which were weaker than expected, notably Economic Sentiment (95.6 vs. 96.3 last month and expected) and Industrial Sentiment (-13.0 vs. -11.0 last month and -10.5 expected). Apparently, the growth was the product of greater than expected government spending, not really the best way to grow your economy. However, the market did respond by pushing the euro (+0.15%) a bit higher although the recent downtrend remains in place as evidenced by the below chart. It remains difficult to get too excited about the single currency given the growing divergence in views on the Fed and ECB, with the former being questioned about its policy easing while the latter is being called on to do more.

Source: tradingeconomics.com

And that was really the macro news for the evening so let’s see how markets overall behaved. Yesterday’s mixed US session was followed by similar price action in Asia with the Nikkei (+1.0%) continuing its recent rally as the market gets comfortable with PM Ishiba putting together a minority government while Chinese shares (CSI 300 -0.9%, Hang Seng -1.55%) suffered as hopes for the ‘bazooka’ stimulus faded, at least temporarily. As to the rest of the region, almost all the stock markets declined on the evening. That negative price action is evident in Europe as well this morning with every major market in the red (CAC -1.4%, DAX -0.8%, IBEX -0.6%) as the better than expected GDP figures don’t seem to have been that enticing for investors. In the UK, too, stocks are softer (FTSE 100 -0.3%), although there has been no data released. The big story there today is the budget release upcoming with most pundits looking for a lot of smoke and mirrors and no progress on spending stability. Meanwhile, US futures are a bit firmer this morning after solid earnings from Google after the close yesterday.

In the bond market, yields have backed off from their recent highs with Treasuries (-4bps) falling after yesterday’s 4bp decline. Yesterday’s US data was a bit softer than expected (Goods Trade Deficit fell to -$108.23B, much larger than expected while the JOLTS data (7.44M) fell to its lowest level since January 2021 and indicates a rough balance in the jobs market. As discussed above, European yields are following Treasuries lower with declines on the order of -3bps across the major economies with only Italy (+1bp) the outlier on higher than expected CPI readings. Meanwhile, UK Gilts (-10bps) are the real outlier as bond investors seem intrigued over the potential budget.

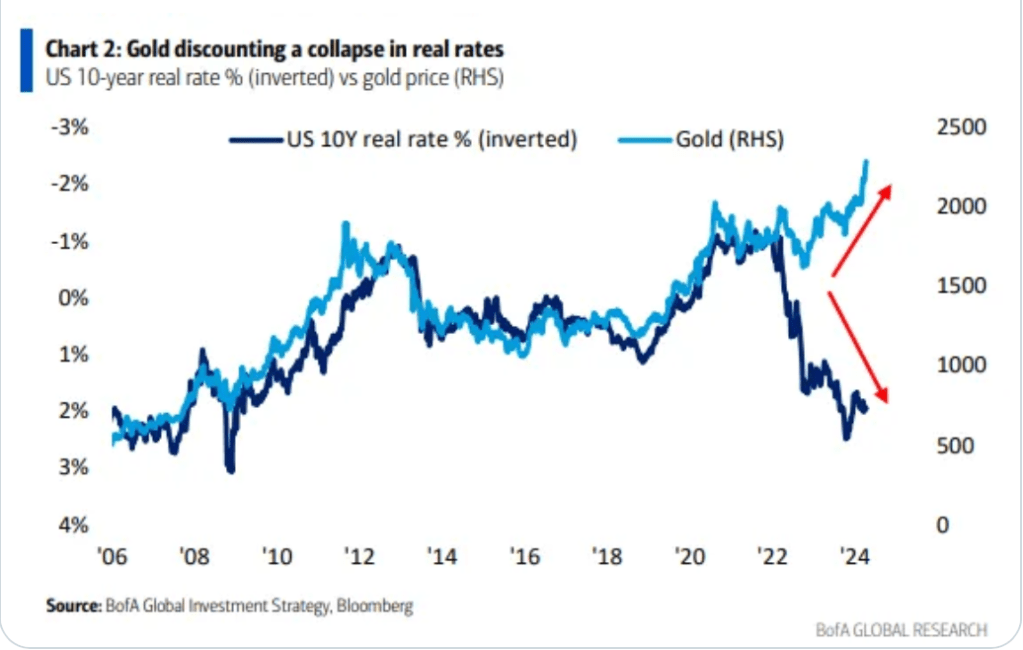

In the commodity space, oil (+1.3%) is bouncing a bit although remains well below the $70/bbl level. It appears that the worst is over for now and a choppy market is in our immediate future pending the election outcome. Consider that if Trump wins, given his ‘drill, baby, drill’ plank in the platform, it is likely that oil will slide on the news while a Harris win is likely to see prices rise on the fear of a fracking ban. Gold (+0.2%) continues its steady march higher with investors abandoning bonds and looking for a haven, although the other metals (silver -1.1%, copper -0.6%) are suffering this morning on the softer economic data.

Finally, the dollar is under very modest pressure this morning but remains at the high end of its recent trading range. JPY (+0.25%) has managed a modest rally ahead of tomorrow’s BOJ meeting but we have seen a mixed picture overall with some gainers (AUD, NZD, KRW) and some laggards (SEK, GBP, HUF). Ahead of the election, I continue to expect choppiness and a lack of direction but once that is complete, as I have said before, market volatility in other markets is likely to lead to a stronger dollar.

On the data front today, we start with ADP Employment (exp 115K) and then see the first look at Q3 GDP (3.0%) along with a key subcomponent of Real Consumer Spending (3.0%). We also see the Treasury Refunding Announcement, with not nearly as much press given to this as today as we had seen over the past several quarters. Expectations are running for no large increases although given the budget deficit continues to widen, I’m not sure how that math works. Lastly, we see oil inventories where a modest build is anticipated.

While the election continues to dominate the discussion, we cannot ignore this data or what is to come tomorrow and Friday, as the Fed will not be ignoring it. We will need to see a spate of much weaker data to change my long-held view that the dollar has further to climb, so let’s watch and wait.

Good luck

Adf