Remember Friday When one percent was declared The top? Just kidding

Much has been written about the BOJ’s surprising change in policy at their meeting last Friday, when they ostensibly widened the cap on their Yield Curve Control to 1.00% while explaining that flexibility in operations was the watchword. They did not touch their overnight rate, which remains at -0.10% and there is no apparent belief that they are going to adjust that anytime soon.

Neither market pricing in the OIS market nor any commentary from any BOJ official has hinted at such a move. So, the question is, did they really change their policy?

This matters a great deal for those amongst us who care about USDJPY and its potential future direction. The prevailing narrative has been that once the BOJ altered policy and allowed Japanese interest rates to rise to a more normal setting, investment would flow into JGBs, and the yen would strengthen rapidly. Remember, a big part of this process is that since the yen is the last remaining currency with negative interest rates in the front end of the curve, it remains the financing currency of choice amongst the speculative and hedge fund set. Adding to this discussion was the fact that back in December of last year, when Kuroda-san truly surprised the market by raising the YCC cap from 0.25% to 0.50%, it took less than one day for the 10-year JGB yield to test the new cap. Expectations recently had been that a similar move was likely to be seen this time around as well.

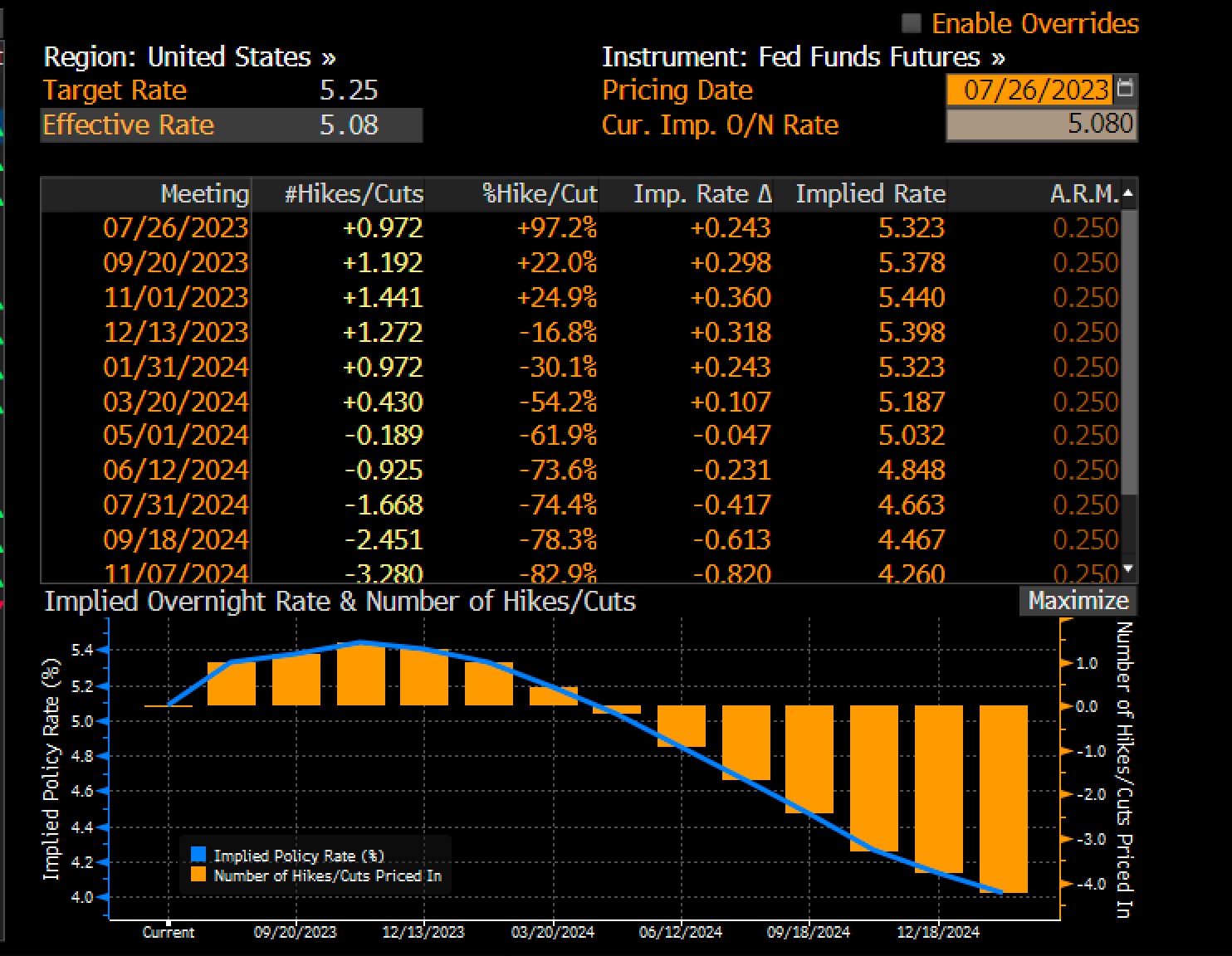

Alas, it is Monday, so some thirty-six market hours into the new policy and already the BOJ has stepped into the market to prevent a further rise in the 10-year yield once it touched 0.60%. Last night they stepped in with a ¥300 billion program of additional QE. One cannot be surprised that USDJPY (+0.9%) is higher on this news as it undermines the entire thesis about imminent JPY strength once they changed policy. And if they didn’t really change policy, as evidenced by the fact that they have already stepped into the market, then THE key pillar of the stronger yen thesis has just been removed. The other problem for the yen bulls is that the US data last week, especially the GDP and IP data, indicate that the Fed will be under no duress if they continue to tighten policy beyond current levels. Despite all the arguments about the Fed making another policy error, and there are sound arguments there, in Jay Powell’s eyes, until NFP starts to fall sharply, or Unemployment starts to rise sharply, or both, there are no impediments to a continuation of the current tightening policy.

It is with this in mind that I foresee continued strength in USDJPY, and while it seems likely that a very rapid move higher will see further intervention by the BOJ/MOF like we saw last autumn, another test of 150 is in the cards. A quick look at the chart below (from tradingeconomics.com) shows that the trend higher in the dollar remains intact with the decline in the first part of July already mostly undone. For those of you who were looking for a reversion to the 120 or 130 level, I fear that is just not in the cards for a long time to come.

Last Thursday the ECB said That policy, looking ahead Need not be so tight And so, they just might Stop raising rates, pausing instead Though their only mandate is prices They’ve come to a bit of a crisis Seems growth’s really weak And so, they will seek A policy, sans sacrifices

The good news in Europe is that Q2 GDP was positive, which followed a negative Q4 and a flat Q1. Hooray! The bad news about the data, which showed a 0.3% rise, is that fully half that number comes from Ireland! Now, Ireland’s weight in the Eurozone economy is tiny, about 4%, so the fact that growth there represented half the entire EZ’s growth is remarkable. However, if you consider that this growth is more illusion than economic activity, it is easier to understand. The growth is a result of the large profitability of US tech companies that generate their profits, from an accounting perspective, in Ireland to take advantage of the extremely low Irish corporate tax rate of 12.5%. So, US tech companies had a good quarter driving Irish GDP higher, and by extension Eurozone GDP higher. But they didn’t really produce that much stuff.

At the same time, Core CPI in the Eurozone printed at 5.5% this morning in July’s preliminary reading, hardly indicative of a collapse and calling into question Lagarde’s seeming dovishness last week. In the end, the dichotomy between the US economy, where the latest data continues to show a robust outcome, and Europe, where the only thing rising is prices with economic activity lackluster at best, remains the key reason why the dollar’s demise is still a theory and not reality.

To summarize the information that we have received from around the world in the past several days, Japan is unwilling to allow interest rates to rise very far, European growth is staggering, US growth is accelerating, the ECB is inclined to stop hiking rates and the Fed continues with ‘higher for longer’. All of this points to the dollar maintaining its value and likely rising further. I have yet to see anything persuasive in the dollar bear case to address all these issues.

Now, those are the big picture views, but let’s take a quick tour of the overnight session. Equities rallied in Asia following the US performance on Friday, but Europe has been a bit more circumspect with a couple of markets showing gains, notably France and Italy, but the rest doing nothing at all. At the same time, US futures are little changed at this hour (7:30).

Arguably, though, it is the bond market where things are really interesting as yields continue to rebound. US Treasuries are higher by 1.5bps and pushing back to that all important 4.00% level this morning. There is a growing belief that if 10-year yields push above 4.10%, that may signal a new framework, a breakout in technical terms, and we could see much higher yields from there. The Fed is likely to welcome such an event as it will help tighten financial conditions, something that they have been unable to achieve thus far. However, I do not believe the equity markets would take kindly to that type of movement, so beware. As to European sovereigns, they are mostly higher by about 1bp-2bps this morning and of course, JGBs saw yields finish higher by 6bps, just below 0.60%.

Oil prices (+1.0%) continue to rise on an organic basis. By this I mean there have been no announcements, no disruptions and no news of any sort that might indicate a change in the current situation. In other words, there is just a lot of buying going on. WTI is well above $81/bbl and we have seen a gain of more than 16% in the past month. Headline inflation will not be sinking on this news. We are also seeing a little strength in the metals space this morning with gold, copper and aluminum all firmer as the week begins. The base metals are responding to continued indications that China is going to support their economy, although direct fiscal payments don’t yet seem likely. Just wait a few months.

Finally, the dollar is net, little changed, although we have a wide array of gainers and losers today. In the G10, AUD (+0.9%) and NZD (+0.75%) are the leaders, rallying alongside the commodity rally, while JPY (-0.8% now), is the laggard based on the discussion above. As to the rest of the bloc, there are more gainers than losers, but the movement has been far less impactful. In the EMG space, MYR (+1.1%) has been the leading gainer on significant (for Malaysia) equity market inflows of ~$40mm -$50mm last night. After that, though, the gainers have mostly been EEMEA currencies, and they have not moved that much. On the downside, ZAR (-0.7%) is the laggard on limited news, implying more of a trading action rather than a fundamental shift. But on this side of the ledger as well, things haven’t moved that far and net, the space is little changed.

It is an important week for data in the US culminating in the payroll report on Friday.

| Today | Chicago PMI | 43.4 |

| Dallas Fed Mfg | -22.5 | |

| Tuesday | JOLTS Job Openings | 9600K |

| ISM Manufacturing | 46.9 | |

| Wednesday | ADP Employment | 183K |

| Thursday | Initial Claims | 227K |

| Continuing Claims | 1723K | |

| Unit Labor Costs | 2.5% | |

| Nonfarm Productivity | 2.2% | |

| Factory Orders | 2.1% | |

| ISM Services | 53.0 | |

| Friday | Nonfarm Payrolls | 200K |

| Private Payrolls | 175K | |

| Manufacturing Payrolls | 5K | |

| Unemployment Rate | 3.6% | |

| Average Hourly Earnings | 0.3% (4.2% Y/Y) | |

| Average Weekly Hours | 34.4 | |

| Participation Rate | 62.6% |

In addition to this, we get the first post-FOMC Fedspeak with just two speakers, Goolsbee and Barkin, on the calendar this week although the pace picks up next week. As long as the data remains strong, I see no reason for the Fed to change its tune nor any reason for the dollar to back off its recent net strength.

Good luck

Adf